Southeast Asia Food Packaging Market Research Report: Forecast (2026-2032)

Southeast Asia Food Packaging Market - By Product Type (Rigid, Glass, Glass Bottles, Glass Jars, Others, Metal, Collapsible Metal Tubes, Metal Aerosol Cans, Metal Beverage Cans, Me...tal Food Cans, Metal Tins, Semi Rigid, Paper, Paper-based Containers, Bag in Box, Board Tubs, Composite Containers, Folding Cartons, Paper Trays, Plastic, HDPE Bottles, PET Bottles, PET Jars, Plastic Trays, Ready Meal Trays, Other Plastic Trays, Squeezable Plastic Tubes, Thin Wall Plastic Containers, Others, Flexible, Flexible Aluminum, Aluminum Foil, Aluminum Trays, Others, Flexible Paper, Flexible Plastic, Blister and Strip Packs, Stand-Up Pouches, Plastic Pouches, Others), By Packaging Type - (Bags & Pouches, Bottles & Jars, Films & Wraps, Boxes & Cartons, Stick Packs & Sachets, Trays, Cans, Clamshells), By Food Type (Confectionary, Dairy Products, Processed Fruits & Vegetables, Processed Meat & Seafood Packaging, Rice, Pasta & Noodles, Savoury Snacks, Sweet Spreads, Sweet Biscuits, Snack Bars, and Fruit Snacks, Others), By End User (Quick & Full Service Restaurants, Cafe & Kiosks, Chain Restaurants), and others Read more

- Food & Beverages

- Dec 2025

- Pages 168

- Report Format: PDF, Excel, PPT

Southeast Asia Food Packaging Market

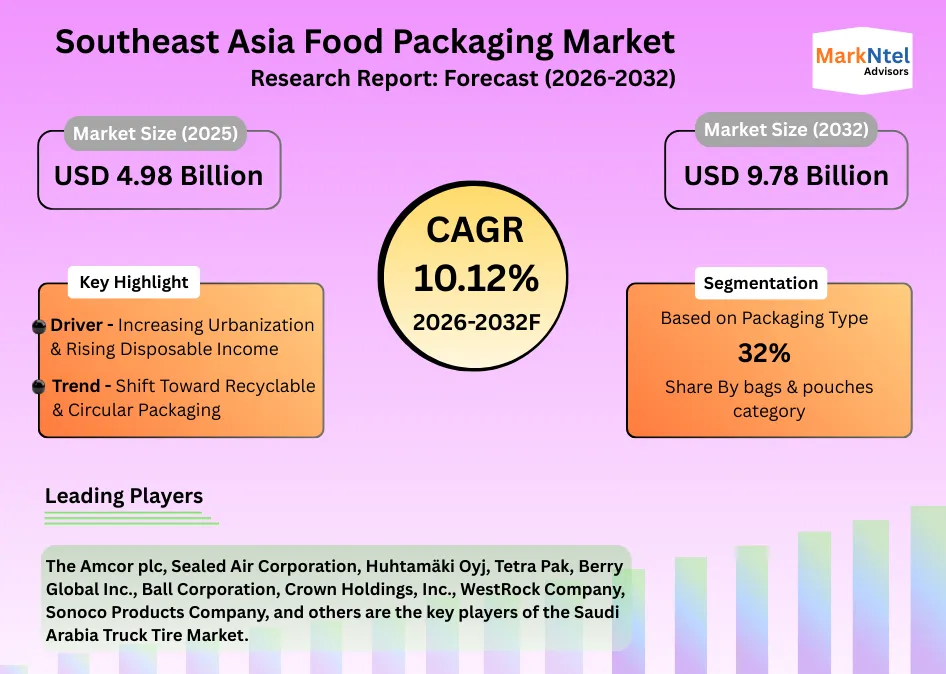

Projected 10.12% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 4.98 Billion

Market Size (2032)

USD 9.78 Billion

Base Year

2025

Projected CAGR

10.12%

Leading Segments

By Packaging Type: Bags & Pouches

Southeast Asia Food Packaging Market Report Key Takeaways:

- The Southeast Asia Food Packaging Market size is valued at around USD 4.98 billion in 2025 and is projected to reach USD 9.78 billion by 2032. The estimated CAGR from 2026 to 2032 is around 10.12%, indicating strong growth.

