Australia LED Lighting Market Research Report: Forecast (2024-2030)

Australia LED Lighting Market - By Product Type (Lamps, Luminaires), By Application (Indoor, Outdoor), By Installation (New, Retrofit), By Sales Channel (Indirect Sales, Direct Sal...es) and others Read more

- FMCG

- Mar 2024

- Pages 128

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Australia LED Lighting Market (2024-30):

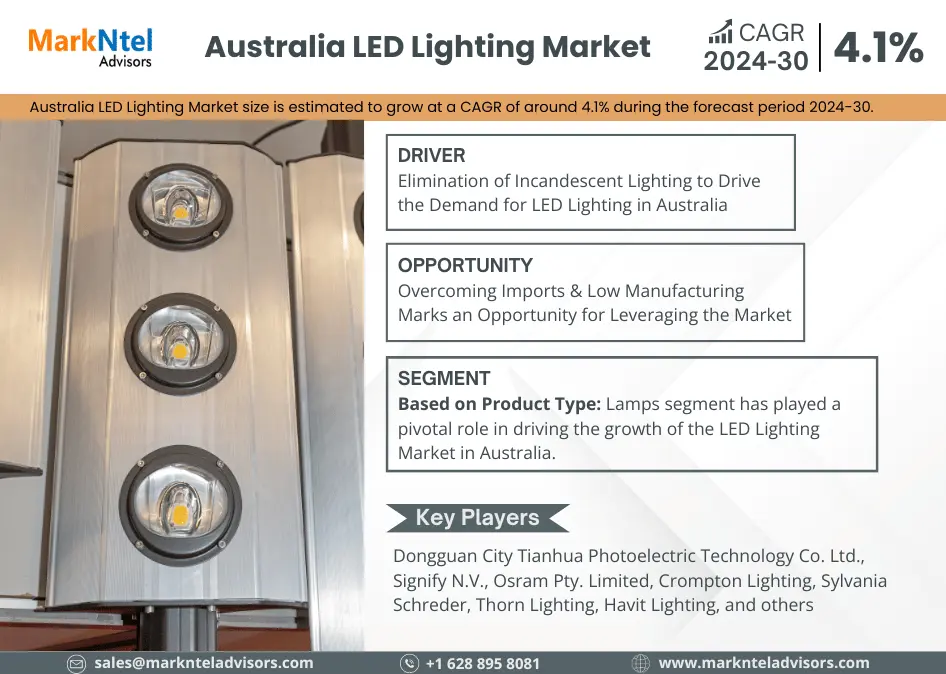

The Australia LED Lighting Market size is estimated to grow at a CAGR of around 4.1% during the forecast period, i.e., 2024-30. With a growing emphasis on energy efficiency, low costs, durability, and sustainability, coupled with government initiatives promoting LED adoption, the market has witnessed significant growth. Australia's commitment to reducing carbon emissions and transitioning towards renewable energy sources has driven widespread adoption of LED lighting solutions across residential, commercial, and industrial sectors.

Additionally, the country's stringent energy efficiency standards and regulations have further propelled the shift towards LED technology. Technological advancements in LED chips, coupled with declining costs and improved performance, have boosted market penetration. However, challenges such as price competitiveness, concerns regarding product quality & durability, and the need for infrastructure upgrades may hinder market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-30) | 4.1% |

| Region Covered | West, North, South, Queensland, New South Wales, Victoria |

| Key Companies Profiled | Dongguan City Tianhua Photoelectric Technology Co. Ltd., Signify N.V., Osram Pty. Limited, Crompton Lighting, Sylvania Schreder, Thorn Lighting, Havit Lighting, Mirabelle International, Aqualuma LED Lighting, Haneco Lighting Australia Pty Ltd., BOSCO Lighting, Others |

| Unit Denominations | USD Million/Billion |

Overall, the Australia LED Lighting Market offers substantial opportunities for manufacturers, suppliers, and stakeholders to capitalize on the growing demand for energy-efficient lighting solutions amidst increasing environmental consciousness and regulatory support.

Australia LED Lighting Market Driver:

Elimination of Incandescent Lighting to Drive the Demand for LED Lighting in Australia – Australia's pioneering move to eliminate incandescent lighting underscores its commitment to energy efficiency & sustainability, positioning the nation as a leader in adopting LED technology. The widespread penetration of LED lighting products in Australia is driven by several factors, including stringent energy efficiency regulations, government incentives, and technological advancements.

With the ban on incandescent bulbs, consumers & businesses have increasingly turned to LED lighting solutions due to their superior energy efficiency, longer lifespan, and environmental benefits. LED lighting continues to gain traction across residential, commercial, and industrial sectors, supported by ongoing infrastructure upgrades & innovative product developments, the Australian LED Lighting Market experiences sustained growth. This penetration not only addresses energy conservation goals but also fosters economic benefits through reduced electricity consumption & maintenance costs, further driving the widespread adoption of LED lighting solutions nationwide.

