India Plant-Based Dairy Products Market Research Report: Forecast (2025-2030)

India Plant-Based Dairy Products Market - By Product Type (Milk, Cheese, Butter, Yogurt, Creamers, Others), By Material Type (Fruits, Vegetables, Seeds & Nuts, Others), By Sales Ch...annel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, E-commerce, Others), By Nature (Organic, Conventional), By End Use (Bakery & Confectionery, Snacks & Savouries, Ready Meals, HoReCa, Dietary Supplements, Other Food Products) and Others Read more

- Food & Beverages

- Dec 2024

- Pages 121

- Report Format: PDF, Excel, PPT

Market Definition

Plant-derived dairy items possess a flavor and consistency akin to conventional dairy products but are created from plant extracts and other plant-based materials without any milk. This category can encompass plant-based milk, cheese, butter, yogurt, ice cream, and other similar products.

Market Insights & Analysis: India Plant-Based Dairy Products Market (2025-2030):

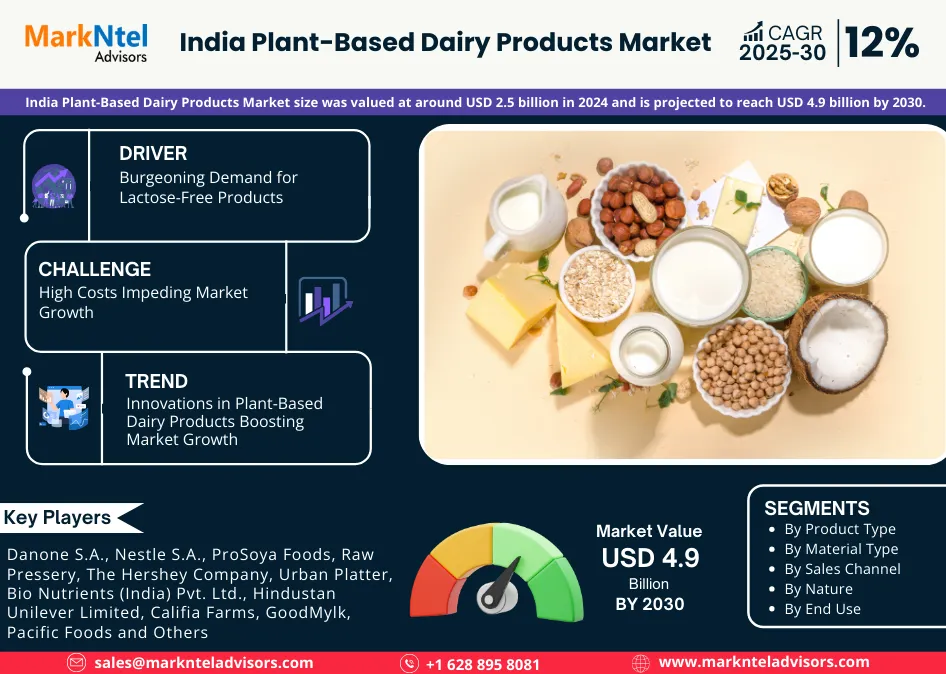

The India Plant-Based Dairy Products Market size was valued at around USD 2.5 billion in 2024 and is projected to reach USD 4.9 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 12% during the forecast period 2025-30. Different factors are credited for the expansion of the market. Consumer acceptance of vegan alternatives primarily due to health and environmental concerns is driving an increase in demand for plant-based milk, cheese, and yogurt. Due to the popularity of veganism the market for plant-based dairy products expanded quickly.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 2.5 Billion |

| Market Value in 2030 | USD 4.9 Billion |

| CAGR (2025-30) | 12% |

| Leading Region | South Region |

| Top Key Players | Danone S.A., Nestle S.A., ProSoya Foods, Raw Pressery, The Hershey Company, Urban Platter, Bio Nutrients (India) Pvt. Ltd., Hindustan Unilever Limited, Califia Farms, GoodMylk, Pacific Foods, Sofit, Epigamia, ALT Foods, 1.5 Degree, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Around 9% of the total Indian population has turned vegan with Ahmedabad as the vegan capital of India. PETA India has honored Ahmedabad as India’s 'Most Vegan-Friendly City' of 2024. This has given a high rise in the demand for the plant-based dairy products market in India with multiple food chains like; Daiya Foods, Nestle, Sofit, and others offering different kinds of vegan & plant-based dairy products added to their portfolios.

Moreover, the plant-based products market is further boosted by government policies and ethical support. The FSSAI in India has introduced guidelines on plant-based foods to standardize and ensure consumer safety. India's Plant-Based Foods Industry Association also works for vegan and plant-based alternatives by spreading awareness and encouraging investments in the sector. Advocacy from groups such as Vegan Outreach, which also focuses on animal welfare, has driven up demand. Plant-based dairy adoption is growing in Cities like; Delhi, Bangalore, Mumbai, and others. Examples include Epigamia's plant-based yogurt and Goodmylk's almond milk, both witnessing strong sales growth. This synergy of supportive policies and ethical awareness makes India a key market for the expansion of plant-based dairy.

