GCC Wound Care Market Research Report: Forecast (2023-2028)

By Product (Wound care products [Foam Dressings {Silicone Dressings, Non-silicone Dressings}, Collagen Dressings, Film Dressing, Hydro gel Dressing, Alginate Dressing, Hydro fiber ...Dressing, Hydrocolloid dressing, Anti-microbial Dressing, Super contact Dressing, Wound Contact layer], Wound therapy devices [Wound Monitoring & Assessment Devices, Pressure Relief Devices, Negative Wound therapy systems {Disposable NPWT Systems, Accessories, Conventional NPWT Systems, Electrical Stimulation Devices}, Functional Wound Care product {Biological Skin Substitutes, A Cellular Animal Derived Products, Biosynthetic Products, Human Donor Tissue-Derived Products}]), By Application (Pressure Sores, Diabetic Foot Ulcers, Traumatic Ulcers, Arterial & Veins, Burns), By End-User (Hospitals [In-Patients, Out-Patients], Specialty Clinics [In-Patients, Out-Patients]), By Country (UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, Oman), By Company (Smith & Nephew, 3M Gulf Ltd, Integra Lifesciences Middle East FZ-LLC, Medtronic PLC, Mundipharma Middle East FZ-LLC, ConvoTec, Coloplast, BSN Medical, Others etc.) Read more

- Healthcare

- Jan 2023

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

Wound care encompasses all stages of wound management. This includes determining the type of wound, factors that influence wound healing, and the appropriate wound management treatments. The treatment facility can determine the best treatment options once the wound has been diagnosed and all factors have been considered.

