Latin America Electric Bicycle Market Research Report: Forecast (2023-2028)

By Propulsion (Pedal Assisted, Throttle Assisted (Power on demand)), By Application (Urban Commute, Trekking, Cargo), By Battery Type (Lithium Ion Battery, Lead Acid Battery, Other...s (Nickel Metal Hydride, Nickel Cadmium, etc.)), By Battery Capacity (Less than 250 W, 251 W to 450 W, 451 W to 650 W, Above 651 W), By Country (Mexico, Brazil, Argentina, Columbia, Rest of Latin America), By Company (E Mov Inc., Trek Bike Corporation, Brazil Electric Bikes, Merida Bikes, Caloi, Ridley Bikes, Haibike, Lev Bicycle, Vela Bikes, E-Moving, and Others) Read more

- Automotive

- Aug 2023

- Pages 146

- Report Format: PDF, Excel, PPT

Market Definition

Electric bicycles or E-bicycles are a type of vehicle deployed with electric motors & added battery facilities to assist the rider while peddling. These electric bicycles are an efficient means of traveling as they are cost-efficient, do not require fuel, and are a sustainable means of transportation.

Market Insights & Projections: Latin America Electric Bicycle Market (2023-28):

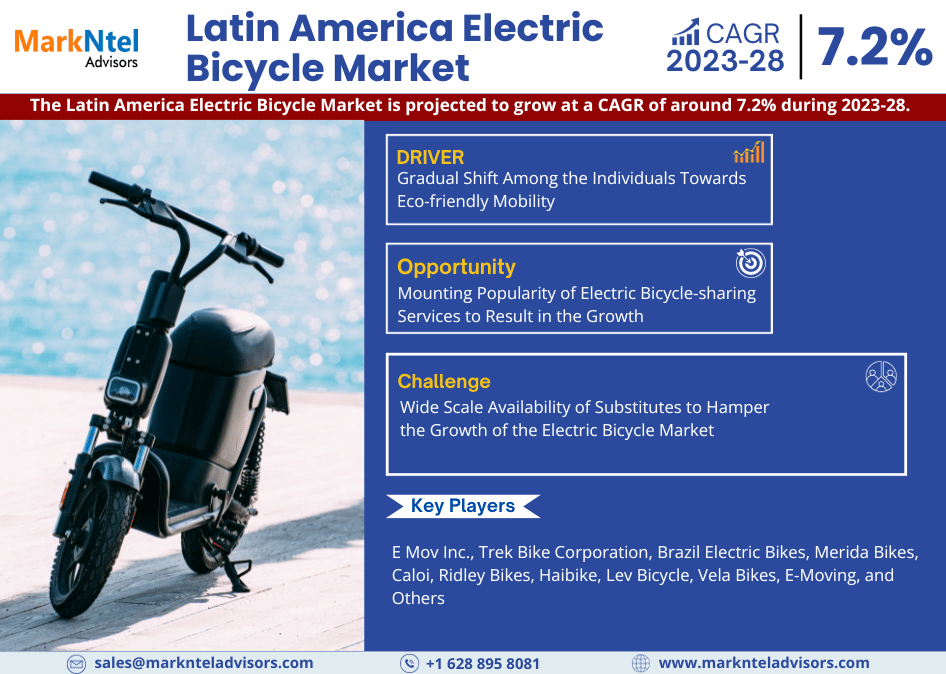

The Latin America Electric Bicycle Market is projected to grow at a CAGR of around 7.2% during the forecast period, i.e., 2023-28. The major factors attributing to its growth are rapid urbanization & the movement of individuals towards urban cities in search of better economic opportunities, improved living standards, and higher education.

In recent years, the urban population in the country has grown considerably. This population segment is the prime user of electric bicycles as they use them for traveling to offices & educational institutions daily. Traffic congestion & road blockages are some of the major issues in cities such as Sao Paulo & Rio de Janeiro in Brazil, Mexico City, and Cancun in Mexico, and many others. Due to this, daily commuters are gradually switching towards e-bicycles for city travel, thus enhancing the E-bicycle Market size.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 7.2% |

| Country Covered | Mexico, Brazil, Argentina, Columbia, Rest of Latin America |

| Key Companies Profiled | E Mov Inc., Trek Bike Corporation, Brazil Electric Bikes, Merida Bikes, Caloi, Ridley Bikes, Haibike, Lev Bicycle, Vela Bikes, E-Moving, and Others |

| Unit Denominations | USD Million |

Further, fuel prices have also been on the rise in the region, which has increased the running cost of the vehicles. For instance, in Brazil, in 2022, the price of fuel grew by more than 33% in comparison to 2021 price levels, stated the government of Brazil. This compelled the riders to switch to more cost-effective means of transportation, such as e-bicycles, which are low maintenance & do not require high-priced fuel to run.

