South Sudan New Commercial Vehicle Market Research Report: Forecast (2025-2030)

South Sudan New Commercial Vehicle Market - By Vehicle Type (Light Commercial Vehicles (LCVs- Upto 7 Tons) [Light Truck, Light Bus, Pickup Trucks & Vans], Medium Commercial Vehicle...s (MCVs- 7.1 to 16 Tons) [Medium Trucks, Medium Bus], Heavy Commercial Vehicles (HCVs- Above 16.1 Tons) [Heavy Truck & Trailers, Heavy Bus]), By Fuel Type (Diesel, Petrol/Gasoline, Electric), By Application (Logistics, Public Transportation, Construction, Mining, Agriculture, Others (Retail, Government, etc.)), By Sales Channel (Direct Sales, Authorized Dealership, Others) and Others Read more

- Automotive

- May 2025

- Pages 120

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: South Sudan New Commercial Vehicle Market (2025-30):

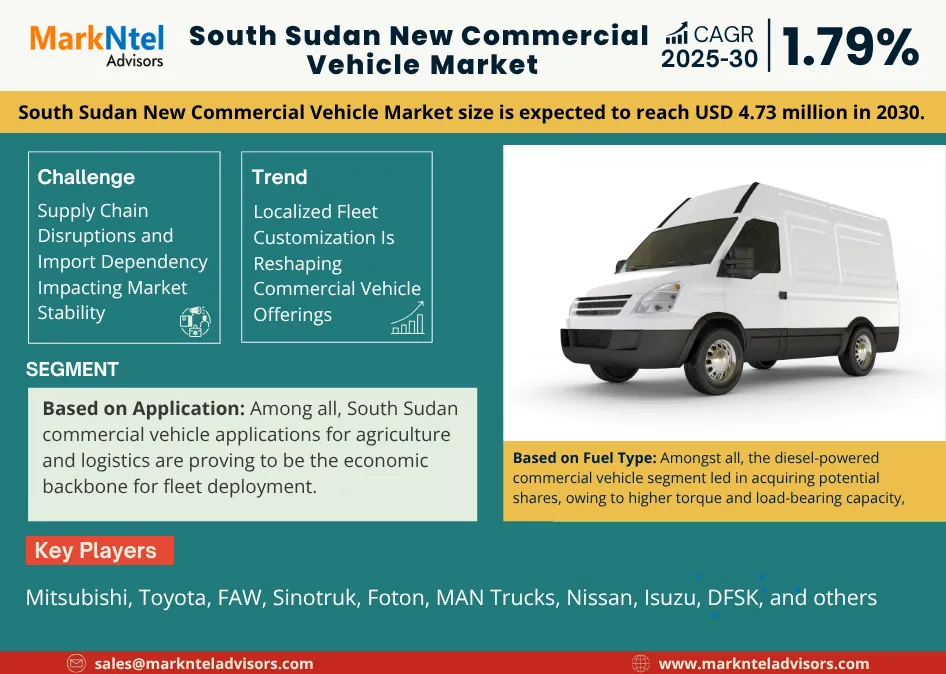

The South Sudan New Commercial Vehicle Market size was valued at around USD 4.25 million in 2024 and is expected to reach USD 4.73 million in 2030. Along with this, the market is estimated to grow at a CAGR of around 1.79% during the forecast period, i.e., 2025-30. The South Sudan new commercial vehicle market demand is being propelled by international organizations, public infrastructure contractors, and rural cooperatives, not just private fleets. This reality creates a uniquely functional, purpose-led market profile, often overlooked in broader South Sudan commercial vehicle industry trends. Moreover, the country’s vehicle import regulations and underdeveloped resale channels have inadvertently created a high-opportunity environment for new vehicle entrants. This positions the Light commercial vehicles and medium commercial vehicles to benefit most—particularly from industries like logistics, food distribution, and construction, where durability and fuel efficiency outweigh cutting-edge tech. Additionally, the demand for heavy commercial vehicle is seeing renewed traction due to cross-border freight movement, particularly with Kenya and Uganda.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–23 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 4.25 Billion |

| Market Value by 2030 | USD 4.73 Billion |

| CAGR (2025–30) | 1.79% |

| Top Key Players | Mitsubishi, Toyota, FAW, Sinotruk, Foton, MAN Trucks, Nissan, Isuzu, DFSK, and others |

| Segmentation | By Vehicle Type (Light Commercial Vehicles (LCVs- Upto 7 Tons) [Light Truck, Light Bus, Pickup Trucks & Vans], Medium Commercial Vehicle...s (MCVs- 7.1 to 16 Tons) [Medium Trucks, Medium Bus], Heavy Commercial Vehicles (HCVs- Above 16.1 Tons) [Heavy Truck & Trailers, Heavy Bus]), By Fuel Type (Diesel, Petrol/Gasoline, Electric), By Application (Logistics, Public Transportation, Construction, Mining, Agriculture, Others (Retail, Government, etc.)), By Sales Channel (Direct Sales, Authorized Dealership, Others) and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

