Saudi Arabia Telehandler Rental Market Research Report: Forecast (2026-2032)

Saudi Arabia Telehandler Rental Market - By Product Type (Fixed, Rotating), By Propulsion Type (ICE, Electric), By Drive Type (Two- Wheel Drive, Four- Wheel Drive, All - Wheel Dr...ive), By Lift Capacity (Up to 3 Ton, 3.1 to 6 Ton, 6.1 to 10 Ton, More than 10 Ton), By Boom Length (Up to 6 Meters, 6.1 to 12 Meters, 12.1 to 18 Meters, More than 18 Meters), By Application (Material Handling, Loading & Unloading, Equipment Installation, Maintenance & Repair Operations), By End User Construction, (Residential Construction, Commercial Construction, Industrial Projects), Oil & Gas, Mining & Metals, Industrial Manufacturing, Government & Defense Projects, Ports, Logistics & Warehousing, Others), and others Read more

- Buildings, Construction, Metals & Mining

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

Saudi Arabia Telehandler Rental Market

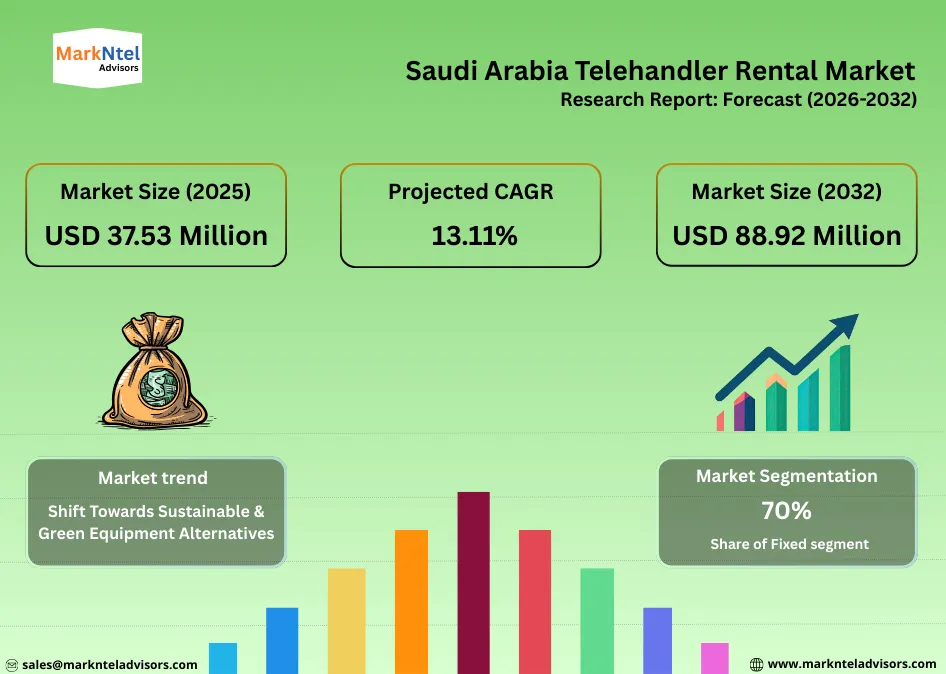

Projected 13.11% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 37.53 Million

Market Size (2032)

USD 88.92 Million

Base Year

2025

Projected CAGR

13.11%

Leading Segments

By Propulsion Type: ICE

Saudi Arabia Telehandler Rental Market Report Key Takeaways:

- The Saudi Arabia Telehandler Rental Market size was valued at around USD 37.53 million in 2025 and is projected to reach USD 88.92 million by 2032. The estimated CAGR from 2026 to 2032 is around 13.11%, indicating strong growth.

- By product type, the fixed segment represented 70% of the Saudi Arabia Telehandler Rental Market size in 2025.

- By propulsion type, the ICE segment holds around 85% of the Saudi Arabia Telehandler Rental Market in 2025.

- The leading Telehandler Rental companies in Saudi Arabia are Abdullah Al-Bahar Group, Zahid Tractor & Heavy Machinery Co, Madinah Equipment Rental, East Directions Industrial Services, Earth Care General Contracting EST, AWAL EQUIPMENT HIRING COMPANY, Dayim Equipment Rental Co., Reliant Rentalz, Reem Equipment Rental, Al Faris Equipment Rentals (LLC), and others.

Market Insights & Analysis: Saudi Arabia Telehandler Rental Market (2026- 2032):

The Saudi Arabia Telehandler Rental Market size was valued at around USD 37.53 million in 2025 and is projected to reach USD 88.92 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 13.11% during the forecast period, i.e., 2026-32.

