UAE Industrial Enzymes Market Research Report: Forecast (2025-2030)

UAE Industrial Enzymes Market - By Type (Carbohydrases [Amylases, Glucanases, Cellulases, Others], Proteases [Serine Proteases, Cysteine Proteases, Aspartyl Proteases, Metalloprote...ases], Lipases [Gastric Lipase, Pharyngeal Lipase, Hepatic Lipase], Phytases [Histidine Acid Phosphatase, β-Propellar Phytase, Cysteine Phosphatase, Purple Acid Phosphatase], Others), By Source Type (Micro-Organisms, Plants, Animals), By Application Type (Food & Beverage Industry [Animal Protein, Baking, Brewing, Dairy, Functional Foods, Beverages, Plant-based Foods, Oils & Fats, Wine], Paper & Pulp Industry, Leather & Textiles, Detergent Industry, Others), By Form Type (Liquid, Powder), By Sales Channel (Online, Offline [Direct Sales, Specialty Stores, Dealers & Distributors]) and others Read more

- Chemicals

- Oct 2024

- Pages 100

- Report Format: PDF, Excel, PPT

Market Definition

Enzymes also known as biocatalysts have various scopes in different industries such as food & beverage, pulp & paper industry, detergent industry, and textile industry, etc. Activities using enzymes such as baking, brewing, dairy production, beverages, and wine production escalate the chemical reactions. They are derived from microorganisms, plants, and animals.

Market Insights & Analysis: The UAE Industrial Enzymes Market(2025-30):

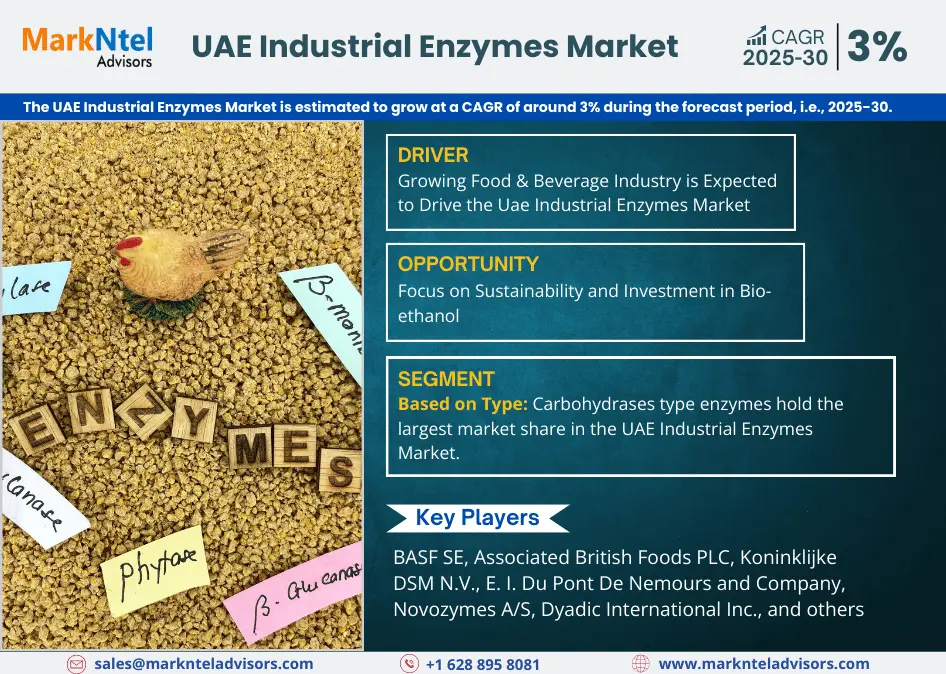

The UAE Industrial Enzymes Market is estimated to grow at a CAGR of around 3% during the forecast period, i.e., 2025-30. The food and beverage sector is the major contributor to the UAE Industrial Enzymes Market. It is used in various applications in this sector from dairy, meat, bakery, brewing, animal proteins, oils & fats, etc. They are also used in the processing of sausages, and snacks. Therefore, the growth of industrial enzymes is the result of the growing tourism industry in the country, by raising the demand for food & beverages. According to the United States Department of Agriculture, more than 550 food & beverage processing industries are there in the UAE, including both small-sized and medium-sized. These processing industries focus on meeting local demand and expanding their horizons to contribute to global needs.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| CAGR (2025-30) | 3% |

| Top Key Players | BASF SE, Associated British Foods PLC, Koninklijke DSM N.V., E. I. Du Pont De Nemours and Company, Novozymes A/S, Dyadic International Inc., Advanced Enzyme Technologies Ltd., Adisseo (A Bluestar Company), Chr. Hansen Holding A/S, Amano Enzyme Inc., and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

National Food Security Strategy 2051 of the government of UAE aims to use modern technologies to increase local food production sustainably. It also aims to make the country the best performer in the global food security index by 2051. In line with this strategy, the UAE government has launched the AgriFood Growth and Water Abundance (AGWA) cluster. This platform will act as a support provider to the local manufacturers & exporters to maximize their local food production. Thus, a rise in local production is projected to open the doors for processing food industries and create the demand for industrial enzymes.

