UAE Ceramic Sanitary Ware Market Research Report: Forecast (2025-2030)

UAE Ceramic Sanitary Ware Market Report - By Product Type (Water Closets, Wash Basins, Urinals & Partitions, Bathtubs, Kitchen Sinks, Others (Bidets, Shower Tray, etc.)), By End Us...ers (Commercial, Residential, Healthcare, Industrial, Oil & Gas, Government, Others (Educational Institutions, etc.)) and Others Read more

- Buildings, Construction, Metals & Mining

- Nov 2024

- Pages 105

- Report Format: PDF, Excel, PPT

Market Definition

Ceramic sanitary wares consist of fixtures & components such as wash basins, sinks, closets, and bathtubs for hygienic purposes. They are cost-effective & environmentally friendly & have excellent chemical resistance. They are mostly available as triaxial compounds made of clay & quartz, among other materials. Despite its affordability as well as its resistance, ceramic sanitary wares have seen significant demand among customers, making them ideal for both commercial & household use. Additionally, the construction & building sector will expand in the UAE in the future, which will drive the demand for ceramic sanitary ware.

Market Insights

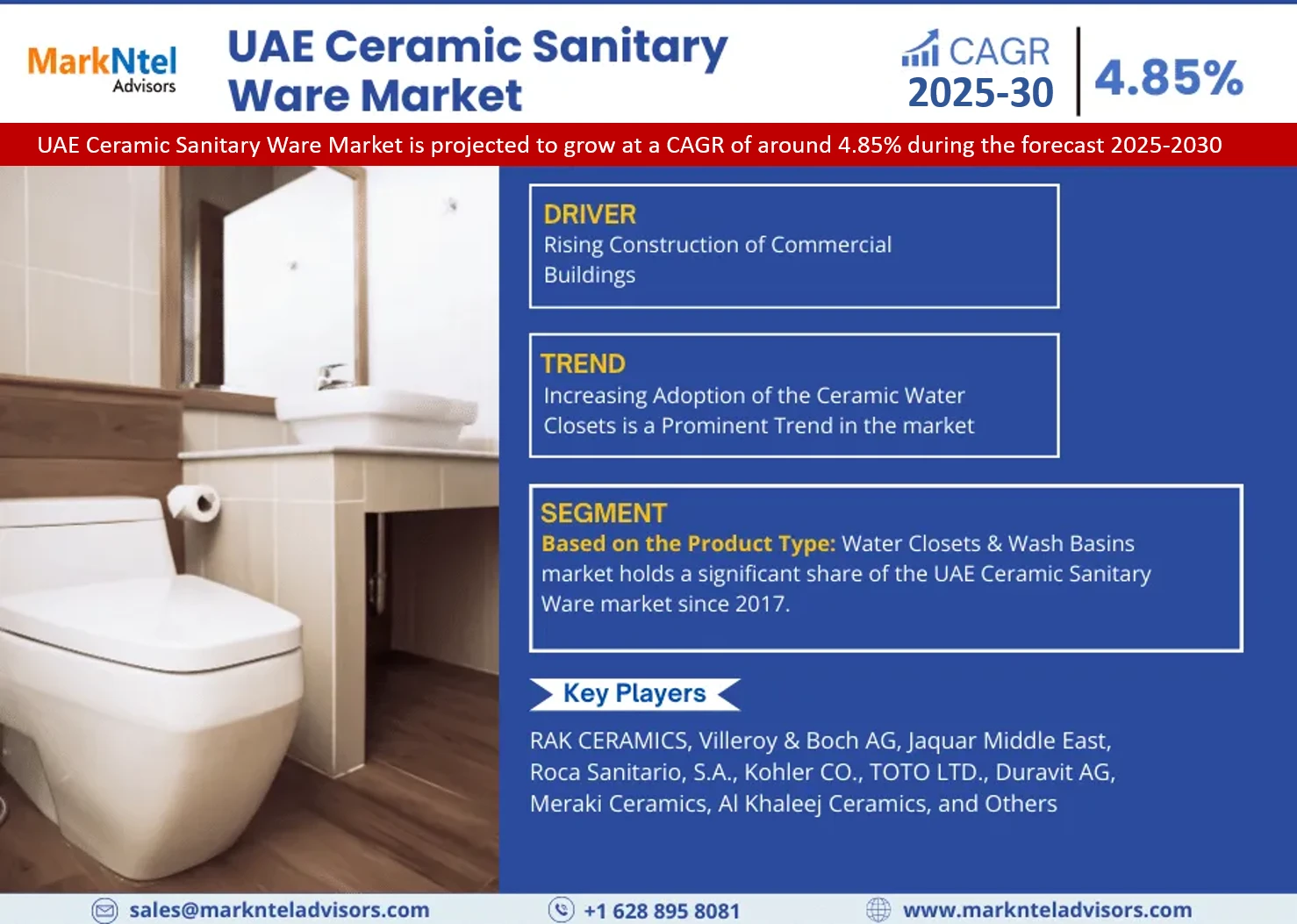

The UAE Ceramic Sanitary Ware Market is projected to grow at a CAGR of around 4.85% during the forecast period, i.e., 2025-30. The factors responsible for the market growth are increasing renovation of existing buildings such as retail malls, business parks, etc., which would result in escalating the demand for ceramic sanitary ware in the coming years. Furthermore, ceramic sanitary wares such as wash basins, urinals, etc., have been in considerable demand, owing to the rising construction of commercial buildings such as luxurious hotels as well as high-rise residential buildings. This would positively impact the growth of ceramic sanitary ware during the forecast period.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2020-23 |

