Global Automotive Cybersecurity Market Research Report: Forecast (2024-2030)

Automotive Cybersecurity Market - By Offering (Hardware, Software), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicle [LCV], Medium & Heavy Commercial Vehicles [MHCV]),... By Propulsion (ICE Vehicles, Electric Vehicles), By Vehicle Autonomy (Non-autonomous Vehicles, Semi-autonomous Vehicles, Autonomous [Driverless] Vehicles), By Deployment Type (Embedded, Integrated [Cloud-based]), By Application (Body Control & Comfort, ADAS & Safety Systems, Telematics System, Infotainment System, Powertrain System, Other), By Security Application Security, Wireless Network Security, Endpoint Security) and Other Read more

- Automotive

- Jun 2024

- Pages 243

- Report Format: PDF, Excel, PPT

Market Definition

Automotive cybersecurity refers to a set of solutions that provides security from malicious attacks to vehicle owners on their vehicle’s communication systems, automotive electronic systems, software, etc. Unauthorized access to the software may result in a lack of sensitive information, which might cause financial damage to the owners, and may also result in threatened vehicle safety.

Market Insights & Analysis: Global Automotive Cybersecurity Market (2024-30):

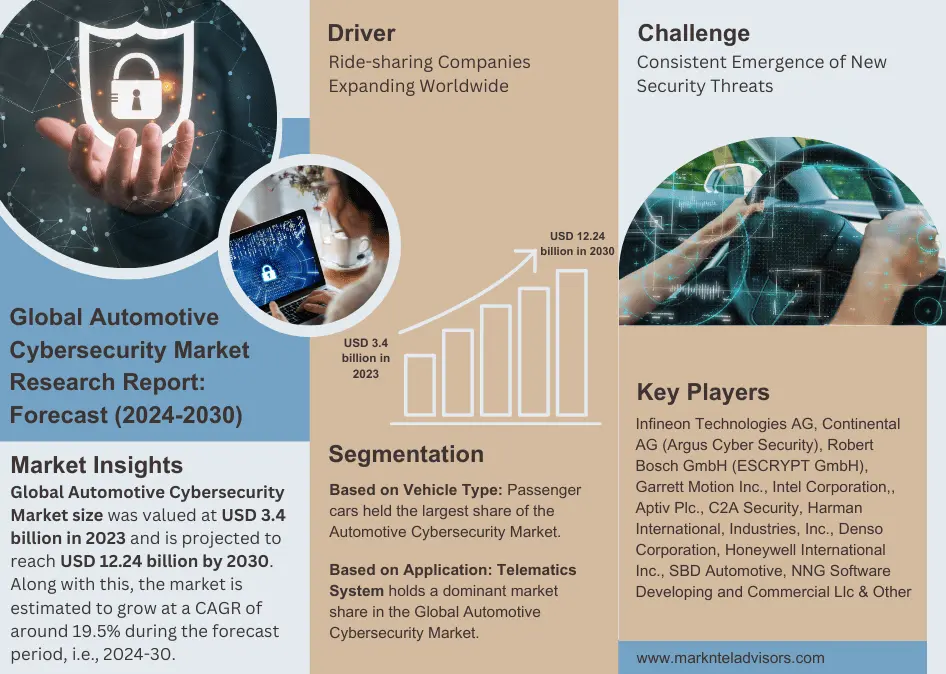

The Global Automotive Cybersecurity Market size was valued at USD 3.4 billion in 2023 and is projected to reach USD 12.24 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 19.5% during the forecast period, i.e., 2024-30. In recent years, the expansion in the number of connected cars on the road has been amplifying the demand for automotive cybersecurity solutions. This is primarily because connected cars require extensive software solutions to facilitate smooth connectivity, which results in generating a large volume of datasets as well.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 19.5% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | Infineon Technologies AG, Continental AG (Argus Cyber Security), Robert Bosch GmbH (ESCRYPT GmbH), Garrett Motion Inc., Intel Corporation,, Aptiv Plc., C2A Security, Harman International, Industries, Inc., Denso Corporation, Honeywell International Inc., SBD Automotive, NNG Software Developing and Commercial Llc., Karamba Security, Vector Informatik GmbH, and others |

