Europe Breakfast Cereals Market Research Report: Forecast (2026-2032)

Europe Breakfast Cereals Market - By Nature (Conventional, Organic), By Product Type (Ready-to-cook Cereals, Ready-to-Eat Cereals), By Ingredient Type (Corn, Wheat, Multi Grain, ...Rice, Gluten-Free, Organic, High Fiber, Oats, Others), By Price Category (Low, Medium, High), By Packaging Type (Boxes, Stand-Up Pouches, Portable containers, Others), By Age Group (Children, Adults, Seniors), By Distribution Channel (Supermarkets & Hypermarkets, Retail Stores, Convenience Stores, Ecommerce, Others), and others Read more

- Food & Beverages

- Dec 2025

- Pages 168

- Report Format: PDF, Excel, PPT

Europe Breakfast Cereals Market

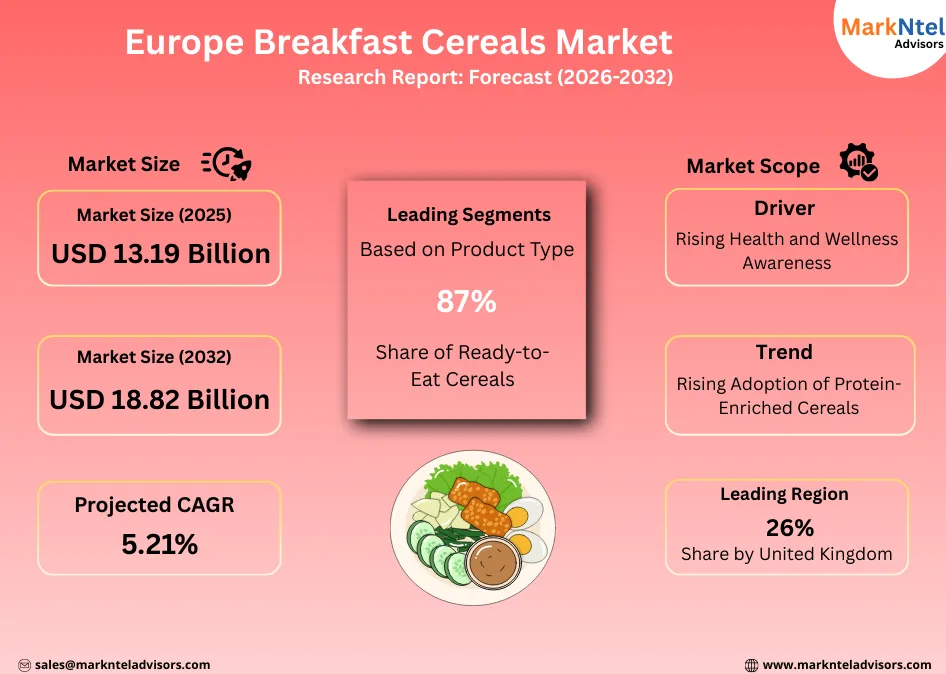

Projected 5.21% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 13.19 Billion

Market Size (2032)

USD 18.82 Billion

Base Year

2025

Projected CAGR

5.21%

Leading Segments

By Product Type: Ready-To-Eat Cereals

Europe Breakfast Cereals Market Report Key Takeaways:

- The Europe Breakfast Cereals Market size is valued at around USD 13.19 billion in 2025 and is projected to reach USD 18.82 billion by 2032. The estimated CAGR from 2026 to 2032 is around 5.21%, indicating strong growth.

- By product type, the ready-to-eat cereals segment represented 87% of the Europe Breakfast Cereals Market size in 2025.

- By nature, the conventional segment holds around 94% share of the Europe Breakfast Cereals Market size in 2025.

- By country, the United Kingdom leads the Europe Breakfast Cereals Market with a substantial 26% share in 2025. Denmark emerges as the fastest-growing country, projected to expand at a robust 7.11% CAGR during 2026-32.

- The leading breakfast cereal companies in Europe are General Mills Inc. (U.S.), Kellogg's Co (U.S.), Nestlé SA (Switzerland), Weetabix Food Company, Post Consumer Brands, Pepsico, Associated British Foods Plc, Oetker-Gruppe, Lantmännen, Peter Kölln GmbH & Co KGaA, and others.

Market Insights & Analysis: Europe Breakfast Cereals Market (2026- 2032):

The Europe Breakfast Cereals Market size is valued at around USD 13.19 billion in 2025 and is projected to reach USD 18.82 billion by 2032. Along with this, the market is estimated to grow at a CAGR of around 5.21% during the forecast period, i.e., 2026-32.

