US Automotive Industry Market Research Report: Forecast (2025-2030)

US Automotive Industry Size and Analysis - Automotive Industry in US - By Vehicle Type (Passenger Cars & Sports Utility Vehicles [SUVs], Commercial Vehicles, Three-Wheelers, Two-Wh...eelers), By Propulsion Type (Internal Combustion Engine [ICE], Electric, Hybrid, Others), By Distribution Channel (Dealerships, Company-Owned Stores, Online Retail/E-Commerce, Fleet Sales, Others), By End-User (Individual/Household, Commercial/Corporate, Government & Public Sector, Ride-Sharing/Subscription Services) and Others Read more

- Automotive

- Aug 2025

- Pages 137

- Report Format: PDF, Excel, PPT

US Automotive Industry Market

Projected 2.1% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2024)

USD 1.2 Trillion

Market Size (2030)

USD 1.6 Trillion

Base Year

2024

Projected CAGR

2.1%

Leading Segments

By Propulsion Type: ICE Engine

Market Insights & Analysis: US Automotive Industry Market (2025-30):

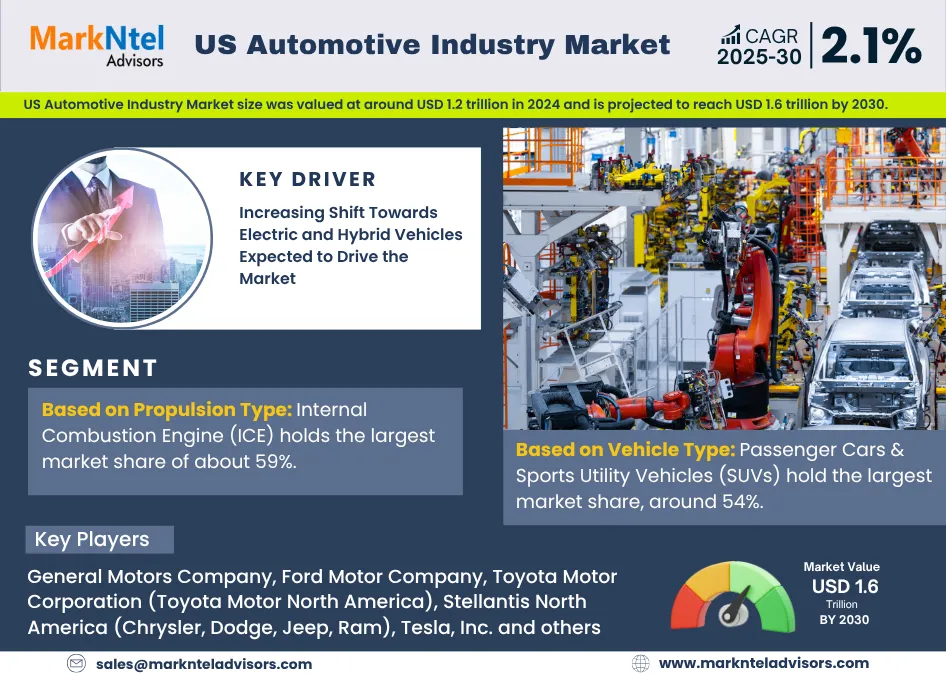

The US Automotive Industry Market size was valued at around USD 1.2 trillion in 2024 and is projected to reach USD 1.6 trillion by 2030. Along with this, the market is estimated to grow at a CAGR of around 2.1% during the forecast period, i.e., 2025-30. The US Automotive Industry Market growth is due to the increasing need for electric & hybrid vehicles, need for automated driving solutions, integration of advanced technologies such as cloud, AI, IIoT, and others, growing acceptance of MaaS, government support, increasing partnerships & collaborations, developing EV charging infrastructure, electrification of the sector, etc.

