Middle East & Africa Green Ammonia Market Research Report: Forecast (2025-2030)

By Technology (Alkaline Water Electrolysis [AWE], Proton Exchange Membrane [PEM], Solid Oxide Electrolysis [SOE]), By Application (Agriculture/ Fertilizers, Power & Energy Generati...on, Energy Storage, Hydrogen Carrier, Shipping Fuel, Others), By Country (The UAE, Saudi Arabia, Oman, Egypt, Turkey, South Africa, Rest of the Middle East & Africa), By Company (Yara International, AMEA Power, Hive Energy, Linde Engineering, ENOC Group, Other) Read more

- Chemicals

- Apr 2023

- Pages 168

- Report Format: PDF, Excel, PPT

Market Definition

Green ammonia is a clean version of ammonia, made in an environmentally friendly way. It is produced using techniques that are sustainable & do not emit carbon. Its production requires green hydrogen as a raw material that passes through the electrolysis process & the source of energy used is solar & wind, as a result, there is no emission of carbon.

Market Insights & Analysis: Middle East & Africa Green Ammonia Market (2025-30)

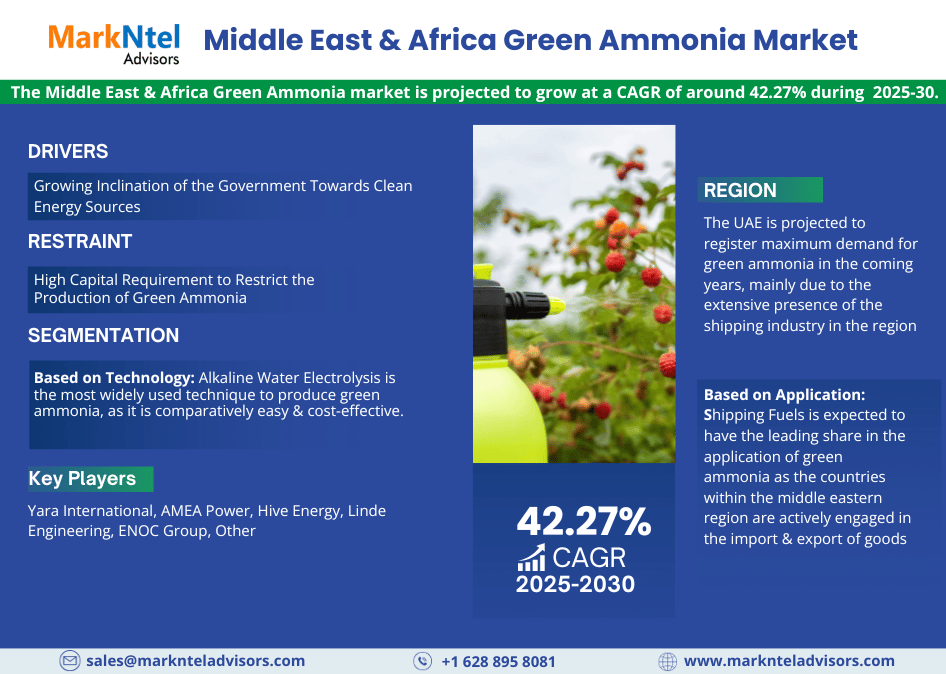

The Middle East & Africa Green Ammonia market is projected to grow at a CAGR of around 42.27% during the forecast period, i.e., 2025-30. The production, usage, and end-user industries are in developmental stages in the Middle East & African region. The companies such as ADNOC, AMEA Group, etc., have announced & are working on developing their dedicated production facilities that would be commercialized during the forecast period of 2025-2030.

Furthermore, the growth within the end-user industries, such as the increasing potential of the manufacturing industry, wastewater treatment facilities, etc., is anticipated to boost the demand in the coming years. Along with this, agriculture & fertilizers is also anticipated to boost the demand as countries like Saudi Arabia & Oman are among the top exporters of fertilizers globally. The availability of this gas within the region would allow the fertilizer manufacturing companies to transition towards it in place of conventional ammonia to reduce the carbon emissions from the food & agriculture sector.

| Report Coverage | Details |

|---|---|

| Study Period | Forecast Period: 2025-30 |

| CAGR (2025-2030) | 42.27% |

| Country Covered | The UAE, Saudi Arabia, Oman, Egypt, Turkey, South Africa, Rest of the Middle East & Africa |

| Key Companies Profiled | Yara International, AMEA Power, Hive Energy, Linde Engineering, ENOC Group, Other |

| Unit Denominations | USD Million/Billion |

Further, the growing environmental concerns & decarbonization of industries are among the other factors resulting in escalating the adoption of green ammonia. As per the Royal Society, close to 1.8% of global carbon emission is released from ammonia production alone. Additionally, to reduce carbon emissions & achieve net neutrality the adoption of this gas is anticipated to advance within industries such as shipping, transportation, chemicals, etc. For it, both public & private players are actively engaging in developing & expanding the production facilities, and massive investments are being announced to achieve this goal, thereby creating a positive market outlook for growth in the coming years.