India Plant-Based Dairy Products Market Driver:

Burgeoning Demand for Lactose-Free Products – A third of the total Indian population faces the issue of lactose intolerance. In Trivandrum and Pondicherry, 66.6% of individuals and 27.4% of New Delhi's residents are lactose intolerant, leading to a significant demand for lactose-free products, which in turn fuels market growth. South India has the highest prevalence rates of lactose intolerance creating most of the market demand. This awareness drives consumers to increasingly look to plant-based dairy alternatives which tend to naturally exclude lactose. Coconut, almond, oat, and soy milk serve as safe and nutritious plant-based choices, allowing individuals to experience dairy-like enjoyment without the discomfort linked to conventional milk. For example; the popularity of Lactose-free milk by Amul has surged significantly in regions of India due to its attraction to lactose-intolerant individuals and its sustainable characteristics. Brands are reacting by introducing more lactose-free products and emphasizing taste, texture, and fortification to resemble the nutrition and versatility of traditional dairy that will continue to fuel the demand for the plant-based dairy products industry.

India Plant-Based Dairy Products Market Opportunity:

Almond Milk Popularity on the Rise – India's plant-based dairy sector has a significant opportunity due to the increasing demand for almond milk in the country. Almond milk is becoming more popular due to its numerous health benefits, including being naturally lactose-free, rich in vitamin E, and low in calories. It serves the expanding demographic of health-aware consumers and individuals. Brands such as; Sofit, Epigamia, and Raw Pressery have launched almond milk options suited to Indian tastes, enhancing the product's availability in key cities like; Mumbai, Delhi, and Bangalore, where the demand for premium, healthy options is high. The urban middle class, benefiting from increasing disposable incomes, is a crucial consumer segment propelling this trend. Retail and e-commerce sites like; BigBasket and Amazon India have increased the distribution of almond milk, enhancing its market presence. This increasing acceptance establishes almond milk as a key component of India’s developing plant-based dairy industry.

India Plant-Based Dairy Products Market Challenge:

High Costs Impeding Market Growth – The elevated costs of plant-based dairy items present a major obstacle in the Indian market, restricting their attractiveness to a wider audience. Typically, the products tend to cost more than traditional dairy options because of costly raw materials, unique manufacturing techniques, and reduced economies of scale. For instance; compared to conventional dairy milk which typically has an average cost of USD 0.67 per liter the same amount of plant-based milk costs above USD 1.18 per liter. Additionally, there is a cost for plant-based manufacturers in terms of the cost of innovation, research, and development to try and perfect the taste and texture. This price gap is most prominent in the Indian market, where affordability plays a key role in mass adoption.

India Plant-Based Dairy Products Market Trend:

Innovations in Plant-Based Dairy Products Boosting Market Growth – New developments are boosting the market for plant-based dairy products by enhancing their flavor, texture, and nutritional content which will increase consumer interest in substitutes. For instance; Epigamia has launched yogurt made from coconut milk, whereas Urban Platter provides options based on almonds and cashews. Innovations such as enriched oat milk and no-sugar options cater to health-aware consumers, an essential market group. Moreover, companies like Goodmylk are utilizing sustainable components like millets, recognized for their minimal water usage, to develop environmentally friendly items. These developments correspond with India's increasing need for ethical, allergen-safe, and eco-friendly alternatives making it a significant market trend.

India Plant-Based Dairy Products Market (2025-2030): Segmentation Analysis

The India Plant-Based Dairy Products Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Nature:

- Organic

- Conventional

By Nature, the organic segment leads the India Plant-Based Dairy Products Market. It holds more than 65 % of the total market share. This is due to an increase in consumer preference towards healthier and more environmentally friendly options. Organic plant-based dairy products are more natural and free from synthetic chemicals, which are becoming a new trend in India toward clean and sustainable eating. Consumers are also willing to pay a premium for organic products, increasing the market size for this segment. Increased calls for transparency in sourcing and production increase the organic options' attractiveness, allowing them to further cement their leadership position in the plant-based dairy market.

Based on Product Type:

- Milk

- Cheese

- Butter

- Yogurt

- Creamers

- Others

Based on product type, milk leads the India Plant-Based Dairy Products Market. It holds around 70% of the total market value. This strong growth is attributed to a few factors. Increased consumer awareness of health and environmental issues has led the market towards dairy milk alternatives. On top of that, product innovation is a never-ending process, giving consumers a wide range of plant-based milk alternatives that differ in their various dietary needs and preferences. These range from almond to soy milk, oat, and coconut milk, among others. It contains different similarities compared to traditional milk which assists in making it a high user in cereal, baking, coffee, and cooking. Moreover, the duration of their availability in the market is longer as compared to other products, allowing them to gain traction.

