Global Commercial Vehicle Coatings Market Research Report: Forecast (2022-27)

By Product Type (Primer, Basecoat, Electro-coats, Clear-coats), By Substrate (Metal, Plastic, Composite), By Technology (Waterborne Coatings, Solvent-borne Coatings, Powder Coating...s, UV-Cured Coatings), By Resin Type (Polyurethane, Epoxy, Acrylic, Others (Vinyl, Alkyd, etc.)), By Application (Light Commercial Vehicle (Pickup Trucks, Pickup Vans & Trucks, Light Bus), Medium & Heavy Commercial Vehicle), By Demand (OEM, Aftermarket), By Region (North America, South America, Europe, Middle East & Africa, Asia-Pacific), By Company (Axalta Coating Systems, BASF, PPG Industries, Kansai Paint, Akzo Nobel, Valspar Corporation, Cabot Corporation, Clariant AG, Eastman Chemical Company, Lord Corporation, Nippon Paints, Arkema SA, Beckers Group, Berger Paints, Clariant AG, Others) Read more

- Automotive

- Aug 2022

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

Automotive coatings are applied on vehicle surfaces for both aesthetic & protection purposes to enhance the vehicle's durability and resistance to heat, UV rays, dust, corrosion, & other foreign particles. Nowadays, automotive OEMs employ multiple layers of coatings on modern vehicles in order to ensure their long-lasting protection.

The growing trend of customized vehicle colors worldwide is compelling more and more companies to expand their production capacities for automotive coatings to cater to the ever-growing end-user requirements, which, in turn, is positively impacting the industry's expansion globally.

Market Insights

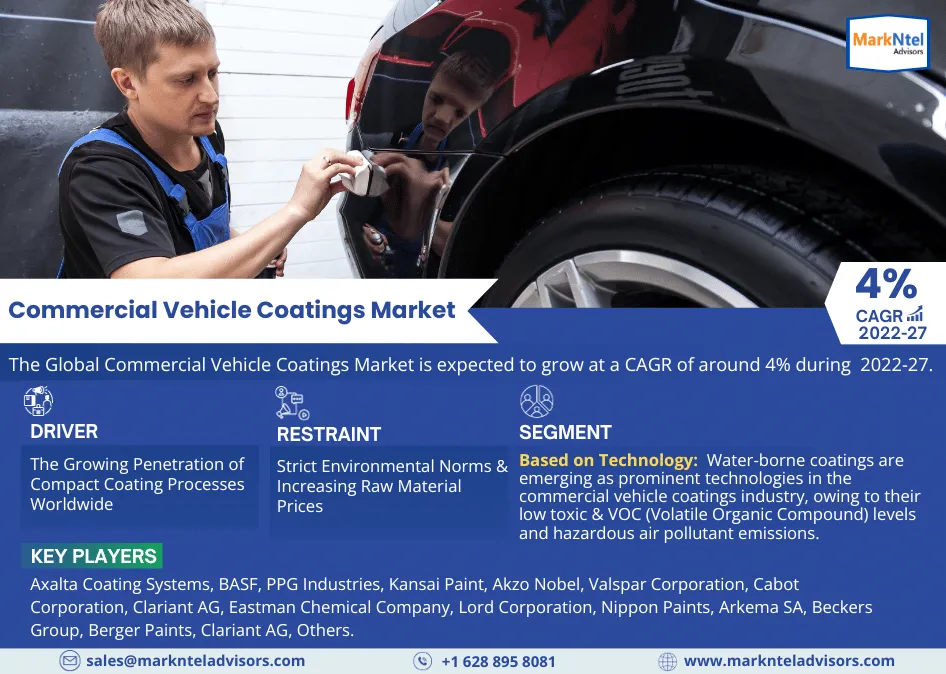

The Global Commercial Vehicle Coatings Market is expected to grow at a CAGR of around 4% during the forecast period, i.e., 2022-27. The growth of the market is driven primarily by the swift expansion of various end-user industries like construction, e-commerce, and transportation & logistics, among others, globally, i.e., leading to the burgeoning production of commercial vehicles and augmenting the demand for paints & coatings for them.

Besides, the increasing focus of governments worldwide on vehicle scrappage programs, their massive investments in infrastructure developments, and stringent regulations for commercial vehicle length & loading limits are further contributing to the expanding size of the commercial vehicle coatings industry. In addition, the growing demand for tippers & trucks owing to a rapid rise in mining activities is further augmenting the production & sales of automotive coatings for commercial vehicles globally.