- By product type, the flexible segment seized around 70% market share in 2025.

- By packaging type, the bags & pouches hold around 32% market share in 2025.

- By country, Indonesia leads the Southeast Asia Food Packaging Market with a market share of around 38% in 2025.

- By food type, dairy products hold the largest market share, 28% in 2025.

- The leading solid cushion companies in Southeast Asia are Amcor plc, Sealed Air Corporation, Huhtamäki Oyj, Tetra Pak, Berry Global Inc., Ball Corporation, Crown Holdings, Inc., WestRock Company, Sonoco Products Company, Constantia Flexibles Group GmbH, SABIC, Scientex Berhad, Dynapack Asia, SCG Packaging Public Company Limited, Foil Packaging Thailand Inc., PT Primajaya Eratama, South East Packaging Industry Co., Ltd., Mondi Group, and others.

Market Insights & Analysis: Southeast Asia Food Packaging Market (2026- 2032):

The Southeast Asia Food Packaging Market size is valued at around USD 4.98 billion in 2025 and is projected to reach USD 9.78 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 10.12% during the forecast period, i.e., 2026-32.

The Southeast Asia Food Packaging Market is experiencing rapid growth, driven by rapid urbanization and rising disposable incomes, which are increasing demand for packaged and processed foods, alongside a strong shift toward recyclable and circular packaging, supported by regulatory mandates and sustainability-focused industry adoption.

Rapid urbanization is a key structural driver, with Southeast Asia’s urban population rising from 51.5% in 2023 to an estimated 52.8% in 2025, representing nearly 370 million consumers. Urban lifestyles and access to modern retail increase reliance on packaged and processed foods, supporting packaging demand.

Concurrently, rising income levels are strengthening consumer purchasing power across Southeast Asia. IMF projections for 2025 nominal GDP per capita show improving living standards, including Malaysia at USD 13,900 and USD 5,070 in Indonesia. Higher incomes are increasing demand for branded and convenience foods, driving the need for advanced, high-quality packaging solutions.

Export growth is further reinforcing the market outlook. For instance, Thailand’s packaged food market was valued at USD 15.95 billion in 2023 and is projected to reach USD 17.61 billion by 2025, supported by processed food exports of about USD 26.5 billion in 2023. Similarly, Indonesia secured potential export commitments of approximately USD 13.6 million at Anuga Select 2025, highlighting the importance of compliant, high-quality packaging in enabling international trade.

From a supply and regulatory perspective, sustainability is reshaping packaging strategies. Companies such as Mondi and Syntegon have introduced recyclable paper-based food packaging with recycled content, reflecting the region’s growing shift toward circular packaging models aligned with environmental regulations and corporate sustainability targets.

Looking ahead, large-scale public and private investments will further accelerate market growth. In late 2025, Indonesia announced plans to invest around USD 22 billion in agricultural and food processing infrastructure, while SCGJWD Logistics is expanding cold-chain and temperature-controlled logistics networks across Indonesia, Malaysia, Singapore, and the Philippines. These developments will expand processed food production, improve supply-chain efficiency, and drive sustained demand for innovative, sustainable, and high-performance food packaging solutions across Southeast Asia.

Southeast Asia Food Packaging Market Recent Developments:

-

September 2025: Unilever & SCG Chemicals launched ASEAN’s first food-grade recycled packaging for Knorr Professional, developed using advanced recycling technology to produce circular resins safe for food use, marking a significant sustainable packaging innovation across the region.

- February 2025: Sustainable packaging firm TomKat KoolPak partnered with Malaysian fresh food retailer Segi Fresh to introduce eco-friendly, NFC-enabled reusable cold-chain containers that replace polystyrene and ice for fresh food distribution. This rollout aims to enhance temperature control, extend shelf life, and cut environmental impact across Malaysia’s food supply network.

