Saudi Arabia Rent a Car Market Research Report: Forecast (2023-2028)

By Type of Car (Economy, SUV, Multi Utility Vehicle, Luxury), By Application (Leisure, Commercial) By Drive Type (Self-Driving, Chauffeur), By Booking Type (Offline, Online), By Us...age (Local, Airport, Outstation), By Rental Duration (Short Term, Long Term), By Region (Central, East, West, South), By Company (Hertz, Sixt Rent a Car, Europcar, LUMI, Avis Budget Group, FinalRentals KSA, Enterprise Holdings, Inc., Alwefaq Transportation Solutions (Yelo), Hanco (Al Tala’a International Transportation Co. Limited), Others) Read more

- Automotive

- May 2023

- Pages 115

- Report Format: PDF, Excel, PPT

Market Insights

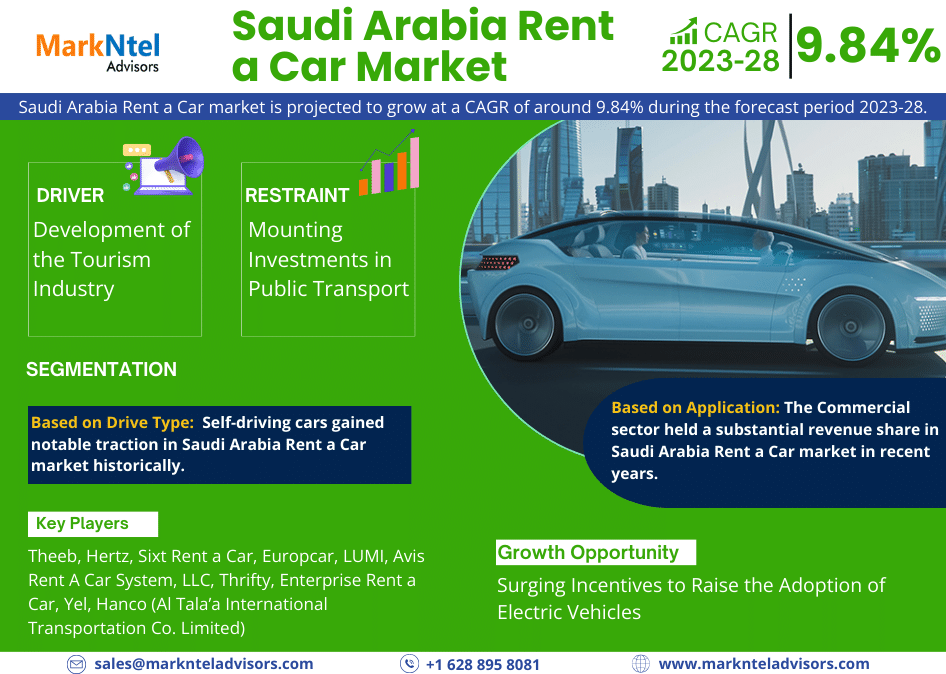

Saudi Arabia Rent a Car market is projected to grow at a CAGR of around 9.84% during the forecast period, i.e., 2023-28. A service provided by renting companies that offer cars for shorter periods to longer periods is termed as rent a car service. The car rental companies offer a variety of cars such as economy, luxury, sports, and SUVs as per the requirement of the customers. The market gained notable traction historically, with local & airport rides holding a key position. It is an established industry with a substantial number of service providers, including Theeb, Udrive, Europcar, etc., that constantly offer pickup & drop services to individuals in the country at competitive pricing.

