GCC Compound Feed Market Research Report: Forecast (2024-2030)

GCC Compound Feed Market - By Animal Type (Ruminants, Poultry, Aquaculture, Equine), By Form (Mash, Pellets, Crumbles), By Distribution Channel (Direct Sales, Dealers & Distributor...s), By Country (The UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman), Others Read more

- Food & Beverages

- Feb 2024

- Pages 145

- Report Format: PDF, Excel, PPT

Market Definition

Compound feed refers to a nutritionally balanced mixture of various ingredients, including cereals, grains, protein sources, vitamins, and minerals, formulated to meet the specific dietary requirements of livestock & poultry. The compound feed is available in various forms, such as pellets, mash, and crumbles.

Market Insights & Analysis: GCC Compound Feed Market (2024-30):

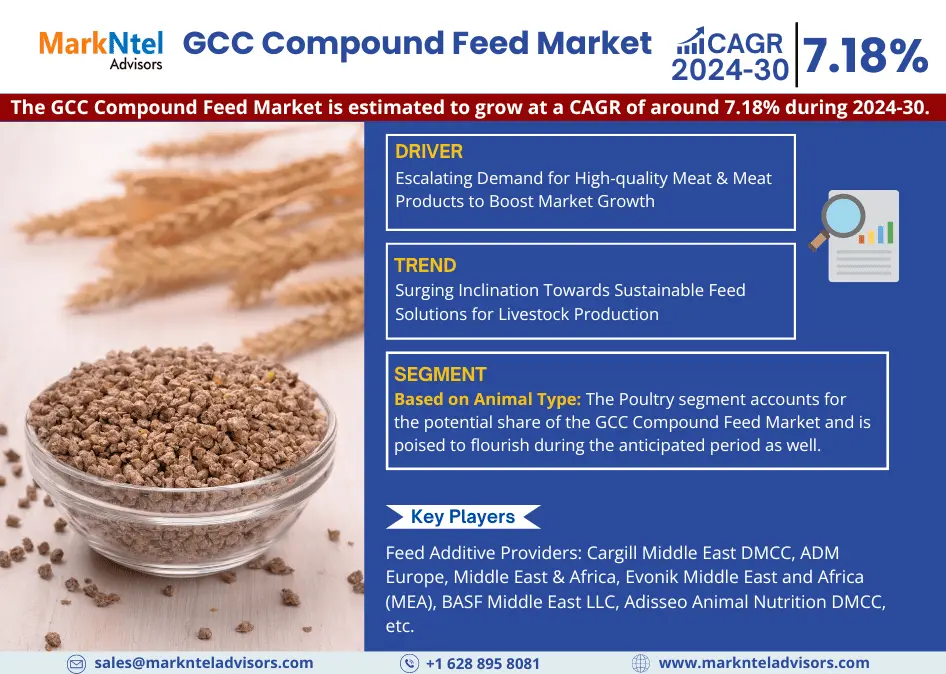

The GCC Compound Feed Market is estimated to grow at a CAGR of around 7.18% during the forecast period, i.e., 2024-30. The market growth imputes the surging attention towards animal health and welfare in the Gulf Cooperation Council (GCC) countries. The growing awareness of the ethical treatment of animals and recognition of the interconnectedness between animal health and human well-being has surged the animal health awareness among individuals.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 7.18% |

| Country Covered | The UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain |

| Key Companies Profiled |

Feed Additive Providers: Cargill Middle East DMCC, ADM Europe, Middle East & Africa, Evonik Middle East and Africa (MEA), BASF Middle East LLC, Adisseo Animal Nutrition DMCC, etc. Compound Feed Providers: ARASCO Feed (WAFI), Trouw Nutrition Middle East and Africa Export, IFFCO Animal Nutrition, Kuwait Animal Feed Factory (KAFF), Oman Flour Mills S.A.O.G., and Omani National Livestock Development Co (S.A.O.C), others |

| Unit Denominations | USD Million/Billion |

Moreover, the rising demand for high-quality animal-derived products such as wool, eggs, meat, milk, etc., has further led farmers to focus on animal wellbeing. As a result, livestock breeders & farmers are looking forward to sustainable & highly nutritious feed options designed particularly for the specific livestock type. Compound feed, with its balanced and scientifically formulated mix of ingredients, is gaining prominence as a key solution to ensure optimal nutrition for livestock and poultry, proliferating growth as well as enhancing the GCC Compound Feed Market size.

