UAE Metal Fabrication Equipment Market Research Report: Forecast (2021-2026)

By Steel Type (Carbon steel, Stainless steel, Alloy steel, Tool steel), By Machinery (CNC/NC Hydraulic Press Brake, Hydraulic Swing Beam Shear Guillotine Shearing Machine, Hydraul...ic Press, Laser Cutting Machine, Ironworker, Others (plate rolling, lathes, drilling, milling, radial drilling, etc.)), By End Users (Industrial Manufacturing (including automobile, textile, etc.), Oil & Gas, Commercial, Residential, Water & Wastewater, Others (Aerospace, Marine, F&B, etc.)), By Competitors (GERIMA, Fezer, Rexroth Parker USA, AMADA, CIDAN Machinery Group (Yes Machinery), Drilltech Oilfield Equipment Manufacturing and Services LLC, NOK Corporation, Al Shirawi Equipment Company, Microteknik, Dishaa Machinery & Tools LLC, Others) Read more

- Energy

- Feb 2022

- Pages 103

- Report Format: PDF, Excel, PPT

Market Definition

Metal Fabrication Equipment is used in fabricating metals like steel, including carbon steel, stainless steel, alloy steel, tool steel, etc., in various industrial applications. The machines & equipment employed in the fabrication process for shaping the metals range across shears, saws, shapers, planers, along with milling, grinding, & drilling machines, etc. The mounting need for metal processing in various industries and rapid industrialization across the UAE have been driving the demand for metal fabrication equipment in the country for a few years.

Market Insights

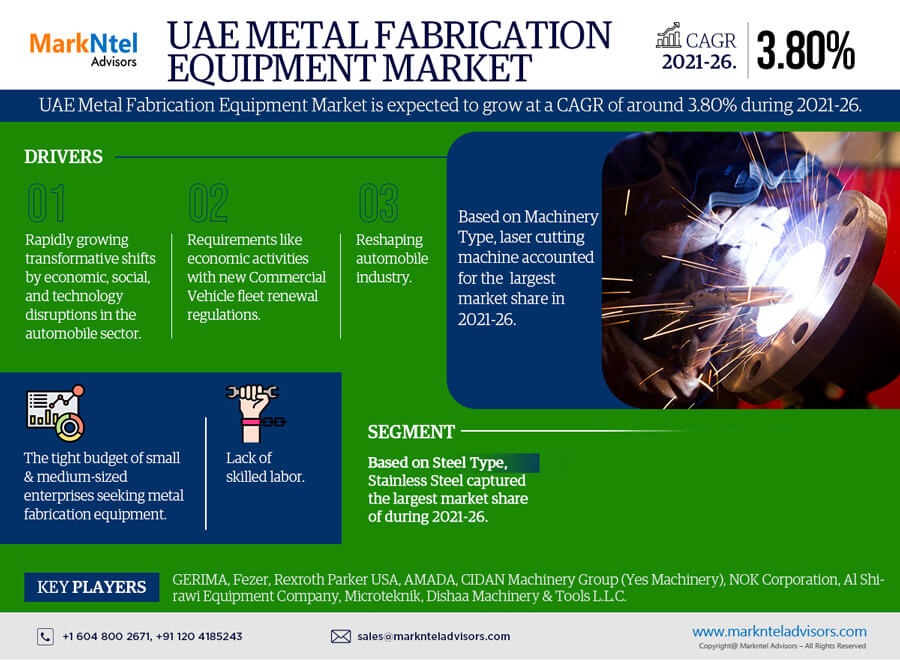

The UAE Metal Fabrication Equipment Market is projected to grow at a CAGR of around 3.80% during the forecast period, i.e., 2021-26. The growth of the market is driven primarily by the mounting demand for metal fabrication equipment in the swiftly expanding manufacturing industries across the UAE, coupled with the surging government focus on diversifying the economy away from oil. It, in turn, is resulting in increasing investments in the construction sector to build commercial & residential complexes.

Besides, several prominent market players are also investing substantially in enhancing existing equipment. The growing adoption of metal fabrication equipment integrated with the latest technologies like the Internet of Things (IoT) & automation to improve performance efficiency shall also drive the market in the coming years. Additionally, vehicle sales across the UAE are substantially rising since they are of immense importance as a status symbol to the UAE population. Hence, the automotive industry is increasing its production capabilities, i.e., propelling the demand for metal fabrication equipment and displaying remunerative growth opportunities for the leading market players over the forecast years.

Moreover, the UAE government is actively participating in the Metal Fabrication Equipment Market in line with UAE Vision 2030 to attain sustainable development targets, including strategies to expand economic growth. For instance:

- Capital City, Abu Dhabi, is actively focused on diversifying the income sources & lowering the dependency on the oil & gas sector by strengthening knowledge-based industries & providing efficient ways of producing goods & services in the coming years, in line with the Economic Vision 2030.

