Press Release Description

US Automotive Industry Size to Reach USD 1.6 Trillion Mark by 2030

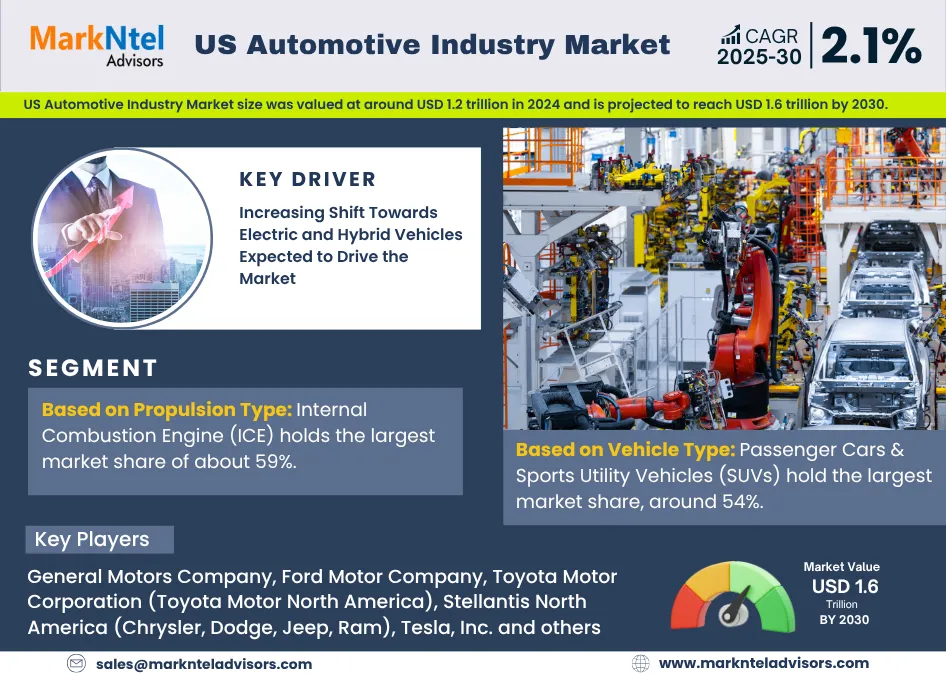

The US Automotive Industry Market size was valued at around USD 1.2 trillion in 2024 and is projected to reach USD 1.6 trillion by 2030. Along with this, the market is estimated to grow at a CAGR of around 2.1% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. The rise in the market is due to an increase in the need for electric & hybrid vehicles, the need for automated driving solutions, growing acceptance of MaaS, increasing partnerships, government support, developing EV infrastructure, integration of advances like automated driving systems, and others.

The increasing shift of consumers towards hybrid and electric vehicles because of the government support through incentives, acts, policies, and others, which encourages the adoption of lower-emission and cleaner vehicles. Further, the growing Gen-Z and millennials population prefer the accessibility to automobile ownership through mobility-as-a-service (MaaS) and other digital services, increasing the consumption of the automotive industry through services in the US.

Moreover, technological advances like ADAS and AI-powered systems are increasingly integrated into the automotive industry, providing traffic & route optimization, automated driving solutions, adaptive cruise management, automated emergency braking, lane changing & keeping, etc., offering a safe and luxurious driving experience. The increasing partnership between the automotive manufacturers and the technological solution providers for a connected vehicle ecosystem, in-car entertainment, and other technological advancements, is fueling the growth of the market in the US, further states the research report, “US Automotive Industry Market Analysis, 2025.”

US Automotive Industry Market Segmentation Analysis

Passenger Cars & Sports Utility Vehicles (SUVs) Lead the US Automotive Industry

Based on vehicle types, the market is further segmented into Passenger Cars & Sports Utility Vehicles (SUVs), Commercial Vehicles, Three-Wheelers, and Two-Wheelers. Passenger Cars & Sports Utility Vehicles (SUVs) hold the majority of the market share, around 54%. This is primarily due to the high sales and demand for SUVs, which is driven by the great power, performance on all terrains, safety features, etc.

The SUVs are the common choice of US citizens, with Toyota RAV4, Honda CR-V, and others among the top-selling models of the vehicles, nationwide. The long-distance travel and the wider road infrastructure of the US provide a comfortable and luxurious traveling experience because of its seating position, integration of advanced driving solutions, powertrain, etc. The spacious interiors of the SUVs provide more legroom and luggage space, efficient for the family road trip. Thus, the manufacturing dynamism and the integration of advanced technological solutions result in the large market share of SUVs based on their unit sales in the US.

Internal Combustion Engine (ICE) is the Most Preferred Propulsion Type

The internal combustion engine (ICE) dominates the Automotive Industry in the United States, with a market share of around 59%. It is due to the widespread accessibility, well-established ICE infrastructure, consumer familiarity, large manufacturing capacities, adaptability, flexibility, etc. The electric vehicles are the fastest-growing automotive segment of the US automotive industry; however, internal combustion engine (ICE) automotive remains the dominant segment of the market, accounting for more than 50% sales annually. This dominance is due to the well-established fueling infrastructure and the familiarity of the consumers with ICE technology and related features.

Additionally, the lower upfront cost of the ICE vehicles as compared to electric and hybrid vehicles because to the high cost of the batteries and technologies implemented in the electric vehicles. The lower cost, well-established ICE infrastructure, and the long-travel-friendly ICE vehicles facilitate the largest market share of the ICE propulsion in the US automotive industry.

Competitive Landscape

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading market companies, including General Motors Company, Ford Motor Company, Toyota Motor Corporation (Toyota Motor North America), Stellantis North America (Chrysler, Dodge, Jeep, Ram), Tesla, Inc., Honda Motor Company (American Honda Motor Co.), Hyundai Motor Group (Hyundai, Kia), Nissan Motor Corporation (Nissan North America), BMW of North America, LLC, Volkswagen Group of America, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the country?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across the country?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure