US Recommerce Market Research Report: Forecast (2024-2030)

US Recommerce Market- By Type (Peer-to-Peer Marketplaces, Resale Marketplaces, Refurbished Goods Marketplaces), By Product (Electronics, Fashion & Apparel, Furniture and Home Goods..., Automotive, Sports and Fitness Equipment, Others), By Product Category (Non-Luxury, Luxury), By Age Group (Up to 18 Years, 19-25 Years, 26-40 Years, 41-55 Years, Above 56 Years), and others Read more

- ICT & Electronics

- Jan 2024

- Pages 128

- Report Format: PDF, Excel, PPT

Market Definition

Recommerce, sometimes referred to as reverse commerce or resale commerce, is a quickly developing business in the larger retail sector that focuses on the purchasing, trading, and selling of pre-owned or used goods. Recommerce aims to extend the lifecycle of current products by enabling their resale, repurchase, or exchange among individuals or enterprises, in contrast to traditional retail, which sells new items to consumers.

Market Insights & Analysis: The US Recommerce Market (2024-30):

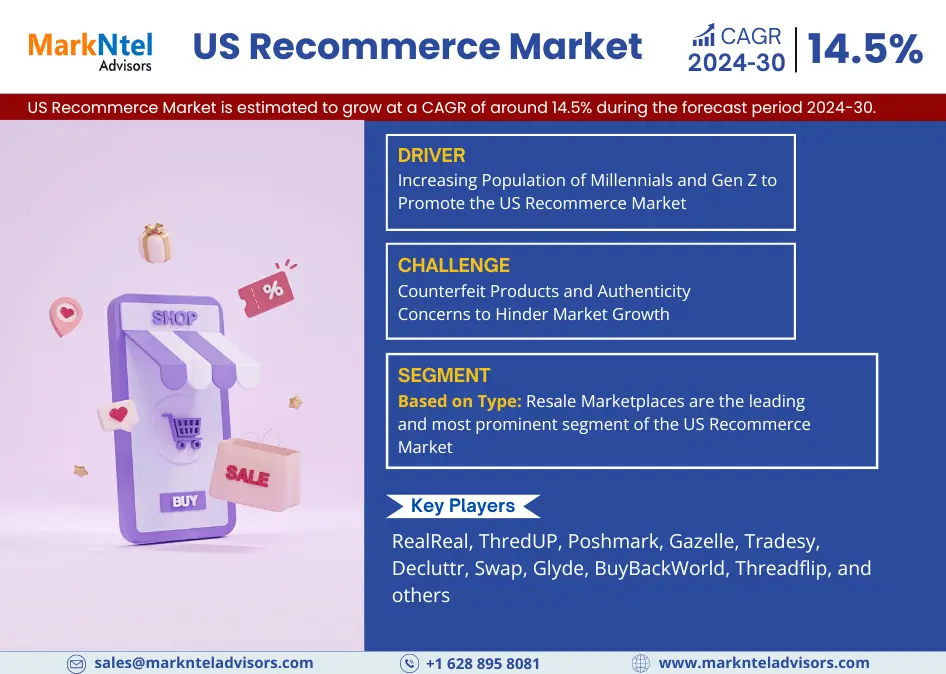

The US Recommerce Market is estimated to grow at a CAGR of around 14.5% during the forecast period, i.e., 2024-30. The recommerce industry in the US is undergoing a profound transformation, experiencing robust growth and reshaping the way consumers think about buying and selling used goods. Today's consumers are more conscious of the environmental impact of their consumption habits, leading many to opt for secondhand goods as a sustainable and responsible choice. The stigma once associated with buying used items has largely disappeared, replaced by a sense of pride in making eco-conscious choices. To cater to this dynamic change in the market outlook for preowned products, major players in the re-commerce industry are actively engaged in the diversification of the product line as well as mergers & acquisitions, thus driving market growth in the country. For instance,

- In 2021, ThredUP acquired Remix, a European recommerce platform, to expand its presence internationally. This strategic development performed by the company will also help to enhance the brand’s position in the US market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 14.5% |

| Region Covered | North, South, East, Mid-West |

| Key Companies Profiled | RealReal, ThredUP, Poshmark, Gazelle, Tradesy, Decluttr, Swap, Glyde, BuyBackWorld, Threadflip, and others |

| Unit Denominations | USD Million/Billion |

Apart from the aforementioned factors, economic factors also play a significant role in the growth of the recommerce industry in the US. As economic disparities persist, consumers are seeking cost-effective ways to access quality products, in turn driving the growth of the recommerce market in the country.

