Press Release Description

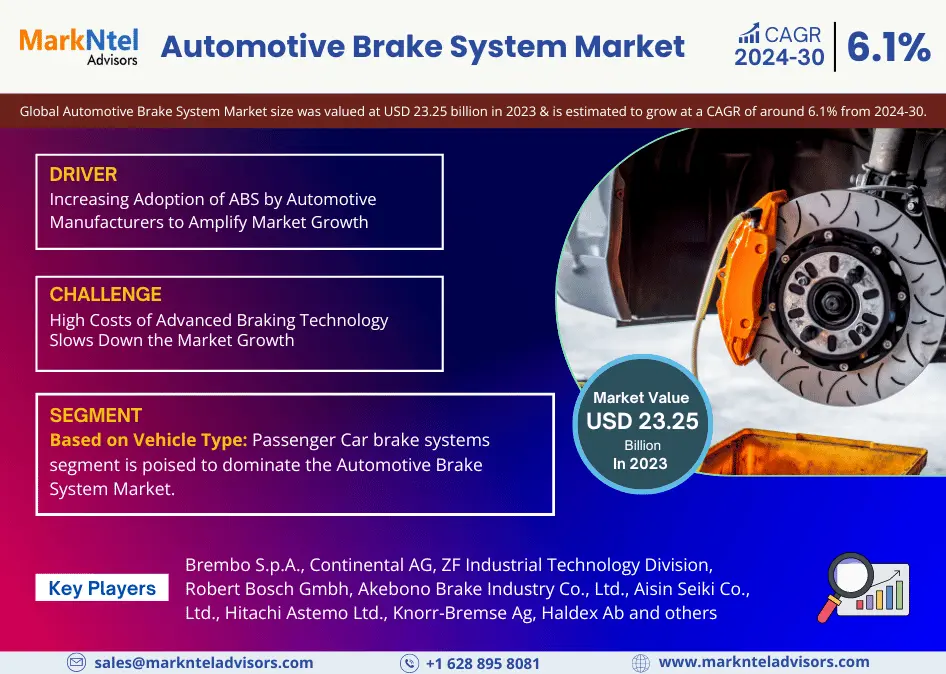

With USD 23.25 Billion Global Automotive Brake System Market to Surge at a CAGR of Around 6.1% During 2024-30

The Global Automotive Brake System Market size was valued at USD 23.25 billion in 2023 and is projected to grow at a CAGR of around 6.1% during the forecast period, i.e., 2024-30, cites MarkNtel Advisors in the recent research report. Automotive manufacturers need to invest in advanced braking systems due to stringent safety regulations aimed at improving vehicle safety standards. Consumers increasingly prefer high-end & luxury vehicles, which require sophisticated brake technologies offering superior performance and improved safety features.

Furthermore, commercial vehicles benefit from air disc brakes because they have better durability and enhanced braking efficiency - leading to increased adoption rates among operators. Overall, these dynamics create an environment for expansion within the automotive brake system sector with numerous opportunities for innovation by manufacturers who can capitalize on developing consumer preferences as well as evolving regulatory requirements.

With the automotive industry steadily thriving in both emerging and developed economies, the market for automotive brake systems is set to experience substantial growth. Stricter government regulations mandating vehicular safety standards have significantly enhanced safety consciousness- a key driver of this positive momentum. Hence, the escalating demand for commercial vehicles and passenger cars alongside evolving road-safety policies are direct contributors towards an upswing in the sector responsible for braking mechanisms on automobiles, indicating that it will continue growing with regulatory support galvanizing expansionary prospects into coming years.

Over the past decade, technology in the automotive brake system market has advanced significantly. Key advancements such as ABS and regenerative braking have emphasized the importance of maintaining a balance between efficient braking and avoiding sudden stops. Utilizing materials like iron cast or carbon-ceramic, disc brakes with frictional pads have become increasingly popular, while drum brakes remain conventional.

Also, increasing safety demands from consumers coupled with technological innovation and government regulations are expected to boost market growth through safer brake systems that optimize efficiency, creating an environment full of new opportunities within this expanding industry, further states the research report, “Global Automotive Brake System Market Analysis, 2024.”

Global Automotive Brake System Market Segmentation Analysis

Vehicle Type Segment to Lead the Market in terms of Market Share

Based on the Vehicle Type segment, the market is further bifurcated into Passenger Cars, Light Commercial Vehicles, Trucks, and Buses. During the forecast period, it is expected that the Passenger Car Brake System will lead other segments of the Automotive Brake System Market in terms of its share. The reason for this dominance can be ascribed to strict government regulations at regional levels conforming with UNECE guidelines which are pushing forward electronic braking solutions like ABS and ESC across all types of passenger cars. Additionally, global and local safety standards set by the New Car Assessment Program (NCAP) act as a factor propelling governments and original equipment manufacturers worldwide towards more advanced brake integration efforts.

Additionally, demand for medium to premium-range sedans and SUVs with advanced braking systems such as ABS and EBD is on the rise not only in countries like Japan or South Korea but also across India at an increasing rate. With Asian nations continuing their dominance over this lucrative industry fueled by rising safety standards, there's immense potential for manufacturers specializing in auto brake systems to tap into this growing demand worldwide.

Asia-Pacific to Dominate the Global Market

During the forecast period, the Asia-Pacific region is expected to dominate due to strong production numbers in both light and heavy-duty vehicle sectors. Countries such as China and India are projected to significantly contribute towards this growth with their preference for economy and mid-range cars within Class A, B, and C categories. Among leading regional producers like Toyota, Hyundai, Honda, and Suzuki there has been an increase in safety features, such as all disc brakes that include ABS on newer model Class C vehicles - a response aligning with consumer demand for greater security emphasis.

The utilization of air disc brakes, particularly in the heavy commercial vehicle sector, is increasing rapidly in markets such as Japan and China. This trend has been motivated by strict safety regulations and a heightened interest in advanced safety features like ABS, ESC, and TCS. In addition to this development, India's decision to require ABS for minibusses and cars highlights its concerted effort towards improving safety standards.

Competitive Landscape

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading market players, including Brembo S.p.A., Continental AG, ZF Industrial Technology Division, Robert Bosch Gmbh, Akebono Brake Industry Co., Ltd., Aisin Seiki Co., Ltd., Hitachi Astemo Ltd., Knorr-Bremse Ag, Haldex Ab, Denso Corporation, Mando Corporation, Hyundai Mobis Co., Ltd., Wuhan Youfin Auto Parts Co., Ltd., Bethel Automotive Safety System Co., Ltd. (WBTL), Beringer, and Others are looking forward to strengthening their market position.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the Global Automotive Brake System Market?

- What key factors would propel and impede the industry across the globe?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping across the regions?

- How has the buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2019-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure