U.S. Catering Market Research Report: Forecast (2025-2030)

U.S. Catering Market Report - By Type (Outsourced, [Contractual, Non-Contractual], In-House), By End User, (Corporate Offices, [Outsourced, In-House], Education, [Outsourced, In-Ho...use]), Healthcare, (Outsourced, In-House), Oil & Gas, (Outsourced, In-House), Defense & Law Enforcement, (Outsourced, In-House), Maritime Industry (Ship Chandler Catering), (Outsourced, In-House), Government, (Outsourced, In-House), Personal Events, (Outsourced, In-House), Business Events, (Outsourced, In-House), Construction Industry, (Outsourced, In-House), Aviation, (Outsourced, In-House), Sports & Leisure, (Outsourced, In-House), Prisons, (Outsourced, In-House), Others (Retail, Manufacturing, Mining & EPC, etc.), (Outsourced, In-House), By Location (Onshore Catering, Offshore Catering), By Model, (Client Pay B2B, Consumer pays/Retail/B2C) and Others , Read more

- Food & Beverages

- Dec 2024

- Pages 130

- Report Format: PDF, Excel, PPT

Market Definition

Catering service means providing food services to events or places. Catering services are in demand across all major sectors such as educational institutions, corporate offices, sports and business events, and others. Additionally, catering services are requested at corporate and business conferences, weddings and celebrations, and institutional events.

Market Insights & Analysis: U.S. Catering Market (2025-30):

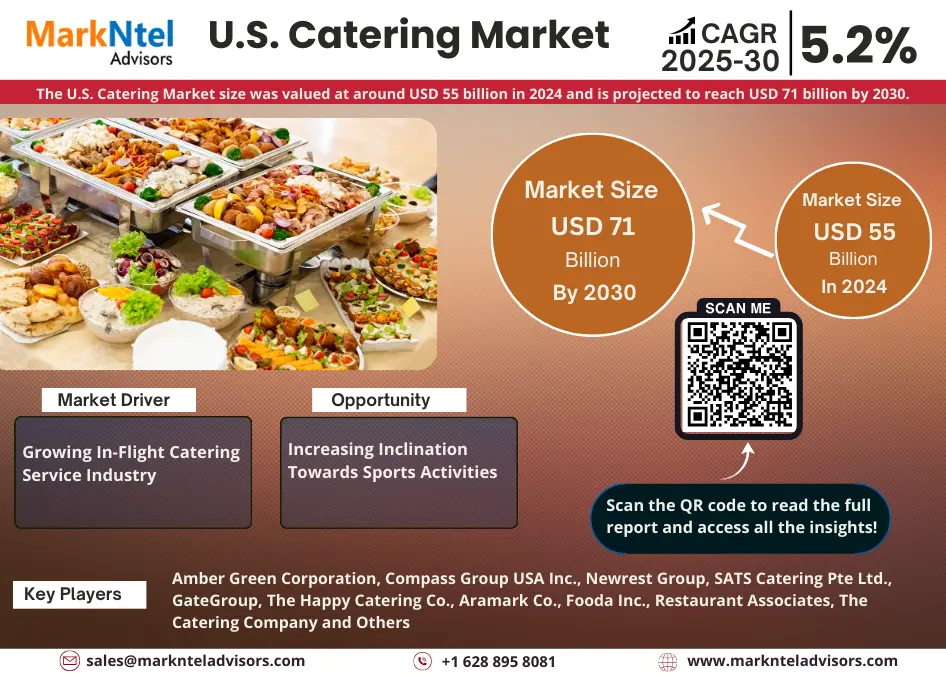

The U.S. Catering Market size was valued at around USD 55 billion in 2024 and is projected to reach USD 71 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.2% during the forecast period, i.e., 2025-30. The continuously growing wide variety of medical establishments, organizations, universities, and colleges, as well as party events, are the major factors driving the quick boom in the U.S. Catering Market.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 55 Billion |

| Market Value By 2030 | USD 71 Billion |

| CAGR (2025-30) | 5.2% |

| Top Key Players | Amber Green Corporation, Compass Group USA Inc., Newrest Group, SATS Catering Pte Ltd., GateGroup, The Happy Catering Co., Aramark Co., Fooda Inc., Restaurant Associates, The Catering Company, Occasions Caterers, Savoie Catering, Sodexo, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

The primary influencing factor of the U.S. catering industry is the increasing number of employees in corporate workplaces. As per the U.S. Bureau of Labour Statistics, the number of workers in corporations and businesses rose from around 20.36 million in 2020 to 22.5 million and above in 2023. The growth resulted from the expansion in the manufacturing & service sector in the country which is an international business hub. Moreover, the headquarters of premier organizations of the United Nations, including the General Assembly, Security Council, the Economic and Social Council, and economic institutions like; the IMF, World Bank, etc. are primarily based in the U.S. As a result, the nation hosts the majority of diplomatic and organizational gatherings, thus propelling demand for catering services in the U.S.A.

