Global Tire (Tyre) Market Research Report: Forecast (2024-2029)

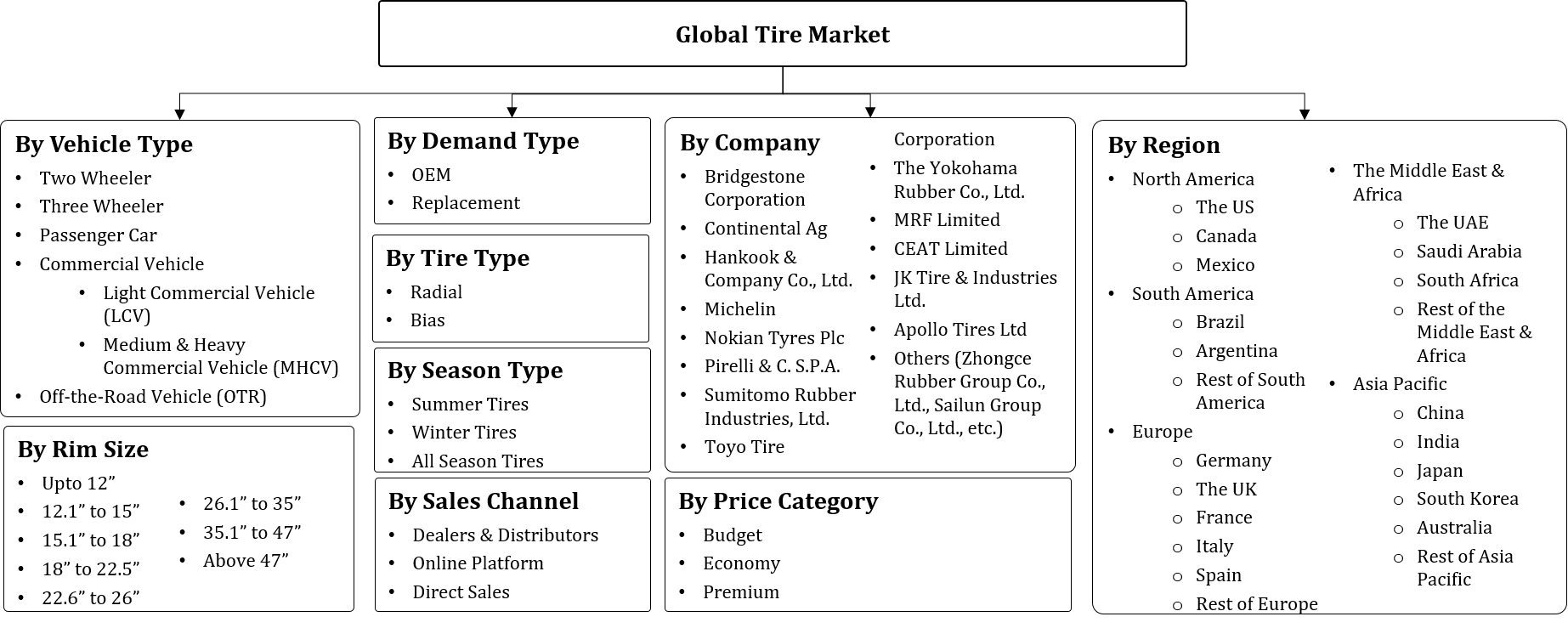

Tire Market0 - By Type of Vehicle (Two Wheeler, Three Wheeler, Passenger Car, [Light Commercial Vehicle {LCV}, Medium & Heavy Commercial Vehicle {MHCV}], Off the Road Vehicle {OTR}...), By Demand Type (OEM , Replacement), By Tire Type (Radial, Bias), By Season (Summer Tires, Winter Tires, All Season Tires), By Sales Channel (Direct Sales, Dealer Distributor, Online Platform), By Rim Size (Up to 12”, 12.1” to 15”, 15.1” to 18”, 18” to 22.5”, 22.6” to 26”, 26.1” to 35”, 35.1” to 47”, Above 47”), By Price Category (Budget, Economy, Premium), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Bridgestone Corporation, Continental AG, Hankook & Company Co., Ltd., Michelin, Nokian Tyres Plc, Pirelli & C. S.P.A., Sumitomo Rubber Industries, Ltd., The Yokohama Rubber Co., Ltd, Toyo Tire Corporation, MRF Limited, CEAT Limited, JK Tire & Industries Ltd., Apollo Tires Ltd, Zhongce Rubber Group Co., Ltd., Sailun Group Co., Ltd, Others) Read more