The Europe Breakfast Cereals Market is experiencing rapid growth, driven by rising health and wellness awareness and increasing demand for protein-fortified cereals that support balanced nutrition, active lifestyles, and preventive health across urban and working populations.

In 2025, the European Food Information Council’s Fiber in Focus campaign underscored the public health urgency associated with low whole-grain and fiber intake, linking dietary gaps to over 145,000 preventable deaths and 2.9 million years of healthy life lost across the EU. This has reinforced policy-led and consumer-driven demand for fiber-rich and whole-grain breakfast cereals.

Regulatory frameworks are further accelerating market transformation. The Nordic Nutrition Recommendations 2023 highlight that a high intake of whole grains, including cereals such as wheat, oats, rye, and barley, lowers risks of cardiovascular disease, colorectal cancer, type 2 diabetes, and premature mortality, while no adverse effects have been found from higher whole-grain consumption. The recommendations advise consuming at least 90 g/day of whole grains (dry weight), with preferential use of whole grain cereals other than rice for both nutritional and environmental benefits. This guidance supports public health efforts to increase whole-grain cereal intake as part of a balanced diet. These guidelines directly influence food procurement standards in schools, hospitals, and public institutions, indirectly boosting demand for compliant breakfast cereals.

Government-supported nutrition programmes also play a critical role. Several European countries continue to integrate whole-grain cereals into school breakfast schemes and public nutrition initiatives, reinforcing healthier eating habits from an early age and supporting long-term consumption growth.

On the demand side, Europe’s large working population of nearly 197.6 million employed individuals in 2024 is driving preference for convenient, time-efficient breakfast solutions. Long commuting times, dual-income households, and urban lifestyles have increased reliance on ready-to-eat cereals that offer both nutritional balance and ease of consumption.

Looking beyond 2025, the EU’s Food 2030 framework is expected to sustain innovation through funding for nutritionally enhanced, functional, and sustainable food products. Research into consumer behavior, protein fortification, and clean-label formulations will further strengthen the role of breakfast cereals within modern diets.

Overall, the convergence of health-driven policies, regulatory reform, and urban lifestyle dynamics will continue to strengthen the positioning of breakfast cereals as a convenient and nutritious staple, supporting steady market growth across Europe in the coming years.

Europe Breakfast Cereals Market Recent Developments:

- April 2025: Kellogg’s expanded its UK breakfast cereal range with the launch of High Protein Bites, targeting health-focused consumers. The new line includes a Choco Hazelnut variant offering 21% plant-based protein and high fiber content. It is produced without high-fructose syrup, aligning with growing demand for cleaner, nutrition-oriented breakfast options in the United Kingdom.

- March 2025: Marks & Spencer rolled out a new Only Ingredients cereal range focused on minimal processing and clean labels. The portfolio includes single-ingredient cornflakes, Multigrain Hoops made with five natural ingredients, and Choco Hoops containing six ingredients. The launch reflects rising European demand for transparent formulations and simplified ingredient lists in breakfast cereals.

Europe Breakfast Cereals Market Scope:

| Category | Segments |

|---|---|

| By Nature | Conventional, Organic), |

| By Product Type | Ready-to-cook Cereals, Ready-to-Eat Cereals), |

| By Ingredient Type | Corn, Wheat, Multi Grain, Rice, Gluten-Free, Organic, High Fiber, Oats, Others), |

| By Price Category | Low, Medium, High), |

| By Packaging Type | Boxes, Stand-Up Pouches, Portable containers, Others), |

| By Age Group | Children, Adults, Seniors), |

| By Distribution Channel | Supermarkets & Hypermarkets, Retail Stores, Convenience Stores, Ecommerce, Others), and others |

Europe Breakfast Cereals Market Drivers:

Rising Health and Wellness Awareness

In Europe, rising health awareness, particularly related to dietary fiber, whole grains, and chronic disease prevention, has become a major driver supporting demand for breakfast cereals. Public health authorities across the region consistently recommend higher whole-grain and fiber intake to improve overall diet quality.

Most European dietary guidelines advise adults to consume 25–35 g of fiber per day; however, average intake remains below recommended levels, prompting governments and nutrition bodies to actively promote whole-grain foods as part of balanced diets.

Industry and health organizations have reinforced this shift through evidence-based advocacy. A June 2025 systematic review published by the European Breakfast Cereal Association (CEEREAL) found that regular consumption of breakfast cereals, particularly whole-grain and high-fiber variants, is linked to a 10%–28% reduction in cardiovascular disease risk and up to a 22% lower risk of type-2 diabetes.