Market Insights

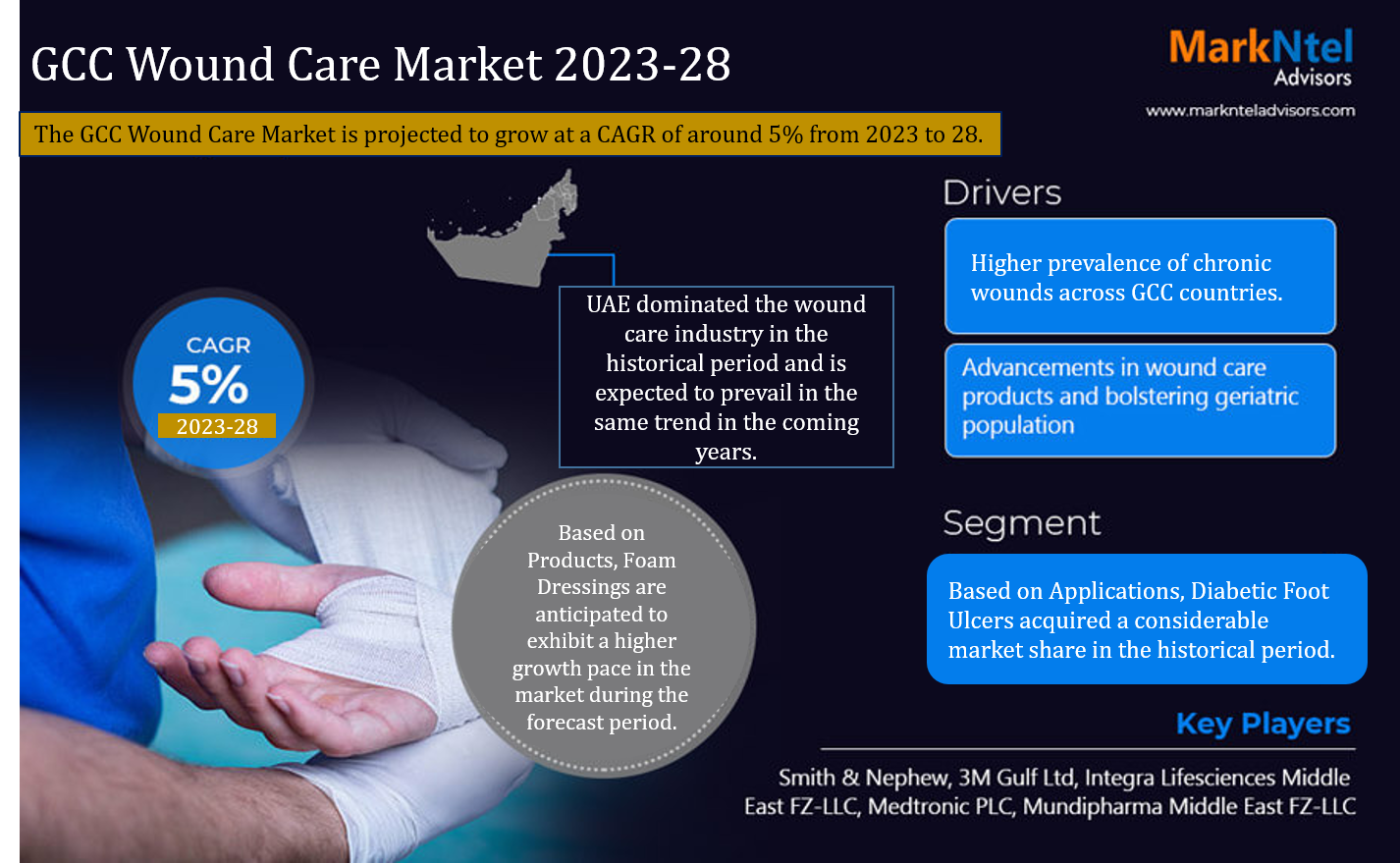

The GCC Wound Care Market is projected to grow at a CAGR of around 5.0% during the forecast period, i.e., 2023-28. The growth of the market is attributed to a significant rise in the number of patients suffering from chronic wounds such as diabetic foot ulcers, venous leg ulcers, cavity wounds, and skin abrasions that have called for more advanced wound healing specialties in healthcare setups. Besides this, the spread of COVID-19 has profoundly impacted the wound care industry as it has led to the accumulation of massive surgeries piled up. However, an attempt to resolve those unmet needs in the future is likely to promote the adoption of such products in order to heal quickly.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 5% |

| Countries Covered | UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, Oman |

| Key Companies Profiled | Smith & Nephew, 3M Gulf Ltd, Integra Lifesciences Middle East FZ-LLC, Medtronic PLC, Mundipharma Middle East FZ-LLC, ConvoTec, Coloplast, BSN Medical, Others etc |

| Unit Denominations | USD Million/Billion |

Moreover, the escalating investment by the government in the healthcare infrastructure has further encouraged research and development activities addressing severe wounds. What has again led to the advancement in lesion care is the inefficacy of the existing methods along with their side effects which, in turn, prompted the key payers to come up with upgraded healing products. Further, the growing geriatric population has necessitated wound care facilities that not just aid more accessible applications but enable faster recovery. However, with intensifying competition among the key market players, in terms of numerous dressings, allografts, and devices, the existing brands might need assistance keeping up the usual pace in the industry.

Market Dynamics

Key Driver: Higher Prevalence of Chronic Wounds Across GCC Countries

The Middle East is one of those regions where incidences of diabetes are pretty prominent. Per the International Diabetes Federation, around 12.3% of the UAE population, accounting for approximately 990,900 people, are affected by diabetes. Since diabetic individuals show apparent signs of chronic wounds, especially foot ulcers, the healthcare system across GCC countries has witnessed a massive burden of chronic wounds in the past few years. Such upscaling incidences of chronic wounds would require adequate treatment facilities and care, which would ultimately propel the industry in the coming years.

Possible Restraint: High Cost and Associated Side Effects

Developing chronic and acute wound care products has pushed up prices in the past few years. This surge in cost has negatively affected the growth of the market. In addition, the market expansion has been hampered in recent years by an increase in the overall cost of treating burn injuries and traumatic wounds. Moreover, side effects associated with wound care products, such as skin irritation, redness/swelling, edema, and mild or moderate pain at the affected site, may also refrain the further adoption of wound care products, thereby restraining the industry expansion in the coming years.

Growth Opportunity: Intensifying Healthcare Reforms Across the Region

Governments are fast adjusting by fostering investment in the area through equal opportunities, significant policy changes, and regulatory frameworks to draw private companies into the GCC while enabling them to build the scale needed to remain competitive and rewarded financially. As a result, the GCC countries continue to allocate a sizeable amount of their budgets to the region's projected increase in healthcare spending. Although the GCC governments may intend to continue to subsidize healthcare for their citizens primarily, the ever-increasing demand can be catered to by the private sector's intervention, thereby opening up new avenues for the market players.

Market Segmentation

Based on Applications,

- Pressure Sores

- Diabetic Foot Ulcers

- Traumatic Ulcers

- Arterial & Veins

- Burns

Amongst all, the Diabetic Foot Ulcers segment acquired a considerable market share in the GCC Wound Care market in the historical period. The growth of the segment is accredited to the increasing incidence of diabetic foot ulcers, the rising government initiative to provide free treatment, easy access to hospitals, and burgeoning awareness regarding the pros of advanced wound care for treatment. Moreover, the surging adoption of wound care devices and the booming geriatric population is anticipated to drive the growth of the Wound Care market across GCC, says the report.

