Kuwait Electric Vehicle Market Research Report: Forecast (2025-2030)

Kuwait Electric Vehicle Market - By Vehicle Type (Passenger Vehicles, Two Wheelers, Commercial Vehicles), By Power Source (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric V...ehicle (PHEV), Hybrid Electric Vehicle (HEV)), By Battery Type (Lithium-Ion Battery, Lithium Titanate Oxide (LTO)), By Region (Al Asimah, Al Farwaniya, Hawalli, Al Ahmadi, Al Jahra), By Company (Renault Group, Tesla, Chevrolet, BMW AG, Hyundai Motor Company, Mazda Motor Corporation Nissan Motor Corporation, Ford Motor Company, Porsche Middle East & Africa, Toyota Motor Corporation, Ashok Leyland, Volvo Bus Company, Others) Read more

- Automotive

- Aug 2025

- Pages 121

- Report Format: PDF, Excel, PPT

Kuwait Electric Vehicle Market

Projected 34.10% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2024)

55 Million

Market Size (2030)

319.84 Million

Base Year

2024

Projected CAGR

34.10%

Leading Segments

By Vehicle Type: Passenger vehicles

Market Definition

Electric vehicles (EVs) are automobiles that are primarily powered by electricity stored (and sometimes even generated) on board the vehicle in batteries. These vehicles are preferred over conventional vehicles because of minimal or zero emissions.

Market Insights and Analysis: Kuwait Electric Vehicle Market (2025-2030):

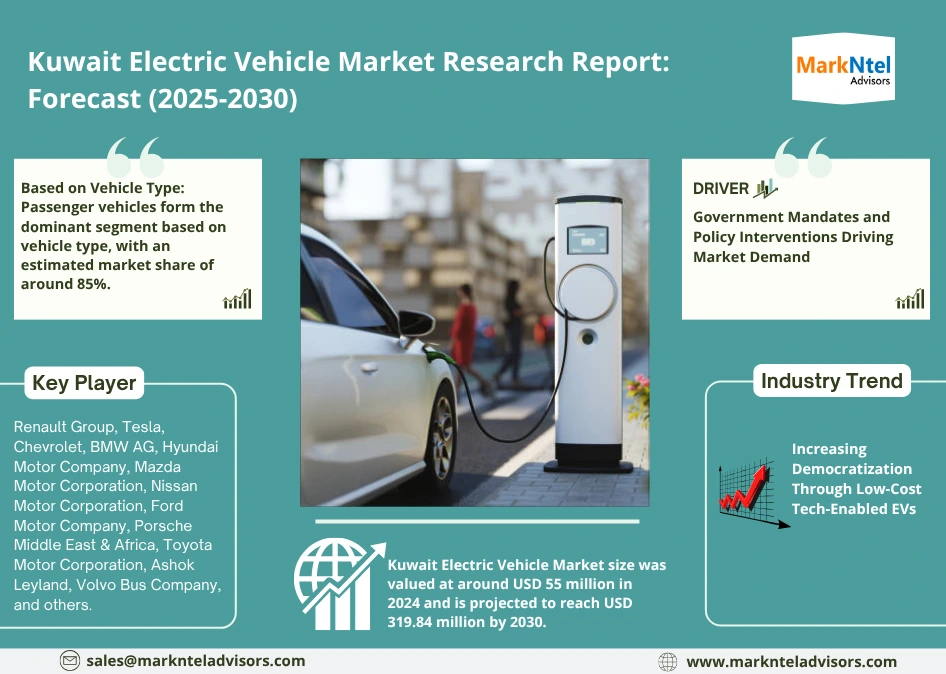

The Kuwait Electric Vehicle Market size was valued at around USD 55 million in 2024 and is projected to reach USD 319.84 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 34.10% during the forecast period, i.e., 2025-30. This high growth is likely to be driven by government mandates and policy interventions, efforts towards economic diversification, and consumer alignment with EVs.

The Kuwaiti government has committed to net-zero emissions by 2060 and has developed a renewable energy roadmap with emphasis on transportation decarbonization under its ‘Vision 2035’ plan. The government has thus mandated fuel stations to install fast EV chargers as per the standards approved by the Ministry of Public Works and the Ministry of Electricity, Water, and Renewable Energy (MEWRE). The government has also issued guidelines to Kuwaiti landlords to allow the installation of home chargers for tenants purchasing EVs. The MEWRE has allowed the installation of rooftop solar panels to encourage the transition towards clean energy and mobility with the launch of the country’s renewable energy strategy in March 2024. These initiatives are creating a strong demand for EVs in the country.

