GCC Wagyu Beef Market Research Report: Forecast (2025-2030)

Wagyu Beef Market in GCC - By Product Type (Wagyu Beef Cuts, Wagyu Ground Beef, Wagyu Processed Beef Products, Others), By Distribution Channel (Supermarkets or Hypermarkets, Onlin...e Retail, Specialty Meat Stores or Butcher Shops, Food Service or Hospitality), By End-User (Household, Commercial) and Others Read more

- Food & Beverages

- Aug 2025

- Pages 167

- Report Format: PDF, Excel, PPT

GCC Wagyu Beef Market

Projected 5.50% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2024)

USD 172.09 Million

Market Size (2030)

USD 237.29 Million

Base Year

2024

Projected CAGR

5.50%

Leading Segments

By Product Type: Wagyu Beef Cuts

Market Insights & Analysis: GCC Wagyu Beef Market (2025-30):

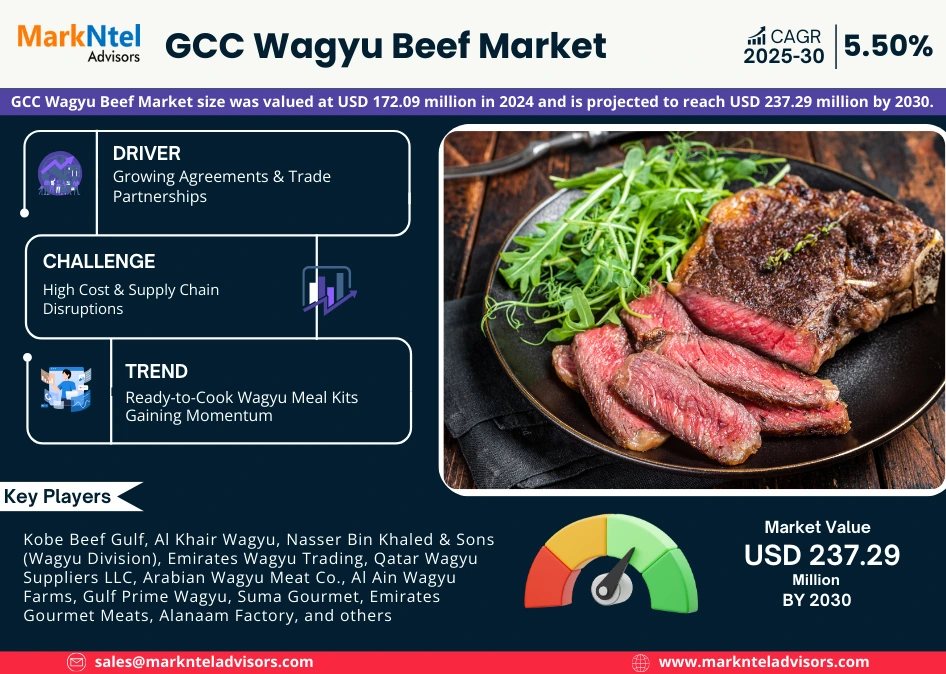

The GCC Wagyu Beef Market size was valued at USD 172.09 million in 2024 and is projected to reach USD 237.29 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.50% during the forecast period, i.e., 2025-30. The GCC Wagyu Beef Market is significantly growing due to several growth factors, including the high demand for animal protein, the active trade partnerships between GCC countries and the Wagyu cattle producing countries, such as Japan, Australia, the US, etc., the rapid adoption of local Wagyu farming, the development of cold chain infrastructure inside the ports and storage facilities, the availability of ready-to-cook wagyu beef meal kits, and many more.

One of the most prominent growth factors is the rising consumers’ preference for a protein-rich diet, which can be fulfilled by high-quality animal-based food products, including wagyu beef. Additionally, the inclination towards local wagyu beef farming in countries like Saudi Arabia and the UAE by companies like Almarai is providing lucrative growth opportunities for this market. This helps in avoiding importing production from Japan and Australia to the GCC countries.

Moreover, the supply of ready-to-cook meal kits of wagyu beef in the region is proactively shaping the market, as these are more convenient and suitable for the busy work lifestyles and tight schedules of these countries. Companies like Prime Gourmet, Casinetto, etc. are actively selling these meal kits in the GCC countries, increasing the GCC Wagyu Beef Market. However, the high cost of wagyu beef production, the long raising time for producing wagyu cattle, import dependence, and supply chain fragmentation are hampering the market growth & expansion.

