India Air Purifier Market Research Report: Forecast (2024-2030)

By Type of Filters (HEPA+ Activated Carbon [AC], HEPA +AC + Ion, HEPA + Electrostatic Precipitator, HEPA + Ion & Ozone, Others), By Region (North, Central, West, South, North East,... East), By Leading Cities (Delhi NCR, Mumbai, Chennai, Kolkata, Hyderabad), By End Users (Hotels, Business Parks, Education, Healthcare), By Company (Eureka Forbes Ltd., Philips India Ltd., Honeywell International Pvt Ltd., Kent RO Systems Ltd., Blueair India Pvt. Ltd., Panasonic India Pvt. Ltd., Crusaders Technologies India Pvt. Ltd., Sharp Business Systems (India) Private Limited, Daikin Air Conditioning India Pvt Ltd.) Read more

- Environment

- Nov 2023

- Pages 102

- Report Format: PDF, Excel, PPT

Market Definition

An air purifier, often known as an air cleaner, is a device that eliminates impurities from a room's air to improve indoor air quality. These devices are frequently marketed as being beneficial to allergy and asthma sufferers, as well as decreasing or eliminating second-hand tobacco smoke.

Market Insights & Analysis: India Air Purifier Market (2024-30):

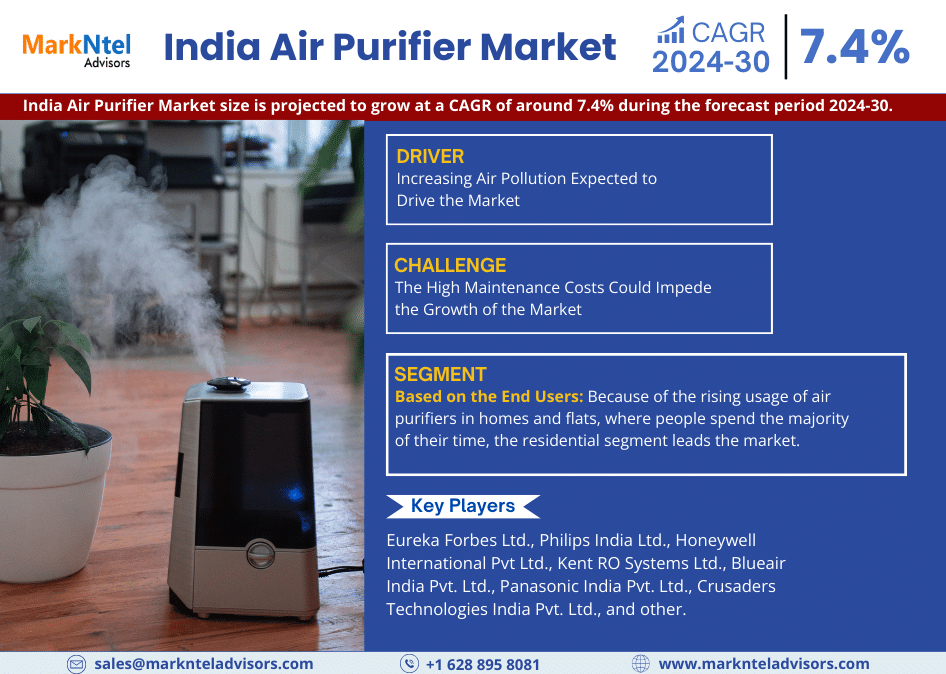

The India Air Purifier Market size is projected to grow at a CAGR of around 7.4% during the forecast period, i.e., 2024-30. The country's rising level of air pollution is pushing the market for air purifiers. The Indian market for air purifiers is quickly developing due to the prevalence of airborne diseases and pollution in various Indian cities. This has led to an increase in the use of air purifiers, as indoor air can be more contaminated than outdoor air due to a lack of circulation, hastening market growth during the forecast period.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-30) | 7.4% |

| Region Covered | North, Central, West, South, North East, East |

| Key Companies Profiled | Eureka Forbes Ltd., Philips India Ltd., Honeywell International Pvt Ltd., Kent RO Systems Ltd., Blueair India Pvt. Ltd., Panasonic India Pvt. Ltd., Crusaders Technologies India Pvt. Ltd., Sharp Business Systems (India) Private Limited, Daikin Air Conditioning India Pvt Ltd., |

| Unit Denominations | USD Million/Billion |

Increased demand for smart air purifiers is creating new prospects during the forecast period. A smart air purifier is a more advanced version of a normal air purifier that filters the air automatically in multiple locations. Smart air purifiers can be controlled remotely using a smartphone app connected via Wi-Fi and Bluetooth.

