North America Autonomous Forklifts Market Research Report: Forecast (2025-2030)

North America Autonomous Forklifts Market - By Navigation (Laser Guidance, Magnetic Guidance, Inductive Guidance, Optical Tape Guidance, Vision Guidance, Slam, Others), By Weight C...apacity (Below 3 Tons, 3 to 5 Tons, Above 5 Tons), By End-User Industry (Food & Beverages, Automotive, E-Commerce, Aviation, Healthcare, Chemical, Semi-Conductor & Electronics, Others), By Fuel (Electric, ICE), By Operability (Indoor, Outdoor), By Sourcing (In-House Purchasing, Leasing), By Level of Autonomy (Level 1, Level 2, Level 3, Level 4, Level 5) and Others Read more

- Automotive

- Mar 2025

- Pages 151

- Report Format: PDF, Excel, PPT

Market Definition

Autonomous forklifts are industrial trucks that automatically lift and transport products from one place to another in the inventories. These machines are fitted with a great variety of cameras, sensors, and navigation systems so that they can perform on their own.

Market Insights & Analysis: North America Autonomous Forklifts Market (2025-30):

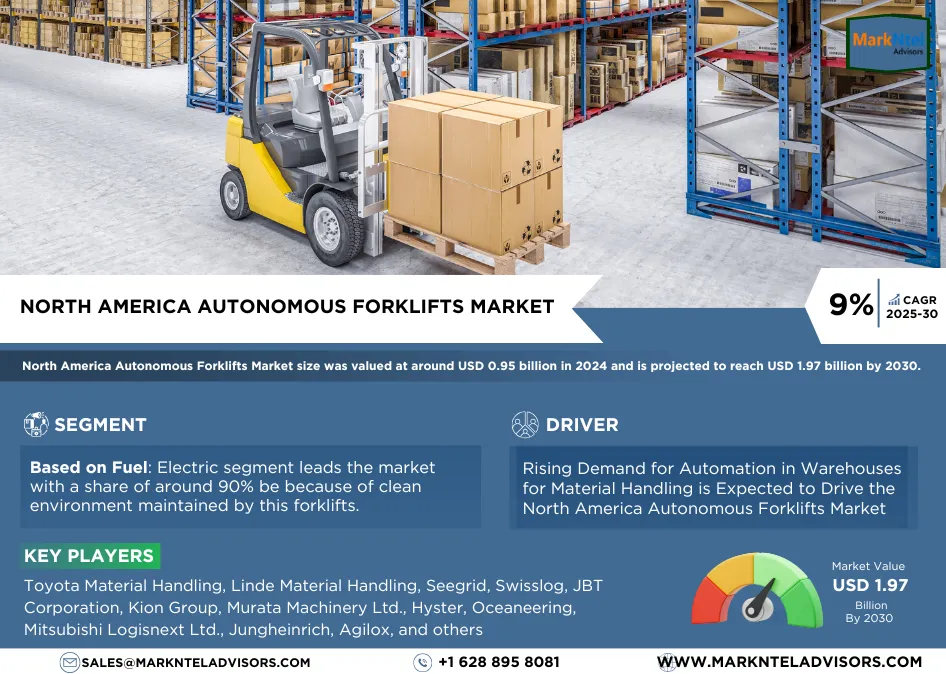

The North America Autonomous Forklifts Market size was valued at around USD 0.95 billion in 2024 and is projected to reach USD 1.97 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 9% during the forecast period, i.e., 2025-30. The main reason behind this growth is the increased work efficiency offered by them as work autonomously without pauses and do not need human intervention which reduces operational costs. Investments in such vehicles have been spurred over few years. For instance, in 2022, Amazon engaged autonomous forklifts in its warehouses to maximize efficiency. This results in increased demand for such vehicles. Alongside the expansion of E-Commerce has further spurred demand for these vehicles for loading inventories in warehouses.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Size in 2024 | 0.95 Billion |

| Market Size By 2030 | 1.97 Billion |

| CAGR (2025-30) | 9% |

| Leading Country | U.S. |

| Top Key Players | Toyota Material Handling, Linde Material Handling, Seegrid, Swisslog, JBT Corporation, Kion Group, Murata Machinery Ltd., Hyster, Oceaneering, Mitsubishi Logisnext Ltd., Jungheinrich, Agilox, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