| Base Year: 2024 | |

| Forecast Period: 2025-30 | |

| CAGR (2025-2030) | 4.85% |

| Region Covered | Abu Dhabi, Dubai, Sharjah & Rest of Emirates |

| Key Companies Profiled | RAK CERAMICS, Villeroy & Boch AG, Jaquar Middle East, Roca Sanitario, S.A., Kohler CO., TOTO LTD., Duravit AG, Meraki Ceramics, Al Khaleej Ceramics, Others |

| Unit Denominations | USD Million/Billion |

In addition, the growing expat population, as well as the national population in the country, has also been escalating the demand for residential buildings, which, in turn, positively impacts the growth rate of the UAE Ceramic Sanitary Ware market. Furthermore, some of the ongoing mega construction projects in the UAE such as the Natural History Museum Abu Dhabi and Louvre Abu Dhabi Residences are expected to be completed by the end of 2025, which is expected to drive the demand for ceramic sanitary wares during the forecast period.

Moreover, the massive investments by the government of the UAE in the infrastructural sector, such as the development of commercial buildings, hospitals, etc., would promulgate the demand for ceramic sanitary wares during the forecast period. In 2018, the Ministry of Energy and Infrastructure, the UAE announced to spend around USD3.2 billion on 130 state-funded development projects by 2023, which includes the development of healthcare units, government buildings, etc.

Key Trend in the market

Increasing Adoption of the Ceramic Water Closets is a Prominent Trend in the UAE Ceramic Sanitary Ware Market

The demand for sanitary ware closets is rapidly increasing in the UAE, owing to the rising government initiatives to surge access to basic sanitation & hygiene need in the country. Furthermore, water closest are available in various categories such as two-piece, one-piece, and wall hung closest, among others. Therefore, the growing government initiatives for a safe sanitation system resulted in escalating the demand for ceramic water closets in the country. This further provides a significant potential for new technology adoption in the country's public toilet sectors. Hence, such initiatives would propel the demand for ceramic water closets in the UAE. Additionally, the launch of ceramic water closest in bold colors such as black matt, brown, grey, sand, etc., for aesthetic purposes, led to escalating the market growth during the forecasted period.

Impact of Covid-19 on the UAE Ceramic Sanitary Ware Market

COVID-19 severely impacted the UAE Ceramic Sanitary Ware market in 2020. The construction industry was the worst-hit industry among others & faced a significant decline due to the temporary shutdown of the industries across the region. Furthermore, the delays in manufacturing & production of ceramic sanitary ware utilized in residential & non-residential spaces resulted in declining market growth. In addition, the contractors face substantial challenges due to increased restrictions on the labor movement across the region, and increased costs in implementing health & safety measures resulted in declining construction activities.

However, the increasing vaccination in Dubai & Abu Dhabi resulted in a reduced number of COVID-19 cases in the region. As a result, sanitary ware manufacturers resume full-scale manufacturing of various sanitary ware components such as wash basins, closets, sinks, and bathtubs. Moreover, in 2021, with the increasing government investment in construction, several other industries such as hospitality & tourism have flourished, which would further escalate the market growth.

Market Segmentation

Based on the Product Type:

- Water Closets

- Wash Basins

- Urinals & Partitions

- Bathtubs

- Kitchen Sinks

- Others (Bidets, Shower Tray, etc.)

Here, the Water Closets & Wash Basins market holds a significant share of the UAE Ceramic Sanitary Ware market since 2017, owing to the retrofitting of existing commercial & residential buildings, along with the construction of new recreational hubs, the development of public toilets, etc. The government of the UAE has focused on the hygiene & sanitization of public spaces to maintain a clean environment in the cities of the UAE, which further intended the government to develop convenient public facilities like the installation of public toilets in public parks, and outdoor commercial areas, etc.

Furthermore, due to the government's initiatives to implement public toilets & accommodate the population's needs in the UAE, the ceramic sanitaryware market is experiencing an increase in demand. For instance, in 2017, the Abu Dhabi City Municipality (ADM) opened 15 automated public toilets in Abu Dhabi & 39 public toilets were expected to be opened by 2018. The project aimed to serve the users of outdoor commercial areas, public parks, etc.

Based on End Users:

- Commercial

- Residential

- Healthcare

- Industrial

- Oil & Gas

- Government

- Others (Educational Institutions, etc.)