In response, CEEREAL members have reformulated products by increasing whole-grain content by approximately 38.6% and fiber by 12.3%, while reducing sugar levels by 9.0% between 2015 and 2023, aligning products more closely with public health recommendations.

Consumer awareness has further improved through the European Food Information Council’s #SwitchToWholeGrains campaign (2025), which promotes replacing refined grains with whole-grain alternatives.

Supported by regulatory guidance, scientific validation, and sustained public health initiatives, rising health consciousness will remain a powerful driver for growth in Europe’s breakfast cereals market in the years ahead.

Europe Breakfast Cereals Market Trends:

Rising Adoption of Protein-Enriched Cereals

Protein-fortified breakfast cereals are emerging as a key trend in Europe as consumers increasingly prioritize muscle health, satiety, weight management, and active lifestyles. The European Food Safety Authority (EFSA) authorizes protein-related nutrition claims, confirming that protein supports the maintenance and growth of muscle mass and normal bone health. This regulatory clarity has enabled manufacturers to integrate higher protein content into everyday cereal formulations while remaining compliant with EU labelling standards.

Public-health guidance further reinforces this shift. European clinical nutrition authorities, including ESPEN, recommend that older adults consume approximately 1.0–1.5 g of protein per kilogram of body weight per day to help preserve muscle mass, support muscle protein synthesis, and promote healthy ageing. These guidelines also emphasize spreading protein intake evenly across meals to maximize metabolic and functional benefits. Parallel growth in recreational fitness, sports participation, and active commuting has strengthened demand for convenient, protein-rich foods that fit busy routines, positioning breakfast cereals as an ideal delivery format.

Manufacturers are increasingly enhancing mainstream cereals rather than launching niche products, using plant-based proteins from oats, wheat, pulses, nuts, and seeds to meet protein and clean-label expectations. For instance, Weetabix Protein provides around 19 g of protein per 100 g serving, nearly double that of standard variants, targeting active and working consumers.

Overall, protein fortification is transforming traditional cereals into functional staples aligned with modern nutritional priorities. By embedding higher protein content into core product lines, manufacturers are scaling this trend rapidly, strengthening breakfast cereals’ relevance within Europe’s evolving dietary landscape.

Europe Breakfast Cereals Market Challenges:

Regulatory Compliance Costs Hindering Market Expansion

Escalating regulatory requirements across Europe are increasing compliance costs for breakfast cereal manufacturers. The EU Nutrition and Health Claims Regulation mandates strict scientific substantiation and precise labelling, while recent EU food-safety reviews have intensified scrutiny of on-pack claims, ingredient disclosures, and nutritional thresholds. This has increased expenditures on laboratory testing, regulatory approvals, and frequent packaging updates.

In the UK, tighter restrictions on foods high in fat, sugar, and salt (HFSS) have compelled manufacturers to reformulate recipes, redesign packaging, and revise promotional strategies to maintain retail visibility. Government impact assessments indicate that such adjustments generate substantial operational and compliance-related expenses for food producers.

Trade and sanitary regulations have further amplified cost pressures. For instance, in 2024, UK food exporters reported approximately USD 216 million in additional regulatory costs linked to border controls, certification, and compliance documentation, directly affecting export-oriented cereal producers’ margins.

Overall, rising regulatory, reformulation, and trade compliance costs are squeezing margins, slowing innovation, and limiting competitive flexibility, thereby restraining growth potential in Europe’s breakfast cereals market.

Europe Breakfast Cereals Market (2026-32) Segmentation Analysis:

The Europe Breakfast Cereals Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type

- Ready-to-cook Cereals

- Ready-to-Eat Cereals

The ready-to-eat cereals are the most preferred products in the European Breakfast Cereals Industry, with a market share of around 87%, driven primarily by convenience, time efficiency, and broad consumer appeal.

Urbanization, high female workforce participation, and dual-income households across Europe have reduced time available for breakfast preparation, making RTE cereals a preferred weekday option. These products require no cooking, offer consistent taste and portion control, and integrate easily with milk, yoghurt, or plant-based alternatives.

RTE cereals also benefit from extensive product variety, whole-grain, high-fiber, low-sugar, and protein-fortified options, allowing manufacturers to address health, wellness, and lifestyle needs within a single format.

Strong penetration in supermarkets and hypermarkets, combined with frequent promotional visibility and private-label availability, further reinforces their dominance. Additionally, school breakfast programmes and institutional catering often favor RTE formats for operational simplicity and cost efficiency.