Along with it, the COVID-19 pandemic has bought a behavioral change in consumers, wherein they have become more health-conscious. This has made the individuals in the region switch to electric bicycles as it allows them to burn calories while riding. Further, the battery used in the electric bicycles also provides an increase while going uphill or against a strong headwind. Hence, these factors have resulted in supplementing the adoption of electric bicycles, thereby positively impacting the Latin America Electric Bicycle Market growth during the years ahead.

Latin America Electric Bicycle Market Drivers:

Gradual Shift Among the Individuals Towards Eco-friendly Mobility – Countries such as Brazil, Mexico, and others have been recording poor air quality & high rates of pollution. This is mainly due to the extensive usage of internal combustion-based vehicles & the heavy traffic congestion rate. According to the Brazil Air Quality Index in 2022, nearly 47% of the country’s energy-related carbon dioxide emissions are released by the transportation sector.

The release of harmful gases & particulate matter, in turn, resulted in severe respiratory diseases among the individuals. Therefore, leading to a behavioral change, where individuals in the region are gradually moving towards cleaner modes of transportation, such as electric bicycles, further augmenting the market growth. Daily urban commuters like working professionals & students have been transitioning to e-bicycles to reduce the overall carbon emissions from the transportation sector.

Bicycles are highly cost-effective in comparison to cars & motorbikes, can easily bypass highly congested city lanes, and do not require any additional parking space. Thus, owing to such environmental & economic factors, the adoption of electric bicycles has been growing, especially among the young population residing in the urban parts of the region.

In addition, the government across the region has set a target to substantially reduce carbon emissions by 2030 & achieve net neutrality by the year 2050. This, in turn, is fuelling the adoption of electric bicycles among the residents as well as mobility service providers across the region, thereby driving the Latin America Electric Bicycle Market.

Latin America Electric Bicycle Market Opportunities:

Mounting Popularity of Electric Bicycle-sharing Services to Result in the Growth – The transition towards sustainable mobility & the high fuel prices have resulted in people switching to shared electric bicycle services in the region. The daily commuters find it very convenient to rent electric bicycles from their nearby station & travel to their desired destination.

For convenience, shared e-bicycles are cost-effective as no maintenance is needed. Due to this, the popularity of electric bicycles is growing among the population in Latin America. Considering this pattern, the existing shared mobility service providers are introducing their dedicated electric bicycle fleet to grab the emerging revenue opportunity. For instance:

- In 2023 Uber Technologies announced to partner with Tembici to offer electric bicycle shared services in Latin America. Under the plan, the company aims to roll out nearly 10,000 electric bikes in Brazil by the end of 2023.

Furthermore, in the coming years, more shared mobility services providers are expected to increase their electric bicycle fleet size to offer services due to the rising tourism industry & surging focus of the regional governments to provide sustainable mobility. This emerges as an opportunity for electric bicycle manufacturers, thus creating a conducive environment for the growth of the Latin America Electric Bicycle market during 2023-28.

Latin America Electric Bicycle Market Challenges:

Wide Scale Availability of Substitutes to Hamper the Growth of the Electric Bicycle Market – For electric bicycles, a wide-scale variety of substitutes is present, including traditional bicycles, electric scooters & electric bikes with low power range, and electric mopeds. These substitutes are ideal to perform & offer the benefits that an e-bicycle has, such as lost efficiency, low maintenance, the ability to bypass traffic congestion, and many others. Due to this, the buyers of electric bikes in the Latin American region can easily switch to other alternatives while buying electric bicycles, thereby hampering the Latin America Electric Bicycle Market growth.

Latin America Electric Bicycle Market Trends:

Rising Adoption of Smart Electric Bicycles Among the Youngsters – The advancements in technology have enabled the integration of artificial intelligence & the Internet of things in electric bicycles, especially for mountaineering & cargo. This allows the users access to information such as display & navigation functions, information relating to the terrain of the surface, automatic locking facilities, over-the-air updates, foldability to conveniently carry the bicycles & many others. Hence, these added features are attracting a wider number population of the region, which, in turn, is leading to the growth of the Electric Bicycle Market.

Latin America Electric Bicycle Market (2023-28): Segmentation Analysis

The Latin America Electric Bicycle Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–28 at the regional & national levels. Based on the analysis, the market has been further classified as:

Based on Propulsion Type:

- Pedal Assisted

- Throttle Assisted

Pedal-assisted electric bicycle holds a significant share as almost every electric bicycle comes in the pedal-assisted format to allow the rider full control over the vehicle. Further, health-conscious customers also have a preference to buy pedal-assisted e-bicycles as it allows them to burn more calories & stay fit.

These pedal-based electric bicycles also come with a battery assist mode, which allows riders to travel extra distances without experiencing fatigue, due to which peddle-assisted e-bicycles are considered ideal for recreational activities. The battery assist mode allows the users to trek & mount on hills, making pedal mode an ideal choice for cargo & mountaineering electric cycles. Thus, these factors have led to the increasing demand for pedal-assisted electric bikes resulting in the overall growth of the Latin America Electric Bicycles Market.

