North America Used Truck Market Research Report: Forecast (2025-2030)

North America Used Truck Market - By Application (Construction, mining and Logistics), By Capacity (3.5 to 7.5 tons, 7.5 tons to 16 tons and Above 16 tons), By Fuel Type (Gasoline.../CNG, Diesel, Petrol and Electric and Hybrid), By Vehicle Type (Light, Medium-duty and Heavy Truck) and Others Read more

- Automotive

- May 2025

- Pages 160

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: North America Used Truck Market (2025-30):

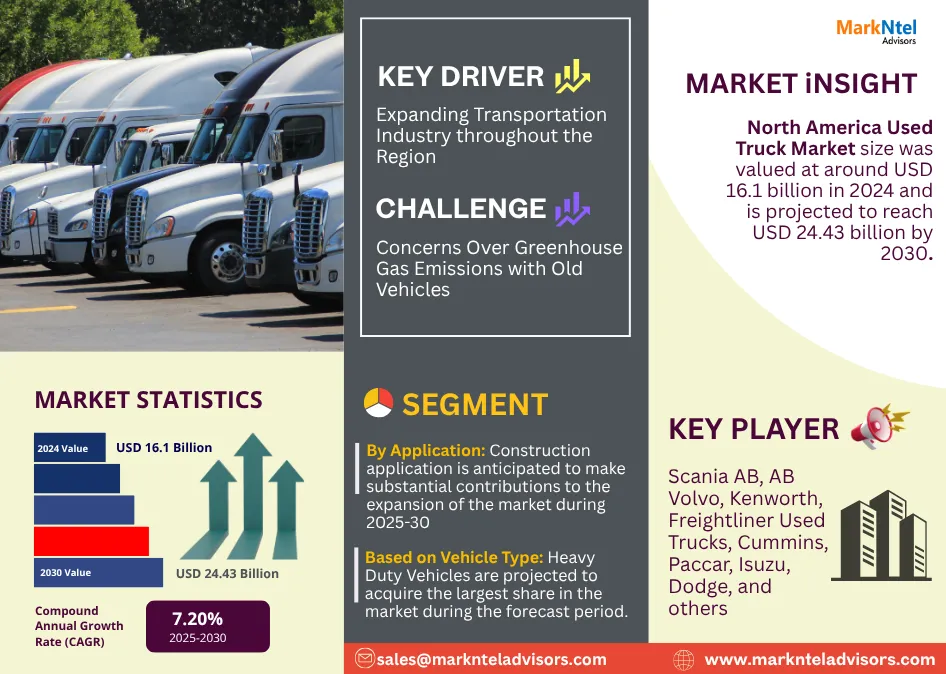

The North America Used Truck Market size was valued at around USD 16.1 billion in 2024 and is projected to reach USD 24.43 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 7.20% during the forecast period, i.e., 2025-30. Most of the market expansion would be propelled by the rapidly increasing number of construction and development projects across different countries in the region, backed by substantial government support and investments. It, in turn, is augmenting the demand for used trucks, which are easily available at affordable prices.

Additionally, the growing integration of technological advancement and innovation particularly in trucking industry has resulted in introduction of newer models into the market. As fleet owners upgrade their trucks to access enhanced fuel efficiency, safety features and connectivity options, a surplus of well-maintained used trucks becomes available. This inclination towards technology elevate the used truck market, providing potential buyers with a range of options that offer modern amenities and technological advancements.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020–24 |

| Forecast Years | 2025–30 |

| Market Value in 2024 | USD 16.1 Billion |

| Market Value by 2030 | USD 24.43 Billion |

| CAGR (2025–30) | 7.20% |

| Leading Country | Mexico |

| Top Key Players | Scania AB, AB Volvo, Kenworth, Freightliner Used Trucks, Cummins, Paccar, Peterbilt, International, Isuzu, Dodge, and others |

| Segmentation | By Application (Construction, mining and Logistics), By Capacity (3.5 to 7.5 tons, 7.5 tons to 16 tons and Above 16 tons), By Fuel Type (Gasoline/CNG, Diesel, Petrol and Electric and Hybrid), By Vehicle Type (Light, Medium-duty and Heavy Truck) and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

With the growing awareness among contractors about these trucks are elevating swiftly and stimulating the overall market growth across North America. The same aspect is also generating lucrative opportunities for the players to widen their service offering and cater to the accelerating demand for used trucks in the region. Furthermore, trends like “Pay as Use” and using used trucks on rental basis are also stimulating the demand & popularity of these vehicles and contributing to the overall market growth.

North America Used Truck Market Driver:

Expanding Transportation Industry throughout the Region – Backed with the improvement in the road connectivity and trade across different countries in the region, the transportation industry in North America is growing substantially and demonstrating a peaking demand for used trucks. As a result, key players are tapping these opportunities and widening their offerings, thereby generating substantial revenue and contributing to the overall growth trajectory of the market in the region.

North America Used Truck Market Challenge:

Concerns Over Greenhouse Gas Emissions with Old Vehicles – As emission levels are gaining more focus of the governments to take stringent actions, restrictions & limitations on the use of older or used vehicles, including trucks, are witnessing a downfall in demand. In fact, the development of new vehicle models equipped with technologies like driveline traction control, automation transmission, anti-lock braking systems, air bags, and driver control monitoring, among others, is challenging the market for used trucks in North America.