As per the U.S. Department of Commerce in Q4, 2024 the retail online sales in the U.S. amounted to USD 308.9 billion, representing an increase of approximately 2.7% compared to the previous quarter of the same year. There exists quite a heavy amount of industrial freight, which drives the demand for decent automatic forklifts that are safer and perform better than inferior manual equivalents. Furthermore, the policies and regulations introduced by the governments of this region boost the sales of self-driving forklifts. These include the regulations that put restrictions on the emission of carbon compounds into the air. Autonomous forklifts help companies to address this norm as they run on electric power.

In addition, purchases of such vehicles result in getting subsidies from the government that encourage more buyers and thus fuel investment in such types of equipment. With ongoing growth in the e-commerce sector that is projected to increase in the forecast period and governmental support for these vehicles, the market for Autonomous forklifts is projected to rise.

North America Autonomous Forklifts Market Driver:

Rising Demand for Automation in Warehouses for Material Handling – Automation across diverse manufacturing industries is gaining a lot of momentum in pursuit of improving manufacturing efficiency. Automated machines are advantageous on account of having the ability to run 24/7 without a break and removing human error, these tend to enhance work efficiency while dramatically reducing operational costs. Thus, several organizations are pouring money into these self-driving forklifts. For instance, in 2024, Walmart, adopted 19 automated electric forklifts to optimize its warehouse operations in an automatic format. Many industries are expected to go further with self-driven forklifts in the upcoming times. Thus the demand for autonomous forklifts is rising to increase the efficiency of work at warehouses of different companies.

North America Autonomous Forklifts Market Opportunity:

Labor Shortage in North America to Offer a Lucrative Growth Opportunity – North America has been facing labor shortages in production facilities manufacturing plants. As per the US Chamber of Commerce, about 1.2 million such workers are reported to be missing from the industry. This shortfall has been blamed on the decrease in the migration of working-age workers from other countries and an accelerated retirement of local labor in the region. Thus affecting the productivity of various industries. Thus, this shortage of labor prompts more outflow of money in terms of daily wages to few available workers in that region which will raise the cost of overall operation.

Since, Autonomous forklifts thus have an unexplored window of opportunity to solve part of these problems and increase productive efficiency. Therefore, the workforce crisis would fuel the demand for autonomous forklifts and eventually drive strong growth in this market.

North America Autonomous Forklifts Market Challenge:

High Initial Costs to Hinder the Market Growth – The crippling effect of high pricing on the growth prospects of this market is only one side of the coin: It sits, blocking the potential growth of autonomous forklifts, with anything around USD80,000 being really beyond neat alternatives sitting at a comparatively lower price, approximating USD30,000. The autonomous technology in Linde Material Handling is a kind of self-driving technology acquired from Balyo, which focuses on robotic innovation. Small, inventive start-ups find it almost impossible to set up a business with this kind of automation. And less automation means fewer customers for autonomous forklifts, meaning their sales volumes shrink. Hence, autonomous forklifts found their natural sales limited because of an extremely high price in the small-scale end-user industries; thus, this presents a valid barrier to market growth.

North America Autonomous Forklifts Market Trend:

Implementation of Industry 4.0 Technologies in Warehouses Boosting the Market Expansion – The deployment of Industry 4.0 technologies, such as AI & ML, robotics, automation, cloud computing, analytics, etc., in warehouses of various industries has gained popularity in recent years. This can be observed in the adoption of such technologies by various companies in this region, such as Amazon, Walmart, and many others. These efforts are made as all such technologies enhance overall efficiency, accuracy, and adaptability. As a result, they also invest in autonomous forklifts that handle, transport, and store products without human intervention.