| Market Value (2023) | USD 3.4 Billion |

| Market Value (2030) | USD 12.24 Billion |

The data generated from connected vehicles poses a risk of undergoing cybersecurity attacks, primarily because of the sensitive information it contains regarding the vehicle and its owner. Therefore, the adoption of connected vehicles increased over the historical years, thus generating the need for cybersecurity solutions for connected vehicles. Furthermore, there has been a substantial increment in the adoption of predictive maintenance technologies among automobile manufacturers & owners. Predictive maintenance solutions allow the owner to detect any kind of abnormality in the vehicle parts and let them get it repaired on time. This helps in preventing the safety of the vehicles & owners from any unnecessary accidents.

Also, to integrate predictive maintenance, manufacturers are including artificial intelligence and machine learning technologies to enhance the performance & accuracy of this technology. The adoption of advanced AI & ML solutions will help prevent the potential failure of vehicles. Similarly, as these technologies require large volumes of data collection, the need for their protection would amplify. Hence, this increasing adoption of predictive maintenance technologies, and vehicle diagnostic solutions has been fueling the demand for cybersecurity solutions among consumers. Moving forward, as more automobiles come with integrated predictive maintenance and diagnostic solutions, the demand for cybersecurity solutions is destined to enhance simultaneously in the forecast years.

Global Automotive Cybersecurity Market Driver:

Ride-sharing Companies Expanding Worldwide – With the increasing populace, which is becoming more urbanized, the workforce is also growing. Hence, in the past few years, the usage of ride-sharing has been amplified. Therefore, ride-sharing companies have been receiving government support in various countries, to fulfill the growing demand for their services worldwide.

The ride-sharing service not only brings ease to consumers but also helps in reducing traffic on roads. Services like these have resulted in high demand, justified by the high level of comfort they offer to consumers. These services are further enabled to deliver greater consumer comfort, along with traffic reduction. Furthermore, these services are designed to mine sensitive user information, such as personal details & travel routes, so cybersecurity is of utmost importance. Hence, ride-sharing services have been contributing to driving the Automotive Cybersecurity Market. Further, ride-sharing companies are also coming up with advanced technology and solutions to enhance their consumer experience and gain market leadership in the forecast years.

Global Automotive Cybersecurity Market Challenge:

Consistent Emergence of New Security Threats – Recently, automotive cybersecurity has become an integral part of vehicles, specifically connected vehicles. However, the cyber threat has been increasing continually over the past years, which has posed a significant challenge to existing solutions for automotive cybersecurity. Also, hackers have been continually developing advanced mechanisms to get through the automobile's software and garner sensitive user-related data. These advanced hacking mechanisms further require upgraded versions to solve cyber threats. Therefore, cybersecurity solution providers need to develop constant upgrades within their services based on upcoming hacking techniques.

This requires immense effort, time, and capital investments, which have been challenging the process of overall revenue generation in the Automotive Cybersecurity Market. Moreover, the consumer's data gets exposed with upgraded hacking techniques, which has been affecting the major concern of trust and authenticity within the available solutions. As a result, these factors have hit the acceptance of automotive cybersecurity solutions negatively, further hampering the market growth as well.

Global Automotive Cybersecurity Market Trend:

Improving Adoption of Autonomous Vehicles Worldwide – Recently, the adoption across the globe regarding autonomous vehicles, especially in North American & European countries, has emerged as a market trend. This has been mainly driven by the introduction of Advanced Driver-Assistance Systems (ADAS), which has been further smoothening the experience of autonomous driving for consumers. Hence, as the adoption of autonomous vehicles amplified the demand for cybersecurity solutions in these vehicles increased. Further, as autonomous vehicles are installed with technologies like IoT, sensors, GPS, Lasers, adaptive cruise control software, etc., the need for protection of generated data amplifies, as all the software solutions generate their specific data.