Further, the continuous transformation of the digital age will also proliferate the growth of the recommerce industry in the country. The rise of online marketplaces and mobile apps has made it easier than ever for consumers to buy and sell pre-owned items. These platforms offer a seamless and convenient experience, allowing users to list, browse, and complete transactions with ease. Digitalization has enabled recommerce companies to reach a broader audience and expand their offerings, thus promoting market growth during the projected timeframe.

The US Recommerce Market Driver:

Increasing Population of Millennials and Gen Z to Promote the US Recommerce Market – The recommerce industry in the US is experiencing a remarkable recovery, with major support from the Millennial and Gen Z populations. These digitally native and sustainability-conscious generations are reshaping the retail landscape by embracing second-hand commerce, thus driving the growth of the recommerce industry in the country. While the recommerce industry has attracted consumers across all age groups, Millennials and Gen Z have emerged as key enthusiasts owing to factors such as sustainability, budget-friendly shopping, unique personal style, tech-savvy engagement, etc. According to the US Census Bureau, millennials and Gen Z accounts for 32.2% of the total US population in 2024, this percentage is expected to grow further in the coming years, thus making the US a key market for refurbished products.

Additionally, recommerce companies are embracing cutting-edge technology to create user-friendly and visually appealing platforms for the younger population. Mobile apps have become a primary focus, providing seamless and on-the-go shopping experiences tailored to the preferences of digital natives. Thus proliferating the growth of the recommerce industry in the US. For instance,

- In 2020, Poshmark, one of the key players in the US recommerce market, has introduced in-app purchasing for its customers. The ability for users to make purchases directly within the app has been introduced to streamline the buying process and enhance customers’ convenience.

The US Recommerce Market Opportunity:

Increasing Demand for Niche Products to Open New Doors for Market Players – Exploration of niche markets in the recommerce industry is expected to stand out as a strategic move that will unlock new dimensions of growth and innovation for industry players. Increasing demand for preowned niche product lines such as DVDs, videogames, vintage clothing, rare collectibles, etc. has opened new growth opportunities for major industry players, thus boosting the market attractiveness in the country. Niche products, especially collectibles and rarities, often command higher price points. This can translate to increased revenue and profit margins for recommerce companies, thus propelling the market growth. For instance,

- In 2023, ComicConnect has collaborated with prominent collectors, comic book artists, and industry experts to curate special auctions or events. This collaboration is a step toward adding prestige to the company’s offerings in the US market.

Further, as the recommerce industry continues to evolve, the exploration of niche markets presents a promising pathway for market players to innovate and expand their horizons. Serving dedicated communities of enthusiasts, offering unique and specialized inventory, and capitalizing on the passion within this industry will unlock new opportunities for growth and success. Thus, it is anticipated to augment the size & volume of the recommerce industry during the forecast period.

The US Recommerce Market Challenge:

Counterfeit Products and Authenticity Concerns to Hinder Market Growth – One of the most daunting challenges faced by the US recommerce sector is the issue of counterfeit products and authenticity concerns related to preowned products. Counterfeit products have become a pervasive problem in the modern retail landscape. The challenge is not only limited to high-end luxury brands but also in categories including fashion, electronics, accessories, and collectibles. Recommerce platforms dealing in pre-owned items are particularly vulnerable to the infiltration of counterfeit goods, thus impacting the brand’s name as well as the growth of the market. Trust erosion, authentication complexity, consumer disputes, legal implications, etc. are some of the major challenges faced by recommerce companies while dealing with the problem of counterfeit products.

