GCC Fertilizer Market Research Report: Forecast (2021-2026)

By Product Type (Nitrogenous Fertilizer, Phosphatic, Potassic, Others), By Country (U.A.E, Saudi Arabia, Bahrain, Kuwait, Oman Qatar), By Competitors (Qatar Fertilizer Company, Sau...di Arabian Fertilizer Company, Gulf Petrochemical Industries Company, Fertil and Emirates BioFertilizer Factory, Emirates Bio Fertilizer Factory, Abu Dhabi Fertilizer Industries Co. W.L.L, RNZ International FZCO, SABIC, RNZ International FZCO, Ma’aden Wa’ad Al-Shamal Phosphate) Read more

- Environment

- Jun 2021

- Pages 232

- Report Format: PDF, Excel, PPT

Market Overview

Fertilizers are chemical materials provided to the crops by farmers to enhance their potency and improve crop yield. These fertilizers comprise vital nutrients for the plants, like potassium, nitrogen, phosphorus, etc.

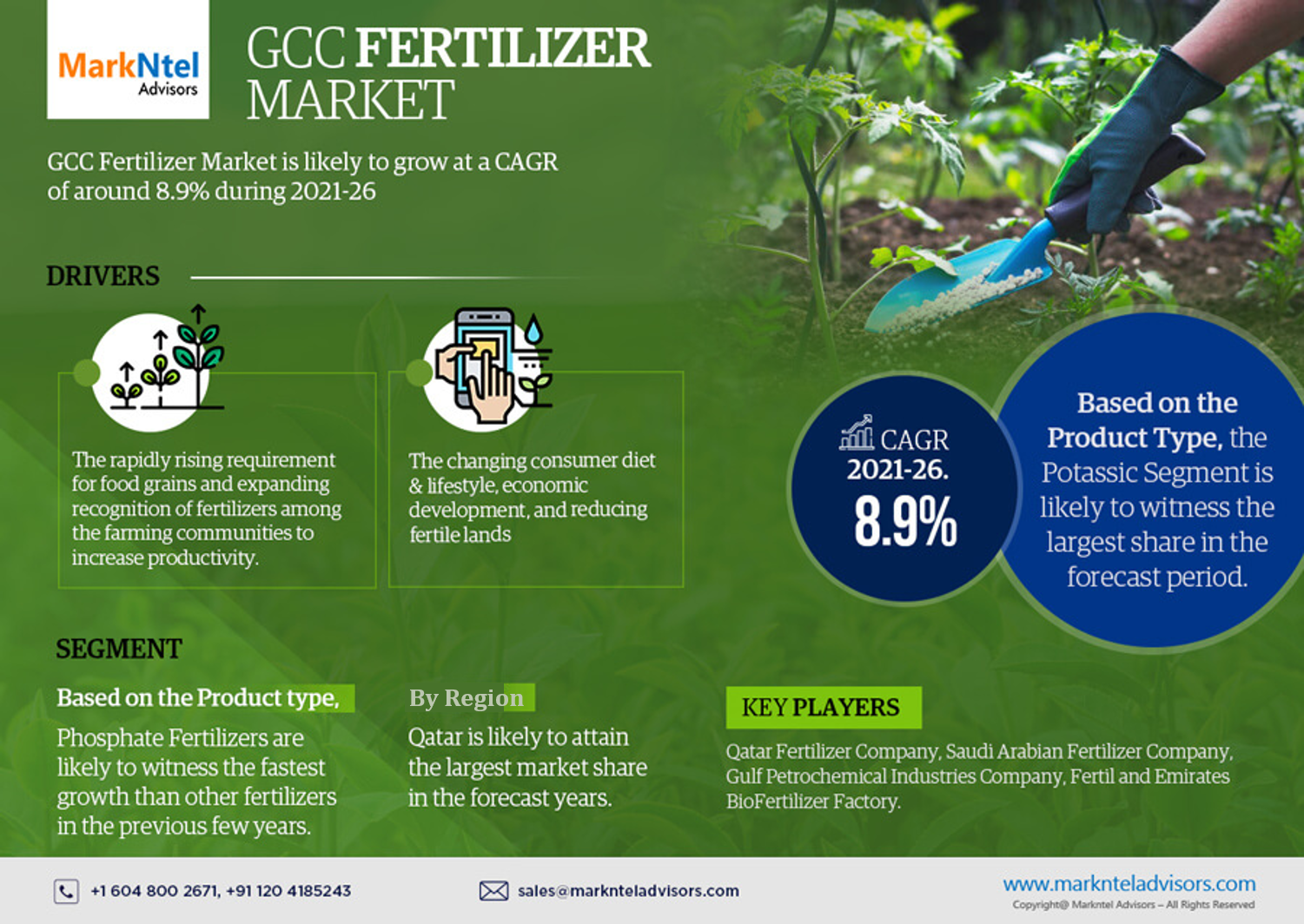

According to the MarkNtel Advisors research report, “GCC Fertilizer Market Analysis, 2021,” the market is likely to grow at a CAGR of around 8.9% in the forecast period of 2021-26. The growth substantially owes to the rapidly surging demand for food & related products with the flooding population. The increasing production of fertilizer plants is accelerating the need for high-performance fertilizer enzymes, which are likely to witness consistent growth in the coming years. Furthermore, the changing consumer diet & lifestyle, economic development, and reducing fertile lands are other crucial factors likely to propel the growth of the GCC Fertilizer Market in the forecast period.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 8.9% |

| Countreis Covered | U.A.E, Saudi Arabia, Bahrain, Kuwait, Oman Qatar |

| Key Companies Profiled | Qatar Fertilizer Company, Saudi Arabian Fertilizer Company, Gulf Petrochemical Industries Company, Fertil and Emirates BioFertilizer Factory, Emirates Bio Fertilizer Factory, Abu Dhabi Fertilizer Industries Co. W.L.L, RNZ International FZCO, SABIC, RNZ International FZCO, Ma’aden Wa’ad Al-Shamal Phosphate |