The participation of country in the AFCFTA (African Continental Free Trade Area) is ultimately projected to rise the demand for heavy trucks and buses, particularly in oil transit corridors and food supply routes. This is because this agreement is expected to increase trade and cross-border freight activity with Uganda, Kenya and Ethiopia, further opening new doors towards the exponential growth of South Sudan industry.

One of the crucial factors uplifting the industry growth is the Juba–Torit–Nadapal Road Project, co-financed by the African Development Bank (AfDB). The major aim behind this project is the enhance and seamless transport connectivity between South Sudan and Kenya, and boost trade between the two countries. Once completed, this corridor is expected to reduce transit times between South Sudan and Kenya by over 30%, allowing for faster turnaround cycles for freight carriers and reducing per-ton transport costs. These shifts create a clear uptick in South Sudan commercial vehicle demand, particularly for fleets that require durability over sophistication.

Emerging South Sudan commercial vehicle applications span logistics for NGO missions, public transportation in semi-urban zones, road-building projects, and agriculture mechanization—further widening the use-case base for new light, medium, and heavy commercial vehicles. As a result, the South Sudan new light commercial vehicles market and South Sudan new medium commercial vehicles market are registering consistent procurement from both development agencies and SME operators.

Notably, the South Sudan commercial vehicle financing landscape is also evolving. Development finance institutions are now working with local transport unions to roll out credit-backed fleet leasing models, providing a boost to South Sudan vehicle market opportunities. Unlike traditional loans, these models are underwritten by aid-related contracts, de-risking investments in new vehicle fleets and making commercial vehicle ownership more accessible to rural entrepreneurs.

South Sudan New Commercial Vehicle Market Challenge:

Supply Chain Disruptions and Import Dependency Impacting Market Stability – A significant challenge facing the South Sudan new commercial vehicle market is its high dependency on vehicle imports and the vulnerability of regional supply chains. The country lacks local manufacturing capacity for commercial vehicles, making it reliant on imports from neighboring countries and global suppliers. This exposes the market to fluctuations in international shipping costs, currency volatility, and periodic border closures due to regional instability. For example, disruptions along key trade corridors can delay vehicle deliveries, inflate costs, and limit the availability of spare parts, directly impacting fleet operations and maintenance schedules

South Sudan New Commercial Vehicle Market Trend:

Localized Fleet Customization Is Reshaping Commercial Vehicle Offerings– A distinct trend emerging in the South Sudan new commercial vehicle market is the rapid localization of fleet designs to suit regional terrain, climate, and fuel availability. Unlike the standardized vehicles deployed in neighboring countries, OEMs operating in South Sudan are now rolling out adaptive features such as reinforced suspensions, low-octane fuel compatibility, and modular storage systems.

South Sudan New Commercial Vehicle Market (2025-30): Segmentation Analysis

The South Sudan New Commercial Vehicle Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Application:

- Logistics

- Public Transportation

- Construction

- Mining

- Agriculture

- Others (Retail, Government, etc.)

Among all, South Sudan commercial vehicle applications for agriculture and logistics are proving to be the economic backbone for fleet deployment. In regions like Western Equatoria and Lakes State, smallholder farmers and cooperatives are transitioning from manual or animal-based transportation to entry-level light and medium trucks. Simultaneously, humanitarian and FMCG logistics continue to dominate the mid-tier demand for medium commercial vehicles (MCVs).

Based on Fuel Type:

- Diseal

- Petrol/Gasoline

- Electric

Amongst all, the diesel-powered commercial vehicle segment led in acquiring potential shares, owing to higher torque and load-bearing capacity, which are essential in a country where vehicle use often involves cross-border freight, construction, and humanitarian logistics on unpaved roads. Another crucial component behind this traction is wide availability and better price relative to gasoline, particularly in states with cross-border fuel supply routes like Eastern Equatoria and Upper Nile.

South Sudan New Commercial Vehicle Industry Recent Development:

- 2024: BEIQI FOTON Launches New Products, aiming to become the leading commercial vehicle brand in Africa. FOTON unveiled the new fuel version of pickup truck and lightweight truck, as well as pure electric version of light trucks, mini trucks, and VAN (mini bus, taxi version) series, which cover modern urban logistics, the 'Last-Mile' and other logistics scenarios, injecting new vitality into South Africa's commercial vehicle industry.