- Tire

- Oct 2023

- 550

- TR10213

Market Definition

Tires play a crucial role in automobiles by performing several functions, including holding the vehicle's weight, transmitting energy while accelerating & braking, changing or maintaining direction, etc. They also provide traction between the vehicle & road to absorb shocks. Usually made of rubber, tires comprise tread, beads, jointless cap plies, & other materials, including synthetic rubber, polyester, carbon black, etc. Worldwide, tires are available in a wide range of sizes & styles to suffice the varied requirements of different vehicles & customers. The escalating sales of passenger & commercial vehicles in emerging economies worldwide are driving the tire industry globally. Moreover, both developed & developing countries are witnessing a rapid rise in infrastructural activities, i.e., resulting in higher demand for construction vehicles and, consequently, tires.

Market Insights & Analysis: Global Tire (Tyre) Market (2024-29)

The Global Tire Market size is valued at around USD 232 billion in 2023 and is estimated to grow at a CAGR of about 4.11% during the forecast period, i.e., 2024-29. With the emergence of more efficient vehicles and a smoother infrastructure, the market is experiencing rapid growth & changes. The rise in vehicle production in developing countries & increased competition among tire manufacturers are the prime aspects projected to drive the market in the forecast years.

Several tire manufacturers are actively working on countermeasures to minimize the impact by collaborating with global automotive OEMs (Original Equipment Manufacturers). Besides, they are also vigorously extending their services to online platforms with responsive customer service. In addition, their evolution in digital transformation to engage with potential buyers has further been a game-changer, resulting in a recovery of the tyre market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-29 | |

| CAGR (2024-2029) | 4.11% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | Bridgestone Corporation, Continental AG, Hankook & Company Co., Ltd., Michelin, Nokian Tyres Plc, Pirelli & C. S.P.A., Sumitomo Rubber Industries, Ltd., The Yokohama Rubber Co., Ltd, Toyo Tire Corporation, MRF Limited, CEAT Limited, JK Tire & Industries Ltd., Apollo Tires Ltd, Zhongce Rubber Group Co., Ltd., Sailun Group Co., Ltd, Others |

| Market Value (2023) | USD 232 Billion |

Numerous vehicles worldwide are back on the roads, allowing the market to flourish & recover from revenue losses. The introduction of rimless, airless, run-flat, and green tires shall also aid in enhancing the Global Tire Market size over the forecast years. Among these innovations, the run-flat tire is one of the greatest inventions, as it allows the driver to continue driving the vehicle even if it has been punctured.

Moreover, the rapidly expanding Electric Vehicle (EVs) industry due to various initiatives by governments of different countries worldwide to curb carbon emissions caused by ICE vehicles and the prompt depletion of fossil fuels, i.e., leading to the increasing adoption of EVs, is also contributing significantly to the overall growth of the market in the years ahead.

Global Tire (Tyre) Market Driver:

Mounting Prevalence of Electric Vehicles – One of the most prominent factors projected to drive the Tyre Market during 2024-29 is the rapidly surging electric vehicle (EV) production across developing countries. Growing awareness about the environment, coupled with increasing oil & gas prices worldwide, are shifting consumers toward buying EVs, which, in turn, would contribute significantly to the Tire Market growth.

.png)

Electric cars require special tires for a variety of reasons. In comparison with ICE (Internal Combustion Engine) vehicles, tires used in EVs have to deal with more weight & provide better torque. Hence, with the burgeoning EV sales across developed countries, the demand for their tires would also ascend significantly, upscaling the demand graph in the future years.

Global Tire (Tyre) Market Challenge:

Volatile Prices of Raw Materials to Impede the Industry Expansion – The volatile raw material prices might restrain the growth of the Global Tire Market during 2024-29. For all the commodities, the prices of raw materials determine the cost of the tire. Hence, pricing is one of the crucial aspects of the sales of the product. The surging prices of butadiene & EPDM rubber due to their limited production are hampering the production & sales of tires.

Furthermore, though tire manufacturing companies are constantly investing in developing sustainable materials, the amount of waste produced by tires is also increasing substantially. Due to this, governments of various countries worldwide have imposed stringent guidelines for tire manufacturers to adopt sustainable waste management solutions, which would lead to additional costs, thus hindering the overall market growth, owing to the limited number of buyers.

Global Tire (Tyre) Market Trend:

Technological Advancement to be a Trending Aspect in the Market – Numerous technological advancements have been made in the tires, and nowadays, many manufacturers are launching highly advanced & innovative tyres in the market, thus becoming a trending aspect across the Tire Market in the present years. The introduction of rimless tires, green tires, and the usage of lightweight elastomers & metals such as alloys & carbon fiber or composites like manganese bronze & nickel aluminum bronze to manufacture tires are some of the technological advancements being done in the industry.