Middle East & Africa Green Ammonia Market Key Driver:

Growing Inclination of the Government Towards Clean Energy Sources - Considering the menace of climate change, the government in the region is constantly working on promoting clean energy sources & the discovery of alternative energy which are sustainable & eco-friendly. As a result of which, the government itself is collaborating with private players to create an ecosystem for the development and production of green ammonia. For instance:

- The Government of the UAE aims to invest close to AED 600 Billion by the year 2050 to cater to the growing demand for energy & plans to fulfill 44% of the total energy requirements through clean fuels from the current levels, which are nearly 19.63% in 2021.

The favorable government policies are creating a way for private players to enter & invest in the production projects to cater to the upcoming demand from manufacturing & food processing industries & agriculture. Along with it, countries like the UAE & Saudi Arabia aim to emerge as a leading player within the production domain & export it to the neighboring countries & diversify their economic profile.

Similarly, in 2021, Saudi Arabia announced the production facility in NEOM City with the capacity of producing 1.2 million tons of this gas annually. The project is being developed by ACWA & Air Product and is expected to be operationalized in the year 2025 to serve domestic requirements as well as to be exported to the countries in the region.

Middle East & Africa Green Ammonia Market Possible Restraint:

High Capital Requirement to Restrict the Production of Green Ammonia - The production of this gas is a highly capital-intensive process because it is still in its developmental stage, along with it, the infrastructural capabilities required for the production are also limited. Further, huge initial capital is needed to set up a production unit, due to which traditional ammonia becomes cost-effective in comparison to green ammonia, hence would result in slowing down adoption among the end users.

Middle East & Africa Green Ammonia Market Growth Opportunity:

Growing Focus of the Government to Improve Food Security in the Region - The countries in the Middle Eastern region suffer from a shortage of food & grains. These countries are highly import dependent to fulfill their food security requirements. However, countries such as the UAE, Saudi Arabia, etc., are constantly working on improving their food security for it to achieve this, R&D is being done to examine the viability of smart agriculture in the region. Smart agricultural practices would generate an increased demand for fertilizers to maintain the fertility of the soil & for better yield production. These fertilizers would require ammonia as a raw material, the availability of green ammonia would allow the fertilizer manufacturers to shift to it as it is more environmentally friendly & cuts down carbon emissions. Along with the growth in agricultural practices, the demand for herbicides & pesticides would also grow, thereby resulting in the requirement of ammonia to produce herbicides and pesticides. For instance:

- In 2021, the government of Abu Dhabi announced a comprehensive plan to develop sustainable agriculture in the country, in line with the UAE government’s aim to achieve carbon neutrality by the year 2050.

In line with this plan, the UAE-US fund has been created to support farmers to switch to climate sustainable agriculture in 2022. The investment amount has doubled from USD4 billion to USD8 billion to support vertical farming, hydroponics, and aquaculture. The development within the agriculture sector of the country would generate the requirement for fertilizers, herbicides, and pesticides, which require ammonia for their production. The availability of green ammonia would allow fertilizers & pesticide manufacturers to switch to clean ammonia, thereby increasing its adoption within the agriculture sector.

Middle East & Africa Green Ammonia Market Key Trend:

Massive Investments by the Private Players - Currently, the production of green ammonia is in the developmental stage in the Middle East & Africa region & is expected to be commercialized in the region by 2025. Currently, major power companies are investing heavily in establishing their production facility in countries like the UAE, Saudi Arabia, Qatar, and South Africa.

- In 2022, Hive Hydrogen announced an investment of nearly USD6 billion for establishing a green hydrogen production facility in Nelson Mandela Bay.

- In 2022, ENOC Group & IHI Corporation signed an MOU to produce and sell green ammonia in the coming years.

These developments within the clean energy sector aim at decarbonizing the industries within the region to attain the global carbon emission norms. Thus, industries like shipping, fertilizer, and chemicals, are anticipated to transition to cleaner fuels, hence escalating the demand.

Middle East & Africa Green Ammonia Market (2025-30): Segmentation Analysis

The Middle East & Africa Green Ammonia Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the global, regional, and national levels. Based on the Technology, and Applicationthe market has been further classified as:

Based on Technology:

- Alkaline Water Electrolysis (AWE)

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolysis (SOE)

Of them all, Alkaline Water Electrolysis is the most widely used technique to produce green ammonia, as it is comparatively easy & cost-effective. Additionally, AWE technology is suitable to expand the scalability of producing hydrogen to produce this gas. For instance, in Saudi Arabia, the production facility of the NEOM City uses Alkaline Water Electrolysis (AWE) technique to produce 1.2 million tons of green ammonia, thereby creating a positive market outlook for growth.