In addition, observing this significant inclination toward autonomous vehicles, automakers like Ford, Tesla, GM, etc., are also focussing on expanding their vehicle portfolio to include autonomous vehicles, to cater to this rising market demand. For instance:

- In 2023, General Motors has announced a Memorandum of Understanding (MoU) with Cruise & Honda, to establish a Joint Venture in Japan. The purpose of this venture would be to launch a driverless ride-hail service by the year 2026, in Japan.

Hence, as the adoption of autonomous vehicles would enhance for commercial purposes as well, the demand for cybersecurity solutions would also escalate, for the protection of automotive software.

Global Automotive Cybersecurity Market (2024-30): Segmentation Analysis

The Global Automotive Cybersecurity Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the global levels. Based on the analysis, the market has been further classified as:

Based on Vehicle Type:

- Passenger Vehicles

- Light Commercial Vehicle (LCV)

- Medium & Heavy Commercial Vehicles (MHCV)

The demand for cybersecurity solutions has been highest among Passenger Cars, driven by the rapid shift in consumer preferences toward electric & autonomous vehicles. In the last few years, governments of different nations have also led an initiative to increase the adoption of electric cars initially to reduce the carbon & greenhouse gas emission problems. Therefore, governments have launched a host of initiatives in the form of policies meant for consumers to increase the popularity & utility of EVs. Since EVs, by default, are incorporated with software, such as web-connected infotainment systems, GPS control, and more, these vehicles create data that could be hacked by cybercriminals. Therefore, with the increasing adoption of EVs and autonomous vehicles, the demand for cybersecurity solutions would also increase, further contributing to the passenger vehicle’s market share.

Based on Application:

- Body Control & Comfort

- ADAS & Safety Systems

- Telematics System

- Infotainment System

- Powertrain System

- Other (On-board Diagnostics, Operational Data, etc.)

Telematics systems have been one of the largely used software, which collects sensitive user information, and requires high-level cybersecurity. The adoption of telematics has been amplifying recently, specifically by car rental companies, which offer their cars for rent. This was primarily because telematics solutions allow companies to collect data related to vehicle location, driving behavior, vehicle health, etc., which makes it easier for them to manage their fleets.

Also, several logistics companies across the globe are adopting telematics solutions, in order to track their vehicles from remote locations. Hence, as the adoption of telematics software is escalating, the demand for cybersecurity solutions for telematics would also amplify, improving its market share in the forthcoming years.

Global Automotive Cybersecurity Market (2024-30): Regional Projection

Geographically, the Global Automotive Cybersecurity Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Europe has been dominating the Global Automotive Cybersecurity Market during the historical years, which has been primarily driven by the rising instances of cyberattacks in the automotive sector across the region. In countries such as Germany, automakers have been facing issues with IT infrastructure hacks, which have been affecting their vehicle production process in the region. For instance:

- In 2023, ThyssenKrupp Automotive Division faced a cyberattack, which resulted in halting the production activity at its plant in Saarland, Germany.

Hence, as instances of cyberattacks in the region have been substantially growing, the automakers are also focusing on the integration of cybersecurity solutions in their vehicles & infrastructure, to improve their security.

Moreover, in Europe, the adoption of EVs and autonomous vehicles has also surged, along with the subsequent development of the charging infrastructure. These EV charging stations are another major threat, which has resulted in several instances of cyberattacks, as they are available publicly.

EV charging stations are easy to access for hackers, owing to which there have been several instances of hacking across these stations in Europe. Hence, as instances of cyberattacks in automotive sectors are amplifying across European countries, the demand for cybersecurity solutions is also projected to uplift in the following years.