The catering services in the educational segment as end-consumer is driven by the increasing number of schools, colleges, and universities. As per the National Center for Education Statistics, the total number of students enrolled across all schools in the U.S. in 2024 has increased to 19.25 million from 18.93 million in 2023. Hygiene and nutrition are the primary concerns for food from parents and government organizations. The National School Lunch Program, via the U.S. government, is supposed to provide lunch offerings to over 28 million students per day throughout more than 95,000 schools in the U.S. Therefore, the growth opportunities for the catering industry in this region have been propelled by the consistently growing student enrolments in academic establishments.

Moreover, the healthcare segment is another major end-user industry driving the U.S. catering business. More than 33 million patients had been admitted in 2023 throughout all the U.S. hospitals, with the supply of beds around 916,750. Furthermore, the strict guidelines and policies inside the healthcare groups that wish to conform with the meal guidelines of the FDA and Healthcare Facilities Accreditation Program (HFAP) are additionally increasing the demand for efficient and proper catering services for the healthcare industry.

U.S. Catering Market Driver:

Growing In-Flight Catering Service Industry – More than 26,000 flights were operating inside the U.S. in 2023, with an average of 2.6 million passengers touring per day. Additionally, only about 790 million passengers were enplaned in 2022, which increased to around 870 million in 2023. The rapidly growing number of operating flights and passengers enplaned is continuously pushing airlines to improve catering services and enhance customer satisfaction. Ultimately, this assistance leads to the growth of the in-flight catering service market in the U.S. and eventually the U.S. Catering Market.

U.S. Catering Market Opportunity:

Increasing Inclination Towards Sports Activities – High-quality catering is mandatory to provide nutritious meals to athletes that meet their dietary requirements for satisfactory overall performance. An attempt to enhance the participation rate of college students in sports activities is continually made with the assistance of the United States government. The U.S. Department of Health and Human Services has also set an intention to increase the participation rate of college students to 60% by 2030, which is currently about 50%.

Moreover, in 2023, more than 38% of participants are aged over sixty-five years. As a result, the demand for proper nutritious meals is being created by these athletes, opening doors of opportunities for catering businesses. Consequently, it is believed that the rising consciousness about nutritious and healthy diets among sports participants for improved overall performance, alongside an increase in the participation rate of students in sports activities, will create enough growth opportunities for companies providing catering services in the forecast period.

U.S. Catering Market Challenge:

Rapidly Changing Customer Preferences – In changing times, the food preferences of customers are varying, and demand for multiregional cuisine, nutritional food, and plant-based diet is rising and this becomes hard to manage for catering businesses. Health and well-being traits are evolving, with consumers preferring vegan diets and natural foods. Additionally, consumers are demanding personalized food services and menus. Sustainability-related preferences are also changing, with a focus on minimizing waste, e-plates, and organic food. With multi-dimensional variations in customer preferences, it is becoming complex for companies to cope with these demands.

U.S. Catering Market Trend:

Integration of AI-based Technologies – Companies are providing personalized menus and food designs to consumers using AI-based technologies, which results in minimizing food waste and loss of revenue. It also helps to automate kitchen operations, supply chain management, staff training, and intelligent customer services. These benefits not only enhance customer experience and satisfaction but also help optimize inventory management and fulfill staff requirements in various applications. Also, during food preparation, smart appliances are being used, which eases the operational efficiency of companies.

Furthermore, issues related to delivery time of orders, supply chain mismanagement, or any other disruptions are quickly identified and resolved using AI. It makes the process easy for companies and quickly solves customer queries. Some of the companies leveraging AI in their catering operations include; Compass Group Inc., Aramark Co., Sodexo, and Fooda Inc.

U.S. Catering Market (2025-30): Segmentation Analysis

The U.S. Catering Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for 2025-2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Type:

- Outsourced

- Contractual

- Non-Contractual

- In-House

Based on the types of catering services, the outsourced type of catering service holds more than 90% market share. Furthermore, in outsourced catering, the largest market share, accounting for almost 85%, is taken up by contractual catering. This is attributed to the high preference for contract-based services over the non-contractual ones. They provide cost-effective long-term solutions to organizations such as aviation, educational institutions, hospitals, and office buildings. Additionally, these institutions, with large numbers of individuals, require food facilities every day. Thus, long-term contracts save costs and are easy and permanent solutions to meet food requirements.