Market demand for EVs in Kuwait is further supported by the country’s efforts towards economic diversification. Oil and gas exports contribute to half of Kuwait’s GDP, so the government is promoting alternative industries to reduce its dependence on the industry. This is highlighted in Kuwait Ports Authority’s proposal for the development of the region’s first ‘EV City’ to promote domestic production of EVs in line with the country’s ‘Vision 2035’ strategy.

EVs are witnessing a strong demand in the country because of their alignment with consumer expectations. Kuwait has a high per capita GDP of over USD33,000 that aligns consumer expectations with EVs because they are generally positioned as premium offerings. This is likely to support high growth in the country’s EV market with increasing awareness and expansion of product offerings by global EV brands.

Kuwait Electric Vehicle Market Scope:

| Category | Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles, Two Wheelers, Commercial Vehicles |

| By Power Source | Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| By Battery Type | Lithium-Ion Battery, Lithium Titanate Oxide (LTO) |

Kuwait Electric Vehicle Market Driver:

Government Mandates and Policy Interventions Driving Market Demand – Kuwait has one of the lowest EV penetrations around the globe, with EVs reportedly constituting 0.03% of the overall automobile sales in the country. The Kuwaiti government is thus accelerating EV adoption in the country by taking several initiatives that are driving structural change in the market. Its regulations on charging standards have created a clear framework for players operating in the country’s EV market. This is reducing the uncertainty faced by EV manufacturers and charging infrastructure developers and creating a conducive environment for EV adoption in the country. The government’s mandate on the installation of charging stations at every fuel station in the country is further driving market demand for EVs by addressing the lack of a fast-charging infrastructure.

The MEWRE is encouraging urban developers and landlords to promote EV adoption in the country by making residential apartments home-charging friendly. This is important for the country as over 50% of its population lives in apartment complexes. The ministry is also working with local governments on improving electrical grid resilience to support increasing charging loads as an increasing number of consumers adopt EVs in the country.

Kuwait Electric Vehicle Market Opportunity

Fleet Electrification to Boost EV Adoption – Kuwait has a strong network of fleet operators that use trucks, buses, and light-duty vehicles (LDVs) to support rising commercial activity and infrastructure growth in the country. Electrification of these vehicles is accelerating EV adoption in the country that has the potential to transform the market. For instance, even a 10% electrification of Kuwait’s 75,000-strong LDV fleet could provide a major boost to the market.

This presents an opportunity to build charging hubs and infrastructure partnerships that would also be beneficial to individual EV owners. Fleet electrification would also accelerate EV adoption by acting as visible evidence to the public experiencing electrified municipal and transportation vehicles, while benefiting fleet operators through cost advantages due to fuel savings and centralized charging. Strategic partnerships between various stakeholders would further accelerate EV ecosystem development and contribute to the growth & expansion of the industry.

Kuwait Electric Vehicle Market Challenge:

Underdeveloped Charging Infrastructure Slowing EV Adoption – The Kuwait EV market is facing a considerable challenge in the form of a severely underdeveloped charging infrastructure in the country. The current network has around 40 chargers, most of which do not support fast charging. This is limiting the adoption of EVs among Kuwaiti consumers who do not have access to home charging. Consumer surveys conducted in recent years have ranked charging unavailability as the number one reason behind consumer hesitation to purchase EVs.

Even the existing charging infrastructure is mostly concentrated in Kuwait City, restricting EV adoption among inter-city commuters. This problem is further amplified due to extreme temperatures in the country. Kuwait regularly sees temperatures crossing 50°C during summer, which can drop EV ranges by up to 30%. This means that an EV rated for a 400-km range could effectively run for less than 300 km in Kuwait, creating a psychological barrier to EV adoption. Underdeveloped charging infrastructure could thus pose a significant challenge to the EV market in the country.

Kuwait Electric Vehicle Market Trend:

Increasing Democratization Through Low-Cost Tech-Enabled EVs – Kuwait has traditionally seen EV adoption in the form of premium offerings by global brands such as BMW i4 and Porsche Taycan, which have limited market access to affluent customers. This is beginning to change with the introduction of mass market offerings such as MG4 and BYD Dolphin (~ USD 18,000-22,000), which are offering modern features and technology at prices comparable to conventional internal combustion engine (ICE) vehicles like the Toyota Corolla. This is leading to multiple-car households and even first-time buyers considering EVs. This is also leading fleet operators to consider EVs because of lower upfront costs and maximized savings (up to 30-40%) over high-mileage operation.

