GCC Plant-Based Dairy Products Market Research Report: Forecast (2026-2032)

GCC Plant-Based Dairy Products Market - By Product Type (Plant-Based Milk [Almond Milk, Soy Milk, Coconut Milk, Oat Milk, Others], Plant-Based Cheese [Nut-Based Cheese, Soy-Based C...heese], Plant-Based Yogurt [Almond Yogurt, Coconut Yogurt], Plant-Based Butter, Plant-Based Creamers, Plant-Based Frozen Desserts, Others), By Ingredient Type (Plant-Based Acidulants, Plant-Based Botanicals, Plant-Based Carotenoids, Vegetable Oils, Polysaccharides & Oligosaccharides, Plant-Based Sweeteners, Other Commodities [Water, Cereals, Juices, etc.]), By Nature (Organic, Conventional), By Distribution Channel (Supermarkets & Hypermarkets, Online Stores, Specialty Stores, Convenience Stores, Others), By End User (Bakery & Confectionery, Snacks & Savouries, Ready Meals, HoReCa, Dietary Supplements, Other Food Products, Others) Read more

- Food & Beverages

- Dec 2025

- Pages 168

- Report Format: PDF, Excel, PPT

GCC Plant-Based Dairy Products Market

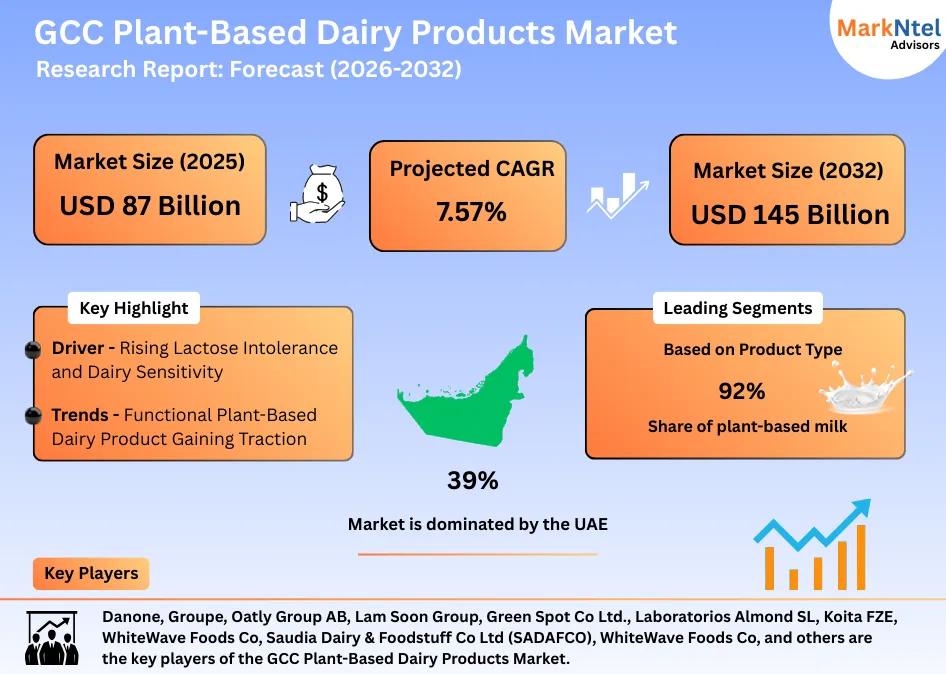

Projected 7.57% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 87 Billion

Market Size (2032)

USD 145 Billion

Base Year

2025

Projected CAGR

7.57%

Leading Segments

By Product Type: Plant-Based Milk

GCC Plant-Based Dairy Products Market Report Key Takeaways:

- The GCC Plant-Based Dairy Products Market size is valued at around USD 87 billion in 2025 and is projected to reach USD 145 billion by 2032. The estimated CAGR from 2026 to 2032 is around 7.57%, indicating strong growth.

- By Product Type, the plant-based milk segment holds 92% share of the GCC Plant-Based Dairy Products Market in 2025.

- By Distribution Channel, the supermarkets & hypermarkets represented 65% of the GCC Plant-Based Dairy Products Market size in 2025.

- By Country, the UAE leads the GCC Plant-Based Dairy Products Market with a dominant 39% market share in 2025.

- The leading plant-based dairy companies in the GCC are Danone, Groupe, Oatly Group AB, Lam Soon Group, Green Spot Co Ltd., Laboratorios Almond SL, Koita FZE, Australasian Conference Association Ltd, Ecotone, Koninklijke Wessanen NV, WhiteWave Foods Co, Saudia Dairy & Foodstuff Co Ltd (SADAFCO), WhiteWave Foods Co, and others.

