UAE Modular Container Houses Market Research Report: Forecast (2026-2032)

UAE Modular Container Houses Market - By Product Type (Standalone Container Homes, Multi‑Container Units / Villas, Expandable / Foldable Container Houses, Container Villages / Cl...uster Units, Special Purposes Units), By Material Type (Steel Container Modules, Insulated Panel Systems (SIPs), Composite / Hybrid Structures, Other Materials), By Deployment Mode (On‑Site Assembled Modular Units, Factory‑Built Pre‑assembled Modules, Mixed Deployment), By Construction Nature (Permanent Modular Homes, Relocatable / Temporary Modular Homes, Hybrid Modular Solutions), By End‑User (Residential, Workforce / Labor Housing, Hospitality & Tourism, Commercial & Retail, Healthcare & Institutions, Other Specialized Uses), and others Read more

- Buildings, Construction, Metals & Mining

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

UAE Modular Container Houses Market

Projected 18.01% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 18.29 Million

Market Size (2032)

USD 58.29 Million

Base Year

2025

Projected CAGR

18.01%

Leading Segments

By End Users: Workforce & Labor Housing

UAE Modular Container Houses Market Report Key Takeaways:

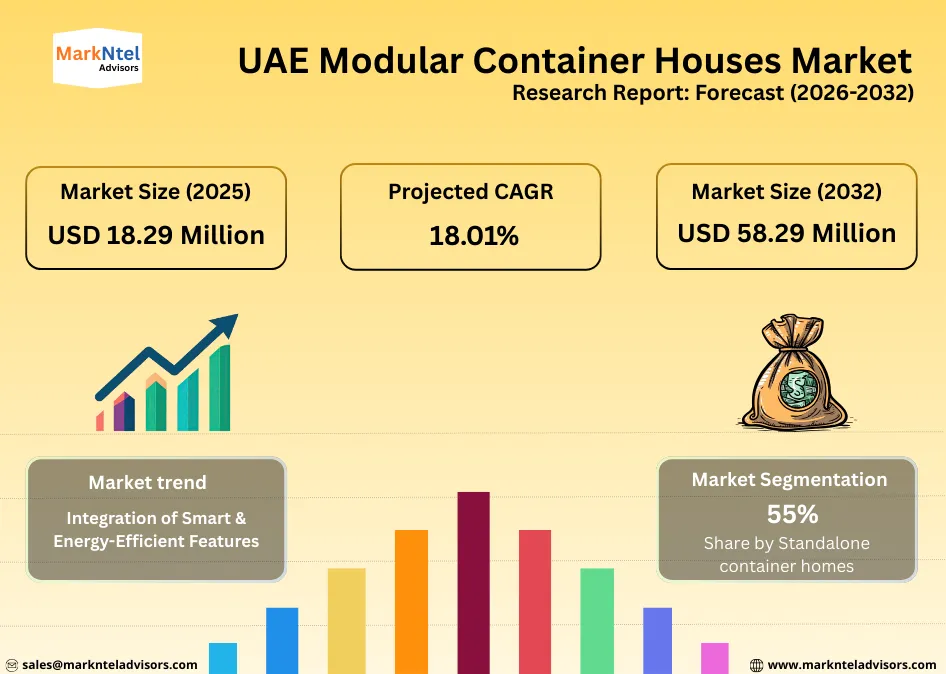

- The UAE Modular Container Houses Market size was valued at around USD 18.29 million in 2025 and is projected to reach USD 58.29 million by 2032. The estimated CAGR from 2026 to 2032 is around 18.01%, indicating strong growth.

- By product type, the standalone container homes represented 55% of the UAE Modular Container Houses Market size in 2025.

- By end user, the workforce/labor housing represented 34% of the UAE Modular Container Houses Market size in 2025.

- Abu Dhabi leads the UAE Modular Container Houses Market with a dominant 48% share in 2025

- The leading modular container houses companies are Dune Modular, Modular Prefab, Al Arab Prefab Houses, Line Prefab Houses Industry, Modest Company, TASS Group (TASS International FZE), Eco Planet Industries LLC, Mas Prefab Houses LLC, Bait Al Maha Prefab Cabins, Container Solutions, and others.

Market Insights & Analysis: UAE Modular Container Houses Market (2026- 2032):

The UAE Modular Container Houses Market size was valued at around USD 18.29 million in 2025 and is projected to reach USD 58.29 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 18.01% during the forecast period, i.e., 2026-32. The UAE Modular Container Houses Market is gaining momentum as the country prioritizes faster housing delivery, cost efficiency, and sustainable construction methods. Large-scale public housing initiatives and infrastructure expansion are creating strong demand for building systems that reduce construction timelines without compromising quality. In the first three quarters of 2025, the Sheikh Zayed Housing Programme approved nearly 2,971 housing units valued at around USD 563 million, underscoring the scale and urgency of residential development across the country.

