India Automotive Paints and Coatings Market Research Report: Forecast (2024-2030)

India Automotive Paints and Coatings Market - By Resin Type (Polyurethane, Epoxy, Acrylic, Alkyd, Polyester, Others), By Composition (Water-based, Solvent-based, Powder-based), By ...Coating type (E-coat, Primer, Basecoat, Clearcoat), By Vehicle type (Two-wheelers, Passenger Cars, Medium & Heavy Commercial Vehicles, Light Commercial Vehicles), By Application (OEM, Refinish) and others Read more

- Chemicals

- Feb 2024

- Pages 132

- Report Format: PDF, Excel, PPT

Market Definition

Automotive paints & coatings are used in the automotive industry for protection as well as decorative purposes. The paints & coating products are available in three different compositions, i.e., water-based, solved-based, and powder-based. These products are mainly made up of resins such as polyurethane, epoxy, acrylic, alkyd, polyester, etc. Automotive refinish is one of the major application sectors of these products.

Market Insights & Analysis: India Automotive Paints and Coatings Market (2024-30):

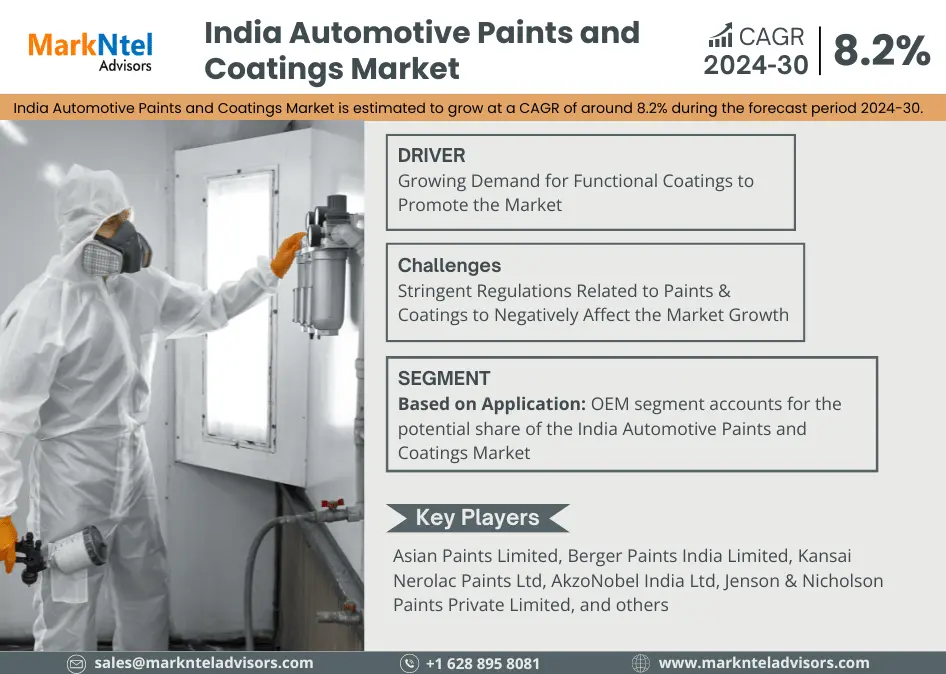

The India Automotive Paints and Coatings Market is estimated to grow at a CAGR of around 8.2% during the forecast period, i.e., (2024-30). The industry has been witnessing robust growth owing to factors such as growing disposable income, changing consumer preferences, the establishment of dynamic manufacturing capabilities, etc., in turn, supporting the development of automotive paints & coatings demand in the country. India being a global hub for automobile manufacturing, has attracted major market players to establish their production units in the country. Companies such as Tata Motors, Mahindra & Mahindra, Maruti Suzuki, Hyundai, Toyota, and Volkswagen are actively expanding their manufacturing capacities in India, which paved the way for the growth of paints & coatings across the country. For instance:

- In 2023, Tata Motors announced the expansion of manufacturing capacity at its Sanand, Gujarat manufacturing unit. The capacity expansion is planned to cater to the bolstering need for new & improved automobiles.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 8.2% |

| Region Covered | North, South, East, West |

| Key Companies Profiled | Asian Paints Limited, Berger Paints India Limited, Kansai Nerolac Paints Ltd, AkzoNobel India Ltd, Jenson & Nicholson Paints Private Limited, Nippon Paint (India) Private Limited, and others |

| Unit Denominations | USD Million/Billion |

Additionally, the increasing consciousness among Indian consumers regarding the appearance and quality of cars has prominently raised the demand for protective paints & coatings in the country. Consequently, the increased demand for vehicles with aesthetic appeal & advanced paint technology to protect against a variety of environmental factors has propelled the demand for effective and reliable paints & coating products. The automotive paints and coating industry has been highly motivated to develop and introduce new product technologies to meet these requirements, thus supporting the overall market growth in the country.

