Global Re-Commerce Market Research Report: Forecast (2025-2030)

Re-Commerce Market - By Type (Peer-to-Peer Marketplaces, Resale Marketplaces, Refurbished Goods Marketplaces), By Product (Electronics , Fashion & Apparel , Furniture and Home Good...s, Automotive, Sports and Fitness Equipment, Others), By Product Category (Non-Luxury, Luxury), By Age Group (Up to 18 Years, 19-25 Years, 26-40 Years, 41-55 Years, Above 56 Years), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (ThredUp, ReFlaunt, Archive, Rush ReCommerce, Rebag, Poshmark, Ebay, Inc., Craiglist, Rebelle, LePrix, Back Market, OLX, Musicmagpie, Amazon, Apple, Inc., Swap, Offerup, Depop, Others) Read more

- ICT & Electronics

- Jul 2025

- Pages 197

- Report Format: PDF, Excel, PPT

Market Definition

Re-Commerce, or reverse commerce, refers to the buying and selling of used and refurbished products through a digital storefront. The primary objective of commerce is to extend the lifecycle of a product by refurbishing and reselling it. It is gaining significant popularity as more consumers are seeking sustainable and budget-friendly options.

Market Insights & Analysis: Global Re-Commerce Market (2025-30):

The Global Re-Commerce Market size is valued at USD 201.4 billion in 2024 and is projected to reach USD 289.76 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.25% during the forecast period, i.e., 2025-30.

This flourishing growth is significantly attributed to the heightened awareness and prioritization of sustainability concerns among consumers, particularly those belonging to Generation Z and Millennials. A survey conducted by the Baker Retailing Center at the Wharton School of the University of Pennsylvania found that 55% of Gen Z respondents indicated a preference for purchasing products from sustainable brands. This strong dedication to environmental causes has propelled Re-Commerce as a preferred choice for sustainable consumption.

In addition to this, mobile internet connectivity has surged across the globe due to digital inclusion efforts by the government, affordability, and the growing importance of the internet in various aspects of life. Moreover, during the historical years, the industry witnessed various economic challenges, such as recessions, financial crises, and job uncertainties. These challenges stemmed from various factors such as the pandemic and the conflict in Ukraine, which led to food and energy crises, a notable rise in inflation, and tighter financial constraints. In response to these economic hardships, individuals and households adjusted their spending habits to become more financially cautious and focused on saving money. As a result, there has been a significant increase in budget-conscious shoppers, and this shift in consumer behavior has notably contributed to the growth of the Re-Commerce market.

Furthermore, the economic growth momentum is anticipated to weaken across the globe due to high inflation, aggressive monetary tightening, and heightened uncertainties. According to the United Nations Conference on Trade and Development (UNCTAD), the economic growth momentum has significantly weakened in the United States, the European Union, and other developed economies. Most developing countries have seen a slower job recovery in previous years and continue to face considerable employment slack.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Base Years | 2024 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 201.4 Billion |

| Market Value by 2030 | USD 289.76 Billion |

| CAGR (2025–30) | 6.25% |

| Leading Region | Europe |

| Top Key Players | ThredUp, ReFlaunt, Archive, Rush Re-Commerce, Rebag, Poshmark, Ebay Inc., Craglist, Rebelle, LePrix, Back Market, OLX, Muscicmagpie, Amazon, Apple Inc., Swap, Offerup, Depop, etc., |

| Segmentation | By Type (Peer-to-Peer Marketplaces, Resale Marketplaces, Refurbished Goods Marketplaces), By Product (Electronics , Fashion & Apparel , Furniture and Home Goods, Automotive, Sports and Fitness Equipment, Others), By Product Category (Non-Luxury, Luxury), By Age Group (Up to 18 Years, 19-25 Years, 26-40 Years, 41-55 Years, Above 56 Years), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (ThredUp, ReFlaunt, Archive, Rush ReCommerce, Rebag, Poshmark, Ebay, Inc., Craiglist, Rebelle, LePrix, Back Market, OLX, Musicmagpie, Amazon, Apple, Inc., Swap, Offerup, Depop, Others) |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

These combined factors have eroded consumers' purchasing power, forcing them to be more frugal in their spending. Consequently, consumers are increasingly turning to cost-effective shopping alternatives, and Re-Commerce platforms have emerged as a compelling choice. This shift in consumer behavior is poised to have a substantial impact on expanding the Re-Commerce market size.