There is a bright future for the India Air Purifier Market but high maintenance costs may stymie market expansion. Despite the astounding Air Quality Index numbers reported in Delhi, the market for air purifiers has yet to realize its full potential. One reason for this is that Indian consumers are wary about purchasing air purifiers. Air purifiers are inexpensive to buy, but they are significantly more expensive to maintain because they require filter changes once or twice a year and must be left on at all times. When electricity and filter maintenance costs are considered, the long-term cost of air purifiers becomes a little more complicated.

India Air Purifier Market Driver:

Increasing Air Pollution Expected to Drive the Market – Because of the prevalence of airborne diseases and pollution in various Indian cities, the India Air Purifier Market is rapidly expanding. This has resulted in a spike in the usage of air purifiers, as indoor air can be more contaminated than outdoor air due to the lack of circulation, accelerating the growth of the market.

Furthermore, the industry is thriving in the country's northern cities such as Delhi, Punjab, and Haryana due to stubble burning, which causes poor air quality, smog conditions, and many health and breathing ailments like asthma and bronchitis. In accordance with this, the market growth can be linked to unfavorable winter circumstances, low wind speed, and ventilation index, which impedes the dispersion of pollutants and leads to breathing issues, hence driving the market growth.

India Air Purifier Market Opportunity:

Increasing Demand for Smart Air Purifiers Opens Up New Opportunities – A smart air purifier is a more advanced version of a standard air purifier that is used to automatically filter the air at various places. A smartphone app connected via Wi-Fi and Bluetooth can control smart air purifiers remotely. The main advantage of smart air purifiers over traditional ones is that users can use their cell phones to monitor and check indoor air quality as well as alter basic settings.

Furthermore, as people become more aware of the bad effects of unclean air on their health, there will be a greater need for creative and smart air purifiers. As a result of increased construction activity and rapid urbanization, air purifiers are often used in metropolitan areas for residential applications. Smart air purifiers, on the other hand, are most commonly installed and used in small business units and the automobile industry. Therefore, higher demand for smart air purifiers is anticipated to increase market size during the forecast period.

India Air Purifier Market Challenge:

The High Maintenance Costs Could Impede the Growth of the Market – Despite the astonishing Air Quality Index levels reported in Delhi, the air purifiers market has yet to reach its full potential. One reason for this is that Indian consumers are hesitant to buy air purifiers. Air purifiers are inexpensive to purchase, but they are far more expensive to operate, as they frequently require filter changes once or twice a year and should be left on at all times. When the cost of energy and filter maintenance is factored in, the long-term cost of air purifiers gets a little more complicated.

Because the health benefits of using air purifiers vary from person to person and depend on the types of pollutants present. Energy costs have been reduced thanks to energy-efficient air purifiers, but filter replacement costs remain unaddressed. Although there is no industry standard for filter replacement frequency, some customers may find the hidden carbon filter costs prohibitively expensive. The majority of air purifiers on the market include a HEPA filter (for particle removal) and a carbon filter (for gas removal). Carbon filters, on the other hand, must be replaced much more frequently.

India Air Purifier Market Trend:

Increasing Use of Energy-efficient Products – Global energy usage is increasing. Rising energy consumption in response to population growth has put unprecedented strain on fuel sources such as coal and oil. However, carbon emissions from coal-fired energy are substantially higher. To address rising emissions concerns, nations have enacted rigorous legislation. Consumer goods makers are also required to produce electronic devices with high energy efficiency ratings. Guidelines for ensuring energy efficiency in household electronics have become more stringent.

Nowadays, consumer electronics are certified with energy-saving ratings. Refrigerators, heating and cooling devices, kitchen equipment, gadgets, and other appliances account for more than 81% of total energy consumption. ENERGY STAR-certified air purifiers are nearly 27% more energy efficient than regular versions, saving buyers money on service fees.

This tendency has also made inroads into the air purifier sector. Customers check for popular energy ratings before making a buying decision. The larger the rating, the greater the potential for sales. As a result, manufacturers are obligated to offer cutting-edge technology and continually improve their features in order to provide energy-efficient air purifiers. So, the inclination of manufacturers and consumers towards energy-efficient air purifiers is anticipated to share the size & growth of the India Air Purifier Market during the forecast period.