Global Automotive Cybersecurity Industry Recent Development:

- 2024: Infineon Technologies AG announced its recent collaboration with ETAS, an automotive software company. Through this collaboration, the company has integrated the ESCRYPT CycurHSM 3.x Automotive Security Software Stack into its AURIX™ TC4X Cybersecurity Real-time Module (CSRM) to enhance security levels, performance, and functionality.

- 2024: Continental AG (Argus Cyber Security) declared the launch of Argus Development Security Operations Platform (DevSecOps platform), which is specifically designed for automotive manufacturers facing complex security challenges.

Gain a Competitive Edge with Our Global Automotive Cybersecurity Market Report

- Global Automotive Cybersecurity Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Automotive Cybersecurity Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Automotive Cybersecurity Market Start-up Ecosystem, 2019-2023

- Entrepreneurial Activity

- Year-on-Year Funding Received

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series-wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Global Automotive Cybersecurity Market Trends & Insights

- Global Automotive Cybersecurity Market Dynamics

- Drivers

- Challenges

- Global Automotive Cybersecurity Market Regulations & Policies

- Global Automotive Cybersecurity Market Hotspots & Opportunities

- Global Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering

- Hardware - Market Size & Forecast 2019-2030F, USD Million

- Software - Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type

- Passenger Vehicles - Market Size & Forecast 2019-2030F, USD Million

- Light Commercial Vehicle (LCV) - Market Size & Forecast 2019-2030F, USD Million

- Medium & Heavy Commercial Vehicles (MHCV) - Market Size & Forecast 2019-2030F, USD Million

- By Propulsion

- ICE Vehicles - Market Size & Forecast 2019-2030F, USD Million

- Electric Vehicles - Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy

- Non-autonomous Vehicles - Market Size & Forecast 2019-2030F, USD Million

- Semi-autonomous Vehicles - Market Size & Forecast 2019-2030F, USD Million

- Autonomous (Driverless) Vehicles - Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type

- Embedded - Market Size & Forecast 2019-2030F, USD Million

- Integrated (Cloud-based) - Market Size & Forecast 2019-2030F, USD Million

- By Application

- Body Control & Comfort - Market Size & Forecast 2019-2030F, USD Million

- ADAS & Safety Systems - Market Size & Forecast 2019-2030F, USD Million

- Telematics System - Market Size & Forecast 2019-2030F, USD Million

- Infotainment System - Market Size & Forecast 2019-2030F, USD Million

- Powertrain System - Market Size & Forecast 2019-2030F, USD Million

- Other (On-board Diagnostics, Operational Data, etc.) - Market Size & Forecast 2019-2030F, USD Million

- By Security

- Application Security - Market Size & Forecast 2019-2030F, USD Million

- Wireless Network Security - Market Size & Forecast 2019-2030F, USD Million

- Endpoint Security - Market Size & Forecast 2019-2030F, USD Million

- Others (Network Security, Cloud Security, etc.) - Market Size & Forecast 2019-2030F, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Market Share of Leading Companies, By Revenues

- By Offering

- Market Size & Analysis

- North America Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Propulsion- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy- Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Canada Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Mexico Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Propulsion- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy- Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- By Country

- Brazil

- Rest of South America

- Brazil Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Propulsion- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy- Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- The UK Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- France Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Spain Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Italy Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Propulsion- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy- Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Saudi Arabia Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- South Africa Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Propulsion- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Autonomy- Market Size & Forecast 2019-2030F, USD Million

- By Deployment Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Japan Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- India Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- South Korea Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Australia Automotive Cybersecurity Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Offering- Market Size & Forecast 2019-2030F, USD Million

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Application- Market Size & Forecast 2019-2030F, USD Million

- By Security- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Automotive Cybersecurity Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Infineon Technologies AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Continental AG (Argus Cyber Security)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Robert Bosch GmbH (ESCRYPT GmbH)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Garrett Motion Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Intel Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aptiv Plc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- C2A Security

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Harman International Industries, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Denso Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Honeywell International Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SBD Automotive

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- NNG Software Developing and Commercial Llc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Karamba Security

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Vector Informatik GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Infineon Technologies AG

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making