UAE Minimally Invasive Surgery Market Research Report: Forecast (2025-2030)

UAE Minimally Invasive Surgery Market - By Product (Surgical Devices, Guiding Devices, Inflation Systems, Laparoscopic Devices, Imaging & Visualizing Systems, Electrosurgical Devi...ces, Endoscopy Devices, Medical Robots), By Application (Cardio-Thoracic Surgery, Vascular Surgery, Neurological Surgery, ENT & Respiratory Surgery, Cosmetic Surgery, Gastrointestinal & Abdominal Surgery, Urological Surgery, Orthopedic Surgery, Oncology Surgery, Dental Surgery, Others, By End-User Hospitals & Clinics, Ambulatory Surgical Centers, Others) and others Read more

- Healthcare

- Apr 2025

- Pages 131

- Report Format: PDF, Excel, PPT

Market Definition

Minimally invasive surgery (MIS) is a kind of surgery performed through small openings with the assistance of special tools, often involving some imaging technology. Such techniques include laparoscopy and endoscopy, through which external organs are reached with a minimal disturbance to the surrounding tissues. It is widely used for different types of orthopedic, gynecology, and cardiovascular operations.

Market Insights & Analysis: UAE Minimally Invasive Surgery Market (2025-30):

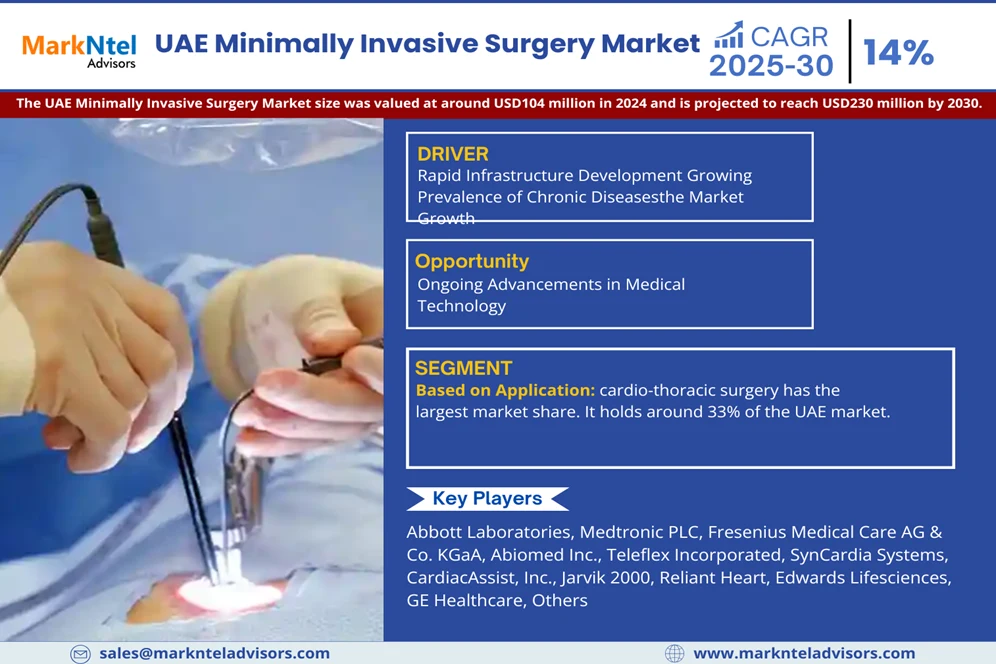

The UAE Minimally Invasive Surgery Market size was valued at around USD104 million in 2024 and is projected to reach USD230 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 14% during the forecast period, i.e., 2025-30.

Surgical intervention has become essential because of the increasing number of road accidents in the UAE. For example, the rise in road accidents in 2023 went up by 11% compared to 2022. This generates a need for MIS in the area since many of these incidents necessitate urgent surgeries because of severe injuries. These operations are crucial because of their multiple benefits.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 104 Million |

| Market Value in 2030 | USD 230 Million |

| CAGR (2025-30) | 14% |

| Top Key Players | Abbott Laboratories, Medtronic PLC, Fresenius Medical Care AG & Co. KGaA, Abiomed Inc., Teleflex Incorporated, SynCardia Systems, CardiacAssist, Inc., Jarvik 2000, Reliant Heart, Edwards Lifesciences, GE Healthcare, Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

To add to the increasing demand for minimally invasive surgery is the rising elderly population. The aged population in the UAE is on the rise, with around 311,000 people aged over 60 recorded in 2020, which is expected to rise to 2 million by 2050. This represented approximately 3.1% of the total population in 2020, rising to an eventual 19.7% by 2050. Those figures indicate an increasing demand for healthcare solutions, minimally invasive surgery being one that specifically caters to the elderly, it being one of the increasing surgeries being performed by doctors nowadays. Older adults suffer from certain illnesses such as heart complaints, arthritis, and cancers, which lead them to the operating table. Such procedures are more and more in demand these days, as they necessitate a shorter stay in hospitals. This method also helps to alleviate the risk of complications and decreases the number of visits to the hospital.