Furthermore, to boost the production capability of the country Al Ghurair Foods at Khalifa Economic Zones in Abu Dhabi is building a plant for starch processing. According to the Islamic Organization for Food Security, the total cost of this and two other mega projects related to food processing will be more than USD 272 million. The manufacturing of food processing farms and plants in the country will add to the demand for enzymes and add to the market growth for the companies.

The UAE Industrial Enzymes Market Driver:

Growing Food & Beverage Industry – The goal of economic diversification of the country led to a boost in many sectors including food & beverage. The expanding tourism industry is the major contributing factor to the expansion of food & beverage. The multicultural atmosphere and the hosting of many international events also added to this. The growing investment in the food and beverage industry in the country is to make the UAE a global destination when it comes to food. Although, Dubai is also termed a culinary spot. Food consumption in the UAE is growing at a growth rate of around 3.5% and according to the United Arab Emirates Ministry of Economy, it was around 10.3 million tons in 2023.

It is driving more investment in the food & beverage sector in the country. Furthermore, manufacturing companies in the food & beverage industry of the UAE are more than 2000 and their revenue is approximately USD7.63 billion in a year as per the United States Department of Agriculture (USDA). With the escalating investments in the UAE’s food & beverage industry, the food service market is projected to surpass USD20 billion in 2024. The manufacturing of the food & beverage sector of the UAE holds almost 25% of the GDP from all manufacturing activities in 2023. Snacks, bakery, and ambient food are among the top foods in the UAE food & beverage manufacturing. Therefore, it is driving the demand for industrial enzymes, as they play an important role in many food processing activities.

The UAE Industrial Enzymes Market Opportunity:

Focus on Sustainability and Investment in Bio-ethanol – With the increase in climate change problems, carbon emissions, pollution, etc. globally the focus has increased on the use of bio-ethanol as a renewable and sustainable energy source. Seeing the global trend, the UAE government is also encouraging the local production and usage of biofuel as a sustainable substitute for fossil fuels, which are made from organic products such as corn and sugarcane, utilizing enzymes. The UAE government is also providing significant investment to support this. For instance,

- A unit of the Abu Dhabi Department of Economic Development, the Industrial Development Bureau (IDB), to set up an enzyme-based fuel additives processing facility in Abu Dhabi partnered with XMILE group which is Netherlands-based.

As a result, in the coming years, bio-fuel utilization in the UAE will increase. The growing demand for biofuel will result in the growing production of bio-ethanol using enzymes and will generate lucrative growth opportunities for the market players.

The UAE Industrial Enzymes Market Challenge:

High Costs Impeding Market Growth & Expansion – The investment cost for enzyme production is quite high which affects the entry of new businesses into the market, and adoption among existing industries. The high cost is associated with the significant cost of research and development in the formulation of the enzyme, the cost of specified equipment, and a particular production process for the formulation of industrial enzymes. The higher efficiency, lower operation cost, and sustainability of the enzymes are the long-term benefits, but in the short term, enzymes are perceived as costly compared to traditional chemical types to perform chemical reactions. The increased economic landscape and the investment by the government in the formulations of green fuel & technology have the potential to lower the effect of this challenge.

The UAE Industrial Enzymes Market Trend:

Use of Enzymes in Animal Feed – The use of enzymes in animal feed is good for both animals and the producer. They improve & balance health, help in uniform growth, and optimize gut health in animals. Further, the manufacturer benefits from the reduced costs of feed and increases profitability. Leading animal feed companies in the UAE such as Fujiarah Feed Factory have a production capacity of high–quality pelleted feed is more than 400 Metric tons per day. The Other major company is National Feed and Flour Production and Marketing (NFFPM), have an annual capacity of ruminant feed production is approximately 320,000 metric tons, and poultry feed production is approximately 380,000 Metric Tons annually. The market for animal feed in the UAE is growing at a CAGR of around 6%, whereas enzymes in animal feed are growing at 6.67% CAGR. Also, enzymes such as amylases, proteases, lipases, etc. account for almost 10% share of the UAE Animal Feed Market.