Southeast Asia Food Packaging Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Rigid, Glass, Glass Bottles, Glass Jars, Others, Metal, Collapsible Metal Tubes, Metal Aerosol Cans, Metal Beverage Cans, Metal Food Cans, Metal Tins, Semi Rigid, Paper, Paper-based Containers, Bag in Box, Board Tubs, Composite Containers, Folding Cartons, Paper Trays, Plastic, HDPE Bottles, PET Bottles, PET Jars, Plastic Trays, Ready Meal Trays, Other Plastic Trays, Squeezable Plastic Tubes, Thin Wall Plastic Containers, Others, Flexible, Flexible Aluminum, Aluminum Foil, Aluminum Trays, Others, Flexible Paper, Flexible Plastic, Blister and Strip Packs, Stand-Up Pouches, Plastic Pouches, Others), |

| By Packaging Type | Bags & Pouches, Bottles & Jars, Films & Wraps, Boxes & Cartons, Stick Packs & Sachets, Trays, Cans, Clamshells), |

| By Food Type | Confectionary, Dairy Products, Processed Fruits & Vegetables, Processed Meat & Seafood Packaging, Rice, Pasta & Noodles, Savoury Snacks, Sweet Spreads, Sweet Biscuits, Snack Bars, and Fruit Snacks, Others), |

| By End User | Quick & Full Service Restaurants, Cafe & Kiosks, Chain Restaurants), and others |

Southeast Asia Food Packaging Market Drivers:

Increasing Urbanization & Rising Disposable Income

Rapid urbanization across Southeast Asia is increasing the proportion of consumers living in cities, where lifestyles lean toward convenience and packaged foods. In 2024, over 54% of Southeast Asia’s population lived in urban areas, up from about 50% in earlier years, according to United Nations data. Markets such as Singapore are fully urbanized, while Indonesia and Thailand continue to record strong urban population shares. This expanding urban base supports greater access to modern retail formats, supermarkets, and e-commerce platforms, which primarily distribute packaged and processed food products.

Alongside rapid urban growth, disposable incomes are increasing across ASEAN economies. IMF projections for 2025 nominal GDP per capita indicate about USD 4,740 in Vietnam and USD 4,320 in the Philippines, reflecting stronger purchasing power across emerging and middle-income markets.

Higher incomes and urban lifestyles are boosting spending on convenience, branded, and processed foods that require advanced packaging for safety and shelf life. This is supported by over 4% regional FMCG growth in early 2025, led by Indonesia and the Philippines, directly increasing demand for food packaging solutions.

These demographic and economic shifts support the sustained expansion of packaged and processed food consumption in Southeast Asia, directly expanding the food packaging market as producers invest in innovative materials and formats to meet evolving consumer needs.

Southeast Asia Food Packaging Market Trends:

Shift Toward Recyclable & Circular Packaging

Governments and industry players across Southeast Asia are increasingly prioritizing recyclable and circular packaging as part of broader efforts to reduce plastic waste and build sustainable economic systems.

According to the OECD’s Regional Plastics Outlook, several ASEAN countries have introduced Extended Producer Responsibility frameworks. For instance, Malaysia targets 50% recycling of post-consumer plastic packaging by 2025 and 100% by 2030, pushing food manufacturers to redesign packaging with higher recyclability and recycled content.

In parallel, governments are actively promoting circular design principles. In 2025, the Philippines hosted the “Unwrapping Sustainable Packaging with Circular Design” workshop, bringing together regulators, industry stakeholders, and designers to encourage compliance with EPR rules and accelerate the adoption of circular packaging solutions. Such initiatives are strengthening industry awareness and aligning packaging design with regulatory expectations.

Companies are actively leveraging this trend through product innovation. For example, Amcor, a leading global packaging supplier, has expanded its Recycle-Ready packaging portfolio, including the AmPrima® Plus range. These flexible packaging solutions are designed to be recyclable within existing waste collection streams while maintaining critical barrier properties for food products.

Regulatory mandates and collaborative industry initiatives are accelerating the shift toward recyclable and circular packaging. As companies scale recycle-ready solutions, this trend is set to significantly drive growth and innovation in the Southeast Asia food packaging market.

