Saudi Arabia Catering Services Market Research Report: Forecast (2025-2030)

By Type (Contractual, Non-Contractual), By End User (Corporate, Educational Institutes, Healthcare, Defense and Offshore, Mining & EPC, Sports & Leisure, Others), By Model (Client ...Pay B2B, Consumer pays/retail, B2C), By Region ( North, East, South, West, Central), By Company (Gulf Catering Company, Tamimi Global Company Ltd., Saudi Catering & Contracting, Algosaibi Services, Nesma Catering, Saudi Airlines Catering, Al-Suwaiket Catering, Al-Suwaidi Services) Read more

- Food & Beverages

- Dec 2024

- Pages 102

- Report Format: PDF, Excel, PPT

Market Definition

Catering services provide food, beverages, and other related services for events and occasions, such as weddings, corporate meetings, parties, and other gatherings. Companies, restaurants, or individuals specializing in food preparation and service for large groups can offer these services, typically including menu planning, food preparation, delivery, setup, service, and cleanup. Caterers may offer a range of options, from casual to formal, and may specialize in specific cuisines or dietary requirements. Some caterers also provide equipment and staffing, such as tables, chairs, linens, and waitstaff, to help manage the event.

Market Insights & Analysis: Saudi Arabia Catering Services Market (2025-30)

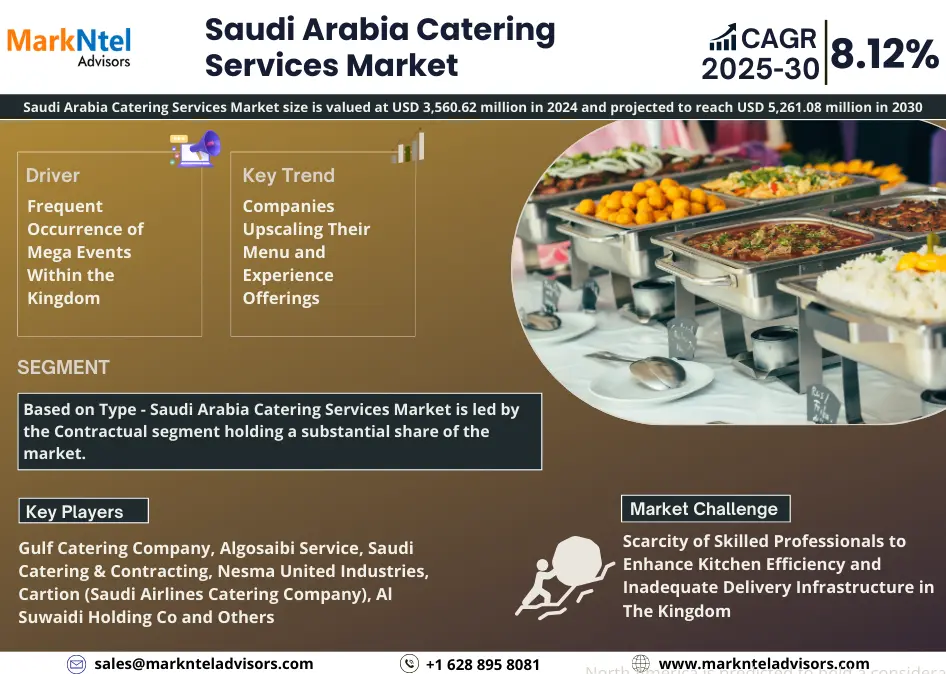

Saudi Arabia Catering Services Market size is valued at USD 3,560.62 million in 2024 and projected to reach USD 5,261.08 million in 2030 and it is estimated to grow at a CAGR of around 8.12% during the forecast period, i.e., 2025-30. The market is primarily driven by the increasing demand for catering services at events and social gatherings, hospitals, corporate offices, and educational institutions, among others. Other than this, the kingdom being the oil and gas giant, has witnessed higher demand of caterers for oil rigs to offer enough and on time food for offshore platforms. Over the years, the cities have been dotted with A’la carte restaurant and food trucks that is expected to bode well for the industry in the long run.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 3,560.62 Million |

| Market Value By 2030 | USD 5,261.08 Million |

| CAGR (2025-30) | 7.0% |

| Top Key Players | Gulf Catering Company, Tamimi Global Company Ltd., Saudi Catering & Contracting, Algosaibi Services, Nesma Catering, CATRION, Al-Suwaidi Services, Gulf Mahmal Support Services Co. Ltd., Others. |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

In addition, the country's Vision 2030 initiative, which aims to diversify the economy and promote tourism, has led to the expansion of mega-projects and events that necessitate high-quality catering services. The growing trend towards healthy eating and the increasing popularity of international cuisines have also contributed to the growth of the market.

