India Catering Market Research Report: Forecast (2025-2030)

India Catering Market - By Type (Outsourced [Contractual, Non Contractual], In-House), By End User (Corporate sector [Outsourced, In-House], Education [Outsourced, In-House], Healt...hcare [Outsourced, In-House], Oil & Gas [Outsourced, In-House], Defense & Law Enforcement [Outsourced, In-House], Government [Outsourced, In-House], Mining & EPC [Outsourced, In-House], Events [Personal Events, Business Events], Construction Industry [Outsourced, In-House], Sports & Leisure [Outsourced, In-House], Prisons [Outsourced, In-House], Others [Outsourced, In-House]), By Model (Client Pay B2B, Consumer Pays/Retail/B2C) and others Read more

- Food & Beverages

- Nov 2024

- Pages 122

- Report Format: PDF, Excel, PPT

Market Definition

Catering is the process of creating specially designed menus and food offerings based on the occasion or event needs of the client. These customers include government agencies, businesses, educational institutions, the healthcare, maritime sectors private events, and other end users.

Market Insights & Analysis: India Catering Market (2025-30):

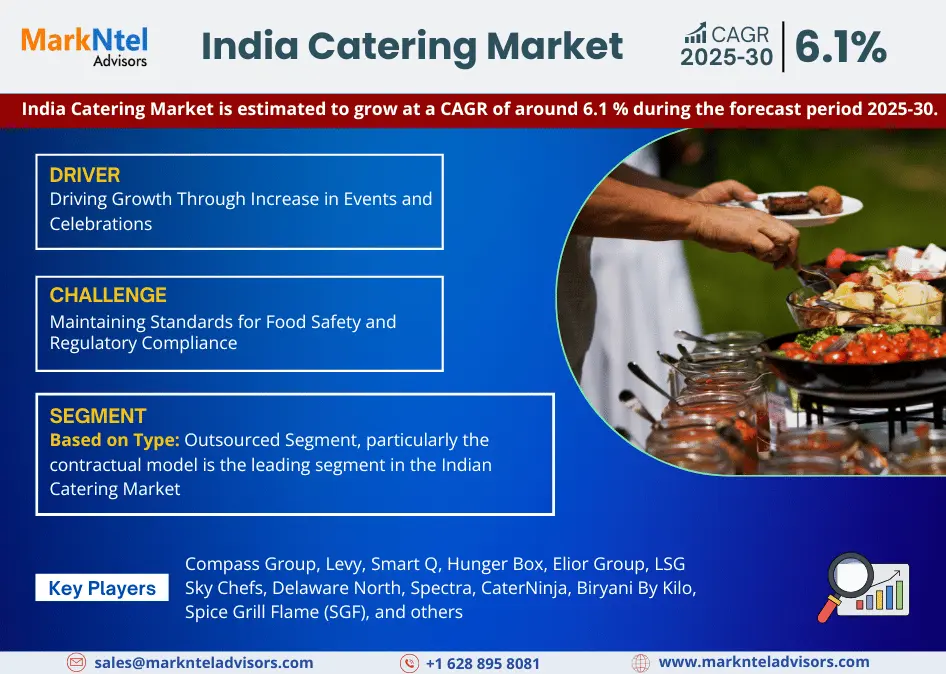

The India Catering Market is estimated to grow at a CAGR of around 6.1 % during the forecast period, i.e., 2025-30. The increase in events and celebrations is the main factor driving the notable expansion of the India Catering Market. Festivities are emphasized in India’s rich cultural tapestry with social gatherings festivals and weddings all playing significant roles in people's lives. Families are increasingly willing to spend on premium catering services for these events as their disposable incomes rise. In addition, the catering service in the hospital sector is also playing a significant role in the Indian catering market.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| CAGR (2025-30) | 6.1% |

| Top Key Players | Compass Group, Levy, Sodexo Food Solution India Pvt Ltd, Smart Q, Hunger Box, Elior Group, LSG Sky Chefs, Delaware North, Spectra, CaterNinja, Biryani By Kilo, Spice Grill Flame (SGF), and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Additionally, the catering market presents a robust growth opportunity by introducing untapped traditional and regional cuisine to its menu. India is the land of diversity, hence there is a variety of food choices, by offering personalized taste catering businesses are generating revenue. In addition to it, Airline catering is also an opportunity as the passengers whether traveling in economy or first class, are demanding fresh meals and refreshments during flights. To ensure that meals are nutritious and pleasurable, airline caterers aim to create menus that meet dietary preferences and cultural cuisines. Similarly, Railway catering also presents robust growth opportunities. Also, the market growth is further supported by the involvement of online platforms like social media and websites in catering to a wider consumer base. Likewise, the market is also offering opportunities for sustainable and Health-Conscious Catering Solutions.

