Saudi Arabia Industrial Gases Market Research Report: Forecast (2025-2030)

Industrial Gases Market in Saudi Arabia - By Product Type (Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Argon, Acetylene, Helium, Others), By Distribution Channel (Tonnage, Bulk & C...ylinder, Packaged, On-Site Supply), By End-User (Manufacturing, Metallurgy & Glass, Energy & Chemicals, Healthcare, Food & Beverages, Electronics) and Others Read more

- Energy

- Aug 2025

- Pages 125

- Report Format: PDF, Excel, PPT

Saudi Arabia Industrial Gases Market

Projected 3.18% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2024)

20 Million Tons

Market Size (2030)

24.13 Million Tons

Base Year

2024

Projected CAGR

3.18%

Leading Segments

By Product Type: Nitrogen Gas

Market Insights & Analysis: Saudi Arabia Industrial Gases Market (2025-30):

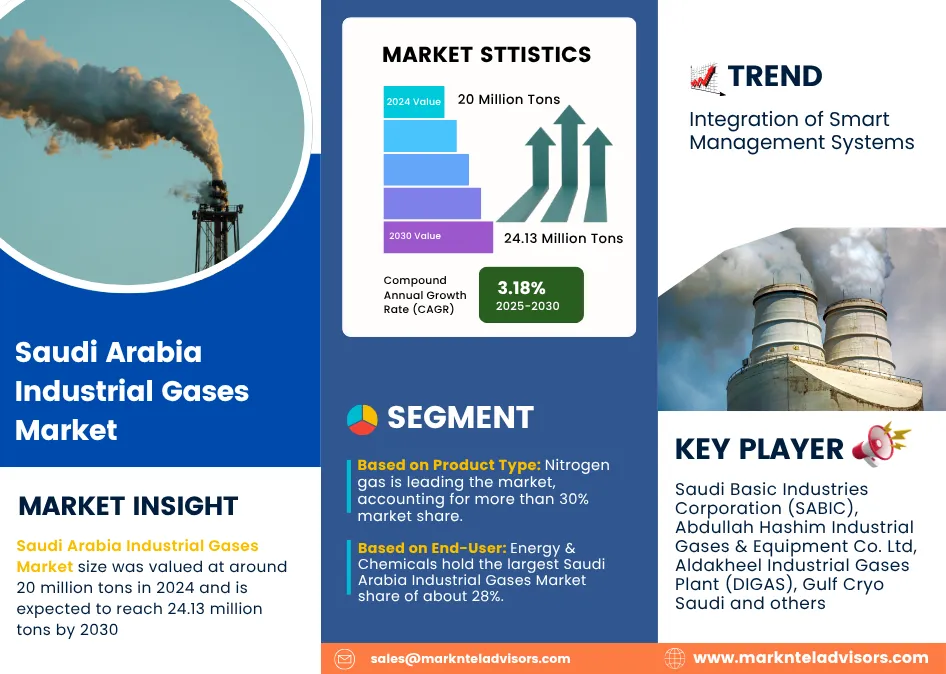

The Saudi Arabia Industrial Gases Market size was valued at around 20 million tons in 2024 and is expected to reach 24.13 million tons by 2030. Along with this, the market is estimated to grow at a CAGR of around 3.18% during the forecast period, i.e., 2025-30. The Saudi Arabia Industrial Gases Market is significantly growing due to several growth factors, including the rising oil and gas industries in the country, due to a well-established base for such industries, the growing investments through government and public sectors in the development of their infrastructure, and the widespread adoption of advanced technologies such as smart management systems, AI features, and IoT sensors.

Along with the oil-based industries, the non-oil ones, such as metallurgy, electronics, food & beverages, etc., are also uplifting the market growth, as these industries require industrial gases for various purposes like cutting, processing, cooling, and much more. Additionally, the growing industrialization in Saudi Arabia, actively supported by the country’s government through different policies and heavy investments, is contributing to the potential market growth. This includes the partnerships of different companies to introduce new industrial gases manufacturing plants in various regions within the country.

Moreover, the widespread applications of nitrogen gas in different industries, as compared to other types of gases, are contributing to the dominance of nitrogen gas among all gases, like oxygen, hydrogen, acetylene, carbon dioxide, etc. This is due to its ability to prevent corrosion and explosions in heavy-duty machinery and to freeze food & beverage items. Furthermore, the integration of smart features in the production facilities is gaining popularity in the market due to high automation, precision, and fast production as compared to traditional manufacturing processes for industrial gases. However, the high capital investments and supply chain disruptions are hindering the market growth & expansion.

Saudi Arabia Industrial Gases Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Argon, Acetylene, Helium, Others |

| By Distribution Channel | Tonnage, Bulk & Cylinder, Packaged, On-Site Supply |

| By End-User | Manufacturing, Metallurgy & Glass, Energy & Chemicals, Healthcare, Food & Beverages, Electronics |

Saudi Arabia Industrial Gases Market Driver:

Expansion of Petrochemical Industry Driving Market Growth – The market growth is driven by the rapidly increasing petrochemical industry in the country due to a strong base of natural oil & gas reserves in Saudi Arabia. For instance, as of 2025, the capacity of this industry is more than 74 million tons per year, which is further projected to double and reach up to 140 million tons per year in Saudi Arabia. Additionally, petrochemical industries require a large amount of industrial gases in many processes, like refining, oxidation, and purging. As a result, these companies are collaborating with the industrial gas manufacturers to fulfil the rising demand.

For instance, Saudi Aramco and TotalEnergies are together building a production unit called the Amiral complex in Jubail to produce ethylene gas with an annual production capacity of about 1.5 million tons. Similarly, a well-established petrochemical company called Spichem (2020) partnered with an industrial gas manufacturing company called Linde PLC, which focuses on supplying various gases, including syngas, carbon monoxide, hydrogen, etc., to the chemical plants for refining purposes, thus augmenting the size & volume of the Saudi Arabian Industrial Gases Market.

Saudi Arabia Industrial Gases Market Opportunity:

Rising Investments Through Public & Private Sectors – The heavy investments in the