Furthermore, technological advancements, such as online ordering and delivery services, have made it easier for consumers to access catering services. The fierce competition between catering companies and restaurants that also offer such services has also led to a focus on quality and innovation in the industry, propelling the market forward.

Saudi Arabia Catering Services Market Key Driver:

Frequent Occurrence of Mega Events Within the Kingdom - The evolution of the industry's offering is based on the shift in demand, the creation of exciting mega-events and entertainment, and the establishment of the kingdom as a leading global business, entertainment, sports, and tourism destination. With the rising construction of corporate buildings, small and medium enterprises have been facilitating VIP dining services for small exclusive gatherings as well as high-profile celebrations, resulting in a significant demand for catering services in Saudi Arabia. Furthermore, the kingdom hosting various international seminars, conferences, etc., related to different educational or industrial backgrounds has reinforced the need for such services. For instance,

- Recently, on March 8, 2023, Saudi Arabia witnessed the first-ever Hospitality 3.0 conference, hosted by Caterer Middle East and Hotelier Middle East. The conference seemed to emerge as an opportunity for the prominent market players as it perfectly encompassed expert insights, predictions, and advice from decision-makers across the kingdom’s hospitality and F&B industries.

Saudi Arabia Catering Services Market Possible Restraint:

Scarcity of Skilled Professionals to Enhance Kitchen Efficiency and Inadequate Delivery Infrastructure in The Kingdom - The catering industry in Saudi Arabia is facing several challenges that need to be addressed to remain competitive. Firstly, kitchen operators are investing in expensive equipment without proper training for their teams on using it effectively. Therefore, training staff to utilize traditional cooking methods and new technology is crucial. Secondly, the rise of delivery services has become a necessity for both diners and restaurant operators, and demand is growing rapidly, but logistics infrastructure needs to keep pace with the demand. To overcome these challenges, catering businesses in kingdom need to focus on proper training and utilizing new technology while also investing in their delivery infrastructure to meet the growing demand.

Saudi Arabia Catering Services Market Growth Opportunity:

Offering Diverse Services for Business Meetings and Introducing Gift Certificates for Clients and Weddings - Professional caterers may provide different levels of service for business meetings, from upscale with wait staff to a hot lunch buffet set up for guests to serve themselves. Box lunches are also a terrific corporate-catered meal for guests who need to work through lunch.

Additionally, introducing gift certificates that can be redeemed for food, beverage, and delivery fees can be a great way to show appreciation to clients, vendors, and wedding couples or as treats for friends, family, and co-workers. With their ability to provide different types of delivery services and gift certificates, catering service providers can meet the diverse needs of their clients in Saudi Arabia in the coming years.

Saudi Arabia Catering Services Market Key Trend:

Companies Upscaling Their Menu and Experience Offerings - With demand at an all-time high, highly experienced and qualified catering companies with Kingdom-wide capacity emphasize providing unique menus and second-to-none services to meet the needs of mega-events. They are also willing to incorporate new and innovative technologies to enhance the customer experience, such as online ordering and payment systems, virtual reality tours, and interactive displays.

In conjugation, catering companies are paying more attention to the aesthetics of their services, including cutlery choices, table decorations, centerpieces, and linens. Also, they offer personalized and customizable options to create unique and memorable client experiences.

Many businesses focus on providing healthy and diverse menu options catering to various dietary restrictions and preferences. These efforts to improve the overall customer experience have been vital in differentiating themselves from other catering services and restaurants that offer catering.

