Global Automotive Brake System Market Research Report: Forecast (2024-2030)

Automotive Brake System Market - By Brake Type (Disc Brakes, Drum Brakes, Hydrostatic Brakes, Hydraulic Wet Brakes, Dynamic Brakes, Others), By Technology (Anti-lock Braking System... [ABS], Electronic Stability Control [ESC], Traction Control System [TCS], Electronic Brakeforce Distribution [EBD], Automatic Emergency Braking [AEB]), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Trucks, Buses), By Actuation Type (Hydraulic, Pneumatic), By Component (Master Cylinders, Brake Pads, Brake Shoes, Brake Calipers, Brake Disc Rotors), By Electric Vehicle Type (Battery EVs, Plug-in Hybrid EVs), By Application (Agricultural Tractors, Construction Equipment, Mining Equipment) and others Read more

- Automotive

- May 2024

- Pages 186

- Report Format: PDF, Excel, PPT

Market Definition

A brake is a mechanical system that slows down motion by consuming energy from a moving body. It is generally used to halt or slow down a moving vehicle, axle, and wheels; these functions are typically performed on the principle of friction.

Market Insights & Analysis: Global Automotive Brake System Market (2024-30):

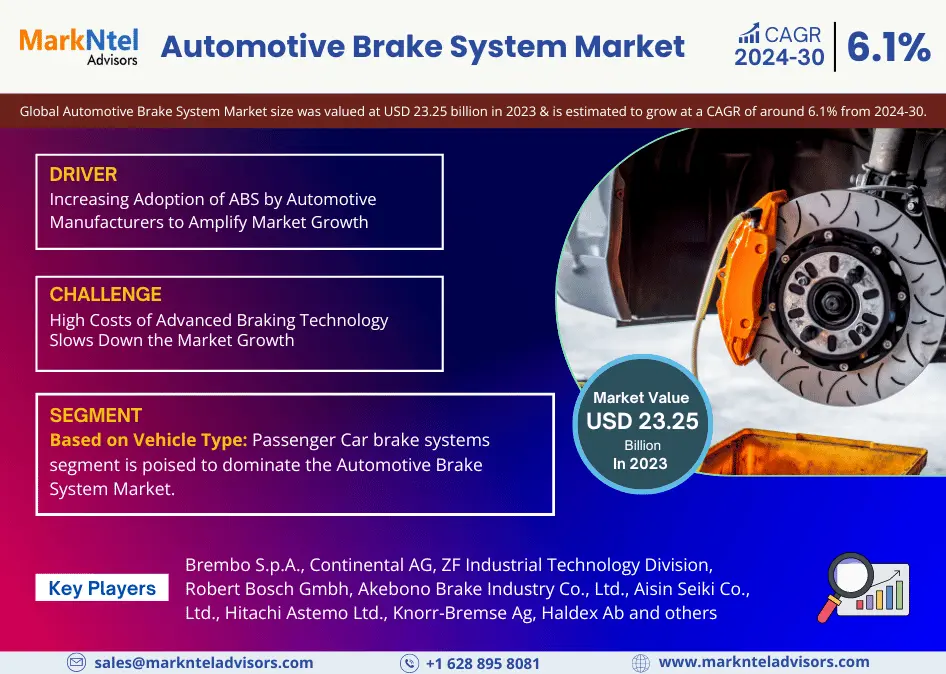

The Global Automotive Brake System Market size was valued at USD 23.25 billion in 2023 and is estimated to grow at a CAGR of around 6.1% during the forecast period, i.e., 2024-30. The market is poised for growth, driven by several key factors like stringent safety regulations aimed at enhancing vehicle safety standards & compelling automotive manufacturers to invest in advanced brake systems. Additionally, individuals nowadays prefer to purchase high-end and luxury vehicles equipped with advanced braking systems. Therefore, the automakers are incorporating the barking systems based on the advanced technologies within their vehicle models, augmenting the Global Automotive Brake System market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 6.1% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia- Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | Brembo S.p.A., Continental AG, ZF Industrial Technology Division, Robert Bosch Gmbh, Akebono Brake Industry Co., Ltd., Aisin Seiki Co., Ltd., Hitachi Astemo Ltd., Knorr-Bremse Ag, Haldex Ab, Denso Corporation, Mando Corporation, Hyundai Mobis Co., Ltd., Wuhan Youfin Auto Parts Co., Ltd., Bethel Automotive Safety System Co., Ltd. (WBTL), Beringer, Others |