Southeast Asia Food Packaging Market Challenges:

High Cost of Sustainable Materials

In Southeast Asia, the adoption of sustainable food packaging materials is constrained by high costs and limited local recycling capacity. Plastic recycling systems across ASEAN remain underdeveloped, with recycling rates in major urban centers estimated at only 8–25%, well below global benchmarks.

Inefficiencies in collection, sorting, and processing result in operational costs that are 1.5–2 times higher than the value of raw plastic waste, reducing the economic viability of recycled materials compared with lower-cost virgin plastics.

Additionally, the rollout of Extended Producer Responsibility (EPR) frameworks across the region imposes compliance and financing obligations on manufacturers, particularly burdening small and mid-sized firms lacking established recovery infrastructure (EU-ASEAN).

Elevated material costs, infrastructure gaps, and regulatory compliance burdens continue to hinder sustainable packaging adoption, potentially slowing food packaging market growth in Southeast Asia.

Southeast Asia Food Packaging Market (2026-32) Segmentation Analysis:

The Southeast Asia Food Packaging Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type

- Rigid

- Glass

- Glass Bottles

- Glass Jars

- Others

- Metal

- Collapsible Metal Tubes

- Metal Aerosol Cans

- Metal Beverage Cans

- Metal Food Cans

- Metal Tins

- Glass

- Semi Rigid

- Paper

- Paper-based Containers

- Bag in Box

- Board Tubs

- Composite Containers

- Folding Cartons

- Paper Trays

- Plastic

- HDPE Bottles

- PET Bottles

- PET Jars

- Plastic Trays

- Ready Meal Trays

- Other Plastic Trays

- Squeezable Plastic Tubes

- Thin-Wall Plastic Containers

- Others

- Paper

- Flexible

- Flexible Aluminum

- Aluminum Foil

- Aluminum Trays

- Others

- Flexible Paper

- Flexible Plastic

- Blister and Strip Packs

- Stand-Up Pouches

- Plastic Pouches

- Others

- Flexible Aluminum

The flexible food packaging holds the top spot in the Southeast Asia Food Packaging Market, with a market share of around 70%, driven by its cost efficiency, material versatility, and strong alignment with modern food consumption patterns.

Formats such as plastic pouches, stand-up pouches, flexible paper, aluminium foil, and blister packs are widely adopted across packaged foods, snacks, ready meals, dairy, and beverages. Compared to rigid and semi-rigid alternatives, flexible packaging requires significantly less raw material, reduces transportation weight, and lowers logistics and storage costs, making it highly attractive for manufacturers operating in price-sensitive markets.

Additionally, flexible packaging offers excellent barrier properties against moisture, oxygen, and light, extending shelf life and reducing food waste critical for both domestic consumption and exports. Its compatibility with re-sealable, single-serve, and portion-controlled formats also supports the rising demand for convenience foods among urban consumers.

Importantly, ongoing innovations in recyclable mono-material films and paper-based flexible solutions are further strengthening adoption, enabling brands to meet sustainability goals while retaining functional performance.

Based on Packaging Type

- Bags & Pouches

- Bottles & Jars

- Films & Wraps

- Boxes & Cartons

- Stick Packs & Sachets

- Trays

- Cans

- Clamshells

The bags & pouches category leads the Southeast Asia Food Packaging Industry, accounting for 32% market share, driven by their versatility, cost efficiency, and strong suitability for modern consumption patterns.

This segment is widely used across snacks, ready-to-eat meals, dairy products, frozen foods, condiments, and beverages. Compared with rigid formats, bags and pouches require less material, offer lower transportation and storage costs, and enable higher packaging efficiency for manufacturers.

The dominance of this segment is further reinforced by growing demand for convenience-oriented formats, including resealable, stand-up, and single-serve pouches, which cater to urban lifestyles and on-the-go consumption.

Additionally, bags and pouches provide excellent barrier protection against moisture, oxygen, and contamination, helping extend shelf life and reduce food waste. Ongoing innovations in recyclable mono-material pouches and paper-based alternatives are also supporting adoption, allowing brands to balance sustainability goals with functional performance.