Simultaneously, the soaring demand for both small and medium & heavy commercial vehicles for the booming transportation & logistics sector, owing to the growing e-commerce & retail businesses, is another prominent aspect expected to continue escalating the expansion of the commercial vehicle coatings market through 2027.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 4% |

| Regions Covered | North America: The US, Canada, Mexico |

| Europe: Germany, The UK, France, Italy, Spain, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Egypt, Rest of MEA | |

| Key Companies Profiled |

Axalta Coating Systems, BASF, PPG Industries, Kansai Paint, Akzo Nobel, Valspar Corporation, Cabot Corporation, Clariant AG, Eastman Chemical Company, Lord Corporation, Nippon Paints, Arkema SA, Beckers Group, Berger Paints, Clariant AG, Others. |

| Unit Denominations | USD Million/Billion |

Latest Trend in the Global Commercial Vehicle Coatings Market

- The Rapidly Expanding Automotive Industry and Diminishing Utilization of Emission-Producing Paints & Coatings

The automotive sector worldwide is undergoing rapid technological advancement along with creative discoveries. Swift transitions in society, technologies, & growing environmental concerns are transforming the way we travel or how products are transported globally. The emerging trend toward sustainability is compelling automakers to adopt more environmentally conscious materials in their manufacturing processes.

The surging demand for commercial vehicles across different end-user industries, such as retail, e-commerce, logistics, construction, etc., especially across countries like China, India, South Korea, Mexico, & Brazil, is leading to the burgeoning production & sales of automotive coatings globally.

As a result, there are increasing concerns over mounting carbon emissions, owing to which automotive coating manufacturers are focusing actively on developing eco-friendly products in order to lower the environmental degradation caused by their product offerings. Moreover, several government organizations are also taking active initiatives toward encouraging the utilization of efficient technologies to reduce emission levels.

Hence, bio-based polyurethane dispersions & water-based coatings, which have low VOC levels, are gaining traction and replacing the conventionally used solvent-borne solutions in automotive manufacturing. Moreover, the growing end-user requirements for aesthetic & comfortable interiors are further contributing to the mounting demand for waterborne coatings that offer a luxury look & feel to vehicles.

Furthermore, the ever-growing inclination of automakers toward using thermal spray technologies & advanced powder coatings is another prominent aspect expected to boost the growth of the commercial vehicle coatings market through 2027.

Market Segmentation

Based on Technology:

- Solvent-Borne

- Water-Based

- Powder

- UV-Cured

Of them all, water-borne coatings are emerging as prominent technologies in the commercial vehicle coatings industry, owing to their low toxic & VOC (Volatile Organic Compound) levels and hazardous air pollutant emissions. These coatings offer better color quality, provide more color options, and shades come out brighter & richer. The constantly evolving environmental standards across several countries are leading to the rising requirements for environment-friendly characteristics in paints & coatings, which, in turn, is augmenting the adoption of water-borne automotive coatings. Besides, properties like high chemical resistance, low-temperature processing, & solvent-free preparations are other aspects contributing to their growing popularity worldwide.

On the other hand, powder coatings are also gaining traction globally as they are environmentally friendly, offer incredible aesthetics, protect against chemicals, moisture, & heat, and exhibit properties like high resistance to corrosion, chipping, & abrasion. As a result, they are witnessing growing utilization for coatings on vehicle engines, chassis, wheels, filters, mirrors, wipers, & horns, among others, and, consequently, propelling the overall expansion of the Global Commercial Vehicle Coatings Market.

Based on Substrate:

- Metal

- Plastic

- Composite

Of all substrates, plastic is witnessing a rapidly rising popularity, owing to its properties like lightweight, design flexibility, high resistance to corrosion, reduced costs, excellent durability & recyclability. The progressive shift of automakers from using metals to lightweight materials is driving the demand for plastic substrates in the global commercial vehicle coatings market. In addition, the growing use of carbon-fiber-reinforced polymers in automotive production is also boosting the demand for plastic substrates and, in turn, fueling the growth of the commercial vehicle coatings industry.

Regional Landscape

Geographically, the Global Commercial Vehicle Coatings Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Among all regions globally, Asia-Pacific, one of the major automotive hubs, is the largest Commercial Vehicle Coatings Market, mainly due to the burgeoning automobile production, the mounting prevalence of ride-hailing services, numerous ongoing & upcoming construction projects, and increasing logistics services due to the rapidly expanding retail & e-commerce sectors across the region.

Besides, massive investments by governments of several Asian countries in infrastructure developments are leading to the growing requirements for heavy equipment and, consequently, paints & coatings for them. The rising industrial production that has widened trade routes across the region is also contributing to the burgeoning demand for paints & coatings for commercial vehicles.

