Global Terrain Awareness And Warning System Market Research Report: Forecast (2026-2032)

Terrain Awareness and Warning System Market - By Product Type (Class A TAWS, Class B TAWS, Class C TAWS, Portable TAWS, Integrated TAWS), By Platform (Fixed-Wing Aircraft, Rotary-W...ing Aircraft, Regional Jets, Turboprops, Business Jets), By Component (Hardware, Software), By Distribution Channel (OEMs, Aftermarket, Online Retail, Specialty Stores), By End User (Civil Airlines, Defense Operators, Charter Services, Corporate Jet Owners, Regional Flight Operators) and others Read more

- Automotive

- Oct 2025

- Pages 197

- Report Format: PDF, Excel, PPT

Global Terrain Awareness And Warning System Market

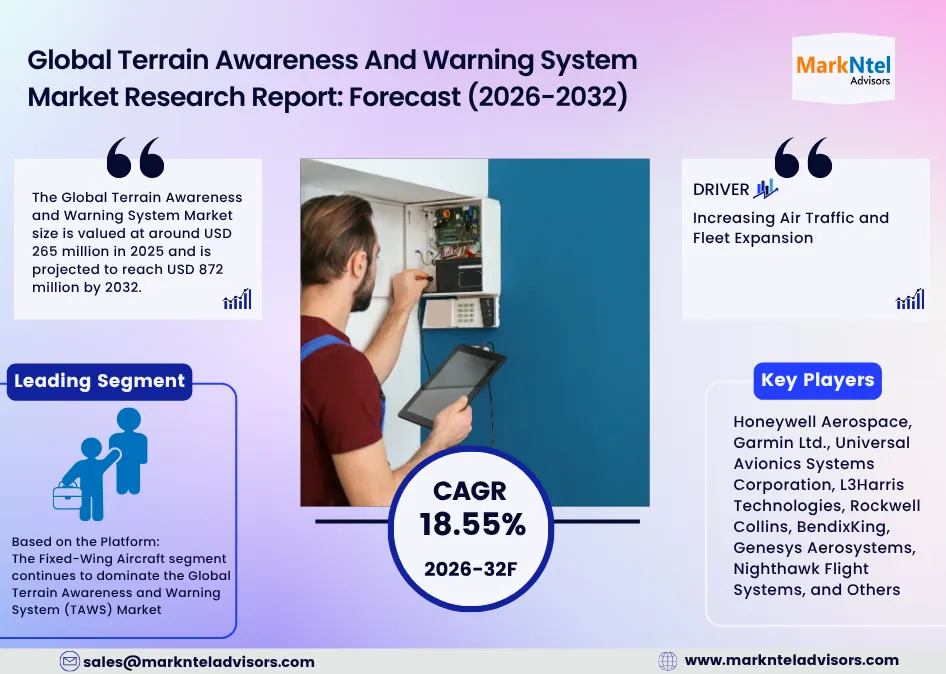

Projected 18.55% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

265 Million

Market Size (2032)

872 Million

Largest Region

2025

Projected CAGR

18.55%

Leading Segments

By Platform: Fixed-Wing Aircraft

Global Terrain Awareness and Warning System Market Size: Forecast (2026-2032)

The Global Terrain Awareness and Warning System Market size is valued at around USD 265 million in 2025 and is projected to reach USD 872 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 18.55% during the forecast period, i.e., 2026-32.

Global Terrain Awareness and Warning System Market Outlook:

The Global Terrain Awareness and Warning System (TAWS) Market is experiencing sustained growth, influenced by regulatory mandates, fleet expansions, and technological upgrades to position TAWS as a critical pillar in the global aviation safety modernization. The aviation regulators and aircraft manufacturers intensify their focus on preventing controlled flight into terrain (CFIT) accidents, thus increasing the demand for highly efficient terrain awareness and warning systems. For instance, the Federal Aviation Administration (FAA) mandates TAWS installation on most turbine-powered aircraft, a regulation that has contributed to a 90% reduction in CFIT incidents since its enforcement. Similarly, the European Union Aviation Safety Agency (EASA) and ICAO have expanded TAWS requirements for both commercial and general aviation fleets, underscoring global alignment on terrain safety standards.