Moreover, with the increasing awareness about the benefits of such technologies, more companies are expected to adopt them, including the automation in warehouses that is achieved by the use of autonomous forklifts. Therefore, Industry 4.0 technologies have enhanced the market’s dynamics in recent years, and this trend is expected to continue in the future as well.

North America Autonomous Forklifts Market (2025-30): Segmentation Analysis

The North America Autonomous Forklifts Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–30 at the regional level. Based on the analysis, the market has been further classified as:

Based on Fuel:

- Electric

- ICE

Based on the type of fuel used in autonomous forklifts, the electric segment leads the market with a share of around 90%. The main reason behind this dominance is the clean environment maintained by electric forklifts which help companies to align with the government sustainability goals, as they do not discharge carbon into the environment. This also makes them suitable for indoor use to ensure a healthy and noise-free environment for the workers. Additionally, these are also suitable for industries such as pharmaceuticals, food & beverages, etc., that have to maintain an oil-free and carbon-free environment to preserve the quality of their products.

Furthermore, their low cost of running is less than that of ICE ones, thus further increasing their popularity. Therefore, due to the several advantages offered by electric forklifts, they have gained the most consumer attention in past years, and this dominance is expected to remain in the coming years as well.

Based on Navigation:

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Optical Tape Guidance

- Vision Guidance

- Slam

- Others

Based on the type of navigation technology used in autonomous forklifts, the laser guidance segment leads the market with a share of around 34%. This is because laser guidance-based forklifts are the most precise forklifts as they can make a real-time map of their surroundings, avoid obstacles and humans, and move easily through narrow spaces. This also makes them the most favorable choice among warehouses where the places of products keep changing, and forklifts with predefined paths cannot operate. Moreover, they are easy to adopt as they do not require any components like magnetic paths or inductive coil-based paths. Therefore, due to the high precision, safety, and versatility of laser guidance-based forklifts, this segment dominates the market, and this dominance is expected to continue in the forecast years.

North America Autonomous Forklifts Market (2025-30): Regional Projections

Geographically, the North America Autonomous Forklifts Market expands across:

- The US

- Canada

- Mexico

Regionally, the US dominates the market with a share of around 62%. This is because of the presence of a very high number of industries in this region that require automation in their warehouses to increase their work efficiency while reducing operational costs. For instance, there were more than 6,30,000 companies in the US that were engaged in manufacturing in 2023. Moreover, the e-commerce sector in the US is continuously expanding. For instance, as per the US Department of Commerce, the revenue generated from online sales in the US in 2024 was valued at around USD1,192.6 billion. This further increases the demand for handling and transporting goods across numerous warehouses in the least possible time. Therefore, the presence of numerous manufacturing industries in the US and the rapidly expanding e-commerce are the main reasons behind this country’s dominance.

North America Autonomous Forklifts Industry Recent Development:

- 2024: Toyota signed an investment in Gideon, a technology company leading in Autonomous Mobile Robotics (AMR). This partnership seeks to simplify automated vehicle systems through standardization and reduced deployment times.

- 2024: Swisslog established its new headquarters in Atlanta, Georgia. The main aim of this establishment is to expand the company’s market position in North America.