India Plant-Based Dairy Products Market (2025-30): Regional Projections

Geographically, the India Plant-Based Dairy Products Market expands across:

- South

- North

- East

- West

Out of them, the south region dominates the India Plant-Based Dairy Products Market. It holds around 40% share of the total market. The deep-rooted culture of consuming plant-based diets featuring coconut in South India strongly coincides with the acceptance of plant-based dairy substitutes such as coconut milk. Sales in the area are additionally enhanced by a robust retail network and the presence of plant-based dairy options in both specialty shops and supermarkets. Numerous cities in the South possess a strong awareness of the health advantages associated with plant-based diets. This adds to the increasing market demand in the area. In South India, shoppers in urban areas such as; Bengaluru and Chennai are becoming increasingly health-aware and opting for lactose-free soy and almond milk as healthier alternatives.

India Plant-Based Dairy Products Industry Recent Development:

- August 2024: 1.5 Degree debuts plant-based dairy products at the 7th India International Hospitality Expo by introducing a complete range of plant-based dairy products, including Oat Milk, Soy Milk, Cold Coffee, Flavored Milkshakes, Gelato in different flavors like – Paan, Belgian Chocolate, Strawberry, Biscoff, Mocha Almond Fudge, etc.

- February 2024: Califia Farms launched a creamy plant-based milk made from a blend of pea, chickpea, and fava bean protein that consists of nine essential nutrients and essential amino acids.

Gain a Competitive Edge with Our India Plant-Based Dairy Products Market Report

- India Plant-Based Dairy Products Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Plant-Based Dairy Products Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Plant-Based Dairy Products Market Trends & Deployments

- India Plant-Based Dairy Products Market Dynamics

- Growth Drivers

- Challenges

- India Plant-Based Dairy Products Market Opportunities & Hotspots

- India Plant-Based Dairy Products Market Value Chain Analysis

- India Plant-Based Dairy Products Market Regulations and Policy

- India Plant-Based Dairy Products Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type

- Milk- Market Size & Forecast 2020-2030, USD Million

- Cheese- Market Size & Forecast 2020-2030, USD Million

- Butter- Market Size & Forecast 2020-2030, USD Million

- Yogurt- Market Size & Forecast 2020-2030, USD Million

- Creamers- Market Size & Forecast 2020-2030, USD Million

- Others

- By Material Type

- Fruits- Market Size & Forecast 2020-2030, USD Million

- Vegetables- Market Size & Forecast 2020-2030, USD Million

- Seeds & Nuts- Market Size & Forecast 2020-2030, USD Million

- Others

- By Sales Channel

- Supermarkets/Hypermarkets- Market Size & Forecast 2020-2030, USD Million

- Convenience Stores- Market Size & Forecast 2020-2030, USD Million

- Specialty Stores- Market Size & Forecast 2020-2030, USD Million

- E-commerce- Market Size & Forecast 2020-2030, USD Million

- Others

- By Nature

- Organic- Market Size & Forecast 2020-2030, USD Million

- Conventional- Market Size & Forecast 2020-2030, USD Million

- By End Use

- Bakery & Confectionery- Market Size & Forecast 2020-2030, USD Million

- Snacks & Savouries- Market Size & Forecast 2020-2030, USD Million

- Ready Meals- Market Size & Forecast 2020-2030, USD Million

- HoReCa- Market Size & Forecast 2020-2030, USD Million

- Dietary Supplements- Market Size & Forecast 2020-2030, USD Million

- Other Food Products- Market Size & Forecast 2020-2030, USD Million

- Others

- By Region

- North

- South

- East

- West

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Product Type

- Market Size & Analysis

- North India Plant-Based Dairy Products Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Material Type-Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- By Nature-Market Size & Forecast 2020-2030, USD Million

- By End Use- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South India Plant-Based Dairy Products Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Material Type-Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- By Nature-Market Size & Forecast 2020-2030, USD Million

- By End Use- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- East India Plant-Based Dairy Products Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Material Type-Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- By Nature-Market Size & Forecast 2020-2030, USD Million

- By End Use- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- West India Plant-Based Dairy Products Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type- Market Size & Forecast 2020-2030, USD Million

- By Material Type-Market Size & Forecast 2020-2030, USD Million

- By Sales Channel- Market Size & Forecast 2020-2030, USD Million

- By Nature-Market Size & Forecast 2020-2030, USD Million

- By End Use- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Plant-Based Dairy Products Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Danone S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Nestle S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- ProSoya Foods

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Raw Pressery

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- The Hershey Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Urban Platter

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Bio Nutrients (India) Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Califia Farms

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- GoodMylk

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Pacific Foods

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Hindustan Unilever Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Sofit

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Epigamia

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- ALT Foods

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- 1.5 Degree

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- Danone S.A.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making