Additionally, the technological innovation is accelerating this transition. For reference, Garmin Ltd. and Honeywell Aerospace have recently introduced enhanced TAWS systems with real-time terrain mapping, forward-looking terrain avoidance, and predictive algorithms that integrate GPS and radar altimetry for greater precision. Similarly, Boeing and Airbus have also embedded advanced terrain databases in their next-generation flight decks, improving situational awareness for operators in mountainous and low-visibility regions. Moreover, the rise in rotary-wing and regional aircraft deliveries, particularly across Asia-Pacific and the Middle East, is boosting retrofit and OEM-fit demand. Likewise, as global passenger traffic rebounds post-2023, airlines are upgrading avionics suites to meet stricter safety and performance benchmarks.

Global Terrain Awareness and Warning System Market Recent Developments:

- July 2025: Nighthawk Flight Systems launched its Guardian avionics suite, featuring an integrated TAWS/HeliTAWS module with a lightweight design and 3D terrain visualization. This innovation expands terrain-awareness technology to general aviation, business jets, and helicopters, reflecting a broader market shift toward advanced, multi-segment TAWS adoption beyond large commercial fleets.

- June 2025: Honeywell Aerospace began deploying its SmartRunway and SmartLanding software, powered by its EGPWS/TAWS suite, across Southwest Airlines' 700+ Boeing 737 aircraft. This large-scale upgrade highlights growing airline investment in terrain and runway safety technologies, driving global momentum for advanced TAWS adoption in commercial aviation fleets.

Global Terrain Awareness and Warning System Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Class A TAWS, Class B TAWS, Class C TAWS, Portable TAWS, Integrated TAWS |

| By Platform | Fixed-Wing Aircraft, Rotary-Wing Aircraft, Regional Jets, Turboprops, Business Jets |

| By Component | Hardware,Software |

| By Distribution Channel | OEMs, Aftermarket, Online Retail, Specialty Stores |

| By End User | Civil Airlines, Defense Operators, Charter Services, Corporate Jet Owners, Regional Flight Operators, and others |

Global Terrain Awareness and Warning System Market Drivers:

Increasing Air Traffic and Fleet Expansion

The rapid growth in global air travel is a key driver boosting the Terrain Awareness and Warning System (TAWS) Market. As passenger volumes rebound post-pandemic, airlines are expanding their fleets and upgrading avionics to enhance flight safety. For instance, the International Civil Aviation Organization (ICAO) projects nearly 4% annual air traffic growth through 2035, signaling continued fleet additions across regions. Additionally, Airbus reported delivering 735 commercial aircraft in 2023, a 12% rise over 2022, reflecting strong airline investments in new, safety-equipped aircraft.

Similarly, the Boeing company (2024) forecasted global demand for over 42,000 new aircraft by 2043, underscoring a long-term surge in air operations. As these fleets grow, operators are increasingly integrating TAWS and Enhanced Ground Proximity Warning Systems (EGPWS) to prevent terrain-related accidents, especially in high-density routes and challenging geographies. This expanding global fleet base is, therefore, directly strengthening the demand for TAWS installations across both OEM and retrofit markets.

Government Initiatives Driving Market Demand

Government initiatives and safety modernization programs are playing a crucial role in accelerating the adoption of Terrain Awareness and Warning Systems (TAWS) across the aviation industry. Many countries have mandated TAWS installation to prevent Controlled Flight into Terrain (CFIT) accidents, one of the leading causes of aviation fatalities. For instance, the Federal Aviation Administration (FAA) in the United States enforces TAWS requirements under 14 CFR §91.223 and §135.154, while the European Union Aviation Safety Agency (EASA) and ICAO have introduced similar regulations for commercial aircraft and helicopters.

In parallel, governments are investing heavily in aviation safety modernization. The FAA’s NextGen program, aimed at upgrading U.S. airspace systems with advanced avionics and terrain-awareness integration, carries a projected cost of USD36 billion, with over USD15 billion already invested by the end of 2024. Additionally, under the U.S. Infrastructure Investment and Jobs Act, around USD5 billion has been allocated for air-traffic facility upgrades over five years, thus contributing to the market growth.

Global Terrain Awareness and Warning System Market Trends:

Integration of 3D Terrain Visualization and Forward-Looking Sensors

A key trend shaping the Terrain Awareness and Warning System (TAWS) Market is the integration of 3D terrain visualization and forward-looking terrain avoidance features into modern avionics. In 2025, major avionics makers such as Honeywell Aerospace and Garmin Ltd. advanced this technology to enhance pilot situational awareness. For instance, Honeywell began deploying its upgraded 3D terrain visualization EGPWS-based SmartRunway and SmartLanding software across Southwest Airlines in North America, strengthening terrain and runway safety.