The Saudi Arabia Telehandler Rental Market is experiencing rapid growth, driven by the rapid development of logistics and warehousing infrastructure and the growing adoption of sustainable, low-emission equipment across construction, industrial, and distribution operations.

According to the General Authority for Statistics (GASTAT), the Kingdom hosted 12,451 warehouses spanning 22.8 million m² in 2023, underscoring the scale of logistics development across strategic regions, including Riyadh, Makkah, and the Eastern Province. This rapid build-out reflects Saudi Arabia’s shift toward large-format distribution hubs and modern fulfilment ecosystems, where continuous pallet movement, loading, and inventory handling are operational necessities directly elevating demand for rental-based material-handling equipment.

Regional momentum is particularly pronounced in the Eastern Province, where six logistics centers collectively covered 6.3 million m² in 2023, supporting petrochemical supply chains, import operations, and consumer-goods distribution. These facilities operate under fluctuating throughput patterns and project-driven workflows, encouraging operators to rely on scalable rental fleets rather than fixed capital assets.

Similarly, the Makkah Region has emerged as one of the Kingdom’s most significant warehousing clusters, with five logistics centers extending across 20 million m², driven by the Jeddah port ecosystem and surrounding trade corridors. These developments align closely with Vision 2030 reforms aimed at modernizing national storage, transportation, and fulfillment capacity.

Beyond physical expansion, sustainability is reshaping procurement priorities. Rental providers are increasingly introducing low-emission and electric equipment to meet environmental compliance and ESG expectations. For example, Bin Harkil now lists electric telehandlers and scissor lifts within its rental portfolio, enabling quieter, zero-emission operations in urban, indoor, and logistics-intensive environments. This shift reflects rising demand from project owners for equipment that aligns with green construction standards and operational efficiency benchmarks.

Looking ahead, large-scale government initiatives will intensify these dynamics. For example, Saudi Arabia’s USD 267 billion logistics investment programme aims to position the Kingdom as a global logistics hub by 2030, encompassing port upgrades, multimodal transport corridors, smart-warehouse deployment, and digital customs infrastructure.

Meanwhile, the National Master Plan to develop 59 logistics centers exceeding 100 million m² across Riyadh, Makkah, and the Eastern Province will structurally expand storage capacity and distribution intensity nationwide.

The convergence of logistics-led infrastructure growth and sustainability-driven fleet modernization is redefining Saudi Arabia’s telehandler rental landscape. These forces are embedding rental-based material handling as a core operational model, ensuring sustained market expansion well beyond 2025.

Saudi Arabia Telehandler Rental Market Recent Developments:

- August 2025: Noblelift has entered the Saudi Arabian market through an exclusive partnership with Bakheet Company for Machinery. The agreement brings Noblelift’s portfolio of forklifts, telehandlers, and advanced lithium-powered equipment to the Kingdom. This expansion strengthens local access to modern material-handling solutions and supports Saudi Arabia’s Vision 2030 objectives for industrial growth and logistics modernization.

Saudi Arabia Telehandler Rental Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Fixed, Rotating |

| By Propulsion Type | ICE, Electric |

| By Drive Type | Two- Wheel Drive, Four- Wheel Drive, All - Wheel Drive |

| By Lift Capacity | Up to 3 Ton, 3.1 to 6 Ton, 6.1 to 10 Ton, More than 10 Ton |

| By Boom Length | Up to 6 Meters, 6.1 to 12 Meters, 12.1 to 18 Meters, More than 18 Meters |

| By Application | Material Handling, Loading & Unloading, Equipment Installation, Maintenance & Repair Operations |

| By End User | Construction, (Residential Construction, Commercial Construction, Industrial Projects), Oil & Gas, Mining & Metals, Industrial Manufacturing, Government & Defense Projects, Ports, Logistics & Warehousing, Others), and others |

Saudi Arabia Telehandler Rental Market Drivers:

Expanding Logistics & Warehousing Boosting Market Growth

Saudi Arabia’s logistics and warehousing ecosystem is expanding at a pace that is structurally reshaping equipment demand patterns. During the first half of 2025, over 1.3 million m² of new warehouse space was delivered nationwide. Despite this supply influx, utilization remains exceptionally tight.

Riyadh’s logistics stock has reached 28.9 million m², with occupancy nearing 98%, reflecting sustained pressure from manufacturing, FMCG, and national distribution networks. This near-full absorption limits operational flexibility within facilities and compels occupiers to seek agile, non-capital-intensive material handling solutions.

Riyadh continues to consolidate its position as the Kingdom’s primary logistics nucleus, supported by a warehouse base exceeding 10.6 million m² and continuous inflows from industrial and consumer supply chains.