The enhanced safety offered by online rental platforms, such as vehicle tracking & ease of booking, has been facilitating the revenue growth of the market in the country. The proliferation of establishments, surging infrastructure construction activities of major tourist attractions, and growing employment opportunities in the country, as a result of a surge in FDI in non-oil sectors, has further led to a rise in the expatriate population in the country, thus spurring the demand for car rentals in Saudi Arabia.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 9.84% |

| Region Covered | Central, East, West, South |

| Key Companies Profiled | Hertz, Sixt Rent a Car, Europcar, LUMI, Avis Budget Group, FinalRentals KSA, Enterprise Holdings, Inc., Alwefaq Transportation Solutions (Yelo), Hanco (Al Tala’a International Transportation Co. Limited), Others |

| Unit Denominations | USD Million/Billion |

Additionally, the soaring inbound tourism activities in the country & their surging spending on leisure, business, and related activities have further uplifted the demand for car rental services of both self-driving & chauffeur drive types. According to the Saudi Ministry of Investment, the number of inbound tourists in the country in the second quarter of 2022 rose annually by about 575.4% to 3.6 million, and their spending soared by 570% in the second quarter to USD4.1 billion in comparison to second quarter 2021. Moreover, the surging domestic & expatriate population in major urban centers of the country, which includes Riyadh, Jeddah, Mecca, and Dammam, etc., is anticipated to further facilitate the need for car rentals in the country during the forthcoming period.

Market Dynamics

Key Driver: Development of the Tourism Industry

The tourism industry of the Kingdom of Saudi Arabia has been growing at a fast pace over the past years due to the increasing focus of the government on this sector. Rising investments & infrastructure expansion, such as the construction of hotels, theme parks, art galleries, metro lines, etc., led to the blossoming of the tourism sector in the country. This has raised the total number of travelers across the country, which enhanced the demand for rental car services owing to the ease of exploring new destinations, and long-term cost-effectiveness, compared to the total expenses on public transport. These cars offer a high level of comfort to tourists, and they get to avail attractive offers made by hotels & travel companies for these services in their packages, which has positively impacted the market in the country.

Furthermore, the growth in medical tourism, in response to the expansion of the healthcare industry, is also creating a new customer base for rental car services in the country. Therefore, medical tourism in Saudi Arabia is expected to grow in the near future, thereby upgrading the growth of the Rent a Car market.

Possible Restraint: Mounting Investments in Public Transport

The Saudi Arabia government has started investing heavily in the development of a robust public transport infrastructure in the country to improve the quality of life in urban areas & to develop a global logistic hub, which has been affecting the adoption of rental car services among consumers. The government has announced several infrastructure projects, including the construction of trains, metro lines, public transport buses, etc., which would improve road connectivity in different regions across the country, such as Jazan, Sabya, Abu Arish, etc.

Also, the government is indulging in public-private partnerships & contracts to expand public transport networking. For instance, in 2021, the Ministry of Transport and Logistics Services launched the National Transport and Logistics Strategy, which includes initiatives designed to reduce the number of road traffic accidents, implement the best global practices, achieve efficient connectivity, and develop public transport in Saudi cities. Hence, with the development of such public transport infrastructure, a major share of consumers, especially the ones looking for affordable transportation options, has been shifting from car rental to public transportation services, thus impeding the market growth.

Growth Opportunity: Surging Incentives to Raise the Adoption of Electric Vehicles

The government of Saudi Arabia is taking steps to build a robust automotive industry in the country, with the expansion of the Electric Vehicles (EVs) market to support the nation's decarbonization efforts. Under the National Strategy for Transport and Logistics Services, the country aims to raise the share of zero-carbon transport vehicles on Saudi roads to nearly 45% of the total number of traditional vehicles.

Furthermore, the country's strategic location at the crossroads of African, Asian, and European markets makes it an ideal point for importing minerals & for the production of batteries & vehicles, which is raising the government's focus on manufacturing EVs inside the country. For instance, in 2022, the Saudi Arabia government launched Ceer, the country's first electric vehicle manufacturing company. Hence, in line with the increased government initiatives for EVs, car rental companies are also taking efforts, such as signing up agreements & contracts to enhance the fleet size of EVs in their car inventory.

Key Trend: Favorable Government Policies for Electronic Authorization of Car Rental Services

The Saudi Arabian government has started laying out favorable initiatives for technological advancement, ease of rules & policies, etc., to improve renting experience of consumers in recent years. These initiatives have been bringing changes in the business environments of car rental companies by easing the authorization of rental documents. For instance, in 2022, Saudi Traffic Authorities & Ministry of Interior launched “Electronic Authorization Services for Visitors”, which allowed auto rental offices to get authorization documents for visitors electronically through the electronic platform Absher Business.