Of them, the Healthcare segment experienced significant growth during the historical period. The ceramic sanitary wares such as water closets, wash basins, urinals & partitions, etc., had been in notable demand during 2017-2021, due to the growing expansion of healthcare units, clinics, and sanatoriums, etc. Furthermore, the rising prevalence of chronic diseases such as cardiovascular disease, cancer, etc., has led to the construction of hospitals in the UAE, thus boosting the demand for ceramic sanitary wares. According to the World Health Organization, the UAE reported 4,807 cancer cases throughout the country in 2020 and 1,896 deaths in that time frame.

In addition, the concerns for communicable diseases like influenza, measles, etc., have also fueled the construction of hospitals, clinics, etc., in the UAE. Hence, rapid construction & development of hospitals would facilitate the demand for ceramic sanitary ware in the UAE in the forthcoming years. For instance:

- In 2021, Al Jalila Foundation, a philanthropic organization announced to establish the UAE’s first charity hospital for the treatment of cancer patients. Additionally, the hospital with a capacity of 250 beds would have the potential to treat 30,000 patients & is expected to start by 2023.

- In 2018, Danat Al Emarat Hospital for Women and Children in Abu Dhabi announced the expansion of its units with an investment of nearly USD81 million. The project includes the construction of a new tower with a capacity of 100 beds.

Recent Developments by the Leading Companies

- In 2021, Rak Ceramics launched a new design ELIE SAAB Bathroom & Surface Collections at Downtown Design in Dubai, along with the partnership of luxury fashion brand ELIE SAAB.

- In 2020, Rak Ceramics collaborated with Azizi developments for bathroom and kitchen fittings at the Riviera project in MBR Cit, Dubai.

Market Dynamics:

Key Drivers: Rising Construction of Commercial Buildings

With the growing construction of commercial buildings such as luxurious hotels, retail malls, business parks, etc., ceramic sanitary wares have been in considerable demand from 2017 to 2021. Furthermore, massive investments in commercial building development have also contributed to the installation of ceramic sanitary ware in kitchens and bathrooms. Moreover, the growing tourism in the country has escalated the construction of 5-star & 7-star hotels, resorts, etc., where sanitary wares have also been installed to enhance the aesthetic beauty of the hotel rooms. Therefore, the rising trend of the establishment of new hotels, malls, etc., in the UAE would ignite the demand for ceramic sanitary ware in the forecast years. Some of the recent developments which helped in the demand for ceramic sanitary wares, such as water closets, washbasins, shower trays, etc., are as follows:

- In 2020, the construction of 365 meters’ tall hotel ‘Ciel Tower’ started in Dubai & the hotel constitutes a total of 1,042 luxury suites. Additionally, the project is expected to be completed by 2023.

- In 2018, the Department of Tourism and Commerce Marketing, Dubai approved the construction of the Sabah Rotana hotel. The project aimed to host 25 million tourists for the Dubai Expo 2020.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the UAE Ceramic Sanitary Ware Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE Ceramic Sanitary Ware Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Ceramic Sanitary Ware Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the UAE Ceramic Sanitary Ware Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumption

- Market Definition

- Executive Summary

- UAE Ceramic Sanitary Ware Market Trends & Developments

- UAE Ceramic Sanitary Ware Market Dynamics

- Growth Drivers

- Challenges

- UAE Ceramic Sanitary Ware Market Supply Chain Analysis

- UAE Ceramic Sanitary Ware Market Hotspot and Opportunities

- UAE Ceramic Sanitary Ware Market Outlook, 2020- 2030F

- Market Size and Analysis

- By Revenue (USD Million)

- Market Share and Analysis

- By Product Type

- Water Closets- Market Size & Forecast 2020-2030, USD Million

- Wash Basins- Market Size & Forecast 2020-2030, USD Million

- Urinals & Partitions- Market Size & Forecast 2020-2030, USD Million

- Bathtubs- Market Size & Forecast 2020-2030, USD Million

- Kitchen Sinks- Market Size & Forecast 2020-2030, USD Million

- Others (Bidets, Shower Tray, etc.) - Market Size & Forecast 2020-2030, USD Million

- By End Users

- Commercial- Market Size & Forecast 2020-2030, USD Million

- Residential- Market Size & Forecast 2020-2030, USD Million

- Healthcare- Market Size & Forecast 2020-2030, USD Million

- Industrial- Market Size & Forecast 2020-2030, USD Million

- Oil & Gas- Market Size & Forecast 2020-2030, USD Million

- Government- Market Size & Forecast 2020-2030, USD Million

- Others (Educational Institutions, etc.) - Market Size & Forecast 2020-2030, USD Million

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- By Company

- Competition Characteristics

- Revenue Shares

- By Product Type

- Market Size and Analysis

- UAE Ceramic Sanitary Ware Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Company Profiles

- RAK CERAMICS

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Villeroy & Boch AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jaquar Middle East

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Roca Sanitario, S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kohler CO.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TOTO LTD.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Duravit AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Meraki Ceramics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Khaleej Ceramics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- RAK CERAMICS

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making