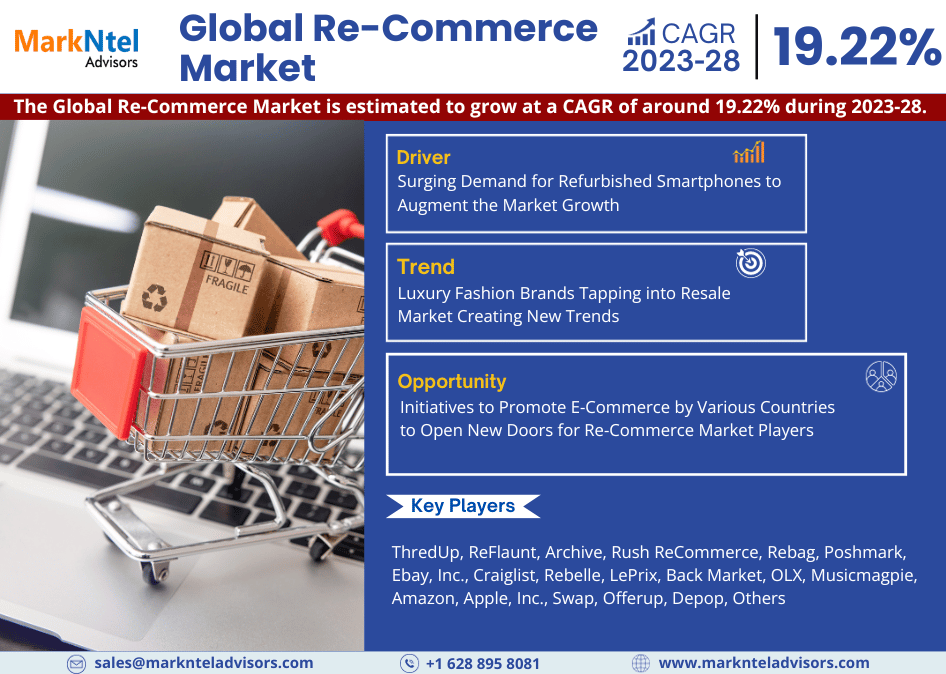

Global Re-Commerce Market Driver:

Surging Demand for Refurbished Smartphones to Augment the Market Growth – The demand for premium smartphones has showcased a substantial growth rate driven by the dual forces of affordability and value retention. Premium phones from companies like Apple, Samsung, etc., often come with high price tags, which limit their accessibility to a select market segment. Owing to this, consumers across the globe, especially in Europe, India, etc., are registering substantial demand for refurbished smartphones.

With e-commerce platforms being the major forum for the sale of these refurbished phones, purchase via this medium has substantially increased, which is subsequently enhancing the market size. The surge in demand is fueled by the affordability of refurbished premium smartphones, which provide consumers with an opportunity to experience top-tier features and performance at a significantly lower cost and would further continue to enhance the market growth during the forecast period.

Global Re-Commerce Market Opportunity:

Initiatives to Promote E-Commerce by Various Countries to Open New Doors for Re-Commerce Market Players – Countries across the globe, such as Saudi Arabia, India, etc., are promoting e-commerce as a strategic move to harness economic growth, job creation, and global trade. For instance, recently, Saudi Arabia has run numerous initiatives, including developing and promoting e-commerce education programs in academic institutions, building the capacity of local service providers, and restructuring the postal sector. The promotion of e-commerce would create a conducive environment for Re-Commerce companies to expand their market presence and tap into a growing consumer base.

Furthermore, as e-commerce grows, Re-Commerce companies can explore partnerships and integration with local and global e-commerce platforms. This integration would make it easier for consumers to discover and purchase refurbished products within the broader e-commerce marketplace. Hence, promotion of E-commerce will open new opportunities for the firms operating in the Global Re-Commerce Market.

Global Re-Commerce Market Challenge:

Availability of Counterfeit Luxury to Hamper the Purchase of Luxury Goods from Re-Commerce Platforms – The inflow of counterfeited luxury from the far east region is increasing across the Asia-Pacific region, and this increased availability of fake luxury products attracts a lot of customers. Moreover, sellers offering counterfeit luxury items, often price them significantly lower than second-hand genuine products. This leads to unfair competition making it challenging for legitimate Re-Commerce businesses to compete, as buyers may be attracted to lower prices, even if the items are fake. Therefore, the availability of such options negatively impacts the Global Re-Commerce Market.