Australia LED Lighting Market Opportunity:

Overcoming Imports & Low Manufacturing Marks an Opportunity for Leveraging the Market – Australia's LED Lighting Market offers significant opportunities despite the country's reliance on imports and an underdeveloped local manufacturing industry. Recent acquisitions by key players like GE and Philips indicate a consolidation trend that could lead to innovative product offerings and market expansion. While the domestic industry is developing slower than Europe & the US, this gap allows Australia to tap into untapped market potential & differentiate itself.

Furthermore, the focus on high-end products with greater profit margins, despite a smaller customer base, presents an opportunity for LED lighting companies to target niche markets and capitalize on the growing demand for premium lighting solutions in Australia. Hence, the Australian LED Lighting Market would offer ample opportunities for growth & differentiation, particularly for companies willing to invest in quality, innovation, and meeting regulatory standards.

Australia LED Lighting Market Trend:

Urban Infrastructure Modernization with LED Street Lighting Systems – The widespread deployment of LED street lights in urban roads across Australia represents a significant trend in the Australia LED Lighting Market. This trend reflects a strategic shift towards energy-efficient & sustainable lighting solutions, driven by factors such as government initiatives promoting energy conservation & environmental sustainability.

The adoption of LED streetlights offers numerous advantages, including lower energy consumption, longer lifespan, reduced maintenance costs, and enhanced visibility & safety on roadways. As urban areas continue to expand & modernize, the demand for efficient & reliable lighting infrastructure is expected to grow. This trend not only demonstrates the increasing acceptance of LED technology in public lighting applications but also presents opportunities for further market expansion and innovation within the Australian LED lighting industry.

Australia LED Lighting Market (2024-30): Segmentation Analysis

The Australia LED Lighting Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the national levels. In accordance to the analysis, the market has been further classified as:

Based on Product Type:

- Lamps

- A-Type

- B-Type

- C-Type

- Luminaires

- Down Lighting

- Decorative Lighting

- Directional Lighting

- Others

The Lamps segment has played a pivotal role in driving the growth of the LED Lighting Market in Australia, primarily due to its significant market share and increasing demand across residential, commercial, and retail sectors. The rising adoption of LED lamps in residential & commercial settings, fueled by factors such as energy efficiency, longer lifespan, and cost-effectiveness, has contributed to the segment's dominance.

The ability of LED lamps to provide customizable lighting solutions, such as adjustable color temperatures & dimming options, has further bolstered their appeal in retail environments. Additionally, the ongoing transition from traditional lighting technologies to LED lamps, driven by government incentives & consumer awareness campaigns promoting energy-efficient lighting, has accelerated the segment's growth.

Based on Applications:

- Indoor

- Residential

- Commercial

- Offices

- Retail Stores

- Hospitality

- Others

- Industrial

- Others

- Outdoor

- Streets & Roadways

- Architectural Buildings

- Sports Complexes

- Tunnels

- Parks & Plazas

The commercial sector's contribution to the Indoor segment is pivotal in gaining the potential share of the Australia LED Lightening Market. LED lighting offers numerous advantages for commercial indoor applications, including energy efficiency, longer lifespan, reduced maintenance costs, and enhanced lighting quality. In office buildings, LED lighting improves employee productivity and well-being by providing flicker-free illumination and customizable lighting controls that align with circadian rhythms.

The ability of LED lighting to produce high-quality, directional light with excellent color rendering makes it particularly well-suited for showcasing products and enhancing the overall shopping experience. Moreover, the adoption of smart lighting systems in the commercial sector allows for advanced features such as occupancy sensing, daylight harvesting, and remote monitoring and control, further optimizing energy usage and operational efficiency.

Australia LED Lighting Market (2024-30): Regional Projection

Geographically, the Australia LED Lighting Market expands across:

- West

- North

- South

- Queensland

- New South Wales

- Victoria

The Western region of Australia significantly contributes to the growth of the LED Lighting Market due to its economic activity, urban development, and government policies promoting sustainability. Cities like Perth, with their expanding urban landscapes and infrastructure projects, drive the demand for efficient lighting solutions across residential, commercial, and public sectors.

Additionally, the region's reliance on industries such as mining necessitates high-quality lighting for operations, with LED technology offering durability and energy efficiency. Hence, the western region serves as a key market for LED lighting solutions, contributing to the broader growth of the Australia LED Lighting Market.

Australia LED Lighting Industry Recent Development:

- In 2023: Crompton Lighting, an Australian-owned company & the largest supplier of LED in Australia, developed new lighting solutions 'deco batten lights’ and LED lights to provide fancy lighting and to design, style & décor the living space.