Furthermore, in non-contractual catering, the market is driven by a large number of events related to celebrations, weddings, etc. Approximately 2 million weddings happen in a year in the U.S.A., which is the major source of non-contractual catering in the country. Cloud kitchens, food trucks, etc. are also facilitating this type of catering business.

Based on End User:

- Corporate Offices

- Education

- Healthcare

- Aviation

- Oil & Gas

- Defense & Law Enforcement

- Maritime Industry (Ship Chandler Catering)

- Government

- Personal Events

- Business Events

- Construction Industry

- Sports & Leisure

- Prisons

- Others (Retail, manufacturing, Mining & EPC, etc.)

Of all the major end users of the U.S. Catering Market, the largest share is held by the corporate offices, which hold approximately more than 30% market share. This is due to the rapid expansion of multinational companies with 44.3 million workers in 2022 as per the U.S. Bureau of Economic Analysis and service sector with employee statistics accounting for 24.8 million as per the U.S. Bureau of Labor statistics. The country’s strategic location and presence of advanced technologies & highly developed infrastructure are the reasons for the large number of corporate offices in the country.

Furthermore, the catering service for healthcare end-users is the fastest-growing end-user industry. It is estimated that the price per plate of the healthcare industry is comparatively 25% higher than other end-user industries, owing to fulfilling the nutritious requirements of the healthcare and medical sectors. Along with this, plant-based meals are also preferred in healthcare, further creating new trends in the healthcare industry of the U.S. Catering Market.

U.S. Catering Industry Recent Development:

- October 2024: Aramark sports plus entertainment in 2024-25 arena season to bring fan-favorite flavors to 7 NBA and NHL venues.

- July 2024: Sodexo partnered with the chef of the white house and army combat trainer Andre Rush to provide 27 million meals every year to servicewomen and men across the country.

Gain a Competitive Edge with Our U.S. Catering Market Report

- U.S. Catering Market by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The U.S. Catering Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- U.S. Catering Market Trends & Development

- U.S. Catering Market Dynamics

- Drivers

- Challenges

- U.S. Catering Market Hotspot & Opportunities

- U.S. Catering Market Policies & Regulations

- U.S. Catering Market Pricing Analysis, 2020-2025

- Pricing Per Plate

- Annual Price Increase Trend

- Key Factors Impacting Prices

- U.S. Catering Market Supply Chain Analysis

- U.S. Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By Type

- Outsourced

- Contractual - Market Size & Forecast 2020-2030F, USD Million

- Non-Contractual - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Outsourced

- By End User

- Corporate Offices

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Education

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Healthcare

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Oil & Gas

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Defense & Law Enforcement

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Maritime Industry (Ship Chandler Catering)

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Government

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Personal Events

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Business Events

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Construction Industry

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Aviation

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Sports & Leisure

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Prisons

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Others (Retail, Manufacturing, Mining & EPC, etc.)

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Corporate Offices

- By Location

- Onshore Catering - Market Size & Forecast 2020-2030F, USD Million

- Offshore Catering - Market Size & Forecast 2020-2030F, USD Million

- By Model

- Client Pay B2B - Market Size & Forecast 2020-2030F, USD Million

- Consumer pays/Retail/B2C - Market Size & Forecast 2020-2030F, USD Million

- By Region

- North - Market Size & Forecast 2020-2030F, USD Million

- East - Market Size & Forecast 2020-2030F, USD Million

- South - Market Size & Forecast 2020-2030F, USD Million

- Mid-West - Market Size & Forecast 2020-2030F, USD Million

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- Market Size & Analysis

- U.S. Contractual Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By End Users- Market Size & Forecast, 2020-2030 USD Million

- By Location- Market Size & Forecast, 2020-2030 USD Million

- By Model- Market Size & Forecast, 2020-2030 USD Million

- By Region- Market Size & Forecast, 2020-2030 USD Million

- Market Size & Analysis

- U.S. Non-Contractual Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By End Users- Market Size & Forecast, 2020-2030 USD Million

- By Location- Market Size & Forecast, 2020-2030 USD Million

- By Model- Market Size & Forecast, 2020-2030 USD Million

- By Region- Market Size & Forecast, 2020-2030 USD Million

- Market Size & Analysis

- U.S. Catering Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Amber Green Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Compass Group USA, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Newrest Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SATS Catering Pte Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GateGroup

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Happy Catering Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aramark Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fooda, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Restaurant Associates

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Catering Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Occasions Caterers

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Savoie Catering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sodexo

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Amber Green Corporation

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making