India Data Center Market Research Report: Forecast (2025-2030)

India Data Center Market - By Type (Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, Hyperscale Data Centers), By Components (Hardware, Software, Services), By ...Size (Small Data Centers, Mid-Size Data Centers, Large Data Centers), By Tier (Tier 1 and 2, Tier 3, Tier 4), By End User BSFI, (Government, IT & Telecom, Media & Entertainment, Manufacturin) and Others Read more

- ICT & Electronics

- Dec 2024

- Pages 130

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: India Data Center Market (2025-2030):

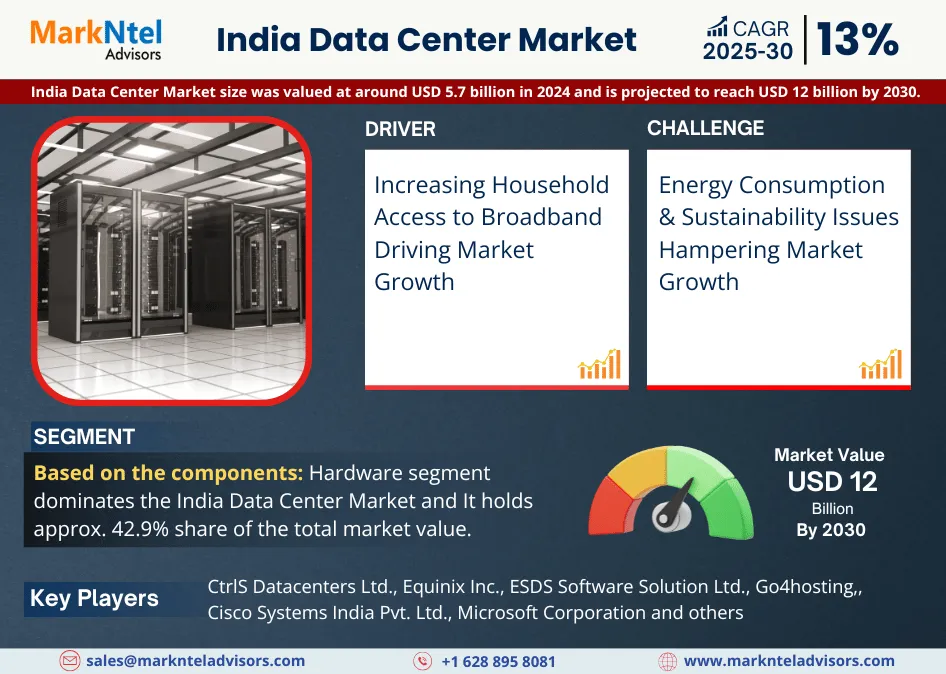

The India Data Center Market size was valued at around USD 5.7 billion in 2024 and is projected to reach USD 12 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 13% during the forecast period, i.e., 2025-30. Numerous factors contribute to the market growth such as; the expansion of telecom operators offering affordable phone & internet services, the adoption of cloud services, the growing volume of data, government initiatives, and incremental investments in the data center market.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 5.7 Billion |

| Market Value in 2030 | USD 12 Billion |

| CAGR (2025-30) | 13% |

| Leading City | Mumbai |

| Top Key Players | CtrlS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., Go4hosting, NTT Global Data Centers & Cloud Infrastructure India Private Limited, Cisco Systems India Pvt. Ltd., Microsoft Corporation, Nxtra Data Ltd., Pi Datacenters Pvt. Ltd., Reliance Communications Ltd. (Reliance Data Centre), Adani Group, Sify Technologies Ltd., STT GDC Pte Ltd., WebWerks, Yotta Infrastructure Solutions, Tata Communications, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

The expansion of the India Data Center Market has been largely fueled by government initiatives. Important initiatives like; Digital India have raised the demand for data centers by increasing internet usage and digital services. Global companies like Microsoft and Google are making large investments & developing infrastructure as a result of the National Data Center Policy (2020) which encourages investment by providing incentives like; tax exemptions and rebates. For Instance;

- Google plans to finish building its 8-story 381-square-foot data center in Navi Mumbai by 2025.

The country hosts over 130 operational data centers, with more than 1180 MW of IT load capacity in 2024, and surpasses 12.5 million square feet of space. For 2024-2026 and beyond, an additional 35+ data centers with 5.7+ million square feet, and 987+ MW of capacity have been announced. Companies like; Adani Group and Tata Communications are leaders in promoting the development of domestic data center infrastructure under the Atmanirbhar Bharat Initiative. Tata Communications has 14 data centers in key cities across India currently.

Furthermore, tax breaks like; income tax advantages and GST exemptions have aided in growth. Also in 2018, the RBI mandated storing financial data within India, leading to increased investment and development in India's data center infrastructure. The Digital Personal Data Protection Act 2023 and other data localization initiatives are driving demand for local data centers. As rural areas gain access to broadband through the BharatNet project, there is a greater demand for local data centers. Government assistance for smart city projects and green data centers expands the market and makes India a desirable place to invest.