| Market Value (2023) | USD 23.25 Billion |

Furthermore, these brakes provide more braking efficiency than the conventional braking systems. Therefore, to enhance the safety of the automotive vehicles used for personal transportation & commercial purposes, automakers are increasingly amalgamating air disc brakes in commercial vehicles, propelling the market growth. These factors collectively create a conducive environment for the expansion of the Automotive Brake System Market, with ample opportunities for manufacturers to innovate and capitalize on evolving consumer preferences and regulatory requirements.

Moreover, the market is poised for significant expansion in the foreseeable future, driven by the continuous growth trajectory of the automotive industry across developed and emerging economies. Heightened safety awareness, underscored by stringent government regulations mandating vehicular safety standards, is a primary catalyst propelling market growth. Hence, the demand for passenger cars and commercial vehicles, coupled with evolving safety norms, directly influences the surging automotive brake system sector. This symbiotic relationship between market demand and regulatory imperatives forecasts a promising outlook for the industry's progression. Furthermore, the burgeoning integration of Advanced Driver Assistance Systems (ADAS) aims at enhancing vehicle automation & is poised to catalyze the global demand for Automatic Emergency Braking (AEB).

Also, disc brakes, composed of materials like iron cast or carbon-ceramic, have gained prominence, utilizing frictional material in the form of brake pads to slow down or halt the wheel's rotation. Conversely, drum brakes, employing shoes against a drum-shaped component, remain a conventional choice. Factors such as the increasing demand for safety features in vehicles, technological advancements, and stringent government regulations promoting vehicle safety are anticipated to propel market growth. Consequently, these trends underscore a shift towards safer and more efficient braking systems, driving opportunities for innovation and market expansion in the projected years.

Global Automotive Brake System Market Driver:

Increasing Adoption of ABS by Automotive Manufacturers to Amplify Market Growth – Road Accidents are common in several regions and these accidents are one of the leading causes of deaths across the globe. Based on a survey by the World Health Organization (WHO), every year more than 1 million individuals die due to road accidents. These accidents are majorly caused by overspeeding & vehicle component failure. Therefore, it has become of utmost importance for individuals to look for vehicles that ensure safety. As a result, several automotive manufacturers are increasingly adopting automotive brake systems since these barking systems provide better performance than conventional brakes. In addition, these accidents impact the individuals economically & emotionally. Therefore, the governing authorities are encouraging automotive manufacturers to adopt technologically advanced systems that ensure the safety of individuals. Therefore, the automakers are increasingly incorporating these advanced brakes within their vehicles, enhancing the Global Automotive Brake System market.

In addition, the awareness among consumers regarding their own safety is also generating the demand for vehicles equipped with these advanced systems. Therefore, to cater to this growing demand, automakers would continue to install these brakes into their newly launched & existing vehicle modes, uplifting the Global Automotive Brake System market in foreseen years as well.

Global Automotive Brake System Market Challenge:

High Costs of Advanced Braking Technology Slows Down the Market Growth – Conventional braking systems are made up of brake pads, brake shoes & brake fluids, which are relatively low costs. However, automatic brake systems have sensors based on advanced technologies like integration with IoT that make the costs of these brakes significantly higher than the traditional brake systems. Moreover, these braking systems require frequent maintenance to ensure the smooth functioning of the vehicles. The maintenance involves regular lubrication & replacement of the brake fluids, which acts as an additional cost for the consumers. Based on the company website, the average repair of the sensors, a pivotal component of the automotive brake system, lies between USD150 to USD400. Therefore, the end-users refrain from purchasing automotive brake systems and tend to use vehicles with conventional brake systems. In addition, the repairing costs of these brake systems are also higher since the repairing includes the replacement of the expensive essential components, like drums & pads. Therefore, individuals rely on conventional braking systems rather than automotive brake systems, restraining the Global Automotive Brake System Market growth.