In parallel, Jeddah’s warehouse supply surpassed 20.1 million m² in 2025, with occupancy approaching 97%. Its proximity to Jeddah Islamic Port, Saudi Arabia’s principal maritime gateway, creates pronounced throughput volatility, particularly during peak import-export cycles. These dynamics heighten congestion risks across port-adjacent storage clusters, bonded facilities, and cold-chain infrastructure.

Under such conditions, operators increasingly rely on on-demand telehandler rentals to manage seasonal surges, project-driven expansions, and inventory reconfigurations without committing long-term capital. Beyond 2025, continued logistics park developments and port-led industrial zones will intensify material movement requirements across high-density warehousing corridors.

Overall, persistently high occupancy, accelerating warehouse development, and port-driven throughput volatility are structurally embedding telehandler rentals into Saudi Arabia’s logistics operations.

Saudi Arabia Telehandler Rental Market Trends:

Shift Towards Sustainable & Green Equipment Alternatives

Sustainability is increasingly shaping equipment procurement decisions across Saudi Arabia’s construction and logistics sectors, directly influencing the telehandler rental market, as contractors prioritize low-emission machinery to meet regulatory standards, ESG commitments, and long-term environmental goals.

Anchored in Vision 2030, the Saudi Green Initiative (SGI) commits the Kingdom to reducing carbon emissions by 278 million tonnes annually by 2030, achieving 50% renewable energy generation by the same year, and reaching net-zero emissions by 2060. These national targets are cascading into operational policies across infrastructure, warehousing, and industrial projects, encouraging contractors to adopt cleaner machinery.

This policy momentum is reinforced by tangible investment. For example, in 2025, Saudi Arabia awarded five renewable energy projects totaling 4.5 GW, with investments exceeding USD 2.4 billion, accelerating the transition toward low-carbon industrial ecosystems. As renewable capacity expands, project owners and logistics operators are increasingly prioritizing equipment that aligns with environmental compliance and ESG frameworks.

Rental providers are responding by integrating electric and low-emission models into their fleets. For instance, HEVEQ now lists electric telehandlers alongside diesel variants across Riyadh and Jeddah. These machines deliver zero on-site emissions, lower noise levels, and improved energy efficiency, making them ideal for indoor warehouses, logistics parks, and environmentally regulated zones.

Overall, national climate commitments and renewable energy expansion are accelerating the adoption of electric telehandlers. This trend is redefining fleet strategies and will structurally drive growth in Saudi Arabia’s telehandler rental industry.

Saudi Arabia Telehandler Rental Market Challenges:

High Maintenance & Operating Costs

High maintenance and operating expenses remain a critical constraint in the Saudi Arabia telehandler rental market, directly shaping pricing strategies, limiting fleet expansion, compressing margins, and reducing the affordability of rental solutions for cost-sensitive contractors.

Government data from the General Authority for Statistics (GASTAT) shows that the Construction Cost Index rose by 1.1% in June 2025 compared to June 2024, while equipment and machinery rental prices increased by 2.5%. This escalation has been driven largely by energy inflation, with diesel prices surging by 27.3%, resulting in a 9.9% increase in energy costs. For telehandlers, which rely heavily on diesel power and frequent servicing, these pressures materially elevate operating expenditure.

Further compounding this challenge, official figures indicate that in July 2025, equipment and machinery rental costs climbed 1.8% year-on-year, including a 2.5% rise in unoperated rental charges. These increases amplify routine maintenance burdens such as parts replacement, mechanical servicing, and fuel consumption costs typically absorbed by rental providers and passed through to end users.

Overall, persistent escalation in fuel, maintenance, and rental input costs constrains profitability and slows fleet expansion, posing a structural barrier to the pace of growth in Saudi Arabia’s telehandler rental industry.

Saudi Arabia Telehandler Rental Market (2026-32) Segmentation Analysis:

The Saudi Arabia Telehandler Rental Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type:

- Fixed

- Rotating

The fixed segment holds the top spot in the Saudi Arabia Telehandler Rental Market with a market share of around 70%. Segment’s market dominance is driven by its versatility, cost efficiency, and suitability for the Kingdom’s dominant construction and logistics applications.

These machines are widely deployed across infrastructure projects, warehousing facilities, industrial zones, and residential developments, where straight-line lifting, pallet handling, and material placement are routine requirements.

Compared to rotating models, fixed telehandlers offer lower acquisition and maintenance costs, simpler mechanical architecture, and higher reliability in demanding operating environments, making them the preferred choice for rental operators and contractors alike. Their robust load capacity, extended forward reach, and ease of operation align well with high-frequency tasks such as unloading trucks, stacking materials, and supporting formwork or façade installation.