The UAE Industrial Enzymes Market (2025-30): Segmentation Analysis

The UAE Industrial Enzymes Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Type:

- Carbohydrases

- Amylases

- Glucanases

- Cellulases

- Others (Lactase & Pectinase)

- Proteases

- Serine Proteases

- Cysteine Proteases

- Aspartyl Proteases

- Metalloproteases

- Lipases

- Gastric Lipase

- Pharyngeal Lipase

- Hepatic Lipase

- Phytases

- Histidine Acid Phosphatase

- β-Propellar Phytase

- Cysteine Phosphatase

- Purple Acid Phosphatase

- Others (Polymerases & Nucleases)

The carbohydrases type enzymes hold the largest market share among all types of enzymes in the UAE Industrial Enzymes Market and account for approximately 40%. The estimated large share is also expected to be the highest in the forecast period for carbohydrates. The rise in the demand for processed as well as healthy foods is creating the demand for carbohydrates. They enhance the flavor, shelf life, and texture of food items and help convert compound sugars into small and simple sugars. They also help in lowering the sugar level in food products. In addition to these factors, the growing requirement to go for renewable energy sources, and the encouragement to clean and biofuels are also driving the market for industrial enzymes.

Based on Source Type:

- Micro-Organisms

- Plants

- Animals

Among all the varied source types of enzymes, the largest market share is held by microorganisms in the UAE Industrial Enzymes Industry. They hold more than 70% share of the market. The production cost of enzymes using microorganisms is lower compared to others, also they are easily available and consistent, which adds to the largest share of this source type. Fungal enzymes & bacterial yeast are sourced from microorganisms. To make the final product from the raw materials, they are used as catalysts and applied in different industries such as pharmaceuticals, food & beverages, paper & pulp, detergent, animal feed, textile, biofuels, etc.

The UAE Industrial Enzymes Industry Recent Development:

- 2024: BASF SE along with the University of Graz has developed a new computer-assisted model which will optimize the efficiency of the biocatalytic production process.

Gain a Competitive Edge with Our The UAE Industrial Enzymes Market Report

- The UAE Industrial Enzymes Market by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The UAE Industrial Enzymes Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Market Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Industrial Enzymes Market Trends & Development

- UAE Industrial Enzymes Market Dynamics

- Drivers

- Challenges

- UAE Industrial Enzymes Market Supply Chain Analysis

- UAE Industrial Enzymes Market Import-Export Statistics

- UAE Industrial Enzymes Market Regulations, Policies & Product Standards

- UAE Industrial Enzymes Market Hotspot & Opportunities

- UAE Industrial Enzymes Market Analysis, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Type

- Carbohydrases -Market Size & Forecast 2020-2030F, Thousand Units

- Amylases-Market Size & Forecast 2020-2030F, Thousand Units

- Glucanases-Market Size & Forecast 2020-2030F, Thousand Units

- Cellulases-Market Size & Forecast 2020-2030F, Thousand Units

- Others (Lactase & Pectinase) -Market Size & Forecast 2020-2030F, Thousand Units

- Proteases -Market Size & Forecast 2020-2030F, Thousand Units

- Serine Proteases-Market Size & Forecast 2020-2030F, Thousand Units

- Cysteine Proteases-Market Size & Forecast 2020-2030F, Thousand Units

- Aspartyl Proteases-Market Size & Forecast 2020-2030F, Thousand Units

- Metalloproteases-Market Size & Forecast 2020-2030F, Thousand Units

- Lipases -Market Size & Forecast 2020-2030F, Thousand Units

- Gastric Lipase-Market Size & Forecast 2020-2030F, Thousand Units

- Pharyngeal Lipase-Market Size & Forecast 2020-2030F, Thousand Units

- Hepatic Lipase-Market Size & Forecast 2020-2030F, Thousand Units

- Phytases-Market Size & Forecast 2020-2030F, Thousand Units

- Histidine Acid Phosphatase-Market Size & Forecast 2020-2030F, Thousand Units

- β-Propellar Phytase-Market Size & Forecast 2020-2030F, Thousand Units

- Cysteine Phosphatase-Market Size & Forecast 2020-2030F, Thousand Units

- Purple Acid Phosphatase-Market Size & Forecast 2020-2030F, Thousand Units

- Others (Polymerases & Nucleases) -Market Size & Forecast 2020-2030F, Thousand Units