| Unit Denominations | USD Million/Billion |

Impact of COVID-19

The outbreak of the Covid-19 pandemic impacted the GCC Fertilizers Market minimally, principally due to shipping restrictions. Most businesses are running their services smoothly in many countries after the gradual relaxation by the government. However, the market is likely to witness ups and downs in the early forecast years. The import of fertilizers across countries is still well-delayed in some areas due to extended lockdown phases. Moreover, numerous businesses have inventories sufficient only for a few months, which might bring further delay in the supply of fertilizers and turn out to be a loss in the sowing season.

Market Segmentation

Phosphatic Fertilizers to Witness the Fastest Market Growth

The GCC Fertilizer Market classifies into multiple divisions contributing to the market growth. Based on the product type, the market segments prominently into Nitrogenous fertilizers, Phosphatic fertilizers, Potassic fertilizers, and various others. Out of all, Phosphatic Fertilizers are more likely to witness the fastest growth than other fertilizers due to the booming population, rising demand for cereals & grains, and burgeoning meat consumption. Additionally, with the confined availability of arable soil, phosphate fertilizers can help develop crop yield smoothly. Hence, these factors shall fuel the demand for Phosphatic Fertilizers in the forecast period.

Bahrain Becomes the Fastest Growing Market Consumer

In Bahrain, Gulf Petrochemical Industries Company (GPIC) produced 1.6m tonnes of urea, ammonia, and methanol of about 1.4% in the previous year and grew higher than its annual targets. Furthermore, Bahrain attains the highest record of the daily production of urea at the rate of 2,055 tonnes and adds up new records per month for methanol at the rate of 62,300 tonnes. The GPIC reveals that it exported 676,791 tonnes. Hence, it has become the fastest consumer in the market, states MarkNtel Advisors in their research report, “GCC Fertilizer Market Analysis, 2021.”