- On the other hand, Dubai Industrial Strategy 2030 is another program that intends to set the basis for Dubai’s Industrial future by increasing the total output from the manufacturing sector. It further aims to deepen the knowledge base, making Dubai the most suitable destination for international businesses.

These initiatives are likely to act as crucial stimulators for the expansion of the UAE Metal Fabrication Equipment Market during the forecast period.

Key Trend in the UAE Metal Fabrication Equipment Market

The growing prevalence of Industry 4.0 is introducing a smart manufacturing process where the operations & physical production is carried out using technologies like machine learning, cloud computing, & big data, among others. These are principally to create a more inclusive & interconnected environment in manufacturing. Industry 4.0 metal fabrication equipment focuses on interconnectivity, automation, machine learning, and real-time data. Industry 4.0 in metal fabrication equipment provides real-time information about the occurring issues & informs engineers or the operators by sending alerts, thereby improving the productivity & efficiency of the manufacturing industry.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 3.80% |

| Key Companies Profiled | GERIMA, Fezer, Rexroth Parker USA, AMADA, CIDAN Machinery Group (Yes Machinery), Drilltech Oilfield Equipment Manufacturing and Services LLC, NOK Corporation, Al Shirawi Equipment Company, Microteknik, Dishaa Machinery & Tools LLC, Others |

| Unit Denominations | USD Million/Billion |

Impact of Covid-19 on the UAE Metal Fabrication Equipment Market

The Covid-19 pandemic in 2020 caused catastrophic upheavals for different industries across the UAE, where the Metal Fabrication Equipment Market was no exception. In response to the rapid spread of this dreadful disease, the UAE government imposed stringent movement restrictions & lockdowns.

As a result of cross-border restrictions and isolation practices, the market faced several unprecedented challenges like the unavailability of labor & raw materials & the shut down of industries, which resulted in massive financial losses to the leading market players. Additionally, these disruptions impacted both the supply chain & the demand for metal fabrication equipment.

However, on the other hand, while people had to stay indoors, the healthcare sector introduced a temporary upsurge in the market growth to build healthcare equipment like ventilators, oxygen cylinders, beds, & other provisions, basically due to the exponentially increasing number of Covid-19 patients.

Hence, it can be said that the UAE Metal Fabrication Equipment Market observed a downfall during the initial stages of the pandemic and witnessed swift growth in the later months. Moreover, since 2021, the government has uplifted the restrictions & allowed the recommencement of business operations, which, in turn, has enabled the market to regain its usual growth pace & revive from revenue losses.

Market Segmentation

By End-Users:

- Industrial Manufacturing (including automobile, textile, etc.)

- Oil & Gas

- Commercial

- Residential

- Water & Wastewater

- Others (Aerospace, Marine, F&B, etc.)

Of all End-Users, the Industrial Manufacturing sector is expected to witness the fastest market growth during the forecast period, owing primarily to the rapidly increasing number of projects associated with industrialization, i.e., surging the requirement of metal fabrication equipment.

Besides, the market is expanding dramatically across industries like defense, aerospace, & automotive sectors, making them the largest consumers of metal fabrication equipment to make precise & accurate shapes out of metals. Moreover, massive government investments in these industries shall also significantly boost the demand for metal fabrication equipment during the forecast period.

By Machinery Type:

- CNC/NC Hydraulic Press Brake

- Hydraulic Swing Beam Shear

- Guillotine Shearing Machine

- Hydraulic Press

- Laser Cutting Machine

- Ironworker

- Others (plate rolling, lathes, drilling, milling, radial drilling, etc.)

Of them all, the demand for Laser Cutting Machines witnessed rapid growth in recent years, primarily for metals that are difficult or impossible to cut using conventional equipment. These machines offer more precision & less energy consumption when cutting metal sheets, which is another reason behind their rapidly increasing demand in the UAE.

Additionally, the swiftly expanding automobile industry is also projected to positively influence the demand for laser cutting machines due to rising vehicle sales on account of increasing urbanization & disposable income, coupled with the need to cut metal precisely.

Furthermore, the defense & aerospace, electrical, electronics, and steel industries are further propelling the demand for laser cutting machines to build accurate & precise shapes of metal structures and, in turn, is fueling the overall market growth.

Recent Developments by Leading Companies

- In January 2022, Rexroth Parker developed a range of Cell-to-Pack (CTP) adhesive technologies that offer excellent thermal conductivity, strong adhesion, improved flow characteristics, & low dielectric constant. It helps EV & battery manufacturers obtain enhanced pack energy densities with lower manufacturing costs.

