Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Research Report Forecast: (2025-2030)

Saudi Arabia Left Ventricular Assist Devices Market - By Type of Flow (Pulsatile Flow, Non-Pulsatile Flow), By Design (Implantable Ventricular Assist Devices, Transcutaneous Ventri...cular Assist Devices), By Application (Bridge to Transplantation, Destination Therapy, Bridge to Recovery, Bridge to Candidacy) and Others Read more

- Healthcare

- Feb 2025

- Pages 114

- Report Format: PDF, Excel, PPT

Market Definition

LVAD is a surgically implanted pump, that is responsible for pumping blood from the left lower region of the body directly to the heart. The left ventricle serves as the conduit to take oxygen-rich blood to enter and exit the body and to transfer it to other organs.

Market Insights & Analysis: Saudi Arabia Left Ventricular Assist Devices (LVADs) Market (2025-30):

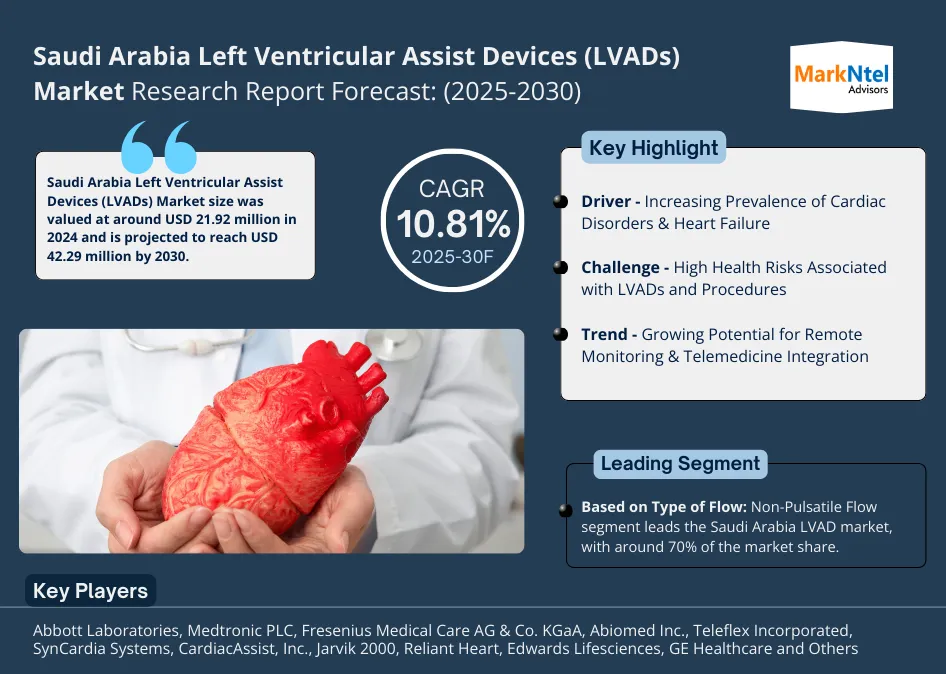

The Saudi Arabia Left Ventricular Assist Devices (LVADs) Market size was valued at around USD 21.92 million in 2024 and is projected to reach USD 42.29 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 10.81% during the forecast period, i.e., 2025-30. The Saudi Arabia Left Ventricular Assist Devices Market reports strong growth pushed via several key factors. One of these is the growing cases in Saudi Arabia of heart failure.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 21.92 Million |

| Market Value in 2030 | USD 42.29 Million |

| CAGR (2025-30) | 10.81% |

| Top Key Players | Abbott Laboratories, Medtronic PLC, Fresenius Medical Care AG & Co. KGaA, Abiomed Inc., Teleflex Incorporated, SynCardia Systems, CardiacAssist, Inc., Jarvik 2000, Reliant Heart, Edwards Lifesciences, GE Healthcare and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

According to the Saudi Heart Association, coronary heart failure cases in 2022 will affect over 1% of Saudi residents, with a predicted yearly incidence rate of over 32,000 cases per year. Scientific treatments like LVADs are getting more popular as coronary heart failure costs rise. LVADs can save the lives of most people of patients with advanced heart failure because they ensure that the heart pumps blood and continues to function. The Saudi Arabian LVAD Market is growing due to the United States’ growing need for LVADs as more human beings there are looking for treatment for heart failure.

