Southeast Asia Third-Party Logistics (3PL) Market Research Report: Forecast (2024-2030)

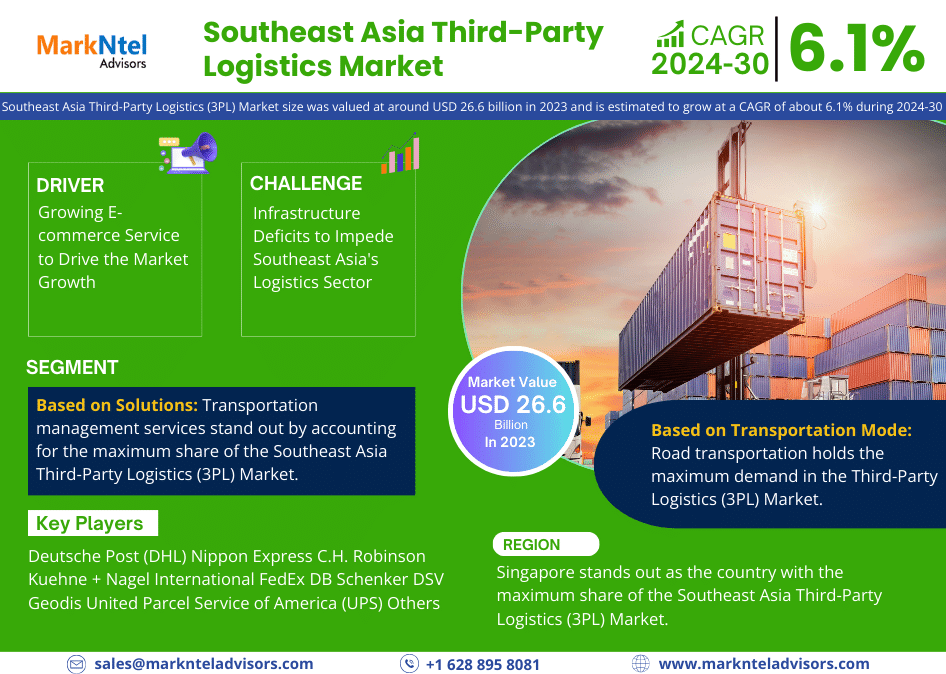

By Solution (Transportation Management, (Domestic, International, Warehousing & Distribution, Dedicated Contract Carriage (DCC), Logistics software, Others (Financial, Information,... etc.)), By Transportation Mode (Rail, Road, Air, Sea), By End User (Manufacturing, Healthcare & Pharmaceuticals, Retail & E-commerce, Automotive, Consumer Goods, Food & Beverage, Others), Country (Indonesia Thailand, The Philippines, Vietnam, Malaysia, Singapore, Rest of Southeast Asia), By Companies (Deutsche Post (DHL), Nippon Express, C.H. Robinson, Kuehne + Nagel International, FedEx, DB Schenker, DSV, Geodis, United Parcel Service of America (UPS), Others) Read more

- Automotive

- Nov 2023

- Pages 145

- Report Format: PDF, Excel, PPT

Market Definition

Third-party logistics is defined as the outsourcing of logistics services of one’s own company to another company for distribution, warehousing, and fulfillment services.

Market Insights & Analysis: Southeast Asia Third-Party Logistics (3PL) Market (2024-30):

The Southeast Asia Third-Party Logistics (3PL) Market size was valued at around USD 26.6 billion in 2023 and is estimated to grow at a CAGR of about 6.1% during the forecast period, i.e., 2024-30. The market in Southeast Asia is experiencing robust growth driven by the expansion of various industries, including manufacturing, automotive, and e-commerce. These sectors rely on an array of logistics services such as transportation, warehousing, packaging, inventory management, and freight forwarding to ensure the efficient and timely delivery of their products. Consequently, the demand for third-party logistics providers is gaining significant traction across diverse industries as companies seek to achieve their operational objectives.

This upward trend is further propelled by the imperative of reducing overall operational costs, the increasing emphasis on punctual delivery, and the manufacturing sector's shift toward reducing assets & concentrating on core business activities. Third-party logistics services offer a valuable solution for managing fluctuations in product demand during different seasons. These factors collectively contribute to the continuous expansion of the market across the region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 6.1% |

| Country Covered | Indonesia Thailand, The Philippines, Vietnam, Malaysia, Singapore, Rest of Southeast Asia |

| Key Companies Profiled |

Deutsche Post (DHL), Nippon Express, C.H. Robinson, Kuehne + Nagel International, FedEx, DB Schenker, DSV, Geodis, United Parcel Service of America (UPS), Others |

| Market Value (2023) | USD 26.6 Billion |

Moreover, the region's strategic location as a Southeast Asia trade crossroads further bolsters the significance of logistics & supply chain services. The region's proximity to major international markets and its role in international trade routes make it a pivotal link in the Southeast Asia supply chain. The continuous infrastructure development, including the construction of modern logistics facilities & transportation networks, aligns with the growing logistics demand. As businesses strive to optimize their supply chains and keep pace with economic expansion, the demand for third-party logistics providers continues to rise.