Furthermore, prominent tire manufacturers are integrating nanotechnology and other cutting-edge software & innovations into their tire production processes, resulting in a diverse range of advanced tire options. For instance, Bridgestone Tires, a renowned tire and rubber manufacturer, employs Contact Area Information Sensing (CAIS) technology to gather & assess data regarding the tire's contact area, enabling the detection of road conditions. Hence, with these advancements the future of transportation would transform completely, thus contributing to encouraging the market growth.

Global Tire (Tyre) Market (2024-29): Segmentation Analysis

The Global Tire Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024-2029 at the global, regional, and national levels. In accordance to the analysis, the market has been further classified as:

Based on Type of Vehicle:

- Two-wheeler

- Three-wheeler

- Passengers Car

- Light Commercial Vehicles (LCV)

- Medium & Heavy Commercial Vehicle (MHCV)

- Off the Road Vehicle (OTR)

Passenger Cars are projected to capture a substantial share of the Tire Market during 2024-29. Modern Passenger car tires are made up of different materials like natural rubber (NR), synthetic rubber (SR), and thermoplastic elastomer (TPE). These materials provide better wear resistance than materials used earlier.

The mounting sales & production of vehicles & the growing interest of consumers in luxury vehicles, such as SUVs & CUVs, especially across countries such as India & China, are crucial aspects projected to drive the Passenger Car Tire Market over the forecast years. Moreover, the rise in car rental & sharing services worldwide is leading to the increasing sales of LCVs (Lightweight Commercial Vehicles), viz., minivans, pickup trucks, & buses, which, in turn, is also assisting in enhancing the Tire Market size in the years ahead.

Based on Type of Tire:

- Radial

- Bias

The Tire Market is primarily governed by Radial Tire as it accounts for the largest share and is presumed to be one of the leading tire types in the forthcoming years as well. It is attributed to the narrow gap between the prices of both radial & bias tires, the growing presence of tire manufacturers, and the rising demand for better performance & durable tires.

Moreover, the presence of Chinese players has been playing a transformational role in the adoption of low-cost radial tyre in passenger car tires, light commercial vehicles, and others, thus contributing to elevating the overall market growth.

Global Tire (Tyre) Market (2024-29): Regional Projections

Geographically, the Global Tire Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Asia-Pacific is expecting the largest share of the Tire Market during 2024-29, owing to the burgeoning sales of passenger & commercial vehicles in emerging economies like China & India on account of rapid urbanization & increased industrial activities. As a result, automotive & tire manufacturers are establishing production plants & expanding their presence across the region. Various strategic collaborations between automakers & tire manufacturers in India are also augmenting the regional market growth.

Moreover, massive investments in Asia-Pacific's automotive sector due to low production costs, economic labor, flexible norms for emissions & safety, and various government initiatives for FDIs have also contributed to the burgeoning tire sales in the region. Besides, countries like India, Japan, & South Korea are immensely focusing on their respective agriculture sectors, which would surge the demand for automotive tires for agricultural vehicles across these countries and, in turn, drive the regional market in the coming years.

Global Tire (Tyre) Industry Recent Development

- 2022: CEAT revealed new WINENERGY X3-R tires, which is specifically designed for electric buses to be used on urban roads.

- 2023: Yokohama Off-Highway Tires (YOHT) launched Agri Star II R – I, a radial tire equipped with SLT (Stratified Layer Technology) that ensures higher lug.

Gain a Competitive Edge with Our Global Tire (Tyre) Market Report

- Global Tire Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Tire Industry Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Tire (Tyre) Market Research Report (2024-2029) - Table of Contents

- Market Segmentation

- Introduction

- Type Definition

- Research Process

- Assumptions

- Executive Summary

- Global Tire Market Trends & Developments

- Global Tire Market Dynamics

- Drivers

- Challenges

- Global Tire Market Supply Chain Analysis

- Global Tire Market Porter Five Analysis

- Global Tire Market Regulations, Policies and Type Standards

- Global Tire Hotspot and Opportunities

- Global Tire (Tyre) Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Size & Analysis

- By Vehicle Type

- Two-wheeler- Market Size & Forecast 2019-2029, (Thousand Units)

- Three-wheeler- Market Size & Forecast 2019-2029, (Thousand Units)

- Passenger Car- Market Size & Forecast 2019-2029, (Thousand Units)

