Saudi Arabia Nutraceutical Ingredients Market Research Report: Forecast (2026-2030)

Saudi Arabia Nutraceutical Ingredients Market - By Ingredient (Vitamins, Minerals, Amino acids, peptides and proteins, Fatty acids and lipids, Carbohydrates and dietary fibers, Pro...biotics and fermented microbial ingredients, Botanicals and phytochemical classes, Antioxidants/polyphenols, Others), By Application (General wellness and immunity, Digestive health, Cardiovascular and metabolic health, Weight management and sports performance, Cognitive and mental health, Bone, joint and musculoskeletal health, Maternal, infant and pediatric nutrition, Others), By End-User (Functional Food and Beverage, Dietary Supplements, Animal Nutrition or Feed, Others), and other Read more

- Healthcare

- Oct 2025

- Pages 132

- Report Format: PDF, Excel, PPT

Saudi Arabia Nutraceutical Ingredients Market

Projected 5.01% CAGR from 2026 to 2030

Study Period

2026-2030

Market Size (2025)

USD 169.4 Million

Market Size (2030)

USD 216.29 Million

Base Year

2025

Projected CAGR

5.01%

Leading Segments

By Ingredient: Vitamins

Market Insights & Analysis: Saudi Arabia Nutraceutical Ingredients Market (2026-30):

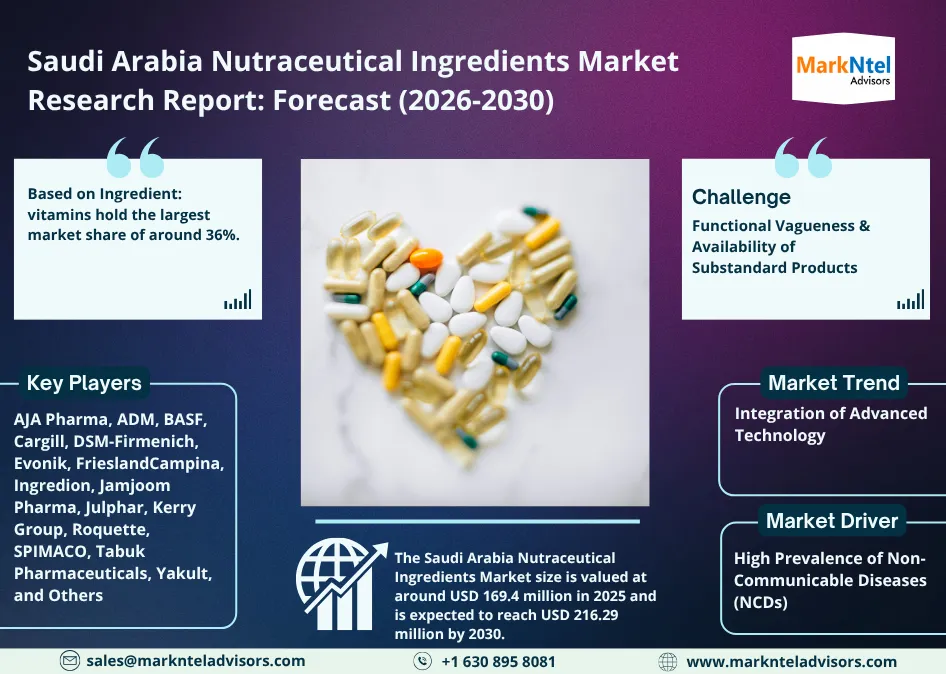

The Saudi Arabia Nutraceutical Ingredients Market size is valued at around USD 169.4 million in 2025 and is expected to reach USD 216.29 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.01% during the forecast period, i.e., 2026-30. The market growth is driven by the high prevalence of non-communicable diseases (NCDs) in the country, as it currently accounts for 73.2% of deaths, with cardiovascular disease being the leading cause. This is due to the underlying spread of an unhealthy diet, characterized by low consumption of fruits, vegetables, whole grains, nuts, seeds, and insufficient physical activity. This, alongside high rates of obesity in the country, is creating high and sustained demand for health-promoting and disease-preventing functional ingredients in nutraceuticals.