Growing information about the treatment of heart failure is another factor propelling the LVAD’s market growth in Saudi Arabia. According to a 2023 Saudi government survey, only 13.8 percent of members were aware that they had a 20 percent risk of getting heart failure in their lifetime. The survey additionally revealed 7.3 percent post-discharge mortality costs and 7.4 percent one-year readmission costs, but very few people knew about these figures. These findings underscore the significance of focused education to improve diagnosis, control, and outcomes for heart failure patients. These consequences highlight the significance of targeted education in the betterment of the diagnosis of heart failure. This results in people becoming aware and opting for clinical attention and treatment like LVAD.

As per the WHO, 2023, there high prevalence of cardiovascular diseases in the kingdom and is expected to rise further. Thus, demand for new treatments is bound to rise which includes the need for advanced heart failure therapies. Hence, with an increased focus on heart diseases, the demand for LVADs will increase, and propel the growth of this market.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Driver:

Increasing Prevalence of Cardiac Disorders & Heart Failure – With the rising prevalence of heart disorders like Arrhythmias, heart valve disease, cardiomyopathy, and heart failure, there is a high demand for left ventricular assist devices. As per Saudi Health Ministry data, in 2022, there were 45% deaths based on heart disorders in the kingdom. In Addition to this, around 15% of Saudi residents are encountering high blood pressure, which gets worsened by diabetes and obesity. With an estimated 70% of people being overweight in 2023, Saudi Arabia has one of the highest obesity rates in the world, according to the Saudi Food and Nutrition Association. The modifiable risk causes such as hypertension, type-2 diabetes, dyslipidemia, and sedentary lifestyle are behind CVD in the population of this country. The prevalence of dyslipidemia is 49.6% and hypertension is 32.1% as per a study conducted by Saudi Medical Journal,2023. The government is running various awareness programs like the National Campaign against Overweight and Obesity, run by the Saudi Government wherein individuals can contact the “Weight Program” of the Ministry of Health to design nutrition programs appropriate to their requirements and health conditions. Still, CVD cases are rising including disorders like Coronary heart disorder, cerebrovascular, peripheral arterial diseases, etc., and thus demand for LVAD is increasing since this is mandatorily required for the treatment of heart failure.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Opportunity:

Growing Healthcare Infrastructure in the Region – The evolving healthcare system in Saudi Arabia is positively affecting the market for left ventricular assist devices. The international healthcare MS industry has greatly benefited from the low investment made by the Saudi government. For instance, Saudi Arabia allocated USD 368 billion towards social and healthcare development in 2022, which constitutes 14.4% of the Saudi budget. Through Vision 2030, Saudi Arabia further allocated USD 66 billion towards improving infrastructure within the healthcare system of the country. To increase the availability, effectiveness, and caliber of healthcare throughout the country, the investment plan calls for privatizing 2,300 primary health facilities and 290 hospitals. Saudi Arabia will become one of the major leaders in contemporary healthcare systems because of the growth in specialized care and cutting-edge medical technologies. With such investments and initiatives, Saudi Arabia is emerging as a leader in cardiac care. The increasing healthcare infrastructure will further boost the LVAD market with improved patient outcomes and demand for these life-saving devices.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Challenge:

High Health Risks Associated with LVADs and Procedures – Employing the devices and methods for their insertion will certainly subject the Saudi Arabian LVAD market to significant health hazards. The dangers associated with LVAD implantation are significant and encompass bleeding, infection, blood clots, and potential device malfunction. It is a highly intricate surgical operation. The consequences of these issues are significant enough to adversely affect both the patient's health and the healthcare system. In Saudi Arabia, these problems are exacerbated by patients and certain medical professionals who have a limited understanding of LVADs. Furthermore, post-implantation care requires ongoing check-ups and specialized expertise, which may often be lacking, especially in rural regions.

The extensive use of LVADs faces obstacles and risks despite the Saudi government’s initiatives to enhance the healthcare system. Enhanced patient education, greater investment in surgical and post-care services, and better training for healthcare professionals would all be essential for solutions.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Trend:

Growing Potential for Remote Monitoring & Telemedicine Integration – In Saudi Arabia, left ventricular assist devices are increasingly being monitored by telemedicine and remote monitoring. The projects released by the Health Ministry, like the Seha mobile application and 937 clinical call centers, are supposed to reduce expenses for unnecessary medical care while providing access to number one healthcare facilities for patients living far from cities. Patients with LVAD benefit from these advancements as they allow for ongoing surveillance and instant clinical attention. The Saudi Arabian authorities are making huge investments in digital health infrastructure, such as telemedicine and remote tracking tools, as a part of Vision 2030. The focus on digital health is expected to result in LVAD therapy becoming more broadly accessible and powerful, also leading to better patient outcomes and decreased healthcare costs.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Market (2025-30): Segmentation Analysis