The US Recommerce Market Trend:

Increasing Awareness of Environment & Sustainability – The US is witnessing a major resurgence of the recommerce industry due to sustainability and environmental awareness. The worldwide issues of plastic pollution, resource depletion, and climate change are making consumers more conscious of their role in solving these problems. To cater to the changing needs of the market, major industry participants are also engaged in providing new services and platforms to customers to keep a proper check on the environment through their purchases. For instance,

- In 2023, Journeys and ThredUP collaborated to launch Journeys’ new resale platform, Journeys Second-Hand. This platform will allow customers to buy second-hand apparel directly from Journeys’ website in an environmentally conscious way.

Additionally, numerous recommerce platforms have emerged in the US in response to the growing demand for sustainable shopping options. Companies like ThredUP, Poshmark, and The RealReal specialize in recommerce as well as in promoting eco-friendly shopping practices. These companies offer a wide range of pre-owned items, from clothing and accessories to electronics and home goods, allowing consumers to make sustainable choices in various aspects of their lives, thus driving the recommerce market in the country.

According to Datafeed Watch, nearly 85% of all textiles, i.e., roughly 13 million tons, were thrown away in the US in 2018, leaving a huge impact on the environment. The average American has been estimated to throw away around 37kg of clothes every year. By 2030, the quantity to be discarded is expected to be more than 134 million tons. Thus, making fashion one of the most unsustainable industries, in turn, provides new opportunities for the fashion recommerce industry.

The US Recommerce Market (2024-30): Segmentation Analysis

The US Recommerce Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the country level. According to the analysis, the market has been further classified as:

Based on Type:

- Peer-to-Peer Marketplaces

- Resale Marketplaces

- Refurbished Goods Marketplaces

Resale Marketplaces are the leading and most prominent segment of the US Recommerce Market. Resale Marketplaces typically involve the buying and selling of pre-owned or secondhand items, including clothing, accessories, electronics, etc. Major market players such as Poshmark, ThredUP, and The RealReal have gained significant traction in this segment. The USP of these platforms lies in finding gently used, high-quality products at a fraction of their original price, thus driving their popularity in the US Recommerce Market.

Market players in this industry are actively undergoing strategic development activities, such as the expansion of product offerings, to capture a sizeable market share of the US Recommerce Industry. For instance,

- In 2023, Poshmark ventured into new resale categories, including home décor products. This launch allowed users to buy and sell pre-owned furniture, home goods, and decor items in the company’s resale channel.

In an era marked by heightened environmental awareness, consumers are increasingly drawn to resale marketplaces as a way to reduce their carbon footprint. These marketplaces prominently help in achieving this goal by extending the lifecycle of the products. Additionally, resale marketplaces also offer affordable products without compromising their quality. Customers can access high-end fashion, vintage items, and luxury goods at significantly reduced prices, making them a budget-conscious choice, thus driving the segment’s growth.

Based on Product Category:

- Non-Luxury

- Luxury

The luxury segment holds a significant share in the US Recommerce Market. The growth of this product category in recommerce is redefining the way consumers perceive high-end fashion, accessories, and coveted items. Purchasing pre-owned luxury items reduces the environmental footprint associated with the production of new goods. With increasing consciousness for the ecosystem and the allure of luxury recommerce, the popularity of preowned luxury products is on the rise in the US Recommerce Industry. Companies operating in this segment are also focusing on diversifying their product portfolio as well as on mergers & acquisitions activities to capture key market share in the luxury segment. For instance,

- In 2021, Poshmark acquired Second Time Around, one of the key companies of luxury consignment. This acquisition has strengthened Poshmark's position in the luxury resale category in the US Recommerce Market.

The luxury product category is on the verge of further growth as consumers take sustainability, affordability, and unique style into account. The potential of the recommerce market is also recognized by luxury fashion brands, which are opening their doors or working together with recommerce platforms to increase product lifecycles. Luxury recommerce not only enables consumers to buy luxury goods, but it also gives them the freedom to do so with a certain level of conscience. The country’s recommerce industry is expected to flourish with the growth of luxury retailing as a part of the evolution of fashion and commerce during the projected timeframe.

The US Recommerce Industry Recent Development:

- 2021: Glyde has launched a dedicated platform for buying and selling used video games, consoles, and accessories under the name Glyde Gaming. This expansion was carried out by the company to cater to gamers and gaming enthusiasts.