Market Insights & Analysis: GCC Plant-Based Dairy Products Market (2026-2032):

The GCC Plant-Based Dairy Products Market size is valued at around USD 87 billion in 2025 and is projected to reach USD 145 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 7.57% during the forecast period, i.e., 2026-32.

The GCC Plant-Based Dairy Products Market is witnessing rapid growth, primarily driven by the rising prevalence of lactose intolerance and dairy sensitivity across the region, along with increasing development of functional plant-based dairy products that offer added nutritional, digestive, and health benefits beyond basic dairy substitution.

Clinical evidence underscores the scale of demand, as in Kuwait, medical research indicates that 82.1% of symptomatic adults tested positive for lactose intolerance, with 67.7% classified as severe cases, highlighting significant digestive sensitivity to conventional dairy among the adult population seeking care. Similarly, regional health assessments in Oman estimate lactose intolerance prevalence of up to 96%, reflecting genetically driven lactase decline and reinforcing the limited tolerance for traditional dairy across large segments of the population.

These health dynamics are accelerating the shift toward plant-based dairy alternatives across the GCC. Importantly, demand is moving beyond basic dairy substitution toward functional plant-based dairy products that deliver added nutritional and digestive benefits.

Regional producers, including SADAFCO in Saudi Arabia and Al Ain Farms in the UAE, are adopting localized formulation strategies, developing fortified oat and soy-based products optimized for shelf stability, halal compliance, and high-temperature storage. These offerings align closely with regional dietary habits and national food-security objectives.

Looking ahead, government-backed investments and industrial-scale innovations are expected to further strengthen market fundamentals. Projects linked to NEOM and Liberation Labs in Saudi Arabia aim to establish precision-fermentation facilities capable of producing dairy-identical proteins for plant-based applications, reducing import dependency and unit costs. Concurrently, the UAE National Food Security Strategy and future food initiatives are supporting agritech and food-processing clusters to scale local plant-based dairy production.

Overall, the convergence of high lactose intolerance prevalence, functional product innovation, and strategic government investment establishes a strong foundation for long-term growth of the GCC Plant-Based Dairy Products Market.

GCC Plant-Based Dairy Products Market Recent Developments:

- July 2025: Alpro (Danone) rolled out a children-focused range of fortified plant-based drinks and soya/oat yoghurts, including chocolate oat and strawberry soya variants. The products are aimed at parents seeking nutritious, kid-friendly dairy alternatives and are marketed across mainstream retail and foodservice channels in the UAE and wider GCC, highlighting added vitamins, minerals, and child-appealing flavours.

- September 2025: The Bridge, an Italian plant-based food company, introduced Biogurt under its ViaMia brand in 2025. This new organic, fermented yogurt alternative uses minimal ingredients and is naturally sweetened with organic apple juice. It offers an extended 80-day shelf life without preservatives and comes in oat coffee and oat peach flavors, now stocked in major supermarkets.

GCC Bathroom & Kitchen Sanitary Fittings Market Scope:

| Category | Segments |

|---|---|

| By Product Type | (Plant-Based Milk [Almond Milk, Soy Milk, Coconut Milk, Oat Milk, Others], Plant-Based Cheese [Nut-Based Cheese, Soy-Based Cheese], Plant-Based Yogurt [Almond Yogurt, Coconut Yogurt], Plant-Based Butter, Plant-Based Creamers, Plant-Based Frozen Desserts, Others), |

| By Ingredient Type | (Plant-Based Acidulants, Plant-Based Botanicals, Plant-Based Carotenoids, Vegetable Oils, Polysaccharides & Oligosaccharides, Plant-Based Sweeteners, Other Commodities [Water, Cereals, Juices, etc.]), |

| By Nature | (Organic, Conventional), |

| By Distribution Channel | (Supermarkets & Hypermarkets, Online Stores, Specialty Stores, Convenience Stores, Others), |

| By End User | (Bakery & Confectionery, Snacks & Savouries, Ready Meals, HoReCa, Dietary Supplements, Other Food Products, Others) |

GCC Plant-Based Dairy Products Market Drivers:

Rising Lactose Intolerance and Dairy Sensitivity

Lactose intolerance caused by insufficient production of the lactase enzyme has emerged as a major dietary concern across the Gulf region, significantly influencing consumer preference for plant-based dairy alternatives. Globally, around 65% of adults experience lactose maldigestion, leading to symptoms such as bloating, abdominal cramps, and diarrhea after consuming conventional dairy products.

In the GCC, the prevalence is notably higher due to genetic and dietary patterns. Regional health assessments estimate lactose intolerance rates of approximately 68% in the UAE and around 78% in Qatar, indicating that a majority of adults are unable to comfortably digest lactose. This widespread intolerance has directly accelerated demand for lactose-free and plant-based milk, yogurt, and cream alternatives in daily diets.