Global Re-Commerce Market Trend:

Luxury Fashion Brands Tapping into Resale Market Creating New Trends – Luxury fashion brands are driving a significant transformation in the global Re-Commerce market by introducing resale programs for their second-hand products. Luxury brands' participation is legitimizing the resale market, which is allowing brands to maintain control over product quality and image, enhancing consumer engagement and loyalty. This trend is not only creating new dynamics but also redefining the Re-Commerce market as a sustainable and fashionable choice for consumers globally, which would play a major role in market expansion during the forecast period.

Global Re-Commerce Market (2025-30): Segmentation Analysis

The Global Re-Commerce Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the global level. Based on the analysis, the market has been further classified as:

Based on Product:

- Electronics

- Fashion & Apparel

- Furniture and Home Goods

- Automotive

- Sports and Fitness Equipment

- Others (Toys, Collectibles, Books, etc.)

The Re-Commerce market has witnessed remarkable growth in recent years, with second-hand fashion and apparel emerging as a dominant force within this sector. Sustainability is one of the major factors that has taken center stage in the fashion industry, prompting consumers to embrace second-hand fashion as a responsible choice that aligns with environmental goals. Along with this, the affordability of second-hand textiles and apparel from luxury brands also acted as a key driver, and this allowed individuals to acquire premium and designer clothing at a fraction of the original cost. To cater the this growing demand for second-hand luxury clothes and apparel, brands such as Levi’s, Madewell, lululemon, Timberland, etc., entered the resale market. Furthermore, as the Millennials and Gen Z population are adamantly shopping more sustainably, the demand for second-hand clothing would further surge, thereby leading to the expansion of the market share of Fashion & Apparel products in the Global Re-Commerce Market.

Based on Type:

- Peer-to-Peer Marketplaces

- Resale Marketplaces

- Refurbished Goods Marketplaces

The refurbished marketplace has emerged as the frontrunner poised for the highest growth rate within the Global Re-Commerce Market, surpassing Peer-to-Peer Marketplaces and Resale Marketplaces. This remarkable growth is attributed to the robust quality assurance that refurbished products provide. Rigorous testing, repair, and restoration processes, often overseen by professionals or authorized refurbishers, ensure that these products attain like-new or near-new condition.

This level of meticulous quality assurance has instilled confidence in consumers, assuring them of reliable and trustworthy alternatives to new items. Furthermore, affordability plays a pivotal role in driving the refurbished marketplace's growth, attracting budget-conscious shoppers seeking value. The ever-growing environmental consciousness has propelled the refurbished marketplace as a sustainable choice, aligning with eco-friendly consumption practices and contributing to waste reduction.

Global Re-Commerce Market (2025-30): Regional Projection

Geographically, the Global Re-Commerce Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

The Re-Commerce market size has substantially expanded in Europe, due to the presence of noteworthy consumers who have prioritized eco-friendly consumption practices and are concerned about the environmental impact of their purchases. Moreover, Europe's strong commitment to circular economy initiatives and the promotion of a more sustainable product lifecycle has further driven the acceptance and growth of Re-Commerce practices. Furthermore, countries such as Finland, Denmark, Ireland, Germany, etc., are actively modernizing their legislation to promote a circular economy. Furthermore, the law also enshrines the need to establish increased transparency on second-hand products while simultaneously fostering a greater trust in refurbished goods. These legal measures would promote trust in refurbished goods and foster greater consumer confidence in the Re-Commerce, thereby enhancing Europe’s share in the Global Re-Commerce Market.

Global Re-Commerce Industry Recent Development:

- 2025: ThredUp, one of the largest online resale platforms for apparel, shoes, and accessories, announced a significant evolution of its Resale-as-a-Service (RaaS) offering, designed to more easily empower brands and retailers to scale and profit from resale. Building on recent technological advancements and a vision to make resale more accessible, ThredUp is removing branded resale fees and introducing a suite of enhanced services to its partners.