These EVs are also coming with powertrains designed with integrated thermal management, which minimizes the effect of extreme temperatures in Kuwait on their performance and driving range. Moreover, market democratization is also accelerating the development of the EV ecosystem in the country through a fast-growing sales and service network and a potential secondary market for EVs in the future.

Kuwait Electric Vehicle Market (2025-2030): Segmentation Analysis

The Kuwait Electric Vehicle Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025-2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Vehicle Type:

- Passenger Vehicles

- Two-Wheelers

- Commercial Vehicles

Passenger vehicles form the dominant segment based on vehicle type, with an estimated market share of around 85%. This is largely due to higher awareness and orientation for EV adoption amongst personal consumers in Kuwait. Early adopters generally include consumers looking for the characteristic performance, tech features, and exclusivity offered by EVs, leading to higher adoption of passenger vehicles. This is further supported by a major dependence on home charging for EVs. Even the small network of public chargers in Kuwait is concentrated in residential, shopping, and business districts, which makes access to these chargers largely limited to passenger vehicle owners.

Passenger vehicles also dominate the market because of a wider range of product offerings in this segment compared to a smaller portfolio of EVs in the other segments. Global auto brands are offering products across different price brackets, such as the Porsche Taycan in the luxury segment, the BYD Atto 3 in the mid-segment, and the MG4 in the affordable segment. This is boosting consumer confidence in the passenger vehicle segment due to increased visibility. This segment is thus likely to continue its dominance because of consistently strong market demand.

Based on Power Source:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Battery electric vehicles (BEV) is the most preferred power source among end-users, with an estimated market share of around 60-65%. Market demand for BEVs is high because of the lower cost of ownership due to their operational and maintenance requirements. BEVs are easier and cheaper to maintain because of fewer mechanical components. They are also up to 30-40% cheaper to operate due to fuel savings, which is amplified by subsidized power offered in Kuwait. Market demand in the segment is further supported by consumer orientation towards sustainability because BEVs have zero tailpipe emissions.

Hybrid electric vehicles (HEV) are also quite popular in the country, estimated to have a market share of 25-30%. This is largely due to limited access to public charging, as HEVs have engines that can act as either an alternative or an intermediate source of electricity for these vehicles. This enables uninterrupted travel over longer distances and in areas where chargers are not accessible, while also reducing vehicle downtime. Market demand for HEVs also comes from the lower end of the market because HEVs are considerably cheaper than BEVs.

Kuwait Electric Vehicle Industry Recent Development:

- April 2025: Tesla officially entered the neighboring country of Saudi Arabia, signaling a focus on the broader Gulf region that is likely to have a spillover effect across the border in Kuwait.

Gain a Competitive Edge with Our Kuwait Electric Vehicle Market Report

- Kuwait Electric Vehicle Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Kuwait Electric Vehicle Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Product Definition

- Assumption

- Executive Summary

- Kuwait Electric Vehicle Market Trends & Developments

- Kuwait Electric Vehicle Market Dynamics

- Drivers

- Challenges

- Kuwait Electric Vehicle Market Regulations, Norms, & Product Standards

- Kuwait Electric Vehicle Market Imports & Exports Analysis

- Kuwait Electric Vehicle Market Hotspots & Opportunities

- Kuwait Electric Vehicle Market Value Chain Analysis

- Kuwait Electric Vehicle Market Analysis, 2020- 2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Vehicle Type

- Passenger Vehicles

- Two Wheelers

- Commercial Vehicles

- By Power Source

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- By Battery Type

- Lithium-Ion Battery

- Lithium Titanate Oxide (LTO)

- By Region

- Al Asimah

- Al Farwaniya

- Hawalli

- Al Ahmadi

- Al Jahra

- By Vehicle Type

- By Company

- Competition Characteristics

- Market Share & Analysis

- Market Size & Analysis

- Kuwait Passenger Electric Vehicles Market Analysis, 2020- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Power Source

- By Company

- By Region

- Market Size & Analysis

- Kuwait Electric Two Wheelers Market Analysis, 2020- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Power Source

- By Company

- By Region

- Market Size & Analysis

- Kuwait Commercial Electric Vehicles Market Analysis, 2020- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Power Source

- By Company

- By Region

- Market Size & Analysis

- Kuwait Electric Vehicle Market Key Strategic Imperatives for Success & Growth

- Kuwait Electric Vehicle Market Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Portfolio, Recent Development, Key Executives, Contact Details)

- Renault Group

- Tesla

- Chevrolet

- BMW AG

- Hyundai Motor Company

- Mazda Motor Corporation

- Nissan Motor Corporation

- Ford Motor Company

- Porsche Middle East & Africa

- Toyota Motor Corporation

- Ashok Leyland

- Volvo Bus Company

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making