The growing young population, primarily Gen-Z and millennials, is evolving the US automotive industry by adopting mobility-as-a-service (MaaS) over the ownership of vehicles. The tech-savvy generation prefers services like Uber, Lyft, Zipcar, Turo, and other subscription-based vehicle services over conventional. To meet such a shifting market, manufacturers such as Toyota, Volvo, and Hyundai have initiated subscription-based services, promoting carpooling and MaaS in the country.

Moreover, the increasing technological advancements nationwide have pushed the automotive manufacturers to partner with technological companies like Google, Amazon, NVIDIA, Apple, etc., for developing the connected vehicle ecosystem, accessibility to in-car entertainment platforms, autonomous driving solutions, and others. For instance, General Motors partners with Google to develop the Android system into their infotainment platforms. Similarly, Hyundai collaborated with Aptiv and developed Motional, a commercial joint venture for autonomous ride-hailing, thus promoting the growth of the market in the United States.

US Automotive Industry Market Scope:

| Category | Segments |

|---|---|

| By Vehicle Type | Passenger Cars & Sports Utility Vehicles [SUVs], Commercial Vehicles, Three-Wheelers, Two-Wheelers |

| By Propulsion Type | Internal Combustion Engine [ICE], Electric, Hybrid, Others |

| By Distribution Channel | Dealerships, Company-Owned Stores, Online Retail/E-Commerce, Fleet Sales, Others |

| By End-User | Individual/Household, Commercial/Corporate, Government & Public Sector, Ride-Sharing/Subscription Services |

US Automotive Industry Market Driver:

Increasing Shift Towards Electric and Hybrid Vehicles – The demand for hybrid and electric vehicles has increased lately due to the shift towards cleaner alternatives, government support, technological advancements, low-cost, expanding EV ecosystem, and others. The government is increasingly supporting EVs through incentives, acts, programs, and other initiatives, with the aim of reducing carbon emissions and carbon pollutants in the environment, primarily generated by the automotive industry in the US. The Inflation Reduction Act (IRA) was initiated in 2022 by the government authorities to expand the Clean Vehicle Credits up to USD7,500 for new EVs and around USD4,000 for used EVs. Additionally, with the increasing investment in the development of the EV ecosystem, an investment of around USD5 billion has been announced to be invested from 2022 to 2026 under the National Electric Vehicle Infrastructure (NEVI) Programs, for the establishment of the fast charging DC infrastructures along major highways in the United States.

Thus, such initiatives and incentives have encouraged US citizens to adopt low-cost, environment-friendly vehicles over conventional ones, with more than 630,500 EVs sold in the first five months of 2025. Similarly, the leading automotive companies such as Toyota and Ford have recorded a rise of nearly 30% in the sales of EVs from 2023 to 2024. Henceforth, the increasing demand and ownership of electric and hybrid vehicles is propelling the automotive industry of the US.

US Automotive Industry Market Challenge:

High Tariff Rates Hinder Market Growth – The ongoing tariff disruptions of the U.S. with other nations are a major setback for the market. As most of the vehicles and automotive parts are imported from other countries like Mexico, Japan, China, South Korea, and Canada, which account for nearly 50% of the automotive vehicles in the nation, this is driving the automotive industry in the US. The increasing tariff rate has immediate and prolonged effects on the market, as the automotive vehicles sold in the U.S. are assembled and imported outside the country. Thus, the surging tariff rate becomes a huge hurdle for the automakers, resulting in the high cost of the vehicles. For instance, in April, a 25% tariff was imposed on the import of all passenger vehicles, including sedans, SUVs, light trucks, etc., and automotive parts like engines, batteries, and electronic components. Such high impositions eventually increase the cost of the vehicles, resulting in the decline of sales in the United States, hence hindering the market growth in the nation.

