Africa Diesel Generator Market Research Report: Forecast (2022-27)

By Power Rating (Up to 30 kW, 30.1 to 60 kW, 60.1 to 150 kW, 150.1 to 300 kW, 300.1 to 500 kW, 500.1 to 1,000 kW, Above 1,000 kW), By End-User (Residential, Mining & Quarrying, Ind...ustrial & Construction, Oil & Gas, Telecom), By Country (Nigeria, Algeria, Kenya, South Africa, Tanzania, Ethiopia, Sudan), By Type (Peak Shaving, Stand-By, Prime Power), By Company (Caterpillar, Cummins, FZ Wilson, Kohler SDMO, Wartsila, Turbomar, Himoinsa, Atlas Copco, Briggs & Stratton Corporation, YOR Power) Read more

- Energy

- Mar 2022

- Pages 170

- Report Format: PDF, Excel, PPT

Market Definition

Diesel generators are machines that generate power and meet the electricity requirements at times of grid failure, power outages, emergencies, etc. These generators are being deployed extensively across Africa's different sectors like residential, mining & quarrying, industrial & construction, oil & gas, and telecom, owing to benefits like low maintenance cost, durability, safe storage, reliability, easy access to fuel, and greater power output, among others.

Market Insights

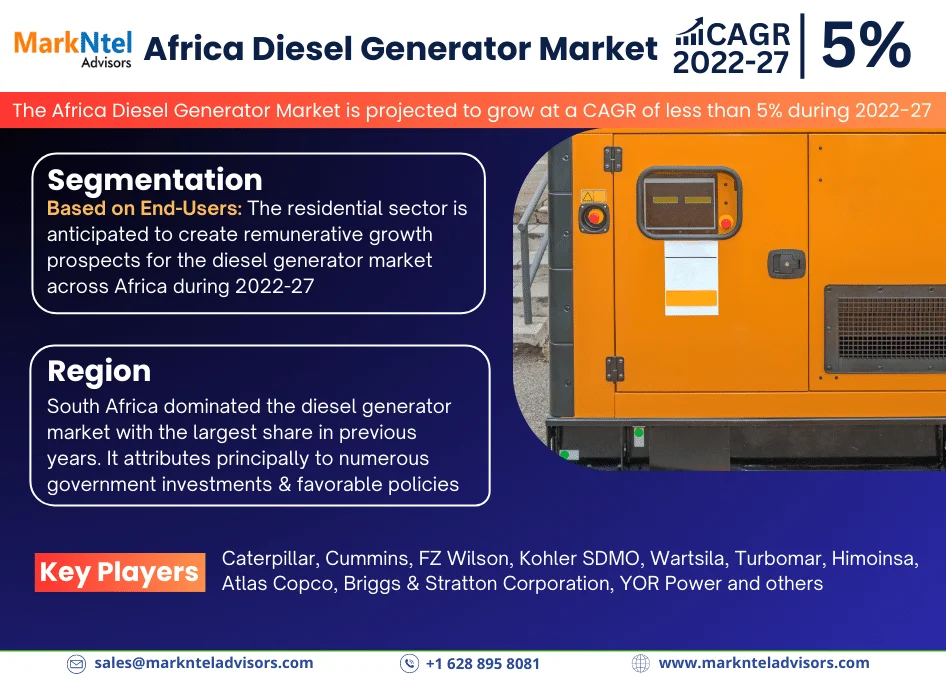

The Africa Diesel Generator Market is projected to grow at a CAGR of less than 5% during the forecast period, i.e., 2022-27. The growth of the market is driven primarily by increasing infrastructural development projects for healthcare, hospitality, residential, commercial, & industrial, among other sectors, i.e., surging the demand for diesel generators across different countries in the region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 5% |

| Key Companies Profiled | Caterpillar, Cummins, FZ Wilson, Kohler SDMO, Wartsila, Turbomar, Himoinsa, Atlas Copco, Briggs & Stratton Corporation, YOR Power |

| Unit Denominations | USD Million/Billion |

In addition, the prevailing deployment of small-capacity diesel generators by several countries in Africa to meet the daily energy requirements for different applications is another aspect stimulating the market growth. Besides, as several countries across the region are indulged mainly in oil & gas, mining, & construction activities, the demand for an uninterrupted supply of energy is constantly required for activities like production, exploration, excavation, extraction, etc.

Moreover, since Africa is witnessing a growing footfall of tourists, governments of different countries are massively investing in the commercial sector associated with tourism & hospitality. It, in turn, is displaying a growing number of construction projects for hotels, restaurants, and shopping complexes, among others, and surging the demand for diesel generators to provide a continuous, reliable, & stable flow of energy. Additionally, the easy availability of oil & gas at lower prices is another aspect playing a crucial role in promoting the deployment of diesel generators across Africa and driving the market through 2027.

Impact of Covid-19 on the Africa Diesel Generator Market

The Covid-19 pandemic in 2020 had a decelerating effect on most industries across Africa, and the diesel generator market was no exception. As the governments of different regional countries had to impose stringent movement restrictions & frequent lockdowns to curb the spread of this dreadful disease, the leading players witnessed several unprecedented challenges associated with the production & distribution of diesel generators amidst the crisis.