The UAE hospitals are going to improve their facilities and equipment to include such types of treatments. So, advanced technologies such as robotics-assisted surgery and sophisticated imaging setups elevate safety and efficiency.

UAE Minimally Invasive Surgery Market Driver:

Growing Prevalence of Chronic Diseases – Along with chronic ailments like diabetes, cancer, heart diseases, and musculoskeletal disorders, the demand for minimally invasive surgical procedures in the region has increased significantly. As of October 2024, 60% of adults have one of the listed diseases. Deaths directly due to cardiovascular causes form a higher percentage than any other disease in the UAE, and it constituted 34% of all deaths. Also, the prevalence of obesity and overweight individuals in this area is alarmingly high, with around 30% of the total population. The data show that diabetes prevalence in the area is close to 16.3%, which is again much higher compared to a global diabetes prevalence of 9.3% as of May 2024. Surgery therapies are common in dealing with chronic conditions. MIS offers many advantages, making it a treatment method of choice for both patients and healthcare providers. Escalating incidence of chronic diseases thus continues to be a very significant determinant by way of the prevalence of MIS techniques in the UAE.

UAE Minimally Invasive Surgery Market Opportunity:

Ongoing Advancements in Medical Technology – The recent technological developments within the UAE market present great opportunities. Continuous innovations in robotic-assisted surgery, advanced imaging technologies, and new surgical tools foster higher precision and effective minimally invasive surgery procedures. For example, hospitals across the UAE are continuously adopting robotic systems like the Da Vinci Surgical System, which offers high precision and reduces human errors. Besides, emerging technologies, such as 3D imaging and augmented reality, are being integrated into procedures and provide surgeons with real-time data to make better decisions. An initiative by the Dubai Health Authority to develop intelligent health systems is one of the many other factors increasing such advances within the UAE in support of incidents. They have increased the investigation of utilizing MIS in urology, orthopedics, and cardiology.

UAE Minimally Invasive Surgery Market Challenge:

Lack of Specialized Training and Equipment – A considerable challenge for the United Arab Emirates market is the lack of associated training and equipment. Though advances in MIS technology have been significant, there still exists a dearth of properly qualified surgeons capable of utilizing the best equipment. Advanced surgical tools, including robotic devices and high-resolution imaging, require a lot of different skills and long-term specialized training. The cost of training programs for robotic surgery is hugely demanding, and not all medical institutions can afford such education for their staff.

Also, the acquisition of advanced technologies such as 3D imaging systems and robotic surgical instruments entails huge financial investments. This will present challenging circumstances for smaller hospitals or clinics. A report by the Dubai Health Authority clearly emphasizes that this gap must be addressed to better provide MIS benefits and, consequently, improve healthcare outcomes for the region.

UAE Minimally Invasive Surgery Market Trend:

Artificial Intelligence (AI) Integration – MIS is on the verge of a major change with the help of artificial intelligence. Artificial Intelligence algorithms being enabled to analyze large volumes of patients' data may prove quite useful in assisting surgeons during their operations, dwelling deep within the mind of a surgeon and silently speaking into their ear during surgeries. Such technology would give the precise kind of intervention they require to make their surgery most likely effective, and the procedures would thus be devised with a closer emphasis on the needs of each individual. Such breakthroughs in the aforementioned areas, like the use of AI in the UAE, elevate these fields by giving better patient results and precision in surgeries. To be very specific, in September 2021, Sheikh Shakhbout Medical City introduced the GI Genius system, an AI-driven technology in colonoscopy that provides pre-cancerous polyp detection, consequently cutting the risk of colon cancer deaths by as much as 50%.

Just as well, dental facial treatments developed by SNB Aesthetic Clinic have advanced with the help of integrated AI methods, allowing personalized therapies to minimize complications in March 2024. Al-Qassimi Hospital utilizes AI-powered robotic systems designed for heart surgeries, which enhance precision and lower recovery times. All these advances correspond to the promise of the UAE's initiative of bringing AI to its health sector, especially minimally invasive procedures, which will discharge a more secure and effective surgical way.