Similarly, Garmin integrated 3D terrain mapping and predictive terrain alerts into its G1000 NXi and G3000 systems, which are now certified by both the FAA and EASA and used widely across North America and Europe. These innovations allow pilots to visualize terrain in real time and anticipate potential threats miles ahead, marking a major step toward predictive, data-driven safety systems in global aviation.

Global Terrain Awareness and Warning System Market Challenges:

High Production and Maintenance Costs

One of the major challenges in the Terrain Awareness and Warning System (TAWS) Market is the high installation and upkeep cost, particularly for small airlines and regional operators. For instance, installing certified avionics such as TAWS or Enhanced Ground Proximity Warning Systems (EGPWS) can cost over USD100,000 per aircraft, depending on aircraft type and system class. In North America, many smaller charter and air-taxi operators delay upgrades because retrofitting older aircraft often requires additional wiring, cockpit integration, and certification expenses.

Similarly, in Europe, regional carriers face high compliance costs due to EASA’s strict TAWS mandates and software update requirements. In emerging regions like the Asia-Pacific, financial constraints and limited technical infrastructure make adoption slower, despite growing regulatory pressure. These high initial and recurring costs continue to limit widespread TAWS implementation, especially among smaller fleets, even as aviation authorities push for stronger safety modernization worldwide.

Global Terrain Awareness and Warning System Market (2026-32) Segmentation Analysis:

The Global Terrain Awareness and Warning System Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on the Platform

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Regional Jets

- Turboprops

- Business Jets

The Fixed-Wing Aircraft segment continues to dominate the Global Terrain Awareness and Warning System (TAWS) Market due to its extensive presence across commercial, regional, and business aviation sectors. These aircraft operate on long, high-traffic routes, making terrain awareness essential for flight safety. As per the International Civil Aviation Organization (ICAO), fixed-wing aircraft represent about 85% of the global active fleet, underscoring their critical role in avionics integration. Regulatory bodies such as the FAA and EASA have made TAWS installation mandatory for turbine-powered aircraft, driving consistent demand. Furthermore, ongoing fleet modernization programs by airlines, such as Airbus A320neo and Boeing 737 MAX deliveries, include advanced TAWS as standard equipment, ensuring this segment remains the key revenue generator in the global market.

Based on Product Type

- Class A TAWS

- Class B TAWS

- Class C TAWS

- Portable TAWS

- Integrated TAWS

The Class A Terrain Awareness and Warning System (TAWS) segment holds the largest share of about 56% of the global market, primarily due to its mandatory use in commercial and large turbine-powered aircraft. Regulatory authorities such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA) require Class A TAWS installations for passenger aircraft with six or more seats, ensuring maximum safety against terrain-related accidents. For instance, major airlines, including Delta Air Lines and Lufthansa, operate extensive fleets equipped with Honeywell’s Enhanced Ground Proximity Warning System (EGPWS), a Class A TAWS solution.

Similarly, Airbus and Boeing integrate Class A TAWS in nearly all new commercial aircraft deliveries. These systems offer advanced features such as forward-looking terrain alerts, predictive algorithms, and detailed terrain databases, making Class A TAWS the industry standard for large-scale aviation safety compliance and operational reliability.

Leading Manufacturers of the Global Terrain Awareness and Warning System Market:

· Avidyne Corporation

Avidyne Corporation delivers advanced flight displays and integrated TAWS solutions designed for small and mid-size aircraft. Its IFD Series combines terrain, weather, and navigation data into a single interface, simplifying situational awareness for pilots.

· BendixKing

A subsidiary of Honeywell, BendixKing serves general aviation markets with affordable terrain-warning and navigation systems. Its continued product modernization supports safer flight operations across private and regional aircraft segments.

· Genesys Aerosystems

Genesys Aerosystems provides certified TAWS-enabled avionics and autopilot systems widely used in helicopters and smaller commercial aircraft. The company’s focus on advanced flight automation and retrofitting solutions enhances terrain protection for older fleets.

Honeywell Aerospace, Garmin Ltd., Universal Avionics Systems Corporation, L3Harris Technologies, Rockwell Collins, ACSS, Safran Electronics & Defense, Cobham Aerospace, Aspen Avionics, Aviation Safety Resources, Sandel Avionics, Nighthawk Flight Systems, and Others are the key players in the Global Terrain Awareness and Warning System Market.