To meet tight delivery schedules and growing workforce accommodation needs, developers are increasingly turning toward factory-built modular and container-based housing. These systems allow parallel off-site manufacturing and on-site preparation, significantly shortening project completion cycles while improving cost predictability, an advantage in the UAE’s fast-paced construction environment.

Product innovation and climate-focused design are also shaping market evolution. At the China (Dubai) Export Brand Expo 2025, CGCH Group showcased its latest modular villas, expandable container houses, and smart capsule cabins engineered specifically for Middle Eastern climatic conditions. The launch highlighted improved thermal insulation, rapid deployment capability, and readiness for smart energy systems, reflecting growing demand for energy-efficient modular housing solutions in the UAE.

Overall, continued government housing programs, infrastructure investments, and sustainability-driven urban planning are expected to accelerate the adoption of modular container houses across residential, hospitality, and industrial segments. As speed, efficiency, and environmental performance become central to construction decisions, modular container housing is set to play a critical role in the UAE’s future built environment.

UAE Modular Container Houses Market Recent Developments:

- December 2025: Turkish modular builder Karmod delivered an 828 m², 2-story container office in Sharjah to support a major villa housing project. Designed for hot-climate performance with high insulation, the modular units improve on-site efficiency and can be quickly installed, demonstrating growing adoption of container structures in UAE construction workflows.

- June 2025: At the Abu Dhabi Infrastructure Summit 2025, stakeholders highlighted modular construction’s role in reducing build timelines by 25–50% and enabling rapid housing scalability. Integration with AI design and smart city plans positions modular methods, including container-based units, as key to affordable, sustainable housing deployment in the UAE.

UAE Modular Container Houses Market Scope:

| Category | Segments |

|---|---|

| Product Type | Standalone Container Homes, Multi‑Container Units / Villas, Expandable / Foldable Container Houses, Container Villages / Cluster Units, Special Purposes Units |

| Material Type | Steel Container Modules, Insulated Panel Systems (SIPs), Composite / Hybrid Structures, Other Materials |

| Deployment Mode | On‑Site Assembled Modular Units, Factory‑Built Pre‑assembled Modules, Mixed Deployment |

| Construction Nature | Permanent Modular Homes, Relocatable / Temporary Modular Homes, Hybrid Modular Solutions |

| End‑User | Residential, Workforce / Labor Housing, Hospitality & Tourism, Commercial & Retail, Healthcare & Institutions, Other Specialized Uses |

UAE Modular Container Houses Market Drivers:

Increasing Requirement of Project Timelines & Cost Efficiency

One of the strongest drivers of the UAE Modular Container Houses Market is the ability of modular construction to significantly reduce project timelines and overall costs compared with conventional building methods. Government-led initiatives such as the Abu Dhabi Projects and Infrastructure Centre’s (ADPIC) Modular Villas Construction Project have reduced housing delivery times from eight years to just two, using off-site manufacturing and pre-assembled components, thereby accelerating occupancy and reducing delay-related costs. This approach also reduced overall construction duration by approximately 30% in pilot programs, demonstrating real-world time efficiencies in public housing delivery.

Modular methods allow simultaneous foundation work and off-site unit fabrication, cutting overall project schedules by up to 30–50% compared with traditional on-site sequential builds. These time savings translate directly into lower financing costs, reduced labor expenses, and earlier revenue realization, critical for high-demand housing and infrastructure projects.

Moreover, the UAE’s expanding public housing rollout of over 40,000 homes announced in 2025 at USD 28.9 billion and continued federal infrastructure investment, over USD 7.4 billion allocated to infrastructure upgrades in mid-2025, will further drive demand for fast, cost-efficient construction models.

Overall, by enabling faster delivery, decreased financing burdens, and better resource utilization, the rapid project timelines and cost-efficiency afforded by modular construction will continue to accelerate market growth in the UAE modular container housing sector well into the future.

UAE Modular Container Houses Market Trends:

Integration of Smart & Energy-Efficient Features

A prominent trend in the UAE modular container houses industry is the integration of smart technologies and energy-efficient systems that cut operational costs and support national sustainability goals. Government building regulations, such as the Dubai Municipality Building Regulations 2025, now require new construction, including residential and modular projects, to incorporate energy-efficient designs using smart technologies like IoT-enabled energy management, automated HVAC controls, and renewable energy integration. These measures align with broader mandates such as the Estidama Pearl Rating System in Abu Dhabi, which demands minimum sustainability standards for buildings funded by government programmes.