Owing to the severity of the pandemic, governments suspended all operations to reduce the spread of the virus. As a result, the demand for diesel generators declined significantly, especially across industries like oil & gas, mining, construction, commercial, & corporate sectors. Besides, the market also underwent massive financial losses, owing to disruptions in the supply chain, hampered transportation & logistics, and delayed deliveries of raw materials.

However, the residential & healthcare sector enabled the market to sustain itself amidst the crisis by augmenting the demand for diesel generators for different applications. As the public adopted work from home policies, the need for diesel generators rose dramatically to attain uninterrupted electricity flow & power backups for home appliances.

On the other hand, with the exponential rise in Covid-19 cases, the healthcare sector was under massive pressure. As a result, the demand for diesel generators remained prevalent amidst the crisis in hospitals & other healthcare facilities, which, in turn, portrayed a temporary hike in the market growth.

Nonetheless, with the gradually declining Covid-19 cases, governments uplifted the restrictions & allowed the recommencement of business operations. It, in turn, surged the demand for diesel generators & generated growth opportunities for the leading players to expand their production capacities & meet the burgeoning end-user requirements.

Market Segmentation

Based on End-Users:

- Residential

- Mining & Quarrying

- Industrial & Construction

- Oil & Gas

- Telecom

Of all end-users, the residential sector is anticipated to create remunerative growth prospects for the diesel generator market across Africa during 2022-27. It owes principally to the swift enhancement in the economy of different countries, i.e., displaying a growing adoption of home appliances in the residential sector and mounting demand for diesel generators for a continuous & stable energy flow.

Besides, the growing government focus on smart city developments, leading to the rise in energy-efficient solutions, is another aspect playing a crucial role in augmenting the demand for diesel generators as a primary source of power generation and, in turn, driving the market through 2027.

On the other hand, the industrial & construction sector is projected to dominate the market with the largest share during the forecast period. The rapid development of industries like healthcare, manufacturing, hospitality, etc., for economic diversification, i.e., infusing the need for a continuous flow of electricity to run power-intensive operations efficiently, is the prime factor driving the market across the industrial & construction sector.

Country Landscape

Geographically, the Africa Diesel Generator Market expands across:

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

Of all countries across Africa, South Africa dominated the diesel generator market with the largest share in previous years. It attributes principally to numerous government investments & favorable policies, i.e., displaying a growing establishment of multinational companies & start-ups across the country. It, in turn, is surging the demand for diesel generators to meet the increasing electricity requirements for running business operations across these companies.

On the other hand, Nigeria is anticipated to dominate the market with the largest share during 2022-27, principally due to the easy & abundant availability of fossil fuels and poor governing infrastructure, resulting in lower transmission capabilities and massive energy consumption. It, in turn, is surging the demand for diesel generators to increase power generation capacities and meet the electricity requirements across the country.

Moreover, since the country's majority population is deploying small-capacity diesel generators, the leading players are projected to witness significant growth opportunities to expand their production capacities and propel the overall market growth through 2027.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Africa Diesel Generator Market?

- What are the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Africa Diesel Generator Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Africa Diesel Generator Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Africa Diesel Generator Market study?

Frequently Asked Questions

- Introduction

- Research Process

- Market Definitions

- Assumption

- Market Segmentation

- Executive Summary

- Africa Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Rating

- Upto 30 kW

- 30.1 to 60 kW

- 60.1 to 150 kW

- 150.1 to 300 kW

- 300.1 to 500 kW

- 500.1 to 1,000 kW

- Above 1,000 KW

- By End User

- Residential

- Mining & Quarrying

- Industrial & Construction

- Oil & Gas

- Telecom

- Others

- By Country

- Nigeria

- Algeria

- Kenya

- South Africa

- Tanzania

- Ethiopia

- Sudan

- By Type

- Peak Shaving

- Stand By

- Prime Power

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Power Rating

- Africa Diesel Generator Pricing Analysis

- By Power Capacity

- Market Attractiveness Indexing

- By Type

- By Country

- By End User

- Market Size & Analysis

- Nigeria Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Algeria Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Kenya Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- South Africa Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Tanzania Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Ethiopia Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Democratic Republic of Congo Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Sudan Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Cameroon Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Mozambique Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Morocco Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Uganda Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Share & Analysis

- By Power Capacity

- By End User

- By Type

- Diesel Generator Pricing Analysis

- List of Distributors

- Policy and Regulatory Landscape

- Market Size & Analysis

- Rest of Africa Diesel Generator Market Analysis, 2017-2027F

- Market Size & Analysis

- Industry Revenues & Units Sold

- Market Size & Analysis

- Africa Diesel Generator Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- Africa Diesel Generator Market Porter’s Five Forces Analysis

- Africa Diesel Generator Market Opportunities & Hotspots

- Africa Diesel Generator Market Trends & Insights

- Africa Diesel Generator Market Key Strategic Imperatives for Growth

- Competition Outlook

- Company Profiles

- Caterpillar

- Cummins

- FZ Wilson

- Kohler SDMO

- Wartsila

- Turbomar

- Himoinsa

- Atlas Copco

- Briggs & Stratton Corporation

- YOR Power

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making