Europe Electric Bus Market Research Report: Forecast (2022-27)

By Propulsion Type (Battery Electric Bus (BEV), Plug-in Hybrid Electric Bus (PHEV), Fuel Cell Electric Bus (FCEV)), By Battery Type (Lithium Ion, Nickel-metal hydride battery, Othe...rs (Lead-Acid Batteries, Ultracapacitors)), By Application (Intercity, Intracity), By End User (Private, Government), By Length of Bus (Less the 9M, 9-15M, 15-20M, Above 20M), By Battery Capacity (100-200 kWh, 200-300 kWh, Above 300 kWh), By Range (100-200 miles, Above 200 miles), By Country (The UK, Germany, Italy, France, Spain, Poland, Sweden, Belgium, The Netherlands, Rest of Europe), By Company (Solaris Bus & Coach, IVECO Bus, Traton Group, AB Volvo, Mercedes-Benz Group AG,, EBUSCO, BYD Auto Co. Ltd., Van Hool, VDL Bus & Coach, EvoBus GmbH, Others) Read more

- Automotive

- Sep 2022

- Pages 260

- Report Format: PDF, Excel, PPT

Market Definition

Electric Buses are vehicles that attain their propulsion & accessory systems by zero-emissions electricity sources like batteries, hydrogen fuel cells, & overhead wires, among others. These buses are also called e-buses and can recharge through regenerative braking systems, solar panels, off-board chargers, & storage battery banks, among others. Usually, these vehicles function by sending a signal to the powertrain system controller for high-voltage battery power & converting the stored chemical energy into electrical energy.

Electric Buses allow drivers to accelerate more responsively and witness exceptional driving experience & bus performance. Backed by the environment-friendly & lower maintenance & fuel costs perks, these buses are gaining widespread adoption and substantial encouragement by the governments of different countries across Europe as an alternative to conventional buses.

Market Insights

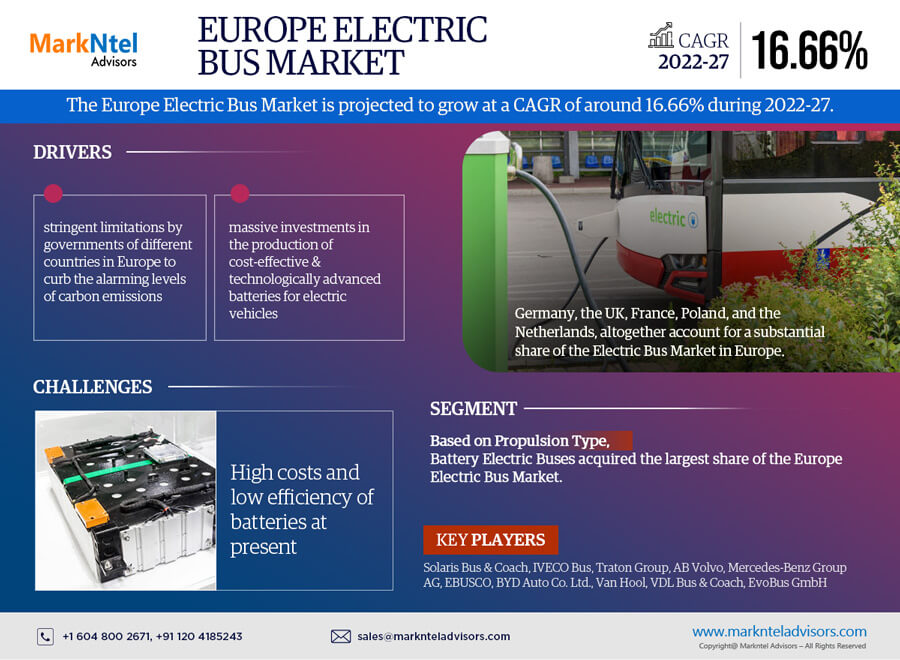

The Europe Electric Bus Market is projected to grow at a CAGR of around 16.66% during the forecast period, i.e., 2022-27. The market is driven by the presence of stringent limitations by the governments of different countries in the region to curb the mounting emissions, where pollution from automobiles has been the prominent cause. It, in turn, is demonstrating a rise in the adoption of electric vehicles, including buses, curating the market dynamics & instigating the leading players to increase their development, production, and distribution capacities for these vehicles.