Based on Products,

- Wound care products

- Foam Dressings

- Silicone Dressings

- Non-silicone Dressings

- Collagen Dressings

- Film Dressing

- Hydro gel Dressing

- Alginate Dressing

- Hydro fiber Dressing

- Hydrocolloid dressing

- Anti-microbial Dressing

- Super contact Dressing

- Wound Contact layer

- Foam Dressings

- Wound therapy devices

- Wound Monitoring & Assessment Devices

- Pressure Relief Devices

- Negative Wound therapy systems

- Disposable NPWT Systems

- Accessories

- Conventional NPWT Systems

- Electrical Stimulation Devices

- Functional Wound Care product

- Biological Skin Substitutes

- A Cellular Animal Derived Products

- Biosynthetic Products

- Human Donor Tissue-Derived Products

Of them all, Foam Dressing is anticipated to exhibit a higher growth pace in the market during the forecast period. It owes principally to its unmatched features, such as non-linting and absorbent, that make it highly crucial in managing chronic wounds. What makes these kinds stand out is their variable thickness having a non-adherent layer that enables non-traumatic removal. When combined with compression therapy, foam dressing promotes smoother wound healing. These types of dressing have gained traction in recent years by offering thermal insulation and a moist environment.

Regional Projection

Geographically, the GCC Wound Care Market expands across:

- UAE

- Saudi Arabia

- Qatar

- Bahrain

- Kuwait

- Oman

Country-wise, UAE dominated the wound care industry in the historical period and is expected to prevail in the same trend in the coming years. The UAE government expenditure accounted for around AED 4.84 billion in 2020 healthcare, per the Telecommunications and Digital Health Regulatory Authority data 2020 on the United Arab Emirates. Besides, with a considerable increase of around 9 percent from the previous year, the diabetic foot and wound care surgeries performed by hospitals in the United Arab Emirates for UAE nationals accounted for a significant portion. Therefore, the large influx of investment in healthcare expenditure paired with awareness campaigns in the UAE is likely to encourage the expansion of the wound care industry across the GCC over the forecast period. For instance,

- In March 2022, Abu Dhabi Health Services Company (SEHA) successfully culminated the 6th World Union of Wound Healing Societies (WUWHS) congress, which seeks to improve patient-centered wound care.

Recent Developments in the Market

- In August 2022, 3M elevated the delivery of its Veraflo Therapy, a NPWT with instillation. With the new 3M Veraflo Cleanse Choice Complete Dressing Kit and a software upgrade for the 3M V.A.C. Ulta Therapy Unit, the brand is determined to reduce the cost burden to consumers. These new offerings are expected to simplify the care delivery processes for clinicians and help make dressing changes less painful and faster.

- In July 2022, Smith+Nephew launched Clinical Support App in order to minimize practice variation in wound care.

Do You Require Further Assistance?

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- GCC Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- Wound care products

- Foam Dressings

- Silicone Dressings

- Non-silicone Dressings

- Collagen Dressings

- Film Dressing

- Hydro gel Dressing

- Alginate Dressing

- Hydro fiber Dressing

- Hydrocolloid dressing

- Anti microbial Dressing

- Super contact Dressing

- Wound Contact layer

- Foam Dressings

- Wound therapy devices

- Wound Monitoring & Assessment Devices

- Pressure Relief Devices

- Negative Wound therapy systems

- Disposable NPWT Systems

- Accessories

- Conventional NPWT Systems

- Electrical Stimulation Devices

- Functional Wound Care product

- Biological Skin Substitutes

- A Cellular Animal Derived Products

- Biosynthetic Products

- Human Donor Tissue-Derived Products

- Wound care products

- By Applications

- Pressure Sores

- Diabetic Foot Ulcers

- Traumatic Ulcers

- Arterial & Veins

- Burns

- By End User

- Hospitals

- In-Patients

- Out-Patients

- Specialty Clinics

- In-Patients

- Out-Patients

- Hospitals

- By Country

- United Arab Emirates

- Saudi Arabia

- Kuwait

- Qatar

- Oman

- Bahrain

- By Company

- Market Share of Top Competitors

- By Product

- Market Size & Analysis

- UAE Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- Saudi Arabia Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- Qatar Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- Kuwait Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- Bahrain Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- Oman Wound Care Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Product

- By Application

- By End Users

- Market Size & Analysis

- GCC Wound Care Market Trends & Developments

- GCC Wound Care Market Dynamics

- Growth Drivers

- Challenges

- GCC Wound Care Market Policies & Regulations

- GCC Wound Care Market Hotspots & Opportunities

- Competition Outlook

- Competitive Benchmarking

- Product Portfolio

- Target Markets

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Smith & Nephew

- 3M Gulf Ltd

- Integra Lifesciences Middle East FZ-LLC

- Medtronic PLC

- Mundipharma Middle East FZ-LLC

- ConvoTec

- Coloplast

- BSN Medical

- Others

- Competitive Benchmarking

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making