Moreover, the market growth is due to the top-down government policy that is aligned with the Saudi Vision 2030 program, which aims to improve population health and increase life expectancy by focusing on prevention and improving nutritional quality. This is because tackling the high risk of elevated blood glucose, high BMI, and poor diet requires nutraceutical ingredients such as dietary fibers, vitamins, and fatty acids in daily consumption in the country. For instance, Tanmiah and Arabian Farms are the first companies to produce DHA (Docosahexaenoic Acid) enriched poultry and eggs to directly target nutritional gaps resulting from low fish consumption among Saudis.

Furthermore, there is increasing consumer awareness of health and purchasing power, particularly among highly educated demographics, thereby driving the demand for dietary supplements such as multivitamins and vitamin D. Therefore, these factors are creating many avenues for market players who deal with enriching staple and packaged foods with functional ingredients, thereby leading to the market growth & expansion in the country.

Saudi Arabia Nutraceutical Ingredients Market Scope:

| Category | Segments |

|---|---|

| By Ingredient | Vitamins, Minerals, Amino acids, peptides and proteins, Fatty acids and lipids, Carbohydrates and dietary fibers, Probiotics and fermented microbial ingredients, Botanicals and phytochemical classes, Antioxidants/polyphenols, Others, |

| By Application | General wellness and immunity, Digestive health, Cardiovascular and metabolic health, Weight management and sports performance, Cognitive and mental health, Bone, joint and musculoskeletal health, Maternal, infant and pediatric nutrition, Others, |

| By End-User | Functional Food and Beverage, Dietary Supplements, Animal Nutrition or Feed, Others, and other |

Saudi Arabia Nutraceutical Ingredients Market Driver:

High Prevalence of Non-Communicable Diseases (NCDs) – The market growth is primarily driven by the high prevalence of NCDs, particularly cardiovascular disease, which accounts for 73.2% of all deaths in the country. This is threatening the government’s Saudi Vision 2030 aim of raising the average life expectancy to 80 years, thereby pushing initiatives towards prevention and driving the nutraceuticals market. For instance, the use of dietary supplements (DS) is already high in the country, observed in almost half (51.8%) of adult participants in 2019, mainly represented by female populations who use DS for general wellness, aesthetic purposes such as hair and nail health, and during specific life stages like pregnancy. Additionally, health consciousness due to NCDs is reinforced by lifestyle choices where high levels of physical activity correlate with greater supplement use, thereby increasing the demand for protein and muscle-building ingredients. Therefore, the high prevalence of non-communicable diseases (NCDs) is driving the demand for nutraceutical ingredients and ultimately the size & volume of the market in Saudi Arabia.

Saudi Arabia Nutraceutical Ingredients Market Opportunity:

Preventive Healthcare Concept Offering Ample Growth Opportunities – The prevention-focused healthcare in the country is creating an opportunity for players in developing and positioning nutraceuticals that target specific conditions rather than general wellness. This is particularly important due to the high prevalence of undiagnosed risk factors such as high cholesterol in regions like Alqaseem, Almadinah, and Makkah. It is propelling the demand for scientifically and evidence-backed formulations such as omega-3 fatty acid products for lipid disorders and cardiovascular disease, which is the country’s leading cause of death. This is thereby increasing the need by suppliers to provide complete ingredient data and toxicological studies to comply with regulatory requirements for the approval of functional foods, thereby making the nutraceutical ingredients essential tools in preventive healthcare.

Saudi Arabia Nutraceutical Ingredients Market Challenge:

Functional Vagueness & Availability of Substandard Products – Nutraceuticals are unregulated, as these supplements are sold by marketing hype rather than being based on actual clinical evidence. This, alongside the widespread circulation of Substandard and Falsified (SFs) nutraceuticals in the country, is compromising consumer safety and undermining confidence in legitimate ingredients. This is because a concerning portion of SFs enter the market through unregulated channels. For instance, approximately half of the surveyed respondents believe SFs originate from foreign-registered internet pharmacies. This is highly detrimental as falsified products often include undeclared medicinal ingredients.