GCC Wagyu Beef Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Wagyu Beef Cuts, Wagyu Ground Beef, Wagyu Processed Beef Products, Others |

| By Distribution Channel | Supermarkets or Hypermarkets, Online Retail, Specialty Meat Stores or Butcher Shops, Food Service or Hospitality |

| By End-User | Household, Commercial |

GCC Wagyu Beef Market Driver:

Growing Agreements & Trade Partnerships – GCC countries are largely dependent upon other countries such as Japan, Australia, and the United States for Wagyu beef consumption. The market growth is driven by the increasing trade agreements between these countries and the GCC region, which are actively producing high-quality Wagyu beef to supply it to the GCC region. These export agreements include the delivery of Halal-certified beef to meet the customs requirements of the region. For instance, in 2023, Australia exported about 5,000 metric tons to the GCC, contributing to the market growth.

Additionally, these exports have reduced import tariffs, which have increased the affordability of the wagyu beef in the region. For instance, in 2024, Australia signed a Memorandum of Understanding with the UAE to eliminate 5% import tariffs on frozen meat. Similarly, in 2023, Japan also got the official certification for exporting wagyu beef in this region with significantly low tariffs, thus increasing the market size & volume.

GCC Wagyu Beef Market Opportunity:

Adoption of Local Wagyu Farming – The practice of local wagyu beef farming in the GCC countries, like Saudi Arabia and the United Arab Emirates, is a key growth opportunity in the GCC Wagyu Beef Market. These countries have started producing wagyu cattle locally to avoid dependence on imports. The governments of these countries are also supporting local farming by providing heavy investments. For instance, in 2024, the Agricultural Development Fund of Saudi Arabia provided about USD530 million to support livestock breeding, including wagyu cattle production in the country.

Similarly, in the UAE, the National Food Security Strategy 2051 targets to offer subsidies on fodder and tax exemptions on locally produced livestock & food items to support the local breeding projects, including wagyu cattle production. Companies like Almarai and Savola Group are heavily investing in the local beef production, including wagyu beef. For instance, Almarai (2021) has invested about USD70 million to support local beef production, thus offering ample growth opportunities for the market players.

GCC Wagyu Beef Market Challenge:

High Cost & Supply Chain Disruptions – The market is facing several challenges, including high production costs as it takes a long time to raise wagyu cattle, which is about 30 months, with a special diet and care under sanitary conditions, making their management highly expensive. For instance, the cost may range between USD2,00,000 to USD3,00,000 wagyu beef per ton. It is limiting their adoption only to the luxurious & high-end hotels & restaurants in the region. Many of the small-scale food providers are unable to enter the market due to unaffordability, thus hindering market growth & expansion.

Additionally, the fragmented supply chains are further creating hindrances in the GCC Wagyu Beef Market, due to the improper management of cold supply chains and transportation delays due to cross-border restrictions, like the Red Sea crisis. It ultimately increases the transportation costs and delivery delays, thus hampering the overall market growth.

GCC Wagyu Beef Market Trend:

Ready-to-Cook Wagyu Meal Kits Gaining Momentum – The market dynamics are changing due to the adoption of ready-to-eat wagyu meal kits in the GCC countries, which is being adopted due to the busy lifestyles and schedules of individuals. These kits include already cut, pre-portioned, and chilled wagyu slices and marinades with cooking instructions, and provide convenience to the consumers.

Several companies like Prime Gourmet, Casinetto, and others are selling these kits in the GCC countries. For instance, the UAE-based Prime Gourmet company provides Australian and Japanese A5 wagyu beef minced kits, with exciting combinations, such as wagyu beef burgers. Similarly, the Maxi Good Food Shop in Dubai sells ready-to-cook wagyu burger patties in their kits. These kinds of practices are actively transforming the GCC Wagyu Beef Market.

GCC Wagyu Beef Market (2025-30): Segmentation Analysis

The GCC Wagyu Beef Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the regional level. Based on the analysis, the market has been further classified as:

Based on Product Type:

- Wagyu Beef Cuts (Ribeye, Sirloin, Tenderloin, etc.)

- Wagyu Ground Beef

- Wagyu Processed Beef Products (Sausages, Jerky, etc.)

- Others

Among these, the wagyu beef cuts are dominating the regional market, accounting for more than 55% of the market share. This is leading due to the high customer preferences for fresh wagyu beef cuts, such as Ribeye, Sirloin, Tenderloin, etc., over ground and processed beef. Cuts are highly preferred for their high quality, rich marbling, tenderness, and unique flavors. Additionally, the import rates for the wagyu beef cuts are more than the other product types, thus dominating the market segment. For instance, in 2023, the total export quantity of wagyu beef from Australia was about 5,000 metric tons, out of which about 2,000 metric tons were wagyu beef cuts from all other product types, showing the dominance of the cuts in the market segment.

Based on Distribution Channel:

- Supermarkets / Hypermarkets

- Online Retail

- Specialty Meat Stores / Butcher Shops

- Food Service / Hospitality (Hotels, Restaurants)

Out of these, the food service and hospitality segment holds the largest market share of about 75%. The dominance is due to the expensive nature of wagyu beef, which is highly sought after by the high-end and luxurious hotels and restaurants in the GCC region. Consequently, hundreds of food services are serving premium wagyu beef dishes in countries like Saudi Arabia, the UAE, and Qatar.