Global Automotive Brake System Market (2024-30): Segmentation Analysis

The Global Automotive Brake System Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024-2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

The Passenger Car brake systems segment is poised to dominate the Automotive Brake System Market, holding the largest market share during the forecast period. This dominance is attributed to stringent regional government regulations aligning with UNECE guidelines, driving the adoption of electronic braking systems like ABS and ESC in passenger cars. Moreover, the enforcement of global & local New Car Assessment Program (NCAP) safety standards is incentivizing governments and regional OEMs worldwide to integrate advanced braking systems. The mandate to make technologies such as ABS, EBD, and ESC compulsory globally, is further propelling the demand for advanced brake systems, even in vehicles below the Class C segment.

With Asia-Pacific emerging as the epicenter of the passenger car market, notably led by China and India, the region commands significant attention, thereby creating a substantial opportunity for automotive brake system manufacturers to capitalize on this burgeoning global market.

Based on Electric Vehicle Type:

- Battery EVs

- Plug-in Hybrid EVs

Of them all, battery EVs hold the dominant market share in the Global Automotive Brake System market. In recent years, individuals have become more aware of the carbon emissions caused by their lifestyle choices due to which they are transitioning towards electric vehicles. These electric vehicles are made of components that align with the sustainability goals. As a result, several electric vehicle automotive manufacturers use advanced brake systems that ensure fuel efficiency & low energy consumption, enhancing the market share of battery EVs in the Global Automotive Brake System market. Further, several market players are also launching various types of advanced automotive brake systems that align with the sustainability goals & improve the performance of the vehicles.

For instance, the Newly Launched braking system launched by Bosc Mobility helped in reducing dust emissions by 95%. Therefore, these new launches are gaining the attention of several automakers. Hence, these automakers are incorporating newly launched braking systems such as regenerative braking systems, vacuum-independent regenerative braking systems, and others, uplifting market growth.

Global Automotive Brake System Market (2024-30): Regional Projection

Geographically, the Global Automotive Brake System Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

The Asia-Pacific Automotive Brake System Market is poised to lead the industry in the forecast years, primarily driven by robust production figures in both light and heavy-duty vehicle segments. Countries like China and India, with a notable affinity for economy and mid-range cars, particularly in the Class A, B, and C categories, are anticipated to contribute significantly to this growth. Notably, major regional players like Toyota, Hyundai, Honda, and Suzuki are enhancing safety features by offering all disc brakes with ABS in newer Class C model cars, aligning with the increasing consumer focus on safety.

Moreover, there's a rising trend towards luxury and high-end vehicles equipped with all 4-disc brakes, emphasizing superior stopping distance. Thus, the adoption of air disc brakes, especially in heavy commercial vehicles, is on the rise in markets like Japan and China, spurred by stringent safety regulations and a growing preference for advanced safety features such as ABS, ESC, and TCS. Also, the Indian government's mandate on ABS for minibusses and cars underscores the region's commitment to elevating safety standards. Japan and South Korea exhibit a strong demand for premium vehicles outfitted with disc brakes on all four wheels, further propelling the market for advanced electronic braking systems.

Global Automotive Brake System Market Recent Development:

- 2023: Brembo S.p.A. introduced Greenance, a cutting-edge brake kit tailored for light commercial vehicles. With over three times the lifespan of current aftermarket alternatives, Greenance slashes particulate emissions by over 80%. This innovative kit strikes a balance between efficiency and durability, significantly reducing environmental impact during braking.

- 2023: Continental AG launched its latest conventional electronic brake system, the MK 120 Electronic Stability Control. It has commenced supplying this system to Chinese automaker Changan.

- 2023: ZF Industrial Technology division unveiled its innovative brake-by-wire system that would integrate into vehicles supporting heavy-duty industries like construction, mining, and agriculture.