Gain a Competitive Edge with Our South Sudan New Commercial Vehicle Market Report

- South Sudan New Commercial Vehicle Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- South Sudan New Commercial Vehicle Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- South Sudan New Commercial Vehicle Market Policies, Regulations, and Product Standards

- South Sudan New Commercial Vehicle Market Trends & Developments

- South Sudan New Commercial Vehicle Market Dynamics

- Growth Drivers

- Challenges

- South Sudan New Commercial Vehicle Market Hotspot & Opportunities

- South Sudan New Commercial Vehicle Market Value Chain Analysis

- South Sudan New Commercial Vehicle Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Outlook

- By Vehicle Type

- Light Commercial Vehicles (LCVs- Upto 7 Tons)- Market Size & Forecast 2020-2030, Thousand Units

- Light Truck - Market Size & Forecast 2020-2030, Thousand Units

- Light Bus - Market Size & Forecast 2020-2030, Thousand Units

- <20 Seats - Market Size & Forecast 2020-2030, Thousand Units

- 21 to 25 Seats - Market Size & Forecast 2020-2030, Thousand Units

- Pickup Trucks & Vans - Market Size & Forecast 2020-2030, Thousand Units

- Medium Commercial Vehicles (MCVs- 7.1 to 16 Tons)- Market Size & Forecast 2020-2030, Thousand Units

- Medium Trucks - Market Size & Forecast 2020-2030, Thousand Units

- Medium Bus - Market Size & Forecast 2020-2030, Thousand Units

- 20-30 Seats - Market Size & Forecast 2020-2030, Thousand Units

- 31-40 Seats - Market Size & Forecast 2020-2030, Thousand Units

- Heavy Commercial Vehicles (HCVs- Above 16.1 Tons)- Market Size & Forecast 2020-2030, Thousand Units

- Heavy Truck & Trailers - Market Size & Forecast 2020-2030, Thousand Units

- Heavy Bus - Market Size & Forecast 2020-2030, Thousand Units

- 40-50 Seats - Market Size & Forecast 2020-2030, Thousand Units

- >50 Seats - Market Size & Forecast 2020-2030, Thousand Units

- Light Commercial Vehicles (LCVs- Upto 7 Tons)- Market Size & Forecast 2020-2030, Thousand Units

- By Fuel Type

- Diesel- Market Size & Forecast 2020-2030, Thousand Units

- Petrol/Gasoline- Market Size & Forecast 2020-2030, Thousand Units

- Electric- Market Size & Forecast 2020-2030, Thousand Units

- By Application

- Logistics- Market Size & Forecast 2020-2030, Thousand Units

- Public Transportation- Market Size & Forecast 2020-2030, Thousand Units

- Construction- Market Size & Forecast 2020-2030, Thousand Units

- Mining- Market Size & Forecast 2020-2030, Thousand Units

- Agriculture- Market Size & Forecast 2020-2030, Thousand Units

- Others (Retail, Government, etc.)- Market Size & Forecast 2020-2030, Thousand Units

- By Sales Channel

- Direct Sales- Market Size & Forecast 2020-2030, Thousand Units

- Authorized Dealership- Market Size & Forecast 2020-2030, Thousand Units

- Others- Market Size & Forecast 2020-2030, Thousand Units

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Vehicle Type

- Market Size & Outlook

- South Sudan Light Commercial Vehicles (LCVs- Upto 7 Tons) Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Outlook

- By Fuel Type- Market Size & Forecast 2020-2030, Thousand Units

- By Application- Market Size & Forecast 2020-2030, Thousand Units

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units

- Market Size & Outlook

- South Sudan Medium Commercial Vehicles (MCVs- 7.1 to 16 Tons) Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Outlook

- By Fuel Type- Market Size & Forecast 2020-2030, Thousand Units

- By Application- Market Size & Forecast 2020-2030, Thousand Units

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units

- Market Size & Outlook

- South Sudan Heavy Commercial Vehicles (HCVs- Above 16.1 Tons) Market Outlook, 2020-2030F

- Market Size & Outlook

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Outlook

- By Fuel Type- Market Size & Forecast 2020-2030, Thousand Units

- By Application- Market Size & Forecast 2020-2030, Thousand Units

- By Sales Channel- Market Size & Forecast 2020-2030, Thousand Units

- Market Size & Outlook

- South Sudan New Commercial Vehicle Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Toyota

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- FAW

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sinotruk

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Foton

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MAN Trucks

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nissan

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Isuzu

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DFSK

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Toyota

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making