- In the same year & month, CIDAN Machinery Group introduced their new back gauge named CIDAN FLEXIBLE for angled gauge positioning for conical folding, XTAP. It is ideal for efficient & speedy production of capping and other details.

Market Dynamics:

Key Driver: Growing Demand for High Precision Fabrication

With the exponentially rising population & increasing number of development activities in the country, the UAE is witnessing a surging demand for metal fabrication equipment, especially across oil & gas, pharmaceuticals, automotive, & petrochemical industries, among others. Of all sectors, the defense & aerospace sectors are anticipated to create profitable opportunities for the leading players in the UAE Metal Fabrication Market due to the extensive utility of this equipment to fabricate metal sheets into advanced machinery with high precision & quality. Besides, the mounting demand for carbon steel in construction projects is another crucial aspect projected to boost the market in the coming years.

Possible Restraint: High Costs of Raw Materials

Raw materials like copper, iron, & aluminum, etc., required to build machinery are witnessing price fluctuations, i.e., making their procurement difficult for the medium & small scale industries, thereby reducing investments in the market & hampering the overall expansion across the UAE.

Growth Opportunity: Government Initiatives for Developing Technological Advanced Metal Fabrication Equipment

The government is taking various initiatives toward developing technologically advanced metal fabrication equipment & addressing issues associated with the high costs of raw materials. It, in turn, is projected to generate significant growth opportunities for the leading players to introduce new products & expand their portfolio across the UAE.

Competitive Landscape

According to MarkNtel Advisors, the leading players in the UAE Metal Fabrication Equipment Market are GERIMA, Fezer, Rexroth Parker USA, AMADA, CIDAN Machinery Group (Yes Machinery), Drilltech Oilfield Equipment Manufacturing and Services LLC, NOK Corporation, Al Shirawi Equipment Company, Microteknik, Dishaa Machinery & Tools LLC, Others.

Key Questions Answered in the Market Research Report:

- What are the overall market statistics or market estimates (Market Overview, Market Size- By Value, Forecast Numbers, Market Segmentation, Market Shares) of the UAE Metal Fabrication Equipment Market?

- What are the industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE Metal Fabrication Equipment Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Metal Fabrication Equipment Market based on the competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during the UAE Metal Fabrication Equipment Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on UAE Metal Fabrication Equipment Market

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Steel Type

- Carbon steel

- Stainless steel

- Alloy steel

- Tool steel

- By Machinery Type

- CNC/NC Hydraulic Press Brake

- Hydraulic Swing Beam Shear

- Guillotine Shearing Machine

- Hydraulic Press

- Laser Cutting Machine

- Ironworker

- Others (plate rolling, lathes, drilling, milling, radial drilling, etc.)

- By End-User

- Industrial Manufacturing (including automobile, textile, etc.)

- Oil & Gas

- Commercial

- Residential

- Water & Wastewater

- Others (Aerospace, Marine, F&B, etc.)

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Matrix

- By Steel Type

- UAE Metal Fabrication Equipment Market Hotspots & Opportunities

- UAE Metal Fabrication Equipment Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on UAE Metal Fabrication Equipment Market

- Impact of IoT & Industry 4.0 on UAE Metal Fabrication Equipment Market

- UAE Metal Fabrication Equipment Market Trends & Insights

- UAE Metal Fabrication Equipment Market Hotspots & Opportunities

- UAE Metal Fabrication Equipment Market Supply Chain Analysis

- UAE Metal Fabrication Equipment Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- Market Share & Analysis

- By Steel Type

- Carbon steel

- Stainless steel

- Alloy steel

- Tool steel

- By Machinery Type

- CNC/NC Hydraulic Press Brake

- Hydraulic Swing Beam Shear

- Guillotine Shearing Machine

- Hydraulic Press

- Laser Cutting Machine

- Ironworker

- Others (plate rolling, lathes, drilling, milling, radial drilling, etc.)

- By End Users

- Industrial Manufacturing (including automobile, textile, etc.)

- Oil & Gas

- Commercial

- Residential

- Water & Wastewater

- Others (Aerospace, Marine, F&B, etc.)

- By Steel Type

- Market Size & Analysis

- UAE Metal Fabrication Equipment Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- UAE Metal Fabrication Equipment Market Key Strategic Imperatives for Success & Growth

- By Competitor

- Competition Characteristics

- Key Competitor & Their Capabilities

- Competitor Factorial Indexing

- Company Profiles

- GERIMA

- Fezer

- Rexroth Parker USA

- AMADA

- CIDAN Machinery Group (Yes Machinery)

- Drilltech Oilfield Equipment Manufacturing and Services LLC

- NOK corporation

- Al Shirawi Equipment Company

- Microteknik

- Dishaa Machinery & Tools L.L.C.

- Others

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making