- In 2023: Haneco Lighting Australia Pvt. Ltd., developed Haneco’s Stax G4 outdoor floodlights, a versatile and efficient range of LED floodlights from 15w to 200w designed to meet the diverse needs of residential, commercial, and industrial applications. It offered selectable color temperature, dual power, and an optional PIR motion sensor, providing adaptability & energy efficiency.

Gain a Competitive Edge with Our Australia LED Lighting Market Report

- Australia LED Lighting Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Australia LED Lighting Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- Australia LED Lights Market PESTLE Analysis

- Australia LED Lights Market Trends & Insights

- Australia LED Lights Market Dynamics

- Growth Drivers

- Challenges

- Australia LED Lights Market Value Chain and Margin Analysis

- Australia LED Lights Market Pricing Analysis, 2024

- Comparative Price Points, By Company

- YoY Product Wise Price Trends

- Forecast- Average Price

- Australia LED Lights Market Hotspots & Opportunities

- Australia LED Lights Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Lamps- (Market Size & Forecast 2019-2030, (USD Million)

- A-Type- (Market Size & Forecast 2019-2030, (USD Million)

- B-Type- (Market Size & Forecast 2019-2030, (USD Million)

- C-Type- (Market Size & Forecast 2019-2030, (USD Million)

- Others- (Market Size & Forecast 2019-2030, (USD Million)

- Luminaires- (Market Size & Forecast 2019-2030, (USD Million)

- Down Lighting- (Market Size & Forecast 2019-2030, (USD Million)

- Decorative Lighting- (Market Size & Forecast 2019-2030, (USD Million)

- Directional Lighting- (Market Size & Forecast 2019-2030, (USD Million)

- Others- (Market Size & Forecast 2019-2030, (USD Million)

- Lamps- (Market Size & Forecast 2019-2030, (USD Million)

- By Application

- Indoor- (Market Size & Forecast 2019-2030, (USD Million)

- Residential- (Market Size & Forecast 2019-2030, (USD Million)

- Commercial- (Market Size & Forecast 2019-2030, (USD Million)

- Offices- (Market Size & Forecast 2019-2030, (USD Million)

- Retail Stores- (Market Size & Forecast 2019-2030, (USD Million)

- Hospitality- (Market Size & Forecast 2019-2030, (USD Million)

- Others- (Market Size & Forecast 2019-2030, (USD Million)

- Industrial- (Market Size & Forecast 2019-2030, (USD Million)

- Others- (Market Size & Forecast 2019-2030, (USD Million)

- Outdoor- (Market Size & Forecast 2019-2030, (USD Million)

- Streets and Roadways- (Market Size & Forecast 2019-2030, (USD Million)

- Architectural Buildings- (Market Size & Forecast 2019-2030, (USD Million)

- Sports Complexes- (Market Size & Forecast 2019-2030, (USD Million)

- Tunnels- (Market Size & Forecast 2019-2030, (USD Million)

- Parks & Plazas- (Market Size & Forecast 2019-2030, (USD Million)

- Others- (Market Size & Forecast 2019-2030, (USD Million)

- Indoor- (Market Size & Forecast 2019-2030, (USD Million)

- By Installation

- New- (Market Size & Forecast 2019-2030, (USD Million)

- Retrofit- (Market Size & Forecast 2019-2030, (USD Million)

- By Sales Channel

- Indirect Sales- (Market Size & Forecast 2019-2030, (USD Million)

- Dealers & Distributors- (Market Size & Forecast 2019-2030, (USD Million)

- Retail Stores- (Market Size & Forecast 2019-2030, (USD Million)

- Direct Sales- (Market Size & Forecast 2019-2030, (USD Million)

- Indirect Sales- (Market Size & Forecast 2019-2030, (USD Million)

- By Region

- West

- North

- South

- Queensland

- New South Wales

- Victoria

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Product Type

- Market Size & Analysis

- Australia Indoor LED Lights Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- (Market Size & Forecast 2019-2030, (USD Million)

- By Installation- (Market Size & Forecast 2019-2030, (USD Million)

- By Sales Channel- (Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Australia Outdoor LED Lights Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- (Market Size & Forecast 2019-2030, (USD Million)

- By Installation- (Market Size & Forecast 2019-2030, (USD Million)

- By Sales Channel- (Market Size & Forecast 2019-2030, (USD Million)

- Market Size & Analysis

- Australia LED Lights Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Dongguan City Tianhua Photoelectric Technology Co. Ltd.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Signify N.V.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Osram Pty. Limited

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Crompton Lighting

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sylvania Schreder

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thorn Lighting

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Havit Lighting

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mirabelle International

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aqualuma LED Lighting

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Haneco Lighting Australia Pty Ltd.

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BOSCO Lighting

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others (Superlight, Coolon Pty Ltd., etc.)

- Business Description

- Product Segments

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dongguan City Tianhua Photoelectric Technology Co. Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making