In practice, modular and prefab construction enables precise integration of high-efficiency systems such as advanced insulation, LED lighting controls, smart thermostats, and solar-ready infrastructure during off-site manufacturing, resulting in lower life-cycle energy consumption. For example, smart building automation systems in the UAE now optimize cooling and lighting based on real-time data, significantly reducing electricity demand in a region where air conditioning accounts for a large share of energy use.

These smart, energy-oriented trends also reflect national ambitions, such as the Dubai Supreme Council of Energy’s retrofit programme targeting energy reductions of up to 30% by 2030 and 50% by 2050 across government and private buildings.

Overall, the integration of smart, energy-efficient features is transforming modular container houses into low-operating-cost, climate-responsive living solutions that support the UAE’s environmental and economic objectives.

UAE Modular Container Houses Market Challenges:

Regulatory & Approval Complexities

A major challenge for the UAE modular container houses industry is the complex and multifaceted regulatory approval process, which can delay project start times and increase costs. In 2025, Dubai Municipality reported processing over 30,000 building permit applications in the first half of the year, a 20% increase compared to the same period in 2024, underscoring the sheer volume of compliance activity that construction stakeholders must navigate.

Developers and contractors must obtain a range of building permits, inspections, and completion certificates from municipal authorities before they can begin construction or modular installation, and stringent codes such as the Dubai Building Code and green building regulations are enforced to ensure safety, sustainability, and quality. The approval process often requires multiple submissions, technical reviews, and coordination with diesel utilities, telecoms, civil defense, and other government bodies, which can lengthen project timelines, especially when plans do not initially meet technical or regulatory standards.

Even with initiatives to digitize and streamline approvals, such as the introduction of AI-driven permit platforms in Abu Dhabi aimed at reducing approval times by up to 70%, navigating these complex requirements remains a significant hurdle for modular housing providers seeking rapid deployment.

The necessity to engage qualified consultants, adhere to evolving codes, and secure multiple municipal approvals increases administrative burden, project uncertainty, and pre-construction costs, slowing adoption of modular solutions despite strong demand.

UAE Modular Container Houses Market (2026-32) Segmentation Analysis:

The UAE Modular Container Houses Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type:

- Standalone Container Homes

- Multi-Container Units / Villas

- Expandable / Foldable Container Houses

- Container Villages / Cluster Units

- Special Purposes Units

Standalone container homes dominate the UAE Modular Container Houses Market with an estimated 55% share, primarily due to their cost efficiency, speed of deployment, and flexibility across use cases. These units are widely adopted for individual housing, site offices, security cabins, remote accommodation, and temporary residential needs, especially in fast-growing urban and semi-urban areas. Their single-unit design allows faster approvals, easier transportation, and minimal on-site assembly, aligning well with the UAE’s emphasis on rapid project execution. Government-backed housing initiatives, disaster-relief readiness, and temporary housing needs for infrastructure and utility projects further support demand.

In addition, standalone units are increasingly integrated with basic insulation, solar readiness, and smart utilities, making them suitable for the UAE’s climatic conditions. Their lower upfront cost compared to multi-container villas also attracts SMEs, contractors, and public-sector users. This combination of affordability, scalability, and quick occupancy positions standalone container homes as the most preferred product type in the market.

Based on End Users:

- Residential

- Workforce / Labor Housing

- Hospitality & Tourism

- Commercial & Retail

- Healthcare & Institutions

- Other Specialized Uses

Workforce and labor housing accounts for approximately 34% of end-user demand, driven by the UAE’s large expatriate workforce and continuous infrastructure expansion. Mega projects across construction, logistics, energy, and industrial zones require rapid, compliant, and relocatable accommodation for workers, making modular container housing a practical solution. These units enable faster camp deployment while meeting municipal regulations for safety, hygiene, and occupancy standards. Government-led housing approvals and sustained spending on transport, utilities, and industrial development further reinforce demand for organized labor accommodation.

Modular container solutions also help employers control costs related to land use, construction timelines, and maintenance. Additionally, relocatable workforce housing aligns with project-based employment cycles, allowing units to be reused across sites. As infrastructure investment and industrial activity continue, workforce housing remains a structurally strong end-user segment, significantly supporting overall market growth.