China, India, & South Korea are witnessing skyrocketing sales of commercial vehicles and thus are the major shareholders in the Asia-Pacific Commercial Vehicle Coatings Industry. The surging Electric Vehicle (EV) sales, easy availability of low-cost labor, and the extensive presence of leading automobile manufacturers are the key factors contributing to the surging demand for commercial vehicle coatings in these countries.

- In August 2022, BASF launched its new invisible TPU (Thermoplastic Polyurethane) PPF (Paint Protection Film) in Asia-Pacific, which would offer multifaceted & long-lasting protection for vehicles.

- The same year in July, the company, in line with its aim to strengthen its position as a leading supplier of automotive coatings across Asia-Pacific, expanded its production capacity of automotive refinish coatings at its site in Jiangmen, South China, to cater to the growing end-user requirements for commercial vehicles in China.

Market Dynamics

Key Driver: The Growing Penetration of Compact Coating Processes Worldwide

Automakers worldwide are exploring new materials for multi-substrate designs & making lightweight vehicles while actively working on enhancing the automotive coating processes without compromising the quality. Since automotive coatings involve high energy & costs and contribute significantly to environmental degradation, the leading automotive coating manufacturers have started using compact coating processes to lower the degradation of the environment caused by their products. B1:B2 technology of PPG Industries, Inc. and 2-wet & 3-wet of Axalta Coating Systems are the most prominent compact coating techniques being deployed excessively all around the globe. Hence, with more & more automotive OEMs adopting these processes, it is creating remunerative prospects for the leading companies in the Global Commercial Vehicle Coatings Market.

Growth Restraint: Strict Environmental Norms & Increasing Raw Material Prices

The harmful effects of VOC emissions from solvent-borne coatings on the environment have led to stringent regulations for automakers across many countries to use bio-based coatings & paints. As a result, there's a gradually declining utilization of solvent-based solutions in the automotive sector. Moreover, the world is witnessing increasing prices of paint & coating raw materials, i.e., another aspect hampering the supply & demand of automotive coatings worldwide. Hence, these aspects are likely to create significant challenges for the Global Commercial Vehicle Coatings Market to expand during 2022-27.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Commercial Vehicle Coatings Market?

- What are the region-wise size, growth drivers, and challenges for the Global Commercial Vehicle Coatings Market?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Commercial Vehicle Coatings Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Commercial Vehicle Coatings Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Commercial Vehicle Coatings Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on Global Commercial Vehicle Coatings Market

- Global Commercial Vehicle Coatings Market Regulations & Policy

- Global Commercial Vehicle Coatings Market Trends & Insights

- Global Commercial Vehicle Coatings Market Dynamics

- Growth Drivers

- Challenges

- Global Commercial Vehicle Coatings Market Hotspots & Opportunities

- Global Commercial Vehicle Coatings Market Supply Chain Analysis

- Global Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type

- Primer

- Basecoat

- Electro-coats

- Clear-coats

- By Substrate

- Metal

- Plastic

- Composite

- By Technology

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- UV-Cured Coatings

- By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Others (Vinyl, Alkyd, etc.)

- By Application

- Light Commercial Vehicle

- Pickup Trucks

- Pickup Vans & Trucks

- Light Bus

- Medium & Heavy Commercial Vehicle

- Light Commercial Vehicle

- By Demand

- OEM

- Aftermarket

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenues Shares

- By Product Type

- Market Size & Analysis

- North America Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Substrate

- By Technology

- By Resin Type

- By Application

- By Demand

- By Country

- The US

- Canada

- Mexico

- The US Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Canada Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Mexico Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Market Size & Analysis

- South America Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Substrate

- By Technology

- By Resin Type

- By Application

- By Demand

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Argentina Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Market Size & Analysis

- Europe Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Substrate

- By Technology

- By Resin Type

- By Application

- By Demand

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- The UK Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- France Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Italy Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Spain Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Substrate

- By Technology

- By Resin Type

- By Application

- By Demand

- By Country

- UAE

- Saudi Arabia

- South Africa

- Egypt

- Rest of MEA

- UAE Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Saudi Arabia Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- South Africa Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Egypt Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Substrate

- By Technology

- By Resin Type

- By Application

- By Demand

- By Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- China Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- India Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Japan Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- South Korea Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Australia Commercial Vehicle Coatings Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product Type

- By Application

- By Demand

- Market Size & Analysis

- Market Size & Analysis

- Global Commercial Vehicle Coatings Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Axalta Coating Systems

- BASF

- PPG Industries

- Kansai Paint

- Akzo Nobel

- Valspar Corporation

- Cabot Corporation

- Clariant AG

- Eastman Chemical Company

- Lord Corporation

- Nippon Paints

- Arkema SA

- Beckers Group

- Berger Paints

- Clariant AG

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making