North America Used Truck Market Trend:

Digitalization and Online Sales Platforms – The rapid digitalization of sales channels and the rise of online platforms for used truck transactions is considered as one of the prominent trends shaping the industry growth. Companies are increasingly enhancing their websites and digital tools to provide a seamless, informative, and convenient online buying experience. Features such as responsive design, virtual inspections, and easy financing, making it easier for customers to compare, select, and purchase used trucks remotely. This digital transformation not only broadens market reach and efficiency but also increases transparency and buyer confidence, contributing significantly to the expansion and modernization of the used truck market in North America.

North America Used Truck Market (2025-30): Segmentation Analysis

The North America Used Truck Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the Regional level. Based on the analysis, the market has been further classified as:

Based on Application:

- Construction

- Mining

- Logistics

Among all, the construction application is anticipated to make substantial contributions to the expansion of the North America Used Trucks Market during 2025-30. This growth attributes to the mounting number of construction & development activities happening across different countries in the region, propelling the demand for used trucks. Besides, the availability & cheap prices of these trucks alongside trends like rental use of these vehicles is also projecting a booming popularity of these vehicles for different construction activities. Moreover, as the population is growing exponentially in the region, alongside its heavy tourist & migrant influx, construction of facilities like hotels, airports, shopping malls, highways, residential complexes, and more, are increasing, thereby boosting the demand for used trucks across North America.

On the other hand, logistics shall also make a positive influence on the overall growth pace of the North America Used Trucks Market during the forecast period. Backed by the improving road connectivity and increasing cross-border trade in the region, the requirement for used trucks is increasing swiftly, particularly to transport goods. Besides, growing consumer awareness about the affordability & availability of these trucks is also curating the fundamentals underlying the flourishing growth trajectory of the Used Trucks Market in North America.

Based on Vehicle Type:

- Light Vehicles

- Medium Duty Vehicles

- Heavy-Duty Vehicles

Here, Heavy Duty Vehicles are projected to acquire the largest share in the North America Used Trucks Market during the forecast period. This dominance is principally on the back of the massive transportation & logistics industry in the region, influenced by the growing number of cross-border trades, boosting the demand for used trucks. Besides, the massive population influx in the region is also stirring the construction industry for the development of facilities to cater the needs of the people. Based on the high number of construction projects across different countries in the region, the demand for heavy duty trucks is upscaling and driving the overall growth of the used trucks market through 2030.

North America Used Truck Market (2025-30): Regional Projection

Geographically, the North America Used Truck Market expands across:

- US

- Canada

- Mexico

Of all countries, Mexico is emerging as a country with substantial opportunities for the players to expand their offerings and drive the Used Trucks Market during the forecast period. This owes to the high dependence of the country on its cross border trade and swiftly growing transportation & logistics sector. It is anticipated to propel the demand for used trucks for trading goods & services, alongside delivering these vehicles cross borders.

Besides, it is also why several new players & prominent companies are investing substantially in the industry for Used Trucks in Mexico, thereby contributing to the generation of new revenue streams in the country. Hence, the market is projected to observe a considerable growth pace across Mexico during the forecast period, i.e., 2025-30.

Gain a Competitive Edge with Our North America Used Truck Market Report

- North America Used Truck Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- North America Used Truck Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Expert Verbatim- What our Experts Say?

- North America Used Trucks Market Voice of Customer

- Brand Awareness

- End User Expectation

- Key Factors Impacting Vendor Selection

- Key Issues Encountered

- Vendor’s Receptiveness to Address Key Customer Issues

- Future Requirements

- North America Used Truck Market Analysis, 2020- 2030F

- Market Potential & Analysis

- Market Revenue

- Units Sold

- Market Segmentation & Analysis

- By Application

- Construction

- Mining

- Logistics

- By Capacity

- 3.5 tons to 7.5 tons

- 7.5 tons to 16 tons

- Above 16 tons

- By Fuel Type

- Diesel

- Petrol

- Gasoline/CNG

- Electric and Hybrid

- By Vehicle Type

- Light Truck

- Medium-duty Truck

- Heavy-duty Truck

- By Country

- United States

- Canada

- Mexico

- Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Application

- The United States Used Truck Market Analysis, 2020- 2030F

- Market Potential & Analysis

- Market Revenue

- Units Sold

- Market Segmentation & Analysis

- By Application

- By Tonnage Capacity

- By Fuel type

- By Vehicle Type

- Market Potential & Analysis

- Canada Used Truck Market Analysis, 2020- 2030F

- Market Potential & Analysis

- Market Revenue

- Units Sold

- Market Segmentation & Analysis

- By Application

- By Tonnage Capacity

- By Fuel type

- By Vehicle Type

- Market Potential & Analysis

- Mexico Used Truck Market Analysis, 2020- 2030F

- Market Potential & Analysis

- Market Revenue

- Units Sold

- Market Segmentation & Analysis

- By Application

- By Tonnage Capacity

- By Fuel type

- By Vehicle Type

- Market Potential & Analysis

- Market Potential & Analysis

- North America Used Truck Market Policies, Regulations, Product Standards

- North America Used Truck Market Trends & Insights

- North America Used Truck Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- North America Used Truck Market Hotspot & Opportunities

- North America Used Truck Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making