Hence, these initiatives launched by the government for electronic authorization made it easy for customers to avail of rental car services & thus impacted the market positively. In addition, to cater to the enhanced demand for car rental services after the launch of government initiatives, more & more rental car companies such as Theem & Udrive are expanding their establishment in the country to captivate the increasing number of opportunities in the Rent a Car market.

Market Segmentation

Based on Application:

- Leisure

- Commercial

The Commercial sector held a substantial revenue share in Saudi Arabia Rent a Car market in recent years. The surging development of service sectors in the country & growth promotion by the Saudi government to boost FDI has widely influenced the demand for rental cars to transport at innumerable business locations. Along with this, the rising presence of various domestic & international organizations due to macroeconomic advantages such as an efficient workforce, ease of entry & exit, and suitable business policies has further augmented the demand for rental cars to provide mobility services to their employees. Hence, as more & more businesses are expanding their operations in the country, a notable rise in inbound & regular business travel is expected to be witnessed in Saudi Arabia, further propelling the demand for rent a car services in the country during the forthcoming period.

Based on Drive Type:

- Self-driving

- Chauffeur

Self-driving cars gained notable traction in Saudi Arabia Rent a Car market historically. The key factor attributed to the growth is greater flexibility, cost-competitive offering, and privacy. These cars offer customers the freedom to travel wherever & whenever they want without the restrictions of a chauffeur-based service. Additionally, customers can plan their itinerary according to their schedule & explore various destinations at their own pace. Self-driving rental cars are often more cost-effective than chauffeur-based services & offer greater privacy, especially for longer-term rentals & customers can avoid the costs of paying for a professional driver, which, in turn, leads to more savings on transportation expenses.

Recent Developments by the Leading Companies

- 2023: Sixt signed agreement with Altawkilat Universal Motors (Chevrolet’s dealer partner in Saudi Arabia) to onboard 25 Chevrolet Bolt EUVs.

- 2022: Theeb Rent a Car launched its second branch in Hail City, with the plan to expand & cover all the Kingdom’s cities, areas, and provinces.

Do you require further assistance?

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on Saudi Arabia Rent a Car Market

- Saudi Arabia Rent a Car Market Trends & Insights

- Saudi Arabia Rent a Car Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia List of Rental Car Service Providers

- By Fleet Size

- By Type of Car

- By Price Range

- By Recent Development

- Saudi Arabia Rent a Car Market Pricing Analysis

- Saudi Arabia Rent a Car Market Hotspot & Opportunities

- Saudi Arabia Rent a Car Market Policies, Regulations, Product Standards

- Saudi Arabia Rent a Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Total Cars Available for Rental

- Market Share & Analysis

- By Type of Car

- Economy

- SUV

- Multi Utility Vehicle

- Luxury

- By Application

- Leisure

- Commercial

- By Drive Type

- Self-Driving

- Chauffeur

- By Booking Type

- Offline

- Online

- By Usage

- Local

- Airport

- Outstation

- By Rental Duration

- Short Term

- Long Term

- By Region

- Central

- East

- West

- South

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Type of Car

- Market Size & Analysis

- Saudi Arabia Rental Economy Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- Saudi Arabia Rental SUV Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- Saudi Arabia Rental Multi Utility Vehicle Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- Saudi Arabia Rental Luxury Car Market Outlook, 2018-2028

- Market Size & Analysis

- Revenues

- Market Share & Analysis

- By Application

- By Drive Type

- By Booking Type

- By Usage

- By Rental Duration

- By Region

- Market Size & Analysis

- Saudi Arabia Rent a Car Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product/ Solution Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Theeb

- Hertz

- Sixt Rent a Car

- Europcar

- LUMI

- Avis Budget Group

- FinalRentals KSA

- Enterprise Holdings, Inc.

- Alwefaq Transportation Solutions (Yelo)

- Hanco (Al Tala’a International Transportation Co. Limited)

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making