Gain a Competitive Edge with Our North America Autonomous Forklifts Market Report

- North America Autonomous Forklifts Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & market share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- North America Autonomous Forklifts Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- North America Autonomous Forklifts Market Trends & Development

- North America Autonomous Forklifts Market Dynamics

- Drivers

- Challenges

- North America Autonomous Forklifts Market Hotspot & Opportunities

- North America Autonomous Forklifts Market Policies & Regulations

- North America Autonomous Forklifts Market Outlook, 2020-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Navigation

- Laser Guidance- Market Size & Forecast 2020-2030, USD Million

- Magnetic Guidance- Market Size & Forecast 2020-2030, USD Million

- Inductive Guidance- Market Size & Forecast 2020-2030, USD Million

- Optical Tape Guidance- Market Size & Forecast 2020-2030, USD Million

- Vision Guidance- Market Size & Forecast 2020-2030, USD Million

- Slam- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Weight Capacity

- Below 3 Tons- Market Size & Forecast 2020-2030, USD Million

- 3 to 5 Tons- Market Size & Forecast 2020-2030, USD Million

- Above 5 Tons- Market Size & Forecast 2020-2030, USD Million

- By End-User Industry

- Food & Beverages- Market Size & Forecast 2020-2030, USD Million

- Automotive- Market Size & Forecast 2020-2030, USD Million

- E-Commerce- Market Size & Forecast 2020-2030, USD Million

- Aviation- Market Size & Forecast 2020-2030, USD Million

- Healthcare- Market Size & Forecast 2020-2030, USD Million

- Chemical- Market Size & Forecast 2020-2030, USD Million

- Semi-Conductor & Electronics- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Fuel

- Electric- Market Size & Forecast 2020-2030, USD Million

- ICE- Market Size & Forecast 2020-2030, USD Million

- By Operability

- Indoor- Market Size & Forecast 2020-2030, USD Million

- Outdoor- Market Size & Forecast 2020-2030, USD Million

- By Sourcing

- In-House Purchasing- Market Size & Forecast 2020-2030, USD Million

- Leasing- Market Size & Forecast 2020-2030, USD Million

- By Level of Autonomy

- Level 1- Market Size & Forecast 2020-2030, USD Million

- Level 2- Market Size & Forecast 2020-2030, USD Million

- Level 3- Market Size & Forecast 2020-2030, USD Million

- Level 4- Market Size & Forecast 2020-2030, USD Million

- Level 5- Market Size & Forecast 2020-2030, USD Million

- By Country

- The US

- Canada

- Mexico

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Navigation

- Market Size & Analysis

- The US Autonomous Forklifts Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Navigation- Market Size & Forecast, 2020-2030 USD Million

- By Weight Capacity- Market Size & Forecast, 2020-2030 USD Million

- By End-User Industry- Market Size & Forecast, 2020-2030 USD Million

- By Fuel- Market Size & Forecast 2020-2030, USD Million

- By Operability- Market Size & Forecast 2020-2030, USD Million

- By Sourcing- Market Size & Forecast 2020-2030, USD Million

- By Level of Autonomy- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Canada Autonomous Forklifts Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Navigation- Market Size & Forecast, 2020-2030 USD Million

- By Weight Capacity- Market Size & Forecast, 2020-2030 USD Million

- By End-User Industry- Market Size & Forecast, 2020-2030 USD Million

- By Fuel- Market Size & Forecast 2020-2030, USD Million

- By Operability- Market Size & Forecast 2020-2030, USD Million

- By Sourcing- Market Size & Forecast 2020-2030, USD Million

- By Level of Autonomy- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Mexico Autonomous Forklifts Market Analysis, 2020-2030

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Navigation- Market Size & Forecast, 2020-2030 USD Million

- By Weight Capacity- Market Size & Forecast, 2020-2030 USD Million

- By End-User Industry- Market Size & Forecast, 2020-2030 USD Million

- By Fuel- Market Size & Forecast 2020-2030, USD Million

- By Operability- Market Size & Forecast 2020-2030, USD Million

- By Sourcing- Market Size & Forecast 2020-2030, USD Million

- By Level of Autonomy- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- North America Autonomous Forklifts Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Toyota Material Handling

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Linde Material Handling

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Seegrid

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Swisslog

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JBT Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kion Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Murata Machinery Ltd .

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hyster

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oceaneering

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi Logisnext Ltd .

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jungheinrich

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Agilox

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Toyota Material Handling

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making