Southeast Asia Third-Party Logistics (3PL) Market Driver:

Growing E-commerce Service to Drive the Market Growth – The booming e-commerce sector in Southeast Asia is a significant driving force behind the increased demand for efficient logistics solutions, particularly from third-party logistics (3PL) providers. This is primarily due to increased internet penetration, rising consumer confidence in online shopping, and a broader range of products available through e-commerce platforms.

As the region experiences a surge in online retail, with a growing number of consumers preferring the convenience of e-commerce, the need for streamlined & reliable logistics operations has been increasing. In this, 3PL providers offer a comprehensive range of services, including warehousing, inventory management, order fulfilment, and last-mile delivery. These services are essential for e-commerce businesses to meet customer expectations for fast & reliable shipping while managing their operational costs effectively.

As a result, the demand for 3PL providers is poised to remain robust, with logistics companies increasingly focusing on offering tailored solutions to meet the specific needs of the e-commerce industry. This demand for third-party logistics services is expected to play a pivotal role in shaping the future of the logistics & supply chain industry in the Southeast Asia region.

Southeast Asia Third-Party Logistics (3PL) Market Opportunity:

Expansion in Trade Activity to Create Growth Opportunity for the Market – The rise in trade activity represents a promising opportunity for the Third-Party Logistics (3PL) Market in Southeast Asia. As trade volumes surge in the region, driven by increased international commerce & regional economic growth, the demand for efficient logistics & supply chain solutions escalates. Southeast Asia's region serves as a crucial crossroads for trade, facilitating both imports & exports. For instance, the "Belt and Road Initiative" led by China has enhanced connectivity and trade flow through Southeast Asia.

Moreover, the flourishing e-commerce sector has led to a higher volume of cross-border trade, especially in nations like Singapore, Malaysia, and Indonesia. Online retail giants & small businesses are seeking agile & reliable 3PL providers to manage their supply chain, warehousing, and last-mile delivery.

Intra-regional trade within Southeast Asia has been stimulated by regional trade agreements such as the ASEAN Economic Community (AEC). This has created opportunities for 3PL providers to promote cross-border logistics. As trade in Southeast Asia continues to grow, the 3PL service provider would have the opportunity to expand their businesses in the region and drive the overall market growth.

Southeast Asia Third-Party Logistics (3PL) Market Challenge:

Infrastructure Deficits to Impede Southeast Asia's Logistics Sector – A significant challenge faced by the logistics sector in Southeast Asia is the inadequate infrastructure, marked by substandard road networks, limited port capacity, and constrained air transport capabilities. This infrastructure shortfall poses obstacles for logistics companies in their efforts to efficiently & promptly deliver goods, ultimately leading to increased costs & shipment delays, thus hindering the Southeast Asia Third-Party Logistics (3PL) Market.

Southeast Asia Third-Party Logistics (3PL) Market (2024-30): Segmentation Analysis

The Southeast Asia Third-Party Logistics (3PL) Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the regional level. In accordance to the analysis, the market has been further classified as:

Based on Solutions:

- Transportation Management

- Domestic

- International

- Warehousing & Distribution

- Dedicated Contract Carriage (DCC)

- Logistics software

- Others (Financial, Information, etc.)

Transportation management services stand out by accounting for the maximum share of the Southeast Asia Third-Party Logistics (3PL) Market. Owing to the region's geography and varying degrees of infrastructure development, which makes transportation logistics complex. 3PL providers offering transportation management solutions help businesses navigate these challenges by optimizing routes, coordinating shipments, and ensuring timely deliveries.

Furthermore, the rapid growth of e-commerce & the need for reliable last-mile delivery services have fueled the demand for transportation management. E-commerce companies rely on 3PLs to efficiently manage and track the movement of goods from warehouses to the end customers, enabling them to meet the expectations of online shoppers.

Based on Transportation Mode:

- Rail

- Road

- Air

- Sea

Road transportation holds the maximum demand in the Third-Party Logistics (3PL) Market. This is mainly attributed to its high versatility, capable of accommodating a wide range of cargo, from small parcels to large shipments. This adaptability makes it an attractive choice for businesses with diverse transportation needs. Furthermore, road transportation offers door-to-door delivery, providing convenience and accessibility to both urban & rural areas. It is one of the most cost-effective and time-efficient modes for short to medium-distance shipments, serving as a crucial link in the supply chain.