Other factors, such as large Foreign Direct Investment (FDI) and domestic investments by the governments in projects like “Atma Nirbhar Bharat” and “Make in India” have played a major role in igniting the market expansion of the automotive sector. Further, as the surge in investments has led to the expansion of businesses & manufacturing activities, the demand for automotive paints & coatings is expected to accelerate during 2024-30.

India Automotive Paints and Coatings Market Driver:

Growing Demand for Functional Coatings to Promote Automotive Paints and Coatings Market – The Indian Automotive Paints & Coatings Industry has evolved significantly, with a marked change in consumers' preferences & requirements within the sector. The growth in demand for functional coatings is at the forefront of trends that have transformed this industry in recent years. Functional coatings are specialized formulations designed not just to beautify surfaces but also to enhance their performance & durability. These coatings are particularly important in electric vehicles, where thermal management varnishes help to regulate the temperature of batteries so that they will last longer & perform better. For instance:

- In 2023, MG launched its new EV in the Indian market by the name Comet EV.

Furthermore, functional coatings are applied to different vehicle components to provide benefits such as corrosion resistance, heat insulation, scratch resistance, and self-cleaning properties. Hence, owing to the beneficial aspects of the Automotive Paints and Coatings Market in India is destined to uplift.

India Automotive Paints and Coatings Market Opportunity:

Growing Market for Automotive Refinishes to Open New Doors for the Market Players – Recently, the India Automotive Market has been witnessing dynamic growth, owing to changing consumer expectations, rising market demand for used vehicles, and an increased interest in car customization. This industry shift has prompted a surge in the demand for automotive refinish products, thus boosting the growth of automotive paints & coatings across the country. Given the desire to be affordable and reliable, the market for used cars in India is experiencing strong growth, thus augmenting the demand for refinishing products in the country.

Additionally, in the Indian market, environmental consciousness is on the rise. Consequently, a shift to eco-friendlier paint & coating solutions has been boosting the acceptance of water-based paints & coatings. Further, meeting these requirements, coupled with strict regulatory policies, has highly motivated the manufacturers of automotive paints & coating products to invest in environmentally friendly products, thus opening new opportunities in the India Automotive Paints and Coatings Market.

India Automotive Paints and Coatings Market Challenge:

Stringent Regulations Related to Paints & Coatings to Negatively Affect the Market Growth – Paint & coatings manufacturers must constantly enhance their processes to meet the growing number of regulatory policies imposed by the government. One of such challenges faced by the industry is the stringent environmental regulations imposed by both the central & state governments. These regulations aim to reduce emissions, control the release of volatile organic compounds (VOCs), and minimize the environmental impact of the coatings manufacturing process. Furthermore, compliance with these regulations often requires substantial investments in technology and processes to reduce pollution & waste, resulting in long approval time, which creates challenges for the India Automotive Paints and Coatings Market.

India Automotive Paints and Coatings Market Trend:

Growing Demand for Electric Vehicles Creating New Trends Across the Market – India's automotive landscape is experiencing a monumental shift as the demand for electric vehicles (EVs) surges. With increasing environmental awareness, government incentives, and advancements in technology, EVs are rapidly gaining traction in the Indian market, thus supporting the growth of paints & coatings in this industry. India with an alarming level of pollution increase in many of the cities has made it an attractive market for electric vehicles. These vehicles produce zero tailpipe emissions, making them an attractive choice for environmentally conscious consumers and government bodies committed to improving air quality, thus propelling the market’s growth. For instance

- In 2023, Hyundai launched its new electric vehicle by the name Ioniq 5 under its flagship product line. This new EV vehicle launched will be assembled in India only.

The Indian government has played a pivotal role in promoting electric vehicles. Initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme provide financial incentives, including subsidies and tax benefits, to both manufacturers and consumers. Additionally, some states offer additional incentives to encourage the adoption of EVs, thus supporting the growth of EVs, which in turn will enhance the market size of the Automotive Paints and Coatings Market in India.

India Automotive Paints and Coatings Market (2024-30): Segmentation Analysis

India Automotive Paints and Coatings Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the national level. In accordance to the analysis, the market has been further classified as:

Based on the Resin Type:

- Polyurethane

- Epoxy

- Acrylic

- Alkyd

- Polyester

- Others (Fluoropolymers, Vinyl, etc.)

Polyurethane (PU) is becoming a prominent player in the India Automotive Paints & Coating Market due to increasing demand. PU-based paints & coatings are known for their exceptional durability, making them an ideal choice for the challenging Indian automotive environment. Vehicles are subject to harsh conditions in India's varied climate, which diverges from blazing summers to heavy rains. Thus, to ensure the durability of the vehicle’s finish for an extended period, polyurethane-based paints & coatings are prominently used by the manufacturers.