Gain a Competitive Edge with Our Global Re-Commerce Market Report

- Global Re-Commerce Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Re-Commerce Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Re-Commerce Market Consumer Behavior Analysis

- Selling Motivation

- Buying Preference/ Motivation

- The Role of Sustainability in Choosing Resale/Refurbished Products

- Global Re-Commerce Market Startup Ecosystem

- Year of Establishment

- Amount Raised (USD Million)

- Series of Fund Raise

- Purpose of Fund Raise

- Investors Involved

- Global Re-Commerce Market Trends & Insights

- Global Re-Commerce Market Dynamics

- Growth Drivers

- Challenges

- Global Re-Commerce Market Policies, Regulations & Product Standards

- Global Re-Commerce Market Hotspot & Opportunities

- Global Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Type

- Peer-to-Peer Marketplaces- Market Size & Forecast 2020-2030, (USD Million)

- Resale Marketplaces- Market Size & Forecast 2020-2030, (USD Million)

- Refurbished Goods Marketplaces- Market Size & Forecast 2020-2030, (USD Million)

- By Product

- Electronics - Market Size & Forecast 2020-2030, (USD Million)

- Smartphones & Tablets - Market Size & Forecast 2020-2030, (USD Million)

- Laptops & Computers - Market Size & Forecast 2020-2030, (USD Million)

- Cameras and Photography Equipment - Market Size & Forecast 2020-2030, (USD Million)

- Home Appliances (Refurbished Refrigerators, Washing Machines, etc.)- Market Size & Forecast 2020-2030, (USD Million)

- Others (Networking Equipment, Gaming Consoles and Accessories, etc.) - Market Size & Forecast 2020-2030, (USD Million)

- Fashion & Apparel - Market Size & Forecast 2020-2030, (USD Million)

- Clothing - Market Size & Forecast 2020-2030, (USD Million)

- Footwear - Market Size & Forecast 2020-2030, (USD Million)

- Accessories (Jewelry, Watches, Handbags, etc.) - Market Size & Forecast 2020-2030, (USD Million)

- Furniture and Home Goods- Market Size & Forecast 2020-2030, (USD Million)

- Sofas and Couches - Market Size & Forecast 2020-2030, (USD Million)

- Tables & Chairs - Market Size & Forecast 2020-2030, (USD Million)

- Home Decor (Rugs, Paintings, Vases, etc.) - Market Size & Forecast 2020-2030, (USD Million)

- Others (Garden Equipment, Bathroom Accessories, etc.) - Market Size & Forecast 2020-2030, (USD Million)

- Automotive- Market Size & Forecast 2020-2030, (USD Million)

- Used Vehicles- Market Size & Forecast 2020-2030, (USD Million)

- Vehicle Parts and Accessories- Market Size & Forecast 2020-2030, (USD Million)

- Sports and Fitness Equipment- Market Size & Forecast 2020-2030, (USD Million)

- Others (Toys, Collectibles, Books, etc.)- Market Size & Forecast 2020-2030, (USD Million)

- Electronics - Market Size & Forecast 2020-2030, (USD Million)

- By Product Category

- Non-Luxury- Market Size & Forecast 2020-2030, (USD Million)

- Luxury- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group

- Up to 18 Years- Market Size & Forecast 2020-2030, (USD Million)

- 19-25 Years- Market Size & Forecast 2020-2030, (USD Million)

- 26-40 Years- Market Size & Forecast 2020-2030, (USD Million)

- 41-55 Years- Market Size & Forecast 2020-2030, (USD Million)

- Above 56 Years- Market Size & Forecast 2020-2030, (USD Million)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Market Share

- Competition Characteristics

- By Type

- Market Size & Analysis

- North America Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- By Product Category- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group- Market Size & Forecast 2020-2030, (USD Million)

- By Country

- The US

- Canada

- Mexico

- The US Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Canada Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Mexico Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- South America Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- By Product Category- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group- Market Size & Forecast 2020-2030, (USD Million)

- By Country

- Brazil

- Rest of South America

- Brazil Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Europe Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- By Product Category- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group- Market Size & Forecast 2020-2030, (USD Million)

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Germany Re-Commerce Market, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- France Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Italy Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Spain Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- By Product Category- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group- Market Size & Forecast 2020-2030, (USD Million)

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Saudi Arabia Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- South Africa Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- By Product Category- Market Size & Forecast 2020-2030, (USD Million)

- By Age Group- Market Size & Forecast 2020-2030, (USD Million)

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- China Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Japan Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- India Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- South Korea Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Australia Re-Commerce Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, (USD Million)

- By Product- Market Size & Forecast 2020-2030, (USD Million)

- Market Size & Analysis

- Market Size & Analysis

- Global Re-Commerce Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Thredup Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ReFlaunt

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Archive

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rush Re-Commerce

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rebag

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Poshmark

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ebay Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Craiglist

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rebelle

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- LePrix

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Back Market

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- OLX

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Musicmagpie

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Amazon

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Apple Inc.

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Swap

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Offerup

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Depop

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Thredup Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making