US Automotive Industry Market Trend:

Increasing Integration of AI and ML Technologies – The advancements in the automotive market of the US have increased lately, due to the growing need for automated driving assistance and management of the vehicle, security reasons, predictive maintenance, traffic & route optimization, etc. The rising cases of road accidents and the rising mortality rate, with approximately 21,400 individuals dying in motor vehicle accidents in the first half of 2025. These numbers have pushed the automotive owners to integrate the Autonomous Driving Assistance System (ADAS) into their vehicles, ensuring the safety of the driver and passengers in the vehicles. The AI, ML-driven ADAS system, in real time, monitors the surroundings of the vehicles and manages the vehicles and alerts the driver before the collision, preventing the accident.

Moreover, the ADAS and AI-powered driving solutions make smart and quick decisions because of the real-time analysis and monitoring of the environment through sensors and cameras, offering an enhanced adaptive cruise control, lane changing, and automated emergency braking. It further optimizes the route of travel, escaping the heavy traffic, and it predicts the maintenance of the vehicle, thus maintaining the efficiency of the vehicle. Companies like Tesla, GM, Waymo, etc., are partnering with Mercedes-Benz’s MBUX and Google Assistant AI solution partners for the deployment of their services. Thus, the optimized navigation, predictive maintenance, automated driving solutions, and others in the automotive industry increase the demand for ADAS and AI-powered automotive vehicles in the US.

US Automotive Industry Market (2025-30): Segmentation Analysis

The US Automotive Industry Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Vehicle Type:

- Passenger Cars & Sports Utility Vehicles (SUVs)

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Three-Wheelers

- Two-Wheelers

Based on vehicle type, the passenger cars & SUVs hold the largest market share, around 54%. This is primarily due to the increasing sales and ownership of SUVs, which account for 57% of the new vehicle sales in the country in 2025. It is due to its power, performance on all terrain types, safety, etc., which makes it a common choice among the citizens in the United States. The Toyota RAV4, Honda CR-V, and Tesla Model Y are among the most popular choices of individuals, resulting in them being among the top-selling vehicles nationwide.

The long-distance traveling, suburban life, and wider roads lead to the increasing adoption of SUVs, offering a comfortable and premium driving experience because of their spacious interior, higher seating position, easier integration of advanced driving solutions, powerful engines, and other features. The growing inclination towards SUVs and their surging sales has resulted in the phase out of their sedan models to focus on their SUV range, like the Ford Escape and Bronco Sport. Thus, this shift impacts and revolutionizes the automotive vehicles market, facilitating the large market share of SUVs in the automotive industry of the US.

Based on Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric

- Hybrid

- Others

The internal combustion engine (ICE) holds the largest market share of about 59%. This is due to the well-established ICE infrastructure, consumer familiarity, cost-effectiveness, adaptability, flexibility, large manufacturing capacities, etc. However, electric vehicles are the fastest growing, while ICE vehicles remain the dominant, with approximately 70% of the new vehicles sold being ICE. This is due to the well-established fueling infrastructure and the consumers' familiarity with the ICE vehicles and their features, whereas the electric infrastructure is emerging with the rapid investments into it, thus, for the long journey and widespread availability of the fueling units, makes ICE a common purchase for US citizens.

The ICE-powered models like Ford F-150, Chevrolet Silverado, and Ram 1500 are among the top-selling automotive in the country, positively influencing the ICE segment. Further, the lower upfront cost of ICEs than electric and hybrid vehicles due to the expensive components and technologies of electric and hybrid models has made ICEs more accessible to middle-class income consumers, thus increasing the demand for ICE vehicles in the US automotive industry.

US Automotive Industry Recent Development:

- 2025: General Motors announced a $4 billion investment in U.S. manufacturing, aimed at expanding its capacity for both gas-powered and electric vehicles across facilities in Michigan, Kansas, and Tennessee. This initiative is projected to elevate GM’s annual U.S. assembly output to over 2 million vehicles by 2027.

- 2025: Stellantis announced the revival of its iconic Street & Racing Technology (SRT) brand, signaling a renewed focus on high-performance vehicles across its core U.S. divisions—Chrysler, Dodge, Jeep, and Ram. This strategic move aims to reinvigorate consumer interest and brand loyalty by leveraging SRT’s performance heritage, aligning with Stellantis’ broader efforts to enhance its product lineup and competitiveness in the North American market.