Moreover, the incremental investments in the India Data Center Market are further propelling its growth. STT GDC Pte Ltd. plans to invest around USD 3.2 billion in India to expand its data center operations by adding 550MW of capacity to its current offering over the next five to six years, thus tripling the company’s IT capacity. Despite having only 3% of the global data center capacity, India produces 20% of the world's data. Furthermore, as 5G IoT and AI technologies are adopted, India's data consumption may triple. The potential capacity expansion is expected to double at around 2,000 MW by 2026, unlocking all-inclusive investment opportunities, for which the projected capital expense is about USD 6 billion. Also, as per the Indian exchange control laws, 100% foreign direct investment is permitted by the government under the automatic route in Indian companies and LLPs that are engaged only in the data center business. This would help companies in the market expansion by reducing entry barriers and bringing global investments to the Indian market.

India Data Center Market Driver:

Increasing Household Access to Broadband Driving Market Growth – The use of fiber optic cables which provide data transmission speeds of up to 10Gbps is creating high demand for the market. Demand for online services like; cloud computing, e-commerce, online education, and entertainment has created the need for substantial processing and data storage capacity in data centers. In March 2024, there were 10.96 million broadband subscribers in India as compared to 10.04 million in March 2023.

As per the Government’s BharatNet project, around 21.6 lakh Gramm Panchayats will have broadband access and shall be implemented in phases. Phase I which covered more than 1 lakh Gram Panchayats was completed in December 2017. By October 2022, the project had installed more than 6 Lakhs km of optical fiber cable, connected more than 1.9 Lakhs Gram Panchayats with Optic fiber cables, and had approximately 1.77 Lakhs Gram Panchayats that were ready for service. In addition, 4466 Gram Panchayats have been connected via satellite. For service 1.82 Lakhs Gram Panchayats are available. India's fiberization rate was approximately 38% as of October 2023. By 2025 the government intends to expand fiberization to 5 million kilometers. Thus, all these factors indicate the increasing household access to broadband, which ultimately drives the size & volume of the data center industry in India.

India Data Center Market Opportunity:

Rising Demand for Edge Data Centers – The data center market in India has a great opportunity to expand due to the growing demand for edge data centers. Low-latency processing close to end users is essential as 5G networks, IoT adoption, and real-time digital services grow. By facilitating effective data processing at local nodes, edge data centers lessen dependency on centralized infrastructure. With over 936 million internet users in India and Reliance Jio & Airtel launching 5G quickly, the demand for edge infrastructure has increased drastically. For Instance; to support its 5G services Reliance Jio announced investments in an edge data center network. Nxtra Data, a division of Airtel is also building regional edge facilities in Tier 2 and Tier 3 cities. As smart city streaming services and driverless cars become more popular, the demand for edge data centers is expected to bring more opportunities for market growth & expansion.

India Data Center Market Challenge:

Energy Consumption & Sustainability Issues Hampering Market Growth – Energy consumption and sustainability issues hamper market growth especially due to its high power requirement and reliance on conventional energy. Data centers consume approximately 2% of India's total electricity demand. High energy costs and dependence on diesel-based backup power systems aggravate their cost structure and the impacts on the environment. Also, the tropical climate of India further increases cooling requirements. There is still very limited adoption of energy-efficient technologies such as; liquid cooling and renewable power integration, as these are highly priced and there is not much availability in non-metro cities. While companies like; Yotta Infrastructure are indeed investing in green data centers, markets struggle to scale the adoption of renewable energy.

India Data Center Market Trend:

Adoption of Cloud Services – Strong data centers are essential to manage the constantly expanding information pool as companies of all sizes & sectors are moving toward cloud-based solutions for apps and data storage making it a significant market trend. Businesses are adopting these services more frequently because they offer several benefits including data analysis, storage, and scalable infrastructure. The need for data centers that can provide businesses and individuals with dependable and secure cloud services is a result of this cloud-based revolution. By 2026 cloud computing will contribute around 8% of India’s GDP. It could increase employment by 14 million and boost the nation's GDP by USD 310– USD 380 billion by 2026. Many companies like; Microsoft Azure, Amazon Web Services, Google Cloud, Adani Group, and others have already started investing intensively to expand their data center footprints with the adoption of cloud services. For Instance;

- For the expansion of its cloud computing services, Amazon Web Services plans to invest around USD 4.4 billion in the Hyderabad region by 2030.

India Data Center Market (2025-2030): Segmentation Analysis

The India Data Center Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

By Components

- Hardware

- Software

- Services

Based on the components, the hardware segment dominates the India Data Center Market. It holds approx. 42.9% share of the total market value. This domination is driven by the essential requirement for robust physical infrastructure. It consists of servers, network equipment, cooling systems, and storage devices, which are necessary for the effective functioning of data centers. The enhanced need for high-functioning computing hardware in various sectors like; IT and banking is fueling market growth. IT sector contributes 7.4% to the Indian GDP, and by 2025, it is likely to account for 10%. Larger companies are also heavily investing in this to enhance their processing power and storage capacity which will further lead to the segment’s revenue growth during the forecast period.