The India Catering Market is welcoming the trend of green and eco-friendly catering practices, because of the growing awareness among customers also supported by the Indian government. The consumers are more health-conscious driving the demand for vegetarian and vegan dishes. In response of it, caterers are offering menus that feature locally sourced, organic ingredients and plant-based options. This gradual shift in the market further amplifies the specialized catering services demand and enhances the market growth.

India Catering Market Driver:

Driving Growth Through Increase in Events and Celebrations – The increase in events and celebrations is the main factor driving the notable expansion of the Indian catering industry. Feasts are emphasized in India's rich cultural pattern with social gatherings, festivals, and weddings all playing significant roles in people's lives. As disposable incomes rise at a rate of 14.5 percent for the year 2022-23, more families are prepared to spend money on premium catering for these events. Additionally, the variety of events from wedding celebrations to business gatherings, offers caterers numerous chances to reach a range of markets. In India, there are about 10 million weddings annually with about 80% of them being Hindu weddings that require well-coordinated catering services.

Moreover, various sports events are also amplifying the Indian Catering Market growth. Furthermore, the expansion of the corporate sector creates a consistent need for catering services at events and meetings. Many people now prefer hiring professional caterers for big events due to health and safety concerns. When taken as a whole these elements are driving the Indian catering industry ahead indicating a rising desire for outside food services that improve festivities. For instance,

- As per the Confederation of All India Traders (CAIT), It is estimated that 48 lakh weddings will take place nationwide in November and December 2024.

India Catering Market Opportunity:

Collaboration with Event Planners and Venues – In the India Catering Market working together with event coordinators and venues offers a big chance for expansion. By collaborating with expert event planners catering services can provide all-inclusive packages that cover not only food but also staffing, logistics, and décor meeting the growing demand for flawless event experiences. Since event planners frequently have existing networks searching for reliable catering services, these partnerships give caterers access to a larger clientele.

Additionally, by collaborating with venues caterers can optimize operations and guarantee that food service perfectly fits the needs and layout of the venue. Additionally, coordinated marketing initiatives among caterers, event coordinators, and venues can increase exposure and draw in new customers making cooperation a calculated move in a competitive industry. Through the utilization of these collaborations, catering companies can establish themselves as essential participants in the event management ecosystem propelling expansion and creativity.

India Catering Market Challenge:

Maintaining Standards for Food Safety and Regulatory Compliance– The major challenge in the catering business is to maintain food safety standards in India proposed by FSSAI at the national level. Also, the catering business has to follow state government regulations for food security. This complex and evolving regulatory landscape leads to an increase in operational costs as businesses are required to invest in staff training. With the changing regulations at both the national and state levels companies have to keep all the updated documentation and licenses to avoid penalties, ultimately increasing the spending. Moreover, increasing awareness about food safety among consumers is also pressuring companies to adhere to high food standards. Lapsing any of the regulatory compliances can cause a loss of customer loyalty and even potential legal consequences. Additionally, consistent compliance is challenging due to the diverse nature of Indian cuisine which necessitates specific handling and storage for different ingredients. For instance,

- January 2024, Food regulator FSSAI has asked airlines and flight caterers to enhance the existing food safety protocols and regulations within the airline catering industry and provide detailed information about items served to passengers through proper labeling.

India Catering Market Trend:

Rising Demand for Multi-Regional Cuisine Including Vegan and Green Foods – One significant trend influencing the Indian catering industry is the growing desire for diversity in Indian cuisine especially the addition of vegan and eco-friendly options. Customers' desire for variety is further heightened by their desire for fusion cuisine which combines traditional Indian flavors with international culinary influences. Customers are looking for multi-regional menu options that accommodate their dietary requirements and lifestyle choices. Veganism is becoming more popular among people who care about animal welfare and the environment in addition to those who are health-conscious. Catering businesses are capitalizing on this trend by providing creative plant-based menu items and utilizing regional organic ingredients to appeal to a wider client base.

In addition, urban populations, and Generation Z consumers prefer vegan options over meat products, considering the environmental impacts of it. As per the survey of NDPI, almost half of the Indian students i.e. 46.5% were planning to shift to a plant-based diet. People are seeking innovative and flavourful dishes that too align with their ethical values. Caterers are redesigning their menu options based on this trend and developing distinctive offerings that appeal to a wide range of customers from corporate gatherings to weddings.