Gain a Competitive Edge with Our US Automotive Industry Market Report

- US Automotive Industry Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- US Automotive Industry Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation (2025–30)

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- US Automotive Industry Market Policies, Regulations, and Product Standards

- US Automotive Industry Market Supply Chain Analysis

- US Automotive Industry Market Trends & Developments

- US Automotive Industry Market Dynamics

- Growth Drivers

- Challenges

- US Automotive Industry Market Hotspot & Opportunities

- US Automotive Industry Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Vehicle Type

- Passenger Cars & Sports Utility Vehicles (SUVs) – Market Size & Forecast 2025–2030, USD Million & Million Units

- Commercial Vehicles – Market Size & Forecast 2025–2030, USD Million & Million Units

- Light Commercial Vehicles – Market Size & Forecast 2025–2030, USD Million & Million Units

- Heavy Commercial Vehicles – Market Size & Forecast 2025–2030, USD Million & Million Units

- Three-Wheelers – Market Size & Forecast 2025–2030, USD Million & Million Units

- Two-Wheelers – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Propulsion Type

- Internal Combustion Engine (ICE) – Market Size & Forecast 2025–2030, USD Million & Million Units

- Electric – Market Size & Forecast 2025–2030, USD Million & Million Units

- Hybrid – Market Size & Forecast 2025–2030, USD Million & Million Units

- Others – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Distribution Channel

- Dealerships – Market Size & Forecast 2025–2030, USD Million & Million Units

- Company-Owned Stores – Market Size & Forecast 2025–2030, USD Million & Million Units

- Online Retail/E-Commerce – Market Size & Forecast 2025–2030, USD Million & Million Units

- Fleet Sales – Market Size & Forecast 2025–2030, USD Million & Million Units

- Others (Direct-to-Consumer, Rental, etc.) – Market Size & Forecast 2025–2030, USD Million & Million Units

- By End-User

- Individual/Household – Market Size & Forecast 2025–2030, USD Million & Million Units

- Commercial/Corporate – Market Size & Forecast 2025–2030, USD Million & Million Units

- Government & Public Sector – Market Size & Forecast 2025–2030, USD Million & Million Units

- Ride-Sharing/Subscription Services – Market Size & Forecast 2025–2030, USD Million & Million Units

- Others – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Vehicle Type

- Market Size & Outlook

- By Company

- Company Revenue Shares

- Competitor Characteristics

- US Internal Combustion Engine (ICE) Automotive Industry Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Vehicle Type – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million & Million Units

- By End-User – Market Size & Forecast 2025–2030, USD Million & Million Units

- Market Size & Outlook

- US Electric Automotive Industry Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Vehicle Type – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million & Million Units

- By End-User – Market Size & Forecast 2025–2030, USD Million & Million Units

- Market Size & Outlook

- US Hybrid Automotive Industry Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Vehicle Type – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million & Million Units

- By End-User – Market Size & Forecast 2025–2030, USD Million & Million Units

- Market Size & Outlook

- US Hydrogen Fuel Cell Automotive Industry Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Units)

- Market Share & Outlook

- By Vehicle Type – Market Size & Forecast 2025–2030, USD Million & Million Units

- By Distribution Channel – Market Size & Forecast 2025–2030, USD Million & Million Units

- By End-User – Market Size & Forecast 2025–2030, USD Million & Million Units

- Market Size & Outlook

- US Automotive Industry Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- General Motors Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ford Motor Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toyota Motor Corporation (Toyota Motor North America)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Stellantis North America (Chrysler, Dodge, Jeep, Ram)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Tesla, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honda Motor Company (American Honda Motor Co.)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyundai Motor Group (Hyundai, Kia)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nissan Motor Corporation (Nissan North America)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BMW of North America, LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Volkswagen Group of America

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- General Motors Company

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making