Collectively, these factors sustain high consumption frequency and replacement cycles, cementing RTE cereals’ leading share in the European breakfast cereals market.

Based on Nature

- Conventional

- Organic

The conventional category leads the European Breakfast Cereals Industry, holding around 94% market share, reflecting their widespread availability, price competitiveness, and established consumer acceptance across Europe.

Conventional cereals benefit from large-scale agricultural supply chains, enabling consistent raw material availability and stable pricing, which supports mass production and broad retail distribution. This makes them more affordable for price-sensitive households, particularly amid inflationary pressures affecting food budgets.

In addition, conventional cereals dominate supermarket and hypermarket shelf space, supported by strong private-label penetration and frequent promotional activity. Manufacturers also have greater flexibility in formulation, fortification, and ingredient sourcing under conventional standards, allowing rapid innovation in areas such as high-fiber, whole-grain, and protein-enriched products without the higher costs associated with organic certification.

Furthermore, institutional buyers, including schools, hospitals, and catering services, largely favor conventional cereals due to cost efficiency and reliable supply volumes. Collectively, these factors sustain the overwhelming dominance of conventional cereals within the European breakfast cereals market.

Europe Breakfast Cereals Market (2026-32): Regional Projection

The Europe Breakfast Cereals Market is dominated by the United Kingdom, which holds a commanding 26% market share, due to its deeply embedded cereal consumption culture and high household penetration of ready-to-eat cereals. Breakfast cereals are a staple in UK diets, supported by long-standing consumer habits and strong brand loyalty toward both multinational and private-label offerings.

The UK’s highly developed grocery retail ecosystem, characterized by extensive supermarket networks, private labels, and frequent promotional activity, ensures wide product availability and competitive pricing.

In addition, regulatory measures targeting foods high in fat, sugar, and salt (HFSS) have accelerated reformulation, driving rapid adoption of low-sugar, high-fiber, and protein-fortified cereals that align with evolving health preferences.

Meanwhile, Denmark is projected to grow at a 7.11% CAGR during the forecast period, driven by strong consumer focus on health and wellness, high adoption of whole-grain and organic foods, and supportive Nordic dietary guidelines promoting fiber-rich cereals.

Strong participation in school breakfast programmes and public nutrition initiatives further reinforces consumption volumes. Combined with high urbanization, busy lifestyles, and a large working population favoring convenient meal options, these factors collectively underpin the UK’s leading market share within Europe.

Gain a Competitive Edge with Our Europe Breakfast Cereals Market Report

- Europe Breakfast Cereals Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Europe Breakfast Cereals Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- Europe Breakfast Cereals Market Trends & Development

- Europe Breakfast Cereals Market Dynamics

- Growth Drivers

- Challenges

- Europe Breakfast Cereals Market Regulations, Policies & Standards

- Europe Breakfast Cereals Market Import & Export Analysis

- Europe Breakfast Cereals Market Supply Chain Analysis

- Europe Breakfast Cereals Market Hotspots & Opportunities

- Europe Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Metric Tons)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- Conventional

- Organic

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- Ready-to-cook Cereals

- Ready-to-Eat Cereals

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- Corn

- Wheat

- Multi Grain

- Rice

- Gluten-Free

- Organic

- High Fiber

- Oats

- Others

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- Low

- Medium

- High

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- Boxes

- Stand-Up Pouches

- Portable containers

- Others

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- Children

- Adults

- Seniors

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Supermarkets & Hypermarkets

- Retail Stores

- Convenience Stores

- Ecommerce

- Others

- By Country

- Germany

- France

- The UK

- Italy

- Spain

- The Netherlands

- Scandinavia

- Rest of Europe

- By Company

- Competition Characteristics

- Market Share of Leading Companies

- By Nature - Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Germany Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- France Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- The UK Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Italy Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Spain Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- The Netherlands Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Scandinavia Breakfast Cereals Market Outlook, 2022-2032F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (USD Million)

- Market Share & Analysis

- By Nature - Market Size & Forecast 2022-2032, USD Million

- By Product Type- Market Size & Forecast 2022-2032, USD Million

- By Ingredient Type- Market Size & Forecast 2022-2032, USD Million

- By Price Category- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type - Market Size & Forecast 2022-2032, USD Million

- By Age Group - Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- Europe Breakfast Cereals Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- General Mills Inc. (U.S.)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kellogg's Co (U.S.)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nestlé SA (Switzerland)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Weetabix Food Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Post Consumer Brands

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pepsico

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Associated British Foods Plc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oetker-Gruppe

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lantmännen

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Peter Kölln GmbH & Co KGaA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- General Mills Inc. (U.S.)

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making