Moreover, this lack of market integrity is due to inadequate awareness and knowledge regarding these illegal products, as reported by community pharmacists, who are the primary defense against the spread of SFs. Even then, most pharmacists have a lack of experience in identifying SFs. Therefore, the high presence of unsafe and fraudulent products is decreasing the trust of consumers, ultimately hindering the further growth & expansion of the Nutraceutical Ingredients Market in the country.

Saudi Arabia Nutraceutical Ingredients Market Trend:

Integration of Advanced Technology – The country is adopting new farming technologies to produce healthy and sustainable ingredients domestically due to the increasing need to overcome resource limitations, such as water scarcity and challenging climate conditions in the country, thereby also pushing players toward highly technical supply chain solutions. For instance, major agribusinesses such as National Agricultural Development Company (NADEC) are implementing controlled-environment farming in collaboration with partners such as Pure Harvest to ensure year-round production of pesticide-free vegetables in the country.

This trend is boosting the incorporation of domestically sourced ingredients such as dietary fibers, plant-based proteins and components used in fortification. Additionally, scientific initiatives are further driving this trend, such as research into locally cultivating microalgae that are adapted to seawater to reduce the reliance on imported animal feed. Therefore, the integration of advanced technology is positively shaping the market growth trajectory.

Saudi Arabia Nutraceutical Ingredients Market (2026-30): Segmentation Analysis

The Saudi Arabia Nutraceutical Ingredients Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2026–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Ingredient:

- Vitamins

- Minerals

- Amino acids, peptides, and proteins

- Fatty acids and lipids

- Carbohydrates and dietary fibers

- Probiotics and fermented microbial ingredients

- Botanicals and phytochemical classes

- Antioxidants/polyphenols

- Others

Out of these, vitamins hold the largest market share of around 36%. This dominance of this ingredient is driven by the lifestyle of covering skin with long sleeves and staying indoors in the country, thereby limiting skin exposure to UVB radiation from the sun, which is the wavelength necessary for vitamin D synthesis in the skin. This has compelled the SFDA to mandate fortification of staples such as milk, oils, and bread with vitamin D. For instance, a survey found that 64% of adults are vitamin D deficient, and 60.7% of supplement users took vitamin D, while 65% took multivitamins/minerals in the country.

Moreover, the lead of vitamins is driven by public health-focused campaigns and the inherent marketing of nutraceutical products in the country, promoting health benefits of vitamins such as immunity and energy, thereby appealing to all demographics compared to minerals like iron and calcium, which only address specific deficiencies. Therefore, this is compelling manufacturers and retailers to prioritize nutraceutical formulations that are rich in vitamins, thereby driving the lead of this segment in this growing & expanding market.

Based on End-User:

- Functional Food and Beverage

- Dietary Supplements

- Animal Nutrition or Feed

- Others

Among these, the functional food and beverage segment dominates the market with a share of around 54%. The dominance is due to several factors, which include government-driven fortification programs encouraging the embedding of vitamins and minerals into its national staples. For instance, Saudi Arabia was one of the first countries to mandate the fortification of wheat flour, thereby ensuring sustained demand for nutraceutical ingredients in food in the country. The growing health awareness amid increasing obesity and diabetes in the country is also driving the demand for “better-for-you” food products. For instance, 75% of Saudis highly rate their health, and 36% highly use dietary supplements, exhibiting an interest in preventive nutrition. Also, the most likely ones to choose enriched dairy, juices, cereals and snacks are the wealthy urban populations.

Moreover, the Saudi Vision 2030 program has emphasized local industry, thereby turning customers toward home-grown health-based brands and encouraging domestic food processors to add nutraceutical ingredients. For instance, major dairy and juice companies now market probiotic yogurts and vitamin‑enriched beverages to meet this demand. Therefore, these factors are driving the lead of this segment based on the end-user in this growing & expanding market.