In Saudi Arabia, clinical and survey-based studies indicate that about 28% of adults exhibit lactose intolerance, while physician-diagnosed prevalence stands at roughly 7.3%. Importantly, dietary surveys suggest that 14.7% of adults are likely lactose intolerant, highlighting a much larger population experiencing symptoms but remaining undiagnosed.

Broader population studies further confirm that a significant share of GCC consumers actively reduce or eliminate dairy intake to avoid digestive discomfort, reinforcing sustained demand for plant-based dairy options.

The high and persistent prevalence of lactose intolerance across GCC countries is structurally shifting dietary habits. As awareness, diagnosis, and digestive health education improve, this driver will continue to accelerate long-term growth of the plant-based dairy market across the region.

GCC Plant-Based Dairy Products Market Trends:

Functional Plant-Based Dairy Product Gaining Traction

Functional plant-based dairy has emerged as a prominent trend as manufacturers move beyond basic dairy substitution toward nutrition-led product innovation. Scientific findings (2023–2025) show that unfortified plant-based diets increase risks of vitamin B12, calcium, iron, iodine, and vitamin D deficiencies, with dairy replacement reducing B12 intake by 39% and calcium by 30%, driving demand for fortified alternatives.

In response, companies are increasingly formulating plant-based milks and yogurts to deliver digestive, nutritional, and functional benefits, aligning with rising health awareness and widespread lactose intolerance. Fortification with essential vitamins and minerals has become a core formulation strategy to ensure nutritional adequacy and daily consumption suitability.

For instance, Alpro (Danone) extensively fortifies its oat and soy drinks with calcium, vitamin D, and vitamin B12 to closely match the nutritional profile of dairy milk. Its plant-based yogurt portfolio increasingly incorporates fermentation and probiotic cultures, positioning products for gut health and family-oriented consumption.

Similarly, Danone’s plant-based portfolios, including Good Plants and Activia Plant-Based, apply traditional dairy fermentation expertise to non-dairy matrices. These products emphasize probiotics, protein enrichment, and immune-support benefits, enabling Danone to retain functional dairy consumers transitioning to plant-based diets.

By addressing documented micronutrient gaps and digestive health needs, functional plant-based dairy is evolving into a nutritional necessity rather than a niche alternative, accelerating long-term market growth.

GCC Plant-Based Dairy Products Market Challenges:

Supply Chain Disruptions & Heavy Dependency on Imported Raw Materials

A significant challenge confronting the plant-based dairy market is supply chain vulnerability combined with heavy reliance on imported raw materials, which undermines production reliability and intensifies cost pressures across sourcing, manufacturing, and distribution.

Plant-based dairy formulations rely heavily on commodities such as almonds, soybeans, oats, and coconuts, whose availability and pricing are influenced by climatic conditions, geographic concentration, and global logistics. Almonds, for instance, are largely sourced from California, where recurring droughts and water scarcity have constrained output, tightening global supply and creating price volatility. Such disruptions increase procurement risk and operational complexity for manufacturers.

These pressures are compounded in the GCC, where approximately 85% of total food consumption is import-dependent, exposing plant-based dairy producers to shipping delays, geopolitical disruptions, rising freight rates, and currency fluctuations. Heavy reliance on imported ingredients also heightens sensitivity to tariff changes and foreign exchange movements, which can compress margins and limit pricing flexibility in consumer markets.

Without stronger local sourcing and supply-chain resilience, continued import dependence will constrain cost efficiency, disrupt production continuity, and limit the scalability and affordability of plant-based dairy across the GCC.

GCC Plant-Based Dairy Products Market (2026-32) Segmentation Analysis:

The GCC Plant-Based Dairy Products Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type

- Plant-Based Milk

- Almond Milk

- Soy Milk

- Coconut Milk

- Oat Milk

- Others

- Plant-Based Cheese

- Nut-based Cheese

- Soy-based Cheese

- Plant-Based Yogurt

- Almond Yogurt

- Coconut Yogurt

- Plant-Based Butter

- Plant-Based Creamers

- Plant-Based Frozen Desserts

- Others

The plant-based milk segment now holds the top spot in the GCC Plant-Based Dairy Products Market, accounting for 92% market share, primarily driven by its role as the most direct and versatile substitute for conventional dairy milk across daily consumption occasions.

Plant-based milk is widely used for drinking, cooking, baking, and beverage applications such as tea, coffee, and smoothies, giving it a significantly broader usage base than other plant-based dairy categories.

High prevalence of lactose intolerance and dairy sensitivity has further accelerated consumer shift toward plant-based milk, as it offers easier digestion while maintaining familiarity in taste and functionality.