Moreover, with the rise of online shopping and the need for swift and flexible deliveries, road transport has become indispensable. The vast road network and infrastructure development in many regions support the efficiency of this mode of transportation, and it is expected to maintain its leading position, particularly for last-mile deliveries and regional distribution, in the foreseeable future.

Southeast Asia Third-Party Logistics (3PL) Market (2024-30): Regional Projection

Geographically, the Southeast Asia Third-Party Logistics (3PL) Market expands across:

- Indonesia

- Thailand

- Philippines

- Vietnam

- Malaysia

- Singapore

Singapore stands out as the country with the maximum share of the Southeast Asia Third-Party Logistics (3PL) Market. Owing to its strategic geographical location, it is a central point for international trade & commerce. In this, Singapore serves as a major transit point for goods entering & exiting the region, enhancing its significance in logistics.

The country has a well-developed infrastructure & transportation network, including world-class ports & airports, which facilitate the efficient movement of goods. The country's commitment to innovation & technology adoption has led to the integration of advanced logistics solutions, including automation and digital tracking systems, making it an attractive choice for 3PL services.

Additionally, as the demand for e-commerce & cross-border trade continues to grow across the region, Singapore's position as a logistics leader is expected to persist and influence the market's trajectory in the coming years.

Southeast Asia Third-Party Logistics (3PL) Industry Recent Development:

- 2023: Deutsche Post plans to invest USD 372 million in Southeast Asia over the next five years to expand its warehousing capacity, workforce & sustainability initiatives.

- 2023: FedEx has introduced a new service in Vietnam, which streamlines transit to Singapore and reduces it by a day. This development is set to expand export opportunities & cater to the diverse demands of various industries.

Gain a Competitive Edge with Our Southeast Asia Third-Party Logistics (3PL) Market Report

- Southeast Asia Third-Party Logistics (3PL) Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Southeast Asia Third-Party Logistics (3PL) Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Southeast Asia Third-Party Logistics (3PL) Market Trends & Insights

- Southeast Asia Third-Party Logistics (3PL) Market Dynamics

- Drivers

- Challenges

- Southeast Asia Third-Party Logistics (3PL) Market Growth Opportunities & Hotspots

- Southeast Asia Third-Party Logistics (3PL) Market Policy & Regulations

- Southeast Asia Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution

- Transportation Management- Market Size & Forecast 2019-2030F, USD Million

- Domestic- Market Size & Forecast 2019-2030F, USD Million

- International- Market Size & Forecast 2019-2030F, USD Million

- Warehousing & Distribution- Market Size & Forecast 2019-2030F, USD Million

- Dedicated Contract Carriage (DCC)- Market Size & Forecast 2019-2030F, USD Million

- Logistics software- Market Size & Forecast 2019-2030F, USD Million

- Others (Financial, Information, etc.)- Market Size & Forecast 2019-2030F, USD Million

- Transportation Management- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode

- Rail- Market Size & Forecast 2019-2030F, USD Million

- Road- Market Size & Forecast 2019-2030F, USD Million

- Air- Market Size & Forecast 2019-2030F, USD Million

- Sea- Market Size & Forecast 2019-2030F, USD Million

- By End User

- Manufacturing- Market Size & Forecast 2019-2030F, USD Million

- Healthcare & Pharmaceuticals- Market Size & Forecast 2019-2030F, USD Million

- Retail & E-commerce- Market Size & Forecast 2019-2030F, USD Million

- Automotive- Market Size & Forecast 2019-2030F, USD Million

- Consumer Goods- Market Size & Forecast 2019-2030F, USD Million

- Food & Beverage- Market Size & Forecast 2019-2030F, USD Million

- Others- Market Size & Forecast 2019-2030F, USD Million

- By Country

- Indonesia

- Thailand

- The Philippines

- Vietnam

- Malaysia

- Singapore

- Rest of Southeast Asia

- By Company

- Competition Characteristics

- Revenue Shares & Analysis

- By Solution

- Market Size & Outlook

- Indonesia Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Thailand Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Philippines Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Vietnam Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Malaysia Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Singapore Third-Party Logistics (3PL) Market Outlook, 2019-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Solution- Market Size & Forecast 2019-2030F, USD Million

- By Transportation Mode- Market Size & Forecast 2019-2030F, USD Million

- By End User- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Outlook

- Southeast Asia Third-Party Logistics (3PL) Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Deutsche Post (DHL)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nippon Express

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- C.H. Robinson

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kuehne + Nagel International

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- FedEx

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DB Schenker

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DSV

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Geodis

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- United Parcel Service of America (UPS)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sinotrans

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Deutsche Post (DHL)

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making