Additionally, the Gulf Cooperation Council (GCC) countries are increasingly directing their efforts towards sustainable farming practices, aiming to bolster their agricultural economy. Moreover, recognizing the importance of food security & environmental conservation, these nations are embracing innovative agricultural technologies & precision farming methods, along with livestock farming. For Instance:

- In 2023, the UAE announced its National Food Security Strategy 2051 to improve its domestic production of food and livestock.

Furthermore, compound feed plays a pivotal role in this endeavor, offering a controlled and balanced nutritional solution for livestock, thereby optimizing production efficiency. The GCC's commitment to reducing reliance on imported food and promoting self-sufficiency aligns with the usage of compound feed to enhance the overall productivity of their livestock sector, therefore contributing to elevating the GCC Compound Feed Market share in the upcoming years.

GCC Compound Feed Market Driver:

Escalating Demand for High-quality Meat & Meat Products to Boost Market Growth – The surging middle-class population and changing dietary preferences have streamed the demand for meat products across the region. The burgeoning tourism in countries such as Saudi Arabia, the UAE, Qatar, etc., has further amplified the need for a diverse and high-quality food supply, including meat products. For Instance:

- In 2021, the per capita meat consumption in Saudi Arabia was about 3.91kg, which increased to around 4.0 in 2022.

Further, as the livestock sector expands to meet the growing appetite for meat products, there is a heightened requirement for nutritionally balanced & efficient feed solutions. Compound feed products provide various nutritional benefits & support the optimal growth, health, and productivity of livestock, creating immense demand in the region and augmenting the GCC Compound Feed Market growth.

GCC Compound Feed Market Opportunity:

Rising Government Initiatives to Boost Food Security in the Region – In response to the imperative of ensuring food security, the GCC countries have witnessed a surge in government initiatives aimed at bolstering agricultural self-sufficiency. Determining the vulnerabilities associated with dependency on food imports, governments in the region are proactively investing in measures to enhance domestic production.

The government bodies of Saudi Arabia, the UAE, etc., have initiated various programs, such as the Green Saudi Initiative, Operation 300 Billion, Qatar's National Food Security Strategy, and others, to focus on reducing reliance on imports through investments in local food production, storage, and distribution. As these nations prioritize local food production, the Compound Feed Market in the GCC stands to benefit from a surge in demand for livestock production in the region, creating profitable opportunities during the projected period.

GCC Compound Feed Market Challenge:

Increasing Consumer Inclination Towards Veganism to Restrict Market Growth – There has been a notable surge in the adoption of veganism in the Gulf Cooperation Council (GCC) countries due to increased awareness of health & wellness among consumers. Concerns about environmental sustainability & animal welfare have further surged the growth of veganism across the GCC countries. The GCC countries have a higher expatriate population demanding a variety of vegan & vegetarian diets, further boosting the growth of veganism in the region. For instance:

- In 2022, the total expat population in the UAE was about 8.92 million from a total population of nearly 10.08 million.

As more consumers shift towards plant-based diets, the demand for animal-derived products, such as meat & dairy, decreases, impacting the need for compound feed in livestock farming. Thus, consumers shifting towards plant-based food options significantly affects the growth, creating a challenge for the GCC Compound Feed Market.

GCC Compound Feed Market Trend:

Surging Inclination Towards Sustainable Feed Solutions for Livestock Production – There is a widespread shift towards sustainable feed solutions in the GCC countries driven by increased environmental consciousness and a growing emphasis on responsible agriculture. Innovations in sustainable feed formulations, including plant-based ingredients and by-products from food processing, are being embraced as viable alternatives to traditional compound feeds.

Moreover, companies such as Cargill, ARASCO, etc., are further focusing on the development of sustainable feed solutions for livestock, thus boosting market growth. Besides, as the agricultural sector shifts towards more environmentally conscious practices, the demand for innovative & sustainable feeds is on the rise, serving as a major trend in the GCC Compound Feed Market.

GCC Compound Feed Market (2024-30): Segmentation Analysis

The GCC Compound Feed Market study by MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024-2030 at the regional level. In accordance to the analysis, the market has been further classified as:

Based on Animal Type

- Ruminants

- Poultry

- Aquaculture

- Equine

The Poultry segment accounts for the potential share of the GCC Compound Feed Market and is poised to flourish during the anticipated period as well. With the surging demand for protein-rich food coupled with rising consumer awareness regarding the nutritional benefits of poultry meat & eggs has fueled a surge in the consumption of poultry products across the GCC countries.