Besides, the active participation of the prominent players in the development of hydrogen fuel cell-powered electric buses is also playing a significant role in driving the demand for e-buses across Europe. Moreover, battery manufacturers, on the other hand, are also investing in the production of cost-effective & technologically advanced batteries to promulgate the demand for e-bus and stimulate the overall market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR | 16.66% |

| Country Covered | The UK, Germany, Italy, France, Spain, Poland, Sweden, Belgium, The Netherlands, Rest of Europe |

| Key Companies Profiled | Solaris Bus & Coach, IVECO Bus, Traton Group, AB Volvo, Mercedes-Benz Group AG, EBUSCO, BYD Auto Co. Ltd., Van Hool, VDL Bus & Coach, EvoBus GmbH, Others |

| Unit Denominations | USD Million/Billion |

Additionally, the growing awareness among people about the benefits of e-buses overall diesel alternatives, particularly in terms of exhaust emissions, air quality & the lower total cost of ownership (TCO), are propelling the deployment of these vehicles for public transportation. Backed by these benefits, the governments of different countries in the region are setting targets to accelerate the adoption of e-buses. For instance:

- The Netherlands is mandating 100% sales of Zero-Emission Vehicle (ZEV) public transport buses, aiming till 2025, alongside a 100% ZEV fleet by 2030 to replace all vehicles running on fossil fuels.

The governments of different regional countries are signing initiatives like European Clean Bus Deployment Initiative to increase the deployment of clean buses and hinting toward the presence of lucrative opportunities for the players to make significant contributions to the market growth through 2027. Furthermore, plans and initiatives for the development of robust charging infrastructure for electric buses shall also make a mark in the industry expansion. For instance:

- In 2021, the Netherlands registered all new urban buses as zero-emission, instigating other countries to catch up. On the other hand, Poland made robust progress, depicting a significant rise in its new urban buses and placing itself far ahead of countries like Germany, Italy, Spain & France.

Key Trends in the Europe Electric Bus Market

- Government Mandates for Electrification of Transit System

As concerns over the ill effects of air pollution & emission on human health & environment are mounting rapidly, alongside the skyrocketing prices of fossil fuels, the demand for greener, cleaner, and cost-effective alternatives is escalating swiftly. It, in turn, is also influencing the demand for Electric Vehicles, including Buses, replacing Internal Combustion Engines (ICE) buses across Europe. In fact, by the time it is 2030, Europe shall demonstrate an approximately 67% surge in the sales of zero-emission buses, which would reflect a fleet size of 65,000 e-buses.

In the same line, various governing agencies in the region are also participating actively in the industry and contributing through the implementation of intense emissions regulations, propelling the demand & sales for electric buses as a zero-emission solution. Since such moves allow cities to meet their environmental goals without compromising the transportation infrastructure, it is set to have a growing & opportunistic future for the industry in the coming years.

Market Segmentation

Based on Propulsion Type:

- Battery Electric Bus (BEV)

- Plug-in Hybrid Electric Bus (PHEV)

- Fuel Cell Electric Bus (FCEV)

Here, Battery Electric Bus acquired the largest share of the Europe Electric Bus Market in the previous years and shall prevail in the same trend during the forecast period. This dominance attributes to the capabilities of these vehicles to store electricity on-board in the high-capacity battery sets that utilize the benefits of those batteries to function as an electrical motor. The growing awareness among people about these perks is demonstrating an inclination toward battery based -buses & instigating the manufacturers to boost their production capacities.

On the other hand, Fuel-Cell Electric Buses shall demonstrate the fastest growth in the Europe Electric Bus Market during the forecast period. It owes principally to the automaker's preference shift to hydrogen-based fuel cell buses for higher durability & speedy refueling capabilities than regular e-buses, attracting a substantial consumer base, thereby contributing to the market growth.

Country-level Projection

On the geographical front, the Europe Electric Bus Market expands across:

- The UK

- Germany

- Italy

- France

- Spain

- Poland

- Sweden

- Belgium

- The Netherlands

Among all, Germany, the UK, France, Poland, and The Netherlands, have altogether accounted for a substantial share of the Europe Electric Bus Market in previous years. It is anticipated that each country would make a significant contribution to the market growth and hint toward the presence of lucrative opportunities for the leading players during the forecast period.

This growth & dominance attributes to the active participation of the governments of different countries and their encouragement toward the adoption of Electric Buses to curb emissions and meet environmental goals. It, in turn, is demonstrating a rise in the sales of e-buses across countries. For instance:

- In November 2021, Belgium announced a plan called Belgian Hydrogen Vision & Strategy after its approval by the Council of Ministers, where it focuses on the electrification of the transportation sector with hydrogen. The country aims to become reliant on hydrogen & go fully carbon neutral in the sector by the year 2050.

- On the other hand, back in June 2020, Germany adopted the National Hydrogen Strategy to extend the investment & enhance the existing public transportation infrastructure with hydrogen technologies in the future.

Considering the hiking sales of Electric Buses, it is anticipated that these buses would reflect a substantial rise in urban bus sales by the end of the decade. It shall be driven on the back of rapid electrification & new mobility business models, including shared mobility & autonomous vehicles.

- Nonetheless, Italy deployed a sustainable bus plan over the period 2019-2033 for the electrification of public buses & meet minimum emission levels. This plan is to achieve the aim of full electrification by 2030.