UAE Minimally Invasive Surgery Market (2025-30): Segmentation Analysis

The UAE Minimally Invasive Surgery Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment. It includes predictions for the period 2025-2030 at the national level. Based on the analysis, the market has been further classified as follows:

Based on Application:

- Cardiothoracic Surgery

- Vascular Surgery

- Neurological Surgery

- ENT & Respiratory Surgery

- Cosmetic Surgery

- Gastrointestinal & Abdominal Surgery

- Urological Surgery

- Orthopedic Surgery

- Oncology Surgery

- Dental Surgery

- Others

Based on Application, cardio-thoracic surgery has the largest market share. It holds around 33% of the UAE market. This growth is attributed to the high prevalence of cardiovascular diseases (CVD) and the advancement in surgical techniques. CVDs are the leading cause of death in the region. Various factors have increased the incidence of heart maladies, spurring demand for cardiothoracic surgery in the UAE. Instead, minimally invasive cardiothoracic surgery, such as robotic & video-assisted thoracoscopic surgery, has gained traction because it minimizes recovery time & complications while improving the accuracy of surgery. It has also enabled the growth of MIS for this segment within the highly developed healthcare infrastructures of the UAE that have specialized cardiac centers & the availability of technology. In addition, the rising number of heart and lung transplants & improvements in coronary artery bypass grafting with valve repair further establishes the segment’s leadership in the regional market.

Based on End User:

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

Based on End User, hospitals & clinics held the largest market share at around 71%. These centers stand out for their modern infrastructure, well-trained staff, and high number of patients handled. Fully equipped with the latest MIS technologies, these multi-facility healthcare centers carry out sophisticated diagnostic and therapeutic procedures. Currently, in the region, hospitals are ever more efficient and accurate in their surgery by using the best surgical instruments and robotic-assisted devices in all disciplines.

In addition, highly qualified surgeons and other professionals are paramount to the successful implementation of MIS techniques; thus, better recovery of patients is ensured. Hospitals and clinics also register a much higher influx of patients than do other end users in the UAE. This creates extra demand for MIS administration, whereby a much shorter length of hospitalization and recovery time is envisaged. Due to continuous investments into advanced medical innovations in addition to the prevalence of chronic diseases, clinics and hospitals come out at the top among the major end-users of the regional market.

UAE Minimally Invasive Surgery Market (2025-30): Regional Projections

Geographically, the UAE Minimally Invasive Surgery Market expands across:

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

Abu Dhabi shares the highest growth in the UAE Minimally Invasive Surgery Market, around 55%. Multiple factors contribute to the growing market. Access to MIS procedures is made convenient as Abu Dhabi has some of the finest modern medical facilities, ranging from advanced hospitals to state-of-the-art technology. Besides, considerable state support is being provided to develop this market progressively, increasing the standard of health care via imposing health insurance requirements and promoting medical tourism. They are improving the accessibility and equity of healthcare services within the country, thus contributing to market growth. The country also has several surgeons and specialists attracted to its foremost research institutions and training programs. Also, the increasing population and rising awareness about the advantages of MIS procedures are creating market demand.

UAE Minimally Invasive Surgery Industry Recent Development:

- September 2024: Abbott Laboratories’ new Dissolvable Stent EspritTM BTK Everolimus Eluting Resorbable Scaffold System (Esprit™ BTK System) for People with Chronic Limb-Threatening Ischemia (CLTI) Below-the-Knee (BTK) was successfully implanted by Al Qassimi Hospital in Sharjah. Approved by the U.S. Food and Drug Administration (FDA) in April 2024, the EspritTM BTK System is designed to keep arteries open and deliver a drug called everolimus to support vessel healing before dissolving. Once the blockage is open, the device is implanted through a catheter-based, minimally invasive procedure.