Polyurethane paint offers superior resistance to weather, UV radiation, chemicals, and abrasion, and it also provides an anti-scratch finish to the vehicle, thus propelling its demand among major players in the automotive industry. Furthermore, owing to a growing luxury and premium vehicle, coatings with protective and good appearance quality are highly demanded in India, thus propelling polyurethane’s demand across the country.

Based on Application:

- OEM

- Refinish

The OEM segment accounts for the potential share of the India Automotive Paints and Coatings Market. India's automobile industry has grown at a remarkable rate over recent decades to become one of the world's most rapidly developing markets. The demand for cars has grown steadily due to growth in the middle-class population and an increase in the standard of living, thereby encouraging automobile manufacturing across the country. This led to a significant increase in demand for automotive paints & coatings, particularly in the OEM segment.

The country is home to several major international & domestic automakers such as Maruti Suzuki, Hyundai Motor India, Ashok Leyland, etc., which has made it an attractive location for paints & coatings providers, thus propelling the market demand. Further, with initiatives such as 'Make in India,' coupled with favorable government policies, automotive production is expected to experience substantial growth. This upsurge in production is majorly driving the demand for high-quality automotive paints & coatings used in the manufacturing process, in turn, propelling the market growth.

India Automotive Paints & Coatings Industry Recent Development:

- 2022: McLaren Racing and AkzoNobel have extended and enhanced their enduring collaboration. The new agreement between the companies was built on the successful 13-year partnership and was expected to explore new sustainability, technical innovation, and product development potential.

- 2022: BASF has extended its Automotive Coatings Application Centre at its Coatings Technology Centre in Mangalore, India. The expansion is planned to boost its customer service capabilities in the country.

Gain a Competitive Edge with Our India Automotive Paints and Coatings Market Report

- India Automotive Paints and Coatings Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of the market dynamics & to make vital decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The India Automotive Paints and Coatings Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Automotive Industry Production Statistics

- India Automotive Paints & Coatings Market Imports & Exports Statistics

- India Automotive Paints & Coatings Market Trends & Insights

- India Automotive Paints & Coatings Market Dynamics

- Growth Drivers

- Challenges

- India Automotive Paints & Coatings Market Hotspot & Opportunities

- India Automotive Paints & Coatings Market Supply Chain Analysis

- India Automotive Paints & Coatings Market Policies, Regulations, & Guidelines

- India Automotive Paints & Coatings Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type

- Polyurethane- Market Size & Forecast 2019-2030, Thousand Tons

- Epoxy- Market Size & Forecast 2019-2030, Thousand Tons

- Acrylic- Market Size & Forecast 2019-2030, Thousand Tons

- Alkyd- Market Size & Forecast 2019-2030, Thousand Tons

- Polyester- Market Size & Forecast 2019-2030, Thousand Tons

- Others (Fluoropolymers, Vinyl, etc.)- Market Size & Forecast 2019-2030, Thousand Tons

- By Composition

- Water-based- Market Size & Forecast 2019-2030, Thousand Tons

- Solvent-based- Market Size & Forecast 2019-2030, Thousand Tons

- Powder-based- Market Size & Forecast 2019-2030, Thousand Tons

- By Coating type

- E-coat- Market Size & Forecast 2019-2030, Thousand Tons

- Primer- Market Size & Forecast 2019-2030, Thousand Tons

- Basecoat- Market Size & Forecast 2019-2030, Thousand Tons

- Clearcoat- Market Size & Forecast 2019-2030, Thousand Tons

- By Vehicle type

- Two-wheelers- Market Size & Forecast 2019-2030, Thousand Tons

- Passenger Cars- Market Size & Forecast 2019-2030, Thousand Tons

- Medium & Heavy Commercial Vehicles- Market Size & Forecast 2019-2030, Thousand Tons

- Light Commercial Vehicles- Market Size & Forecast 2019-2030, Thousand Tons

- By Application

- OEM- Market Size & Forecast 2019-2030, Thousand Tons

- Refinish- Market Size & Forecast 2019-2030, Thousand Tons

- By Region

- North

- South

- East

- West

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Paints

- By Coatings

- By Resin Type

- Market Size & Analysis

- India Automotive Paints Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Composition- Market Size & Forecast 2019-2030, Thousand Tons

- By Coating Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Vehicle Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application - Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- India Automotive Coatings Market Analysis, 2019-2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Resin Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Composition- Market Size & Forecast 2019-2030, Thousand Tons

- By Coating Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Vehicle Type- Market Size & Forecast 2019-2030, Thousand Tons

- By Application - Market Size & Forecast 2019-2030, Thousand Tons

- Market Size & Analysis

- India Automotive Paints & Coatings Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Asian Paints Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Berger Paints India Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kansai Nerolac Paints Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AkzoNobel India Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF India Limited.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jenson & Nicholson Paints Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nippon Paint (India) Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sheenlac Noroo Coatings India Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Esdee Paints Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Taralac

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Asian Paints Limited

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making