Regulatory Landscape in the Europe Electric Bus Market

- The European Union (EU) has set up stringent rules to cut emissions & decarbonize the economy, contributing to a greener & cleaner environment and promoting sustainability by the year 2050.

- In this view, the EU instigates various public authorities to use alternative fuels such as electricity & hydrogen, among others, to run new buses & trucks by 2030 under the new binding.

- These rules entail minimum national procurement targets for new 'clean' light duty vehicles, buses, and trucks for 2025 & 2030 as an update to the Clean Vehicles Directive by the EU, declared in 2009.

- As for Electric Buses, a prominent share of targets must meet zero-emission, where electric buses are most likely to come into the picture. Countries like Germany & Sweden suggest nearly a quarter of new public buses must be zero emission by 2025.

Recent Developments in the Europe Electric Bus Market

- Recently, VDL Bus & Coach began the construction of a new, climate-neutral factory in Roeselare, Belgium, for manufacturing the first e-bus. The facility is designed to manufacture only electrically powered buses in a climate-neutral & efficient manner.

- In June 2022, another company, Van Hool, launched a new category of zero-emission public buses, the A-Series, at the European Mobility Expo hosted in Paris. This A-series of zero-emission buses is set to feature a battery-electric & fuel cell (hydrogen) powertrain in four different lengths (12m, 13m, 18m, and 24m).

- Moreover, BYD Auto Co. Ltd. China collaborated with Castrosua, a Spain-based bodywork design & assembly company, to manufacture customized 12-meter electric buses for urban & commuter use in Spain. The Chinese player would provide advanced chassis with an electric powertrain for building the e-bus, whereas the Spanish brand would utilize the NELEC body to provide high-caliber electric transport solutions to the users.

- The European Parliament & Council in June 2019 brought an Under Clean Vehicle Directive target to boost the demand & deployment of low- & zero-emission vehicles. Here, Germany & several western European countries, where 45 % of buses purchased must be low emissions by 31 December 2025, and half of them (22.5%) must be zero emissions.

Possible Restraint

- High Cost & Low Battery Efficiency

Since Electric Buses equipped with batteries are expensive and need a timely inspection to ensure top-notch performance, may cost-sensitive users might be hesitant in investing in Electric Buses. Besides, the total cost of ownership & maintenance for these buses is higher than conventional buses, discouraging users to buy gasoline-powered buses.

Moreover, as of today, the overall battery performance of e-buses is lesser than traditional buses owing to the low charging capacity, long charge duration, and limited range per charge. Such lower performance might affect the demand for these buses, particularly in colder climates, affecting the overall perform performance efficiency of the vehicle and hampering the fledged growth of the Europe Electric Bus Market.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Europe Electric Bus Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Europe Electric Bus Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Europe Electric Bus Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Europe Electric Bus Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumptions

- Market Definition

- Executive Summary

- Impact of COVID-19 on the Europe Electric Bus Market

- European Government Initiatives for Adoption of Electric Buses, By Country

- Europe Electric Bus Market Trends & Insights

- Europe Electric Bus Market Dynamics

- Growth Drivers

- Challenges

- Europe Electric Bus Market Hotspot & Opportunities

- Europe Electric Bus Market Government Regulations & Policies, 2017-2027F

- Europe Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- Battery Electric Bus (BEV)

- Plug-in Hybrid Electric Bus (PHEV)

- Fuel Cell Electric Bus (FCEV)

- By Battery Type

- Lithium Ion

- Nickel-metal hydride battery

- Others (Lead-Acid Batteries, Ultracapacitors)

- By Application

- Intercity

- Intracity

- By End User

- Private

- Government

- By Length of Bus

- Less the 9M

- 9-15M

- 15-20M

- Above 20M

- By Battery Capacity

- 100-200 kWh

- 200-300 kWh

- Above 300 kWh

- By Range

- 100-200 miles

- Above 200 miles

- By Country

- The UK

- Germany

- Italy

- France

- Spain

- Poland

- Sweden

- Belgium

- The Netherlands

- Rest of Europe

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Propulsion Type

- Market Size & Analysis

- The UK Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Germany Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Italy Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- France Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Spain Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Poland Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Sweden Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Belgium Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- The Netherlands Electric Bus Market Outlook, 2017-2027F

- Market Size & Analysis

- By Unit Sold

- Market Share & Analysis

- By Propulsion Type

- By Battery Type

- By Application

- By End User

- By Length of Bus

- By Battery Capacity

- By Range

- Market Size & Analysis

- Europe Electric Bus Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Competition Matrix

- Application Portfolio

- Brand Specialization

- Target Markets

- Target Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Solaris Bus & Coach

- IVECO Bus

- Traton Group

- AB Volvo

- Mercedes-Benz Group AG,

- EBUSCO

- BYD Auto Co. Ltd.

- Van Hool

- VDL Bus & Coach

- EvoBus GmbH

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making