Gain a Competitive Edge with Our UAE Minimally Invasive Surgery Market Report

- UAE Minimally Invasive Surgery Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE Minimally Invasive Surgery Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Minimally Invasive Surgery Market Regulations and Policy

- UAE Minimally Invasive Surgery Market Trends & Developments

- UAE Minimally Invasive Surgery Market Supply Chain Analysis

- UAE Minimally Invasive Surgery Market Dynamics

- Drivers

- Challenges

- UAE Minimally Invasive Surgery Market Hotspots & Opportunities

- UAE Minimally Invasive Surgery Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product

- Surgical Devices- Market Size & Forecast 2020-2030, USD Million

- Handheld Instruments- Market Size & Forecast 2020-2030, USD Million

- Tubular Retractor- Market Size & Forecast 2020-2030, USD Million

- Dilator- Market Size & Forecast 2020-2030, USD Million

- Suturing Instruments- Market Size & Forecast 2020-2030, USD Million

- Probes- Market Size & Forecast 2020-2030, USD Million

- Laser Fiber Devices- Market Size & Forecast 2020-2030, USD Million

- Handheld Instruments- Market Size & Forecast 2020-2030, USD Million

- Guiding Devices- Market Size & Forecast 2020-2030, USD Million

- Guiding Catheters- Market Size & Forecast 2020-2030, USD Million

- Guidewires- Market Size & Forecast 2020-2030, USD Million

- Inflation Systems- Market Size & Forecast 2020-2030, USD Million

- Balloon Catheters- Market Size & Forecast 2020-2030, USD Million

- Balloon Inflation Systems- Market Size & Forecast 2020-2030, USD Million

- Laparoscopic Devices- Market Size & Forecast 2020-2030, USD Million

- Laparoscope- Market Size & Forecast 2020-2030, USD Million

- Trocar & Cannula- Market Size & Forecast 2020-2030, USD Million

- RASP (Robotic Assisted Simple Prostatectomy)- Market Size & Forecast 2020-2030, USD Million

- Graspers & Dissectors- Market Size & Forecast 2020-2030, USD Million

- Imaging & Visualizing Systems- Market Size & Forecast 2020-2030, USD Million

- Ultrasound- Market Size & Forecast 2020-2030, USD Million

- CT Imaging- Market Size & Forecast 2020-2030, USD Million

- MRI Imaging- Market Size & Forecast 2020-2030, USD Million

- X-Ray Imaging- Market Size & Forecast 2020-2030, USD Million

- Visualization Systems- Market Size & Forecast 2020-2030, USD Million

- Electrosurgical Devices- Market Size & Forecast 2020-2030, USD Million

- Electrosurgical Generators & Accessories- Market Size & Forecast 2020-2030, USD Million

- Electrocautery Devices- Market Size & Forecast 2020-2030, USD Million

- Endoscopy Devices- Market Size & Forecast 2020-2030, USD Million

- Rigid Endoscopes- Market Size & Forecast 2020-2030, USD Million

- Flexible Endoscopes- Market Size & Forecast 2020-2030, USD Million

- Diagnostic Endoscopes- Market Size & Forecast 2020-2030, USD Million

- Medical Robots- Market Size & Forecast 2020-2030, USD Million

- Robotic Systems- Market Size & Forecast 2020-2030, USD Million

- Robotic Instruments- Market Size & Forecast 2020-2030, USD Million

- Robotic Softwares & Services- Market Size & Forecast 2020-2030, USD Million

- Surgical Devices- Market Size & Forecast 2020-2030, USD Million

- By Application

- Cardio-Thoracic Surgery- Market Size & Forecast 2020-2030, USD Million

- Vascular Surgery- Market Size & Forecast 2020-2030, USD Million

- Neurological Surgery- Market Size & Forecast 2020-2030, USD Million

- ENT & Respiratory Surgery- Market Size & Forecast 2020-2030, USD Million

- Cosmetic Surgery- Market Size & Forecast 2020-2030, USD Million

- Gastrointestinal & Abdominal Surgery- Market Size & Forecast 2020-2030, USD Million

- Urological Surgery- Market Size & Forecast 2020-2030, USD Million

- Orthopedic Surgery- Market Size & Forecast 2020-2030, USD Million

- Oncology Surgery- Market Size & Forecast 2020-2030, USD Million

- Dental Surgery- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By End-User

- Hospitals & Clinics- Market Size & Forecast 2020-2030, USD Million

- Ambulatory Surgical Centers- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- By Company

- Competition Characteristics

- Market Share & Analysis- By Revenues

- By Product

- Market Size & Analysis

- The UAE Hospitals & Clinics Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product - Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Region-Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UAE Ambulatory Surgical Centers Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product - Market Size & Forecast 2020-2030, USD Million

- By Application- Market Size & Forecast 2020-2030, USD Million

- By Region-Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- The UAE Minimally Invasive Surgery Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Abbott Laboratories

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Medtronic PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Fresenius Medical Care AG & Co. KGaA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abiomed Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Teleflex Incorporated

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SynCardia Systems

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CardiacAssist, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jarvik 2000

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Reliant Heart

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Edwards Lifesciences

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GE Healthcare

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Abbott Laboratories

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making