Global Terrain Awareness and Warning System (2026-32): Regional Projection

North America continues to lead the Global Terrain Awareness and Warning System (TAWS) market, driven by strong regulatory enforcement, early technology adoption, and the presence of key avionics manufacturers. For instance, the Federal Aviation Administration (FAA) in the United States has made TAWS installation mandatory for most turbine-powered aircraft since the early 2000s, creating a mature, safety-driven market environment. Additionally, the region is also home to leading companies such as Honeywell Aerospace, Garmin Ltd., L3Harris Technologies, BendixKing, and Sandel Avionics, all of which continue to introduce advanced predictive and AI-based TAWS technologies.

Moreover, major U.S. carriers, for reference, Southwest Airlines’ 2025 fleetwide integration of Honeywell’s SmartRunway and SmartLanding systems, shows ongoing investment in terrain and runway safety modernization. Similarly, Canada’s Transport Canada Civil Aviation (TCCA) has aligned closely with FAA standards, driving consistent adoption across North America, thus contributing to its dominance in this market.

Gain a Competitive Edge with Our Global Terrain Awareness and Warning System Market Report

- Global Terrain Awareness and Warning System Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Terrain Awareness and Warning System Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Technology Definition

- Research Process

- Assumptions

- Executive Summary

- Global Terrain Awareness and Warning System Market Trends & Developments

- Global Terrain Awareness and Warning System Market Dynamics

- Growth Drivers

- Challenges

- Trends

- Opportunities

- Global Terrain Awareness and Warning System Market Hotspot and Opportunities

- Global Terrain Awareness and Warning System Market Pricing Analysis

- Global Terrain Awareness and Warning System Market Strategic Insights

- Global Terrain Awareness and Warning System Market Regulations, Policies & Technology Standards

- Global Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Product Type

- Class A TAWS- Market Size & Forecast 2020-2030, USD Million

- Class B TAWS- Market Size & Forecast 2020-2030, USD Million

- Class C TAWS- Market Size & Forecast 2020-2030, USD Million

- Portable TAWS - Market Size & Forecast 2020-2030, USD Million

- Integrated TAWS- Market Size & Forecast 2020-2030, USD Million

- By Platform

- Fixed-Wing Aircraft- Market Size & Forecast 2020-2030, USD Million

- Rotary-Wing Aircraft- Market Size & Forecast 2020-2030, USD Million

- Regional Jets- Market Size & Forecast 2020-2030, USD Million

- Turboprops- Market Size & Forecast 2020-2030, USD Million- Market Size & Forecast 2020-2030, USD Million

- Business Jets- Market Size & Forecast 2020-2030, USD Million

- By Component

- Hardware- Market Size & Forecast 2020-2030, USD Million

- Software- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- OEMs- Market Size & Forecast 2020-2030, USD Million

- Aftermarket- Market Size & Forecast 2020-2030, USD Million

- Online Retail- Market Size & Forecast 2020-2030, USD Million

- Specialty Stores- Market Size & Forecast 2020-2030, USD Million

- By End User

- Civil Airlines- Market Size & Forecast 2020-2030, USD Million

- Defense Operators- Market Size & Forecast 2020-2030, USD Million

- Charter Services- Market Size & Forecast 2020-2030, USD Million

- Corporate Jet Owners- Market Size & Forecast 2020-2030, USD Million

- Regional Flight Operators- Market Size & Forecast 2020-2030, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share & Analysis

- By Product Type

- Market Size & Analysis

- North America Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- By Organization Size- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Canada Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mexico Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- By Organization Size- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Argentina Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- By Organization Size- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UK Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- France Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Spain Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Italy Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- By Organization Size- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- The UAE Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Africa Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity- Market Size & Forecast 2020-2030, USD Million

- By Organization Size- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- China Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Japan Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South Korea Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Australia Terrain Awareness and Warning System Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Service Type- Market Size & Forecast 2020-2030, USD Million

- By Type of Entity - Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Terrain Awareness and Warning System Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- Honeywell Aerospace

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Garmin Ltd.

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Universal Avionics Systems Corporation

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- L3Harris Technologies

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rockwell Collins

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ACSS

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Safran Electronics & Defense

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cobham Aerospace

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aspen Avionics

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aviation Safety Resources

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sandel Avionics

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Avidyne Corporation

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BendixKing

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Genesys Aerosystems

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nighthawk Flight Systems

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Honeywell Aerospace

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making