- July 2024, Spice Grill Flame (SGF), has launched a new vegan menu with two categories —100% Plant-Based Protein and Vegan. The dishes in the first category are made with soy, meanwhile, the second category aims to provide wholesome meals meeting plant-based dietary requirements.

India Catering Market (2025-30): Segmentation Analysis

The India Catering Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025-2030 at the global level. Based on the analysis, the market has been further classified as:

Based on Type:

- Outsourced

- Contractual

- Non Contractual

- In-House

The outsourced segment, particularly the contractual model is the leading segment in the Indian Catering Market with more than 60% of the market share. Contractual catering is a long-term agreement with corporate clients, educational events, and various event organizations to meet their specific needs and service standards. Also, the non-contractual outsourced segment is growing engaging only to individual smaller gatherings or events. Unlike the contractual segment, the non-contractual segment does not involve any formal agreements. Contractual catering involves a pre-defined scope of services, performance metrics, risk management, and cost structures, providing both parties with legal protections. The segment is likely to grow in the forecasted period also, shaping the future dynamics of the catering market in India.

Based on Model:

- Client Pay B2B

- Consumer Pays/Retail/B2C

Client Pay B2B (Business-to-Business) segment is dominating the India Catering Market, accounting for approximately 60-70% of the total market share. The increasing demand for corporate catering amplifies the segment growth as companies need professional catering services for various corporate functions, meetings, and events. This segment involves contractual agreements to meet the unique needs of the business in the long term. As businesses continue to prioritize professional catering for various corporate functions, the B2B segment is expected to maintain its leading position reflecting a trend toward organized consistent, and scalable catering solutions.

India Catering Industry Recent Development:

- March 2024, Levy has partnered with the Baltimore Ravens to become the team's official food beverage, and hospitality (FandB) partner for M&T Bank Stadium Hospitality.

- January 2024, Elior India Inaugurates State-of-the-Art Kitchen Facility in Hyderabad. This kitchen is built on 20,000 sq ft with the capacity of 25000 meals which can be scaled up to 30,000 meals.

Gain a Competitive Edge with Our India Catering Market Report

- India Catering Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The India Catering Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- India Catering Market Regulations

- India Catering Market Trends & Developments

- India Catering Market Dynamics

- Impact Analysis

- Drivers

- Challenges

- India Catering Market Pricing Analysis

- Price Per Plate

- Annual Price Increase Trend

- Key Factors Impacting Prices

- India Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By Type

- Outsourced

- Contractual - Market Size & Forecast 2020-2030F, USD Million

- Non Contractual - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Outsourced

- By End User

- Corporate sector

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Education

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Healthcare

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Oil & Gas

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Defense & Law Enforcement

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Government

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Mining & EPC

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Events

- Personal Events

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Business Events

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Personal Events

- Construction Industry

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Sports & Leisure

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Prisons

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Others (Retail, Manufacturing, Aviation, etc.)

- Outsourced - Market Size & Forecast 2020-2030F, USD Million

- In-House- Market Size & Forecast 2020-2030F, USD Million

- Corporate sector

- By Model

- Client Pay B2B - Market Size & Forecast 2020-2030F, USD Million

- Consumer Pays/Retail/B2C - Market Size & Forecast 2020-2030F, USD Million

- By Region

- North - Market Size & Forecast 2020-2030F, USD Million

- East - Market Size & Forecast 2020-2030F, USD Million

- South - Market Size & Forecast 2020-2030F, USD Million

- West - Market Size & Forecast 2020-2030F, USD Million

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Type

- India Contractual Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By Type - Market Size & Forecast 2020-2030F, USD Million

- By End Users - Market Size & Forecast 2020-2030F, USD Million

- By Model - Market Size & Forecast 2020-2030F, USD Million

- By Region - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- India Non-Contractual Catering Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Number of Meals Served (Million Meals)

- Market Share & Analysis

- By Type - Market Size & Forecast 2020-2030F, USD Million

- By End Users - Market Size & Forecast 2020-2030F, USD Million

- By Model - Market Size & Forecast 2020-2030F, USD Million

- By Region - Market Size & Forecast 2020-2030F, USD Million

- Market Size & Analysis

- Company Profiles

- Company Profiles

- Compass Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Levy

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Sodexo Food Solution India Pvt Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Smart Q

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Hunger Box

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Elior Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- LSG Sky Chefs

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Delaware North

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Spectra

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- CaterNinja

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Biryani By Kilo

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Spice Grill Flame (SGF)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Others

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Pricing Range Per Plate

- Price Margin Per Plate

- Type of Customers Served

- Others

- Compass Group

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making