Gain a Competitive Edge with Our Global Automotive Brake System Market Report

- Global Automotive Brake System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Automotive Brake System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumption

- Executive Summary

- Global Automotive Brake System Market Trends & Insights

- Global Automotive Brake System Market Dynamics

- Growth Drivers

- Challenges

- Global Automotive Brake System Market Hotspot & Opportunities

- Global Automotive Brake System Market Supply Chain Analysis

- Global Automotive Brake System Market Regulation & Policy

- Global Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type

- Disc Brakes- Market Size & Forecast 2019-2030, (USD Million)

- Drum Brakes- Market Size & Forecast 2019-2030, (USD Million)

- Hydrostatic Brakes- Market Size & Forecast 2019-2030, (USD Million)

- Hydraulic Wet Brakes- Market Size & Forecast 2019-2030, (USD Million)

- Dynamic Brakes- Market Size & Forecast 2019-2030, (USD Million)

- Others- Market Size & Forecast 2019-2030, (USD Million)

- By Technology

- Anti-lock Braking System (ABS)- Market Size & Forecast 2019-2030, (USD Million)

- Electronic Stability Control (ESC)- Market Size & Forecast 2019-2030, (USD Million)

- Traction Control System (TCS)- Market Size & Forecast 2019-2030, (USD Million)

- Electronic Brakeforce Distribution (EBD)- Market Size & Forecast 2019-2030, (USD Million)

- Automatic Emergency Braking (AEB)- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type

- Passenger Cars- Market Size & Forecast 2019-2030, (USD Million)

- Light Commercial Vehicles- Market Size & Forecast 2019-2030, (USD Million)

- Trucks- Market Size & Forecast 2019-2030, (USD Million)

- Buses- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type

- Hydraulic- Market Size & Forecast 2019-2030, (USD Million)

- Pneumatic- Market Size & Forecast 2019-2030, (USD Million)

- By Component

- Master Cylinders- Market Size & Forecast 2019-2030, (USD Million)

- Brake Pads- Market Size & Forecast 2019-2030, (USD Million)

- Brake Shoes- Market Size & Forecast 2019-2030, (USD Million)

- Brake Calipers- Market Size & Forecast 2019-2030, (USD Million)

- Brake Disc Rotors- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type

- Battery EVs- Market Size & Forecast 2019-2030, (USD Million)

- Plug-in Hybrid EVs- Market Size & Forecast 2019-2030, (USD Million)

- By Application

- Agricultural Tractors- Market Size & Forecast 2019-2030, (USD Million)

- Construction Equipment- Market Size & Forecast 2019-2030, (USD Million)

- Mining Equipment- Market Size & Forecast 2019-2030, (USD Million)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- By Brake Type

- Market Size & Analysis

- North America Automotive Brake System Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Technology- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type- Market Size & Forecast 2019-2030, (USD Million)

- By Component- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- By Country- Market Size & Forecast 2019-2030, (USD Million)

- The US

- Canada

- Mexico

- The US Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Canada Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Mexico Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Automotive Brake System Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Technology- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type- Market Size & Forecast 2019-2030, (USD Million)

- By Component- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- By Country- Market Size & Forecast 2019-2030, (USD Million)

- Brazil

- Argentina

- Rest of South America

- Brazil Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Argentina Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Automotive Brake System Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Technology- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type- Market Size & Forecast 2019-2030, (USD Million)

- By Component- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- By Country- Market Size & Forecast 2019-2030, (USD Million)

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Germany Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- France Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Italy Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Spain Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Automotive Brake System Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Technology- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type- Market Size & Forecast 2019-2030, (USD Million)

- By Component- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- By Country- Market Size & Forecast 2019-2030, (USD Million)

- Saudi Arabia

- The UAE

- South Africa

- Rest of The Middle East & Africa

- Saudi Arabia Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- The UAE Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- South Africa Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Automotive Brake System Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Technology- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Actuation Type- Market Size & Forecast 2019-2030, (USD Million)

- By Component- Market Size & Forecast 2019-2030, (USD Million)

- By Electric Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- By Country- Market Size & Forecast 2019-2030, (USD Million)

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- China Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Japan Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- South Korea Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- India Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Australia Automotive Brake System Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Brake Type- Market Size & Forecast 2019-2030, (USD Million)

- By Vehicle Type- Market Size & Forecast 2019-2030, (USD Million)

- By Application- Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Automotive Brake System Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Continental Ag

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Robert Bosch Gmbh

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Zf Friedrichshafen Ag

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Akebono Brake Industry Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Brembo S.P.A

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Aisin Seiki Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Hitachi Astemo Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Knorr-Bremse Ag

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Haldex Ab

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Denso Corporation

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Mando Corporation

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyundai Mobis Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Wuhan Youfin Auto Parts Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Bethel Automotive Safety System Co., Ltd. (WBTL)

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Beringer

- Business Description

- Product Portfolio

- Strategic Alliances Or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Continental Ag

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making