Southeast Asia Food Packaging Market (2026-32): Regional Projection

The Southeast Asia Food Packaging Market is dominated by Indonesia, which holds a commanding 38% market share, driven by its large population base, expanding middle class, and rapidly growing food and beverage industry.

As Southeast Asia’s most populous country, Indonesia generates strong demand for packaged and processed foods across urban and semi-urban markets, directly supporting high packaging consumption volumes. Rising urbanization, increasing disposable incomes, and changing dietary habits have accelerated demand for ready-to-eat meals, snacks, dairy products, and beverages, all of which require diverse packaging formats.

In addition, Indonesia’s expanding modern retail footprint, spanning supermarkets, minimarts, and e-commerce platforms, has increased the penetration of packaged food products nationwide. The country is also a major exporter of processed foods, requiring compliant, high-quality packaging to meet domestic safety standards and international regulations.

Continuous investments in food processing, cold-chain logistics, and packaging manufacturing further strengthen Indonesia’s leadership position within the regional food packaging market.

Gain a Competitive Edge with Our Southeast Asia Food Packaging Market Report

- Southeast Asia Food Packaging Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Southeast Asia Food Packaging Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- Southeast Asia Food Packaging Market Trends & Development

- Southeast Asia Food Packaging Market Dynamics

- Growth Drivers

- Challenges

- Southeast Asia Food Packaging Market Regulations, Policies & Standards

- Southeast Asia Food Packaging Market Import & Export Analysis

- Southeast Asia Food Packaging Market Supply Chain Analysis

- Southeast Asia Food Packaging Market Hotspots & Opportunities

- Southeast Asia Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- Rigid

- Glass

- Glass Bottles

- Glass Jars

- Others

- Metal

- Collapsible Metal Tubes

- Metal Aerosol Cans

- Metal Beverage Cans

- Metal Food Cans

- Metal Tins

- Glass

- Semi Rigid

- Paper

- Paper-based Containers

- Bag in Box

- Board Tubs

- Composite Containers

- Folding Cartons

- Paper Trays

- Plastic

- HDPE Bottles

- PET Bottles

- PET Jars

- Plastic Trays

- Ready Meal Trays

- Other Plastic Trays

- Squeezable Plastic Tubes

- Thin Wall Plastic Containers

- Others

- Paper

- Flexible

- Flexible Aluminum

- Aluminum Foil

- Aluminum Trays

- Others

- Flexible Paper

- Flexible Plastic

- Blister and Strip Packs

- Stand-Up Pouches

- Plastic Pouches

- Others

- Flexible Aluminum

- Rigid

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- Bags & Pouches

- Bottles & Jars

- Films & Wraps

- Boxes & Cartons

- Stick Packs & Sachets

- Trays

- Cans

- Clamshells

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- Confectionary

- Dairy Products

- Processed Fruits & Vegetables

- Processed Meat & Seafood Packaging

- Rice, Pasta & Noodles

- Savoury Snacks

- Sweet Spreads

- Sweet Biscuits, Snack Bars, and Fruit Snacks

- Others

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Quick & Full Service Restaurants

- Cafe & Kiosks

- Chain Restaurants

- By Country

- Malaysia

- Indonesia

- Singapore

- Cambodia

- Vietnam

- Thailand

- Philippines

- Others

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Malaysia Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold ((Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Indonesia Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Singapore Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Cambodia Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Vietnam Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Thailand Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Philippines Food Packaging Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Tons)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Material - Market Size & Forecast 2022-2032, Thousand Tons

- By Packaging Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Food Type - Market Size & Forecast 2022-2032, Thousand Tons

- By Application - Market Size & Forecast 2022-2032, Thousand Tons

- By End User - Market Size & Forecast 2022-2032, Thousand Tons

- Market Size & Analysis

- Southeast Asia Food Packaging Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Amcor plc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sealed Air Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Huhtamäki Oyj

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tetra Pak

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Berry Global Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ball Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Crown Holdings, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- WestRock Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sonoco Products Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Constantia Flexibles Group GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SABIC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Scientex Berhad

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dynapack Asia

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SCG Packaging Public Company Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Foil Packaging Thailand Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PT Primajaya Eratama

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- South East Packaging Industry Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mondi Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Amcor plc

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making