Saudi Arabia Catering Services Market (2025-30): Segmentation Analysis

Saudi Arabia Catering Services Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the regional levels. Based on the analysis, the market has been further classified as:

Based on the Type:

- Contractual

- No-Contractual

Saudi Arabia Catering Services Market is led by the Contractual segment holding a substantial share of the market. The demand for contractual services was widely dominated by the tourism industry, owing to a constant need to serve both inbound and outbound tourists. For instance, by 2030, the Saudi Arabian government hopes to have 330 million travelers, which will encourage the demand for in-flight catering services. Additionally, as the government hires third-party caterers each year to suffice the meals for ever-growing hajj pilgrims, the government's aim to cater to more than 6 million pilgrims under the Pilgrimage Experience Program 2030 would cause the catering business to grow in Mecca alone.

Based on Model,

- Client Pay B2B

- Consumer pays/retail

- B2C

The Client Pay B2B segment is projected to witness a significant share in the Saudi Arabia Catering services market during 2025-30. Business models and service innovations have enabled catering businesses to survive and thrive amid an industry-wide revamp. The growing expansion of service industries, and commercial companies in the kingdom, to gain the emerging revenue opportunities from its proliferating religious tourism and growing trade activities is anticipated to widely support the demand for B2B catering services in the country.

Saudi Arabia Catering Services Market Recent Development:

2023: Red Sea Global partnered with Saudi Airlines Catering Company to bring essential hospitality services to their employees. With this partnership, SACC designed, built, and operated a Central Production Unit (CPU) for catering services for Red Sea Global’s employee meals. This partnership would help Saudi Catering Company strengthen its position in the Saudi Market.

Gain a Competitive Edge with Our Saudi Arabia Catering Services Market Report

- Saudi Arabia Catering Services Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players.This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Catering Services Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- Saudi Arabia Catering Services Market Outlook

- Saudi Arabia Catering Services Market Trends & Developments

- Saudi Arabia Catering Services Market Dynamics

- Drivers

- Challenges

- Saudi Arabia Catering Services Market Regulations

- Saudi Arabia Catering Services Market Winning Strategies, 2024

- Investment Scenario

- Hotspots

- Saudi Arabia Catering Services Market Pricing Analysis

- Price Per Plate

- Annual Price Increase Trend

- Key Factors Impacting Prices

- Saudi Arabia Catering Services Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By Type

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- Contractual – Market Size & Analysis By Revenues (USD Million)

- Non Contractual – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- By End User

- Construction Industry – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Corporate Offices – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Education – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Healthcare – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Oil & Gas – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Defense & Law Enforcement – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Government – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- In-Flight – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Mining & EPC – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Others – Market Size & Analysis By Revenues (USD Million)

- Outsourced – Market Size & Analysis By Revenues (USD Million)

- In-House– Market Size & Analysis By Revenues (USD Million)

- Construction Industry – Market Size & Analysis By Revenues (USD Million)

- By Model

- Client Pay B2B – Market Size & Analysis By Revenues (USD Million)

- Consumer pays/Retail/B2C – Market Size & Analysis By Revenues (USD Million)

- By Region

- Riyadh – Market Size & Analysis By Revenues (USD Million)

- Jeddah – Market Size & Analysis By Revenues (USD Million)

- Damam – Market Size & Analysis By Revenues (USD Million)

- Rest of Saudi Arabia – Market Size & Analysis By Revenues (USD Million)

- By Company

- Revenue Shares

- Competition Characteristics

- By Type

- Saudi Arabia Contractual Catering Services Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenues

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By End Users – Market Size & Analysis By Revenues (USD Million)

- By Region – Market Size & Analysis By Revenues (USD Million)

- By Model – Market Size & Analysis By Revenues (USD Million)

- Market Size & Analysis

- Saudi Arabia Non-Contractual Catering Services Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenues

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By End Users – Market Size & Analysis By Revenues (USD Million)

- By Region – Market Size & Analysis By Revenues (USD Million)

- By Model – Market Size & Analysis By Revenues (USD Million)

- Market Size & Analysis

- Competitive Benchmarking

- Company Profiles

- CATRION

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Tamimi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- NESMA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Algosaibi Services Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Unique Catering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Catering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Suwaidi Services Company Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saudi Catering and Contracting Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Detail

- Others

- Sodexo (Kelvin Catering Services)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Mahmal Support Services Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CATRION

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making