The Saudi Arabia Left Ventricular Assist Devices (LVADs) Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the country level. Based on the analysis, the market has been further classified as:

Based on Type of Flow:

- Pulsatile Flow

- Non-Pulsatile Flow

The Non-Pulsatile Flow segment leads the Saudi Arabia LVAD market, with around 70% of the market share. Non-pulsatile flow LVADs have become a preference over pulsatile flow devices since they are more reliable, available in smaller sizes, and offer better patient outcomes. They ensure steady and efficient blood circulation, which helps minimize complications such as device failure or blood clots, thereby becoming a safer option for long-term usage. They are also less bulky, hence more convenient and portable to patients, especially those in continuous need of support. Increased demand for non-pulsatile flow LVADs is also attributed to technological advancement that makes the device cheaper and more accessible. The non-pulsatile flow of LVADs will most likely continue to be ahead of the market in Saudi Arabia, providing patients with the most effective and convenient treatment for managing heart failure.

Based on Application:

- Bridge to Transplantation

- Destination Therapy

- Bridge to Recovery

- Bridge to Candidacy

With roughly 50% of the market, the Bridge to Transplantation segment is the most popular application in the Saudi Arabian LVAD industry. Patients with advanced heart failure who are awaiting a heart transplant use this. In BTT applications, LVADs offer vital short-term support and aid in patient stabilization until a suitable donor heart is available. BTT has emerged as a crucial treatment option for transplant candidates as the number of heart failure cases and donor organ shortages rise.

In Saudi Arabia, heart transplant programs are now expanding, and BTT is commonly used in top hospitals like King Faisal Specialist Hospital & Research Center, which offers advanced cardiac care. Increasing heart failure rates are pushing the need for heart transplants up, thereby increasing the demand for BTT. This means that the BTT segment remains a critical component in the Saudi market, helping address the critical need for heart transplant support and improving patient outcomes.

Saudi Arabia Left Ventricular Assist Devices (LVADs) Industry Recent Development:

- January 2025: King Faisal Specialist Hospital and Research Center in Riyadh made history by performing the world’s first robotic-assisted implant of Abbott’s HeartMate 3 LVAD on a 35-year-old patient with advanced heart failure, ensuring quicker recovery.

Gain a Competitive Edge with Our Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Report

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Trends & Developments

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Start-up Ecosystem

- Entrepreneurial Activity

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series-wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Industry Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Opportunities & Hotspots

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Value Chain Analysis

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Regulations and Policy

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type of Flow

- Pulsatile Flow - Market Size & Forecast 2020-2030, USD Million

- Non-Pulsatile Flow - Market Size & Forecast 2020-2030, USD Million

- By Design

- Implantable Ventricular Assist Devices - Market Size & Forecast 2020-2030, USD Million

- Transcutaneous Ventricular Assist Devices - Market Size & Forecast 2020-2030, USD Million

- By Application

- Bridge to Transplantation - Market Size & Forecast 2020-2030, USD Million

- Destination Therapy - Market Size & Forecast 2020-2030, USD Million

- Bridge to Recovery - Market Size & Forecast 2020-2030, USD Million

- Bridge to Candidacy - Market Size & Forecast 2020-2030, USD Million

- By Region

- West

- East

- North

- South

- Central

- By Company

- Competition Characteristics

- Market Share & Analysis- By Revenues

- By Type of Flow

- Market Size & Analysis

- Saudi Arabia Pulsatile Flow Left Ventricular Assist Devices (LVADs) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Design - Market Size & Forecast 2020-2030, USD Million

- By Application - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Non-Pulsatile Flow Left Ventricular Assist Devices (LVADs) Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Design - Market Size & Forecast 2020-2030, USD Million

- By Application - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Left Ventricular Assist Devices (LVADs) Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Abbott Laboratories

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Medtronic PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fresenius Medical Care AG & Co. KGaA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abiomed Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Teleflex Incorporated

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SynCardia Systems

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CardiacAssist, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jarvik 2000

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Reliant Heart

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Edwards Lifesciences

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GE Healthcare

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Abbott Laboratories

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making