- Commercial Vehicle -Market Size & Forecast 2019-2029, (Thousand Units)

- Light Commercial Vehicle (LCV) -Market Size & Forecast 2019-2029, (Thousand Units)

- Medium & Heavy Commercial Vehicle (MHCV) -Market Size & Forecast 2019-2029, (Thousand Units)

- Off-the-Road Vehicle (OTR)-Market Size & Forecast 2019-2029, (Thousand Units)

- By Demand Type

- OEM - Market Size & Forecast 2019-2029, (Thousand Units)

- Replacement - Market Size & Forecast 2019-2029, (Thousand Units)

- By Tire Type

- Radial- Market Size & Forecast 2019-2029, (Thousand Units)

- Bias - Market Size & Forecast 2019-2029, (Thousand Units)

- By Season

- Summer Tires- Market Size & Forecast 2019-2029, (Thousand Units)

- Winter Tires - Market Size & Forecast 2019-2029, (Thousand Units)

- All Season Tires- Market Size & Forecast 2019-2029, (Thousand Units)

- By Sales Channel

- Direct Sales- Market Size & Forecast 2019-2029, (Thousand Units)

- Dealer Distributor - Market Size & Forecast 2019-2029, (Thousand Units)

- Online Platform- Market Size & Forecast 2019-2029, (Thousand Units)

- By Rim Size

- Up to 12” - Market Size & Forecast 2019-2029, (Thousand Units)

- 12.1” to 15” - Market Size & Forecast 2019-2029, (Thousand Units)

- 15.1” to 18” - Market Size & Forecast 2019-2029, (Thousand Units)

- 18” to 22.5” - Market Size & Forecast 2019-2029, (Thousand Units)

- 22.6” to 26” - Market Size & Forecast 2019-2029, (Thousand Units)

- 26.1” to 35” - Market Size & Forecast 2019-2029, (Thousand Units)

- 35.1” to 47” - Market Size & Forecast 2019-2029, (Thousand Units)

- Above 47” - Market Size & Forecast 2019-2029, (Thousand Units)

- By Price Category

- Budget- Market Size & Forecast 2019-2029, (Thousand Units)

- Economy- Market Size & Forecast 2019-2029, (Thousand Units)

- Premium- Market Size & Forecast 2019-2029, (Thousand Units)

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Vehicle Type

- Market Size & Analysis

- North America Tire (Tyre) Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2029, Thousand Units

- By Rim Size- Market Size & Forecast 2019-2029, Thousand Units

- By Price Category- Market Size & Forecast 2019-2029, Thousand Units

- By Country

- The US

- Canada

- Mexico

- The US Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Canada Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Mexico Tire (Tyre) Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Market Size & Analysis

- South America Tire (Tyre) Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2029, Thousand Units

- By Rim Size- Market Size & Forecast 2019-2029, Thousand Units

- By Price Category- Market Size & Forecast 2019-2029, Thousand Units

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Tire (Tyre) Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Argentina Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Europe Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2029, Thousand Units

- By Rim Size- Market Size & Forecast 2019-2029, Thousand Units

- By Price Category- Market Size & Forecast 2019-2029, Thousand Units

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- The UK Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- France Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Spain Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Italy Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2029, Thousand Units

- By Rim Size- Market Size & Forecast 2019-2029, Thousand Units

- By Price Category- Market Size & Forecast 2019-2029, Thousand Units

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- The UAE Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- South Africa Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- By Sales Channel- Market Size & Forecast 2019-2029, Thousand Units

- By Rim Size- Market Size & Forecast 2019-2029, Thousand Units

- By Price Category- Market Size & Forecast 2019-2029, Thousand Units

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Japan Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- India Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- South Korea Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Australia Tire Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Unit)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2029, Thousand Units

- By Demand Type- Market Size & Forecast 2019-2029, Thousand Units

- By Tire Type- Market Size & Forecast 2019-2029, Thousand Units

- By Season Type- Market Size & Forecast 2019-2029, Thousand Units

- Market Size & Analysis

- Market Size & Analysis

- Global Tire Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Bridgestone Corporation

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental AG

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hankook & Company Co., Ltd.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Michelin

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nokian Tyres Plc

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pirelli & C. S.P.A.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sumitomo Rubber Industries, Ltd.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- The Yokohama Rubber Co., Ltd.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toyo Tire Corporation

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MRF Limited

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CEAT Limited

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JK Tire & Industries Ltd.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Apollo Tires Ltd

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zhongce Rubber Group Co., Ltd.

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Sailun Group Co., Ltd

- Business Description

- Type Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Bridgestone Corporation

- Company Profiles

- Disclaimer