Additionally, strong product diversity spanning almond, soy, oat, coconut, and blended variants allows brands to cater to varied taste preferences, nutritional needs, and price points. Shelf-stable formats, longer storage life, and wider retail availability across supermarkets, convenience stores, and foodservice outlets also support higher penetration.

In comparison, categories such as plant-based cheese, yogurt, and frozen desserts remain niche, consumption-specific, and less frequently purchased, reinforcing plant-based milk’s dominant market position.

Based on Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Specialty Stores

- Convenience Stores

- Others

The supermarkets & hypermarkets segment leads the GCC Plant-Based Dairy Industry, with a market share of around 65%, as they remain the primary point of purchase for everyday food and beverage products. Their dominance is driven by extensive shelf space, which allows retailers to stock a wide variety of plant-based milk, yogurt, and other dairy alternatives across multiple brands, formats, and price tiers. This wide assortment enables consumers to compare products easily and encourages trial of new plant-based offerings.

Additionally, hypermarkets attract high footfall due to their one-stop shopping convenience, particularly for families and bulk purchasers. Frequent in-store promotions, private-label offerings, and competitive pricing further strengthen their appeal. Established cold-chain infrastructure and efficient inventory management also ensure consistent product availability and quality.

Compared to online platforms and specialty stores, hypermarkets provide immediate product access and physical visibility, which is especially important for first-time buyers seeking familiarity and trust. As a result, supermarkets and hypermarkets continue to serve as the dominant distribution channel, reinforcing their leading share in the plant-based dairy market.

GCC Plant-Based Dairy Products Market (2026-32): Regional Projection

The GCC Plant-Based Dairy Products Market is dominated by the UAE, which holds a commanding 39% share, driven by its advanced retail infrastructure, high consumer purchasing power, and strong adoption of health-oriented food products.

The country has a large expatriate population with diverse dietary preferences, including a higher inclination toward plant-based and lactose-free alternatives. Rising awareness of lactose intolerance, vegan and flexitarian lifestyles, and nutritional labeling has further supported demand growth.

The UAE’s well-developed supermarket and hypermarket network ensures wide product availability, while premium cafés and foodservice outlets increasingly incorporate plant-based milk options into their menus.

Additionally, government-led initiatives focused on food security, sustainability, and future food systems encourage local manufacturing and innovation in plant-based categories. Compared to other GCC countries, faster product launches, greater brand presence, and higher consumer acceptance position the UAE as the leading market, reinforcing its dominant share in the regional plant-based dairy landscape.

Gain a Competitive Edge with Our GCC Plant-Based Dairy Products Market Report

- GCC Plant-Based Dairy Products Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Plant-Based Dairy Products Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Plant-Based Dairy Products Market Trends & Development

- GCC Plant-Based Dairy Products Market Dynamics

- Growth Drivers

- Challenges

- GCC Plant-Based Dairy Products Market Regulations, Policies & Standards

- GCC Plant-Based Dairy Products Market Import & Export Analysis

- GCC Plant-Based Dairy Products Market Supply Chain Analysis

- GCC Plant-Based Dairy Products Market Hotspots & Opportunities

- GCC Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- Plant-Based Milk

- Almond Milk

- Soy Milk

- Coconut Milk

- Oat Milk

- Others

- Plant-Based Cheese

- Nut-based Cheese

- Soy-based Cheese

- Plant-Based Yogurt

- Almond Yogurt

- Coconut Yogurt

- Plant-Based Butter

- Plant-Based Creamers

- Plant-Based Frozen Desserts

- Others

- Plant-Based Milk

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- Plant-based Acidulants

- Plant-based Botanicals

- Plant-based Carotenoids

- Vegetable Oils

- Polysaccharides & Oligosaccharides

- Plant-based Sweeteners

- Other Commodities (Water, Cereals, Juices, etc.)

- By Nature - Market Size & Forecast 2022-2032, USD Million

- Organic

- Conventional

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Supermarkets & Hypermarkets

- Online Stores

- Specialty Stores

- Convenience Stores

- Others

- By End User - Market Size & Forecast 2022-2032, USD Million

- Bakery & Confectionery

- Snacks & Savouries

- Ready Meals

- HoReCa

- Dietary Supplements

- Other Food Products

- Others

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- The UAE Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Saudi Arabia Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Qatar Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Kuwait Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Oman Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Bahrain Plant-Based Dairy Products Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product Type - Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type - Market Size & Forecast 2022-2032, USD Million

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By End User - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- GCC Plant-Based Dairy Products Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Danone, Groupe

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oatly Group AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lam Soon Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Green Spot Co Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Laboratorios Almond SL

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Koita FZE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Australasian Conference Association Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ecotone

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Koninklijke Wessanen NV

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- WhiteWave Foods Co

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saudia Dairy & Foodstuff Co Ltd (SADAFCO)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- WhiteWave Foods Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Danone, Groupe

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making