Moreover, the AWE production method uses saline or brackish water at the production stage, which is most suitable for the Middle East region, as it already has limited availability of freshwater. Owing to these reasons adoption of the AWE production technique is anticipated to have the largest share of the market.

Based on Application:

- Agriculture/ Fertilizer

- Power & Energy Generation

- Energy Storage

- Hydrogen Carrier

- Shipping Fuels

- Others

Here, Shipping Fuels is expected to have the leading share in the application of green ammonia as the countries within the middle eastern region are actively engaged in the import & export of goods, as a result of which the shipping industry is very prominent across the region. Additionally, the industry is one of the largest emitters of carbon globally. As per the World Bank, the shipping industry alone is responsible for realizing close to 3% of global carbon emissions, due to which the industry is expected to switch to ammonia to be used as a fuel to decarbonize the industry.

Further, it has been mandated for the global shipping industry to reduce 40% of its carbon emissions by the year 2030, owing to which shipping companies in the Middle Eastern region are anticipated to boost the adoption of this gas, thereby augmenting its demand in the coming years.

Middle East & Africa Green Ammonia Market Countries Projection

Geographically, the expands across:

- The UAE

- Saudi Arabia

- Oman

- Egypt

- Turkey

- South Africa

Within the Middle East & Africa region, the UAE is projected to register maximum demand for green ammonia in the coming years, mainly due to the extensive presence of the shipping industry in the region, which could emerge as the major end-user. Along with it, the constant promotion of sustainable & smart agriculture in the country would generate the demand for fertilizers, pesticides & herbicides, and the manufacture the ammonia is required. Hence, the availability of this gas would allow fertilizer producers to easily switch to it, thereby expanding its demand in the coming years.

Middle East & Africa Green Ammonia Industry Recent Developments

- 2022: In Egypt, the European Bank for Reconstruction & Development announced to provide a loan of USD80 million to Egypt Green for the production of green hydrogen & from that to produce green ammonia. The ammonia produced from this facility would be used to serve domestic as well as the international demand.

Gain a Competitive Edge with Our Middle East & Africa Green Ammonia Market Report

- Middle East & Africa Green Ammonia Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Middle East & Africa Green Ammonia Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

Middle East & Africa Green Ammonia Market Research Report (2025-2030) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The Middle East & Africa Hydrogen Industry Outlook, 2022

- Roadmap

- Projects, By Phase

- Operational

- Development

- Future Scope

- The Middle East & Africa Energy Storage Industry, 2020-2030

- Current Scenario

- By Storage Type

- Battery

- Pumped Storage

- Compressed Gas Storage

- Cryogenic Liquid Storage

- Thermal Energy Storage

- Future Scope

- The Middle East & Africa Green Ammonia Market Trends & Insights

- The Middle East & Africa Green Ammonia Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- The Middle East & Africa Green Ammonia Market Regulations & Policy

- The Middle East & Africa Green Ammonia Market Strategic Investments, 2022

- Third-Party Investments

- Purpose of Investment

- Investment Amount

- Target Result

- Investments for Self Consumption

- Third-Party Investments

- The Middle East & Africa Green Ammonia Market Supply Chain

- OEMs

- Production Technology & Equipment Developers

- Others

- The Middle East & Africa Green Ammonia Market Consortium & Association, 2020-2030

- The Middle East & Africa Green Ammonia Market Analysis, 2025-2030

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- The Middle East & Africa Green Ammonia Market Development, By Technology, 2025-2030

- Alkaline Water Electrolysis (AWM)

- Proton Exchange Membrane (PEM)

- Solid Oxide Electrolysis (SOE)

- The Middle East & Africa Green Ammonia Market, Source of Energy, 2025-2030

- By Solar

- By Wind

- Others (Biogas)

- The Middle East & Africa Green Ammonia Market Development, By Country

- The UAE

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- Saudi Arabia

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- Oman

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- Egypt

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- Turkey

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- South Africa

- Country Wise Readiness for Green Ammonia, 2020-2030

- Market Size & Analysis, 2025-2030

- By Revenue (USD Million)

- By Volume (in Thousand Tons)

- The UAE

- The Middle East & Africa Green Ammonia Market Development, By Application, 2025-2030

- Agriculture/ Fertilizer

- Power & Energy Generation

- Energy Storage

- Hydrogen Carrier

- Shipping Fuel

- Others

- The Middle East & Africa Green Ammonia Market Development, By OEM, 2025-2030

- Yara International

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- AMEA Power

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- HIVE Energy

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- Linde Engineering

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- ENOC Group

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- Others Potential Players

- Technological Developments

- Investments

- Production Plans

- Future Roadmap

- Yara International

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making