Country Landscape

Qatar Attains the Largest Market Share

While all GCC countries contribute to the market share at a firm pace, Qatar is more likely to attain the largest market share in the forecast years, owing to the massive investments by governments in research & development because of the rigorous management and product complexities. It is predominantly due to the sales of fertilizer products that vary depending on climatic conditions & crop variance. Furthermore, multiple market players are introducing modern technologies and making investments in the GCC Fertilizer market to increase the production capacity & reduce costs. Hence, based on these aspects, Qatar shall witness robust market growth in the forecast years.

Market Driver

The GCC region is one of the largest producers of fertilizers and exports a prominent part of the production to numerous other countries. The countries shipping fertilizers from the GCC include the United States, India, Thailand, and Brazil, accommodating about 70% of the total fertilizer exports. Furthermore, the expanding demand for fertilizers within GCC countries is another factor burgeoning the overall market growth in the forecast period.

Competitive Landscape

According to MarkNtel Advisors, the major leading players in the GCC Fertilizer Market are Qatar Fertilizer Company, Saudi Arabian Fertilizer Company, Gulf Petrochemical Industries Company, Fertil and Emirates BioFertilizer Factory, Emirates Bio Fertilizer Factory, Abu Dhabi Fertilizer Industries Co. W.L.L, RNZ International FZCO, SABIC, RNZ International FZCO, Ma’aden Wa’ad Al-Shamal Phosphate.

Key Questions Answered in the Market Research Report:

- What are the overall market statistics or market estimates (Market Overview, Market Size- By Value, Forecast Numbers, Market Segmentation, Market Shares) of the GCC Fertilizer Market?

- What are the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the GCC Fertilizer Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in GCC Fertilizer Market based on the competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during the GCC Fertilizer Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on GCC Fertilizer Market

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Product Type

- Nitrogenous Fertilizer

- Phosphatic

- Potassic

- Others

- By Region

- The U.A.E. Fertilizer Market Outlook, 2016-2026F (USD Million)

- Saudi Arabia Fertilizer Market Outlook, 2016-2026F (USD Million)

- Oman Fertilizer Market Outlook, 2016-2026F (USD Million)

- Bahrain Fertilizer Market Outlook, 2016-2026F (USD Million)

- Qatar Fertilizer Market Outlook, 2016-2026F (USD Million)

- Kuwait Fertilizer Market Outlook, 2016-2026F (USD Million)

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Matrix

- GCC Fertilizer Market Hotspots & Opportunities

- GCC Fertilizer Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- GCC Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Introduction

- Market Segmentation

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Expert Verbatim- What our Experts Say?

- Impact of COVID-19 on the GCC Fertilizer market

- GCC Fertilizer Market Policies, Regulations, Product Standards

- GCC Fertilizer Value Chain Analysis

- GCC Fertilizer Market Trends & Insights

- GCC Fertilizer Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- GCC Fertilizer Market Hotspot & Opportunities

- GCC Fertilizer Market Key Strategic Imperatives for Success & Growth

- GCC Fertilizer Market Analysis, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- Nitrogenous Fertilizer

- Phosphatics

- Potassic

- Others

- By Country

- UAE

- Saudi Arabia

- Bahrain

- Kuwait

- Qatar

- Oman

- By Company

- Market Shares, By Revenue

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Product Type

- Market Size & Analysis

- UAE Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Saudi Arabia Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Bahrain Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Kuwait Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Qatar Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Oman Fertilizer Market Outlook, 2016-2026F

- Market Size & Analysis

- Quantity Sold

- Market Revenues

- Market Share & Analysis

- By Product Type

- By Distribution Channel

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Manufacturing Units

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Qatar Fertilizer Company

- Saudi Arabian Fertilizer Company

- Gulf Petrochemical Industries Company

- Fertil and Emirates Bio Fertilizer Factory

- Emirates Bio Fertilizer Factory

- Abu Dhabi Fertilizer Industries Co. W.L.L

- RNZ International FZCO

- SABIC

- RNZ International FZCO

- Ma’aden Wa’ad Al Shamal Phosphate

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making