India Air Purifier Market (2024-30): Segmentation Analysis

The India Air Purifier Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It also includes predictions for the period 2024–2030 at the national level. According to the analysis, the market has been further classified as:

Based on the Distribution Channel:

- Small Retailers

- Modern Retail / MBO

- Online

In the Indian air purifier business, small retailers generate the most revenue. The air purifier market in India's small retail sector has enormous growth potential. Small merchants can profit from the rising demand for air purifiers by offering a variety of solutions at reasonable costs.

Because of its diverse product offerings, the online distribution channel is expected to grow at the fastest rate during the projected period. It offers shoppers more selections at lower prices than traditional retail outlets. This channel is likely to drive air purifier sales due to increased urbanization and a desire for a more cost-effective and comfortable shopping experience.

Based on the End Users:

- Commercial

- Residential

- Industrial

Because of the rising usage of air purifiers in homes and flats, where people spend the majority of their time, the residential segment leads the market. The home air purifier market in India is expanding as a result of numerous causes, including the rising prevalence of airborne diseases and pollution in urban areas.

They have become more health-conscious as their disposable incomes and living standards have increased. Air pollution's detrimental impacts are encouraging the adoption of air pollution management technology, particularly in India. Because of the increased desire for a healthy lifestyle, particularly among young urban populations, the market is likely to rise dramatically in the future years.

Gain a Competitive Edge with Our India Air Purifier Market Report

- India Air Purifier Market report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Air Purifier Industry Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

India Air Purifier Market Research Report (2024-2030) - Table of Contents

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on India Air Purifier Market

- India Air Pollution Key Statistics & Infographics

- State wise Pollution Levels

- Air Contaminants & Their Historical Trend in Various Regions

- India Air Purifiers Market Analysis, 2019-2030F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Type of Filters

- HEPA+ Activated Carbon (AC)

- HEPA +AC + Ion

- HEPA + Electrostatic Precipitator

- HEPA + Ion & Ozone

- Others

- By Region

- North

- Central

- West

- South

- North East

- East

- By Leading Cities

- Delhi NCR

- Mumbai

- Chennai

- Kolkata

- Hyderabad

- By End Users

- Hotels

- Business Parks

- Education

- Healthcare

- By Distribution Channel

- Small Retailers

- Modern Retail / MBO

- Online

- By Competitors

- Competition Characteristics

- Market Shares

- By Type of Filters

- Market Size & Analysis

- India Air Purifiers Market Attractiveness Index 2024-2030F

- Market Size & Analysis

- By Revenues

- By Unit Sold

- Market Share & Analysis

- By Type of Filters

- By Region

- By Distrubution Channel

- By Leading Cities

- By End Users

- Market Size & Analysis

- India HEPA+ Activated Carbon Air Purifiers Market Analysis, 2019-2030F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Region

- By Leading Cities

- By End Users

- Market Size & Analysis

- India HEPA+ Activated Carbon +Ion & Ozone Air Purifiers Market Analysis, 2019-2030F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Region

- By Leading Cities

- By End Users

- Market Size & Analysis

- India HEPA+ Electrostatic Precipitator Air Purifiers Market Analysis, 2019-2030F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Region

- By Leading Cities

- By End Users

- Market Size & Analysis

- India HEPA+ Ion & Ozone Air Purifiers Market Analysis, 2019-2030F

- Market Size & Analysis

- Market Revenues

- Units Sold

- Market Share & Analysis

- By Region

- By Leading Cities

- By End Users

- Market Size & Analysis

- India Air Purifiers Market Hotspot & Opportunities

- India Air Purifiers Market Key Strategic Imperatives for Growth & Success

- India Air Purifiers Market Regulatory Environment

- Norms & Regulations

- Products Standards OR Industry Benchmarks

- Pollution Control Initiatives

- India Air Purifiers Market Supply Chain Analysis

- Leading Stakeholders in Supply Chain

- Margins at Various Levels

- India Air Purifiers Market Import Export Statistics

- Imports & Exports

- By Revenue

- Leading Export & Import Destinations

- By Revenues

- Imports & Exports

- India Air Purifier Market Insights

- Growth Drivers

- Restraints

- Impact Analysis

- India Air Purifier Foam Market, Competition Outlook

- Competitive Matrix

- Manufacturing Capabilities

- Target Markets

- Target End Users

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Eureka Forbes Ltd.

- Philips India Ltd.

- Honeywell International Pvt Ltd.

- Kent RO Systems Ltd.

- Blueair India Pvt. Ltd.

- Panasonic India Pvt. Ltd.

- Crusaders Technologies India Pvt. Ltd.

- Sharp Business Systems (India) Private Limited

- Daikin Air Conditioning India Pvt Ltd.

- Competitive Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making