The advancements in feed technology & a surging focus on optimizing poultry nutrition are expected to enhance productivity & overall yield in the poultry farming sector. Furthermore, government initiatives promoting sustainable agriculture practices and self-sufficiency in food production are likely to bolster the growth of the segment within the Compound Feed Market in the GCC region.

Based on Form:

- Mash

- Pellets

- Crumbles

Pellets captured a prominent share in the GCC Compound Feed Market owing to the convenience offered in storage, transportation, and handling, aligning with the region's focus on efficient & modern farming practices. Pellets offer precise control over feed composition, ensuring optimal nutrition for various livestock categories. The increasing focus on animal health and performance is further propelling the adoption of pellets, as they facilitate enhanced digestibility & nutrient absorption. Moreover, the arid climate of the GCC nations necessitates measures to conserve water, and pelleted feed, by nature, requires less water in its production compared to traditional feed forms, further contributing to its growth in the market.

GCC Compound Feed Market (2024-30): Regional Projection

Geographically, the GCC Compound Feed Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Bahrain

The UAE is expected to witness considerable growth in the GCC Compound Feed Market driven by the country’s commitment to modernizing its agricultural sector, coupled with substantial investments in advanced technologies & infrastructure. The country's strategic initiatives, such as Operation 300 Billion, aim to significantly boost domestic food production to fuel the growth of the compound feed market in the country. Additionally, the nation's proactive measures in implementing sustainable practices, including water conservation & precision farming, contribute to the production of environmentally responsible feeds, further boosting the growth of the Compound Feed Market in the country. For instance:

- In 2023, Pure Harvest Smart Farms announced its partnership with Al Dahra, a diversified agribusiness in the UAE, to bring the benefits of controlled-environment agriculture (CEA) to the animal feed industry in the UAE.

Thus, the proliferating government initiatives coupled with rising food security measures in the country are expected to boost the growth of the UAE Compound Feed Market.

GCC Compound Feed Industry Recent Development:

- 2023: ARASCO, NEOM & Cargill signed an agreement for the sustainable expansion of the Saudi aquacultural sector and its aspiration to achieve self-sufficiency in aquaculture protein demand by 2030.

- 2022: Al Dhahra Holding has agreed with the compound feed manufacturer in the Middle East, ARASCO to supply up to 180,000 tons of WAFI animal feed to the Emirates.

Gain a Competitive Edge with Our GCC Compound Feed Market Report

- GCC Compound Feed Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Compound Feed Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Livestock Industry, Outlook, 2019-2022

- GCC Compound Feed Market Trends & Development

- GCC Compound Feed Market Dynamics

- Drivers

- Challenges

- GCC Compound Feed Market Supply Chain Analysis, By Key Stakeholders

- Feed Millers

- Pre-Mixers

- Integrators

- Farmers

- Others

- GCC Compound Feed Market Hotspots & Opportunities

- GCC Compound Feed Market Regulations & Policy Standards

- GCC Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type

- Ruminants- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Poultry- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Aquaculture- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Equine- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form

- Mash- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Pellets- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Crumbles- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel

- Direct Sales- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Dealers & Distributors- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

- By Competitors

- Market Share & Analysis

- Competition Characteristics

- By Animal Type

- Market Size & Analysis

- The UAE Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- Saudi Arabia Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- Qatar Compound Feed Market Outlook, 2019-2030FF

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- Kuwait Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- Bahrain Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- Oman Compound Feed Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Animal Type- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Form- Market Size & Forecast 2019-2030F, (Thousand Tons)

- By Distribution Channel- Market Size & Forecast 2019-2030F, (Thousand Tons)

- Market Size & Analysis

- GCC Compound Feed Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profile

- Feed Additives Providers

- Cargill Middle East DMCC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ADM Europe, Middle East & Africa

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Evonik Middle East and Africa (MEA)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF Middle East LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Adisseo Animal Nutrition DMCC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cargill Middle East DMCC

- Compound Feed Providers

- ARASCO Feed (WAFI)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Trouw Nutrition Middle East and Africa Export

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IFFCO Animal Nutrition

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kuwait Animal Feed Factory (KAFF)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oman Flour Mills S.A.O.G.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Omani National Livestock Development Co (S.A.O.C)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ARASCO Feed (WAFI)

- Others

- Feed Additives Providers

- Company Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making