In Saudi Arabia’s large-scale construction sites and logistics hubs, where equipment is expected to operate continuously with minimal downtime, fixed telehandlers deliver consistent performance and faster return on investment for rental fleets.

Moreover, the availability of a broad attachment ecosystem, such as forks, buckets, winches, and platforms, enhances functional flexibility without the complexity associated with rotating systems. This balance of capability, durability, and cost-effectiveness underpins the segment’s dominance across the national rental landscape.

Based on Propulsion Type:

- ICE

- Electric

The ICE category leads the Saudi Arabia Telehandler Rental Industry, holding around 85% market share. Market dominance is primarily due to its superior suitability for the Kingdom’s demanding operating environments.

Construction, infrastructure, oil & gas, and logistics projects are often located in remote or semi-developed areas where grid power and charging infrastructure are limited or unavailable. Internal combustion engine telehandlers, mainly diesel-powered, offer uninterrupted operation, rapid refueling, and consistent performance across long shifts, making them indispensable for high-intensity project sites.

These machines also deliver higher torque and lifting capacity, enabling efficient handling of heavy pallets, steel structures, and bulk construction materials across uneven terrain. Their resilience under extreme temperatures and dusty conditions further reinforces their preference in Saudi Arabia’s harsh climate.

From a commercial standpoint, ICE models remain more cost-effective to acquire and maintain compared to electric alternatives, especially for rental operators managing large, multi-brand fleets.

Moreover, contractor familiarity, widespread service networks, and readily available spare parts reduce downtime risks and enhance operational reliability. Collectively, these factors anchor ICE telehandlers as the preferred propulsion type across most rental applications, sustaining their market leadership.

Gain a Competitive Edge with Our Saudi Arabia Telehandler Rental Market Report

- Saudi Arabia Telehandler Rental Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Telehandler Rental Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Telehandler Rental Market Policies, Regulations, and Product Standards

- Saudi Arabia Telehandler Rental Market Trends & Developments

- Saudi Arabia Telehandler Rental Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Telehandler Rental Market Hotspot & Opportunities

- Saudi Arabia Telehandler Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- Fixed

- Rotating

- By Propulsion Type – Market Size & Forecast 2022-2032, USD Million

- ICE

- Electric

- By Drive Type– Market Size & Forecast 2022-2032, USD Million

- Two- Wheel Drive

- Four- Wheel Drive

- All - Wheel Drive

- By Lift Capacity – Market Size & Forecast 2022-2032, USD Million

- Up to 3 Ton

- 3.1 to 6 Ton

- 6.1 to 10 Ton

- More than 10 Ton

- By Boom Length – Market Size & Forecast 2022-2032, USD Million

- Up to 6 Meters

- 6.1 to 12 Meters

- 12.1 to 18 Meters

- More than 18 Meters

- By Application – Market Size & Forecast 2022-2032, USD Million

- Material Handling

- Loading & Unloading

- Equipment Installation

- Maintenance & Repair Operations

- By End User – Market Size & Forecast 2022-2032, USD Million

- Construction

- Residential Construction

- Commercial Construction

- Industrial Projects

- Oil & Gas

- Mining & Metals

- Industrial Manufacturing

- Government & Defense Projects

- Ports, Logistics & Warehousing

- Others

- Construction

- By Region

- Eastern

- Central

- Western

- Northern

- Southern

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type – Market Size & Forecast 2022-2032, USD Million

- Market Size & Outlook

- Saudi Arabia Fixed Telehandler Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Propulsion Type – Market Size & Forecast 2022-2032, USD Million

- By Drive Type– Market Size & Forecast 2022-2032, USD Million

- By Lift Capacity – Market Size & Forecast 2022-2032, USD Million

- By Lift Height – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- Saudi Arabia Rotating Telehandler Rental Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- Market Share & Outlook

- By Propulsion Type – Market Size & Forecast 2022-2032, USD Million

- By Drive Type– Market Size & Forecast 2022-2032, USD Million

- By Lift Capacity – Market Size & Forecast 2022-2032, USD Million

- By Lift Height – Market Size & Forecast 2022-2032, USD Million

- By Application – Market Size & Forecast 2022-2032, USD Million

- By End User – Market Size & Forecast 2022-2032, USD Million

- By Region

- Market Size & Outlook

- Saudi Arabia Telehandler Rental Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Abdullah Al-Bahar Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zahid Tractor & Heavy Machinery Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Madinah Equipment Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- East Directions Industrial Services

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Earth Care General Contracting EST

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AWAL EQUIPMENT HIRING COMPANY

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dayim Equipment Rental Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Reliant Rentalz

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Reem Equipment Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al Faris Equipment Rentals (LLC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Abdullah Al-Bahar Group

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making