Gain a Competitive Edge with Our US Recommerce Market Report

- The US Recommerce Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations gain a holistic understanding of market dynamics & make vital decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The US Recommerce Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The US Recommerce Market Consumer Behavior Analysis

- Selling Motivation

- Buying Preference/ Motivation

- The Role of Sustainability in Choosing Resale/Refurbished Products

- The US Recommerce Market Startup Ecosystem

- Year of Establishment

- Amount Raised (USD Million)

- Series of Fund Raise

- Purpose of Fund Raise

- Investors Involved

- The US Recommerce Market Trends & Insights

- The US Recommerce Market Dynamics

- Growth Drivers

- Challenges

- The US Recommerce Market Policies, Regulations & Product Standards

- The US Recommerce Market Hotspot & Opportunities

- The US Recommerce Market Outlook, 2019-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type

- Peer-to-Peer Marketplaces- Market Size & Forecast 2019-2030, (USD Million)

- Resale Marketplaces- Market Size & Forecast 2019-2030, (USD Million)

- Refurbished Goods Marketplaces- Market Size & Forecast 2019-2030, (USD Million)

- By Product

- Electronics - Market Size & Forecast 2019-2030, (USD Million)

- Smartphones & Tablets - Market Size & Forecast 2019-2030, (USD Million)

- Laptops & Computers - Market Size & Forecast 2019-2030, (USD Million)

- Cameras and Photography Equipment - Market Size & Forecast 2019-2030, (USD Million)

- Home Appliances (Refurbished Refrigerators, Washing Machines, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- Others (Networking Equipment, Gaming Consoles and Accessories, etc.) - Market Size & Forecast 2019-2030, (USD Million)

- Fashion & Apparel - Market Size & Forecast 2019-2030, (USD Million)

- Clothing - Market Size & Forecast 2019-2030, (USD Million)

- Footwear - Market Size & Forecast 2019-2030, (USD Million)

- Accessories (Jewelry, Watches, Handbags, etc.) - Market Size & Forecast 2019-2030, (USD Million)

- Furniture and Home Goods- Market Size & Forecast 2019-2030, (USD Million)

- Sofas and Couches - Market Size & Forecast 2019-2030, (USD Million)

- Tables & Chairs - Market Size & Forecast 2019-2030, (USD Million)

- Home Decor (Rugs, Paintings, Vases, etc.) - Market Size & Forecast 2019-2030, (USD Million)

- Others (Garden Equipment, Bathroom Accessories, etc.) - Market Size & Forecast 2019-2030, (USD Million)

- Automotive- Market Size & Forecast 2019-2030, (USD Million)

- Used Vehicles- Market Size & Forecast 2019-2030, (USD Million)

- Vehicle Parts and Accessories- Market Size & Forecast 2019-2030, (USD Million)

- Sports and Fitness Equipment- Market Size & Forecast 2019-2030, (USD Million)

- Others (Toys, Collectibles, Books, etc.)- Market Size & Forecast 2019-2030, (USD Million)

- Electronics - Market Size & Forecast 2019-2030, (USD Million)

- By Product Category

- Non-Luxury- Market Size & Forecast 2019-2030, (USD Million)

- Luxury- Market Size & Forecast 2019-2030, (USD Million)

- By Age Group

- Up to 18 Years- Market Size & Forecast 2019-2030, (USD Million)

- 19-25 Years- Market Size & Forecast 2019-2030, (USD Million)

- 26-40 Years- Market Size & Forecast 2019-2030, (USD Million)

- 41-55 Years- Market Size & Forecast 2019-2030, (USD Million)

- Above 56 Years- Market Size & Forecast 2019-2030, (USD Million)

- By Region

- North

- South

- East

- Mid-West

- By Company

- Market Share

- Competition Characteristics

- By Type

- Market Size & Analysis

- The US Recommerce Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- The RealReal

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ThredUP

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Poshmark

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gazelle

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tradesy

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Decluttr

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Swap

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Glyde

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BuyBackWorld

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Threadflip

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- The RealReal

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making