Top Saudi Arabia Nutraceutical Ingredients Market Companies: Players, Analysis & Future Outlook

The leading nutraceutical ingredients players in the Saudi Arabia Industry include AJA Pharma, ADM, BASF, Cargill, DSM-Firmenich, Evonik, FrieslandCampina, Ingredion, Jamjoom Pharma, Julphar, Kerry Group, Roquette, SPIMACO, Tabuk Pharmaceuticals, Yakult, and Others.

Saudi Arabia Nutraceutical Ingredients Industry Recent Development:

- 2025: Roquette, a global leader in plant-based ingredients and pharmaceutical excipients for the health and nutrition sectors, announces the successful completion of its acquisition of IFF Pharma Solutions. This strategic milestone marks a significant step forward in its ambition to become a leader in support of the global pharma markets.

- 2024: BASF declared Force Majeure on vitamin A, E, and carotenoid product deliveries after a plant fire in a BASF plant in Ludwigshafen, Germany, at the end of July 2024. This also went into effect on selected aroma ingredients that the company offers.

Gain a Competitive Edge with Our Saudi Arabia Nutraceutical Ingredients Market Report

- Saudi Arabia Nutraceutical Ingredients Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Nutraceutical Ingredients Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Nutraceutical Ingredients Market Policies, Regulations, and Product Standards

- Saudi Arabia Nutraceutical Ingredients Market Supply Chain Analysis

- Saudi Arabia Nutraceutical Ingredients Market Trends & Developments

- Saudi Arabia Nutraceutical Ingredients Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Nutraceutical Ingredients Market Hotspot & Opportunities

- Saudi Arabia Nutraceutical Ingredients Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Ingredient

- Vitamins – Market Size & Forecast 2020-2030, USD Million

- Minerals – Market Size & Forecast 2020-2030, USD Million

- Amino acids, peptides and proteins – Market Size & Forecast 2020-2030, USD Million

- Fatty acids and lipids – Market Size & Forecast 2020-2030, USD Million

- Carbohydrates and dietary fibers – Market Size & Forecast 2020-2030, USD Million

- Probiotics and fermented microbial ingredients – Market Size & Forecast 2020-2030, USD Million

- Botanicals and phytochemical classes – Market Size & Forecast 2020-2030, USD Million

- Antioxidants/polyphenols – Market Size & Forecast 2020-2030, USD Million

- Others – Market Size & Forecast 2020-2030, USD Million

- By Application

- General wellness and immunity – Market Size & Forecast 2020-2030, USD Million

- Digestive health – Market Size & Forecast 2020-2030, USD Million

- Cardiovascular and metabolic health – Market Size & Forecast 2020-2030, USD Million

- Weight management and sports performance – Market Size & Forecast 2020-2030, USD Million

- Cognitive and mental health – Market Size & Forecast 2020-2030, USD Million

- Bone, joint and musculoskeletal health – Market Size & Forecast 2020-2030, USD Million

- Maternal, infant and pediatric nutrition – Market Size & Forecast 2020-2030, USD Million

- Others – Market Size & Forecast 2020-2030, USD Million

- By End-User

- Functional Food and Beverage – Market Size & Forecast 2020-2030, USD Million

- Dietary Supplements – Market Size & Forecast 2020-2030, USD Million

- Animal Nutrition or Feed – Market Size & Forecast 2020-2030, USD Million

- Others – Market Size & Forecast 2020-2030, USD Million

- By Region

- North

- East

- South

- West

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Ingredient

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Vitamins Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Minerals Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Amino acids, peptides and proteins Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Fatty acids and lipids Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Carbohydrates and dietary fibers Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Probiotics and fermented microbial ingredients Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Botanicals and phytochemical classes Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Antioxidants/polyphenols Market Outlook, 2026–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Application – Market Size & Forecast 2020-2030, USD Million

- By End-User – Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nutraceutical Ingredients Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- AJA Pharma

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ADM

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cargill

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- DSM-Firmenich

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Evonik

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- FrieslandCampina

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ingredion

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jamjoom Pharma

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Julphar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kerry Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Roquette

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SPIMACO

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tabuk Pharmaceuticals

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yakult

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- AJA Pharma

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making