Based on Application Type:

- Urban Commute

- Trekking

- Cargo

Urban Commute accounts for a notable share of the Latin America Electric Bicycle Market, as urban commute e-bicycles serve multiple purposes, including daily commuting, bike riding for health benefits, and many others. Further, e-bicycles are also used by residents as well as visitors in the region for leisure & recreational activities while touring.

Riders can easily ride for longer distances & over rough terrains without experiencing fatigue. Due to these factors, the demand for e-bicycle for urban commutes is higher, which, in turn, is leading to the growth of the Latin America E-bicycle Market.

Latin America Electric Bicycle Market (2023-28): Regional Analysis

Geographically, the Latin America Electric Bicycle Market expands across:

- Mexico

- Brazil

- Argentina

- Columbia

- Rest of Latin America

Brazil holds a substantial share of the Latin America Electric Bicycle Market. Factors such as rising urbanization, increasing traffic congestion, and growing focus & awareness among the residents as well as the government to opt for sustainable mobility are augmenting the sales of electric bicycles in the country.

In addition, urbanization in the country has also led to increasing instances of lifestyle-related issues such as obesity, diabetes, hypertension, etc. This has also resulted in the higher adoption of electric bicycles among such individuals to keep their body fit.

The growing adoption of electric bicycles among the e-commerce & food delivery service providers in the country, such as iFood, Deliver Much, etc., due to its cost-effectiveness is positively impacting the market growth. For instance,

- In 2022, IFood, a food delivery e-commerce website, and Tembici, an electric bicycle service provider, announced to collaborate. Under the plan, Tembici would provide nearly 2,500 electric bikes to IFood to expand its presence in Brazil, thereby leading to higher sales of electric bicycles.

Further, this population base is expected to switch to electric bicycles for daily commuting & fitness purposes due to their cost-effectiveness. Therefore, creating a conducive environment for the growth of the Latin America Electric Bicycles Market during 2023-28.

Gain a Competitive Edge with Our Latin America Electric Bicycle Market Report

- Latin America Electric Bicycle Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Latin America Electric Bicycle Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Latin America Electric Bicycle Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Research Process

- Assumption

- Market Definition

- Executive Summary

- Latin America Electric Bicycle Battery Pack Local Production Investment Outlook, By Country 2018-2023

- Latin America Electric Bicycle Market Startup Ecosystem

- Latin America Electric Bicycle Market Trends & Development

- Latin America Electric Bicycle Market Dynamics

- Growth Drivers

- Challenges

- Latin America Electric Bicycle Market Supply Chain Analysis

- Latin America Electric Bicycle Market Policies, Regulations, and Product Standards

- Latin America Electric Bicycle Market Hotspot and Opportunities

- Latin America Electric Bicycle Market Outlook, 2018-2028F

- Market Size and Analysis

- By Unit Sold (Thousands)

- Market Share and Analysis

- By Propulsion

- Pedal Assisted, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Throttle Assisted (Power on demand), Market Size & Forecast 2018-2028F, Unit Sold (Thousand)

- By Application

- Urban Commute, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Trekking, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Cargo, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Type

- Lithium Ion Battery, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Lead Acid Battery, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Others (Nickel Metal Hydride, Nickel Cadmium, etc.), Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Capacity

- Less than 250 W, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- 251 W to 450 W, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- 451 W to 650 W, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Above 651 W, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Country

- Mexico

- Brazil

- Argentina

- Columbia

- Rest of Latin America

- By Company

- Competition Characteristics

- Market Share & Analysis

- By Propulsion

- Market Size and Analysis

- Mexico Electric Bicycle Market Outlook, 2018-2028F

- Market Size & Analysis

- By Unit Sold

- Market Share and Analysis

- By Propulsion, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Application, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Type, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Capacity, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Market Size & Analysis

- Brazil Electric Bicycle Market Outlook, 2018-2028F

- Market Size & Analysis

- By Unit Sold

- Market Share and Analysis

- By Propulsion, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Application, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Type, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Capacity, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Market Size & Analysis

- Argentina Electric Bicycle Market Outlook, 2018-2028F

- Market Size & Analysis

- By Unit Sold

- Market Share and Analysis

- By Propulsion, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Application, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Type, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Capacity, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Market Size & Analysis

- Columbia Electric Bicycle Market Outlook, 2018-2028F

- Market Size & Analysis

- By Unit Sold

- Market Share and Analysis

- By Propulsion, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Application, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Type, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- By Battery Capacity, Market Size & Forecast 2018-2028F, Unit Sold (Thousands)

- Market Size & Analysis

- Latin America Electric Bicycle Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Company Profiles

- E Mov Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Trek Bike Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Brazil Electric Bike

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Merida Bikes

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Caloi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ridley Bikes

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Haibike

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Lev Bicycles

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Vela Bikes

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- E-Moving

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- E Mov Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making