By End User

- BSFI

- Government

- IT & Telecom

- Media & Entertainment

- Manufacturing

- Others

Based on End User, IT & Telecom segment dominates the India Data Center Market. It occupies around 45% of the total market. This is attributed to the astounding growth in data traffic, caused by increased usage of smartphones, internet penetration, and rapid adoption of cloud services across the sector. 56% of all new connections in India will be in the rural space by 2025. Telecom operators and IT service companies are also investing aggressively in increasing data center capacity to manage the gigantic volumes of data and propel newer technologies, such as; 5G, IoT, and AI. The next generation of these technologies has robust infrastructure requirements, thereby fueling the demand for high-performance data centers.

India Data Center Market (2025-30): Regional Projections

Geographically, the India Data Center Market expands across:

- Bangalore

- Chennai

- Hyderabad

- Mumbai

- NCR

- Pune

- Rest of India

Based on regional hotspots, The Mumbai dominates the India Data Center Market. It holds approx. 44% of the total Market. This is due to the presence of major companies like; Sify, STT, CtrlS, Yotta, Nxtra Data, Web Werks, NTT, and many others which bring new investment into the region, further pushing the market growth in Navi Mumbai. Moreover, Mumbai is the financial capital of India, thus ensuring high market demand from various sectors like; IT, BSFI, and Telecom. In addition, submarine cable landing points are plenty in Mumbai that ensure fast global connectivity. The cables are essential for international data flow & cloud and content delivery services. Besides that, the city provides a relatively sound power infrastructure and a high availability of commercial real estate adapted to meet the needs of a data center.

India Data Center Industry Recent Development:

- August 2024: CtrlS Datacenters Ltd. acquired land in Patna for the establishment of its second data center in the region with an investment of around USD 474.53 million.

- January 2024: NTT Data launched a new data center facility in Noida, which is spread across six acres and provides 52.8MW critical IT load in two data storage centers.

Gain a Competitive Edge with Our India Data Center Market Report

- India Data Center Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Data Center Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Data Center Market Trends & Deployments

- India Data Center Market Dynamics

- Growth Drivers

- Challenges

- India Data Center Market Opportunities & Hotspots

- India Data Center Market Value Chain Analysis

- India Data Center Market Regulations and Policy

- India Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Enterprise Data Centers- Market Size & Forecast 2020-2030, USD Million

- Colocation Data Centers- Market Size & Forecast 2020-2030, USD Million

- Edge Data Centers- Market Size & Forecast 2020-2030, USD Million

- Hyperscale Data Centers- Market Size & Forecast 2020-2030, USD Million

- By Components

- Hardware- Market Size & Forecast 2020-2030, USD Million

- Software- Market Size & Forecast 2020-2030, USD Million

- Services- Market Size & Forecast 2020-2030, USD Million

- By Size

- Small Data Centers- Market Size & Forecast 2020-2030, USD Million

- Mid-Size Data Centers- Market Size & Forecast 2020-2030, USD Million

- Large Data Centers- Market Size & Forecast 2020-2030, USD Million

- By Tier

- Tier 1 and 2- Market Size & Forecast 2020-2030, USD Million

- Tier 3- Market Size & Forecast 2020-2030, USD Million

- Tier 4- Market Size & Forecast 2020-2030, USD Million

- By End User

- BSFI-Market Size & Forecast 2020-2030, USD Million

- Government-Market Size & Forecast 2020-2030, USD Million

- IT & Telecom-Market Size & Forecast 2020-2030, USD Million

- Media & Entertainment-Market Size & Forecast 2020-2030, USD Million

- Manufacturing-Market Size & Forecast 2020-2030, USD Million

- Others

- By City

- Bangalore

- Chennai

- Hyderabad

- Mumbai

- NCR

- Pune

- Rest of India

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Type

- Market Size & Analysis

- Bangalore Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Chennai Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Hyderabad Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mumbai Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- NCR Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Pune Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Rest of India Data Center Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By Component-Market Size & Forecast 2020-2030, USD Million

- By Size-Market Size & Forecast 2020-2030, USD Million

- By Tier- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Data Center Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- CtrlS Datacenters Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Equinix Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- ESDS Software Solution Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Go4hosting

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- NTT Global Data Centers & Cloud Infrastructure India Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Cisco Systems India Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Microsoft Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Nxtra Data Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Pi Datacenters Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Reliance Communications Ltd. (Reliance Datacentre)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Adani Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Sify Technologies Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- STT GDC Pte Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- WebWerks

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Yotta Infrastructure Solutions

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Tata Communications

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- CtrlS Datacenters Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making