UAE Modular Container Houses Market (2026-32): Regional Projection

The UAE modular container houses market is dominated by Abu Dhabi, holding around 48% market share. The emirate’s dominance is driven by large-scale government housing programs, continuous infrastructure expansion, and strong demand for workforce accommodation linked to energy, industrial, and transport projects. Abu Dhabi hosts major public housing initiatives, industrial zones, and logistics hubs that require fast, cost-efficient, and compliant construction solutions, favoring modular container housing. The presence of centralized planning authorities and government-backed developers enables quicker adoption of factory-built and relocatable units for residential, labor, and institutional use.

In addition, Abu Dhabi’s focus on sustainability, smart infrastructure, and rapid project delivery supports the use of prefabricated and container-based structures. Compared to other emirates, the scale of public-sector spending, long-term infrastructure pipelines, and large land availability further strengthen Abu Dhabi’s leadership, making it the primary growth engine for the UAE market overall.

Gain a Competitive Edge with Our UAE Modular Container Houses Market Report:

- UAE Modular Container Houses Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- UAE Modular Container Houses Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Modular Container Houses Market Policies, Regulations, and Product Standards

- UAE Modular Container Houses Market Trends & Developments

- UAE Modular Container Houses Market Dynamics

- Growth Drivers

- Challenges

- UAE Modular Container Houses Market Hotspot & Opportunities

- UAE Modular Container Houses Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Product Type- Market Size & Forecast 2022-2032F, USD Million

- Standalone Container Homes

- Multi‑Container Units / Villas

- Expandable / Foldable Container Houses

- Container Villages / Cluster Units

- Special Purposes Units

- By Material Type- Market Size & Forecast 2022-2032F, USD Million

- Steel Container Modules

- Insulated Panel Systems (SIPs)

- Composite / Hybrid Structures

- Other Materials

- By Deployment Mode- Market Size & Forecast 2022-2032F, USD Million

- On‑Site Assembled Modular Units

- Factory‑Built Pre‑assembled Modules

- Mixed Deployment

- By Construction Nature- Market Size & Forecast 2022-2032F, USD Million

- Permanent Modular Homes

- Relocatable / Temporary Modular Homes

- Hybrid Modular Solutions

- By End‑User- Market Size & Forecast 2022-2032F, USD Million

- Residential

- Workforce / Labor Housing

- Hospitality & Tourism

- Commercial & Retail

- Healthcare & Institutions

- Other Specialized Uses

- By Region

- Dubai

- Abu Dhabi

- Sharjah & Northern Emirates

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type- Market Size & Forecast 2022-2032F, USD Million

- Market Size & Outlook

- UAE Modular Standalone Container Homes Market Outlook, 2022-2032

- Market Size & Analysis

- Market Share & Analysis

- By Material Type- Market Size & Forecast 2022-2032, USD Million

- By Deployment Mode- Market Size & Forecast 2022-2032, USD Million

- By Construction Nature- Market Size & Forecast 2022-2032, USD Million

- By End‑User- Market Size & Forecast 2022-2032, USD Million

- UAE Multi‑Container Units / Villas Houses Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Material Type- Market Size & Forecast 2022-2032, USD Million

- By Deployment Mode- Market Size & Forecast 2022-2032, USD Million

- By Construction Nature- Market Size & Forecast 2022-2032, USD Million

- By End‑User- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Expandable / Foldable Modular Container Houses Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Material Type- Market Size & Forecast 2022-2032, USD Million

- By Deployment Mode- Market Size & Forecast 2022-2032, USD Million

- By Construction Nature- Market Size & Forecast 2022-2032, USD Million

- By End‑User- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Container Villages / Cluster Units Modular Container Houses Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Nature- Market Size & Forecast 2022-2032, USD Million

- By Dog Type- Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Special Purposes Units Modular Container Houses Market Outlook, 2022-2032

- Market Size & Analysis

- Market Revenues (USD Million)

- Market Share & Analysis

- By Nature- Market Size & Forecast 2022-2032, USD Million

- By Dog Type- Market Size & Forecast 2022-2032, USD Million

- By Distribution Channel- Market Size & Forecast 2022-2032, USD Million

- By Packaging Type- Market Size & Forecast 2022-2032, USD Million

- Market Size & Analysis

- UAE Modular Container Houses Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Dune Modular

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Modular Prefab

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Arab Prefab Houses

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Line Prefab Houses Industry

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Modest Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TASS Group (TASS International FZE)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Eco Planet Industries LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mas Prefab Houses LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bait Al Maha Prefab Cabins

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Container Solutions

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Dune Modular

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making