Additionally, in recent years, these countries have witnessed a strong growth in event conduction, like the FIFA World Cup in Qatar, Expo Dubai 2020, etc. This has led to the rising inbound tourism in these countries, which is growing the demand for food services to offer hospitality, which ultimately increases the demand for all category food items, including premium wagyu beef dishes. These factors show the dominance of the food service and hospitality distribution segment in the industry.

GCC Wagyu Beef Market (2025-30): Regional Projections

Geographically, the GCC Wagyu Beef Market expands across:

- Saudi Arabia

- The UAE

- Qatar

- Kuwait

- Oman

- Bahrain

- Others

The UAE is the leading country, with a market share of around 50%. This is because the UAE has the wealthiest population out of all the GCC countries, who are spending more on expensive and premium food items such as wagyu beef. Also, the strong presence of luxurious hotels and fine-dining restaurants in the UAE, offering sirloin, ribeye wagyu dishes, is contributing to the dominance of the UAE in the regional segment of this market. Additionally, the famous cities, like Dubai, Abu Dhabi, etc., attract millions of international visitors annually, who are further increasing the demand for premium food products such as wagyu beef dishes. For instance, in 2023, Dubai received over 16 million inbound tourist arrivals.

Moreover, the country has about 40 free trade zones, such as KIZAD in Abu Dhabi, Jebel Ali Free Zone (JAFZA), and Dubai Airport Free Zone, which have advanced cold storage facilities, quick customs clearance, etc., contributing to the dominance of the UAE in this regional market.

Top Wagyu Beef Companies in the GCC Market: Players, Analysis & Future Outlook

The leading GCC Wagyu Beef Companies in the market, including Kobe Beef Gulf, Al Khair Wagyu, Nasser Bin Khaled & Sons (Wagyu Division), Emirates Wagyu Trading, Qatar Wagyu Suppliers LLC, Arabian Wagyu Meat Co., Al Ain Wagyu Farms, Gulf Prime Wagyu, Suma Gourmet, Emirates Gourmet Meats, Alanaam Factory, and others are looking forward to increasing their market size & share.

GCC Wagyu Beef Industry Recent Development:

- 2025: Alanaam Factory launched its first Wagyu beef steak product. The meat is prepared according to Islamic Sharia rules, without using electric stunning. They import Wagyu calves directly from Japan and introduced the product during Ramadan. Along with this, they started a big livestock import of over 23,000 animals and made the Wagyu beef available through their app and website, offering easy home delivery across Qatar.

- 2024: Suma Gourmet expanded through their online platform DXBBQ, offering top-quality meats like Wagyu and Black Angus to homes in the UAE, Oman, and Qatar. They also partnered with UNISOT to track halal meat and improved their delivery system to meet rising demand in the Gulf region.

Gain a Competitive Edge with Our GCC Wagyu Beef Market Report

- GCC Wagyu Beef Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Wagyu Beef Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Wagyu Beef Market Policies, Regulations, and Product Standards

- GCC Wagyu Beef Market Supply Chain Analysis

- GCC Wagyu Beef Market Trends & Developments

- GCC Wagyu Beef Market Dynamics

- Growth Drivers

- Challenges

- GCC Wagyu Beef Market Hotspot & Opportunities

- GCC Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type

- Wagyu Beef Cuts (Ribeye, Sirloin, Tenderloin, etc.)- Market Size & Forecast 2020-2030, USD Million

- Wagyu Ground Beef- Market Size & Forecast 2020-2030, USD Million

- Wagyu Processed Beef Products (Sausages, Jerky, etc.)- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Supermarkets / Hypermarkets- Market Size & Forecast 2020-2030, USD Million

- Online Retail- Market Size & Forecast 2020-2030, USD Million

- Specialty Meat Stores / Butcher Shops- Market Size & Forecast 2020-2030, USD Million

- Food Service / Hospitality (Hotels, Restaurants)- Market Size & Forecast 2020-2030, USD Million

- By End-User

- Household- Market Size & Forecast 2020-2030, USD Million

- Commercial- Market Size & Forecast 2020-2030, USD Million

- By Region

- Saudi Arabia

- The UAE

- Qatar

- Kuwait

- Oman

- Bahrain

- Others

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- UAE Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Qatar Arabia Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Kuwait Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Oman Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Bahrain Wagyu Beef Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- GCC Wagyu Beef Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Kobe Beef Gulf

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Khair Wagyu

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nasser Bin Khaled & Sons (Wagyu Division)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emirates Wagyu Trading

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qatar Wagyu Suppliers LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arabian Wagyu Meat Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Ain Wagyu Farms

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Prime Wagyu

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Suma Gourmet

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emirates Gourmet Meats

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Alanaam Factory

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Kobe Beef Gulf

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making