- Carbohydrases -Market Size & Forecast 2020-2030F, Thousand Units

- By Source Type

- Micro-Organisms -Market Size & Forecast 2020-2030F, Thousand Units

- Plants -Market Size & Forecast 2020-2030F, Thousand Units

- Animals -Market Size & Forecast 2020-2030F, Thousand Units

- By Application Type

- Food & Beverage Industry- Market Size & Forecast 2020-2030F, Thousand Units

- Animal Protein- Market Size & Forecast 2020-2030F, Thousand Units

- Baking- Market Size & Forecast 2020-2030F, Thousand Units

- Brewing- Market Size & Forecast 2020-2030F, Thousand Units

- Dairy- Market Size & Forecast 2020-2030F, Thousand Units

- Functional Foods- Market Size & Forecast 2020-2030F, Thousand Units

- Beverages- Market Size & Forecast 2020-2030F, Thousand Units

- Plant-based Foods- Market Size & Forecast 2020-2030F, Thousand Units

- Oils & Fats- Market Size & Forecast 2020-2030F, Thousand Units

- Wine- Market Size & Forecast 2020-2030F, Thousand Units

- Paper & Pulp Industry- Market Size & Forecast 2020-2030F, Thousand Units

- Leather & Textiles- Market Size & Forecast 2020-2030F, Thousand Units

- Detergent Industry- Market Size & Forecast 2020-2030F, Thousand Units

- Others (Bio-ethanol, Soil & wastewater Treatment)- Market Size & Forecast 2020-2030F, Thousand Units

- Food & Beverage Industry- Market Size & Forecast 2020-2030F, Thousand Units

- By Form Type

- Liquid-Market Size & Forecast 2020-2030F, Thousand Units

- Powder-Market Size & Forecast 2020-2030F, Thousand Units

- By Sales Channel

- Online-Market Size & Forecast 2020-2030F, Thousand Units

- Offline- Market Size & Forecast 2020-2030F, Thousand Units

- Direct Sales-Market Size & Forecast 2020-2030F, Thousand Units

- Specialty Stores-Market Size & Forecast 2020-2030F, Thousand Units

- Dealers & Distributors-Market Size & Forecast 2020-2030F, Thousand Units

- By Region

- Dubai

- Abu Dhabi & Ain

- Sharjah & North Emirates

- Rest of the UAE

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- UAE Carbohydrases Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Micro-Organisms- Market Size & Forecast 2020-2030F, Thousand Units

- Plant- Market Size & Forecast 2020-2030F, Thousand Units

- Animals- Market Size & Forecast 2020-2030F, Thousand Units

- By Application Type- Market Size & Forecast 2020-2030F, Thousand Units

- By Form Type-Market Size & Forecast 2020-2030F, Thousand Units

- By Sales Channel, Market Size & Forecast 2020-2030F, Thousand Units

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Market Size & Analysis

- UAE Proteases Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Micro-Organisms- Market Size & Forecast 2020-2030F, Thousand Units

- Plant- Market Size & Forecast 2020-2030F, Thousand Units

- Animals- Market Size & Forecast 2020-2030F, Thousand Units

- By Application Type- Market Size & Forecast 2020-2030F, Thousand Units

- By Form Type-Market Size & Forecast 2020-2030F, Thousand Units

- By Sales Channel, Market Size & Forecast 2020-2030F, Thousand Units

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Market Size & Analysis

- UAE Lipases Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Micro-Organisms- Market Size & Forecast 2020-2030F, Thousand Units

- Plant- Market Size & Forecast 2020-2030F, Thousand Units

- Animals- Market Size & Forecast 2020-2030F, Thousand Units

- By Application Type- Market Size & Forecast 2020-2030F, Thousand Units

- By Form Type-Market Size & Forecast 2020-2030F, Thousand Units

- By Sales Channel, Market Size & Forecast 2020-2030F, Thousand Units

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Market Size & Analysis

- UAE Phytases Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Micro-Organisms- Market Size & Forecast 2020-2030F, Thousand Units

- Plant- Market Size & Forecast 2020-2030F, Thousand Units

- Animals- Market Size & Forecast 2020-2030F, Thousand Units

- By Application Type- Market Size & Forecast 2020-2030F, Thousand Units

- By Form Type-Market Size & Forecast 2020-2030F, Thousand Units

- By Sales Channel, Market Size & Forecast 2020-2030F, Thousand Units

- By Source Type- Market Size & Forecast 2020-2030F, Thousand Units

- Market Size & Analysis

- UAE Industrial Enzymes Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- BASF SE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Associated British Foods PLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Koninklijke DSM N.V.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- E. I. Du Pont De Nemours and Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Novozymes A/S

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dyadic International Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Advanced Enzyme Technologies Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Adisseo (A Bluestar Company)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Chr. Hansen Holding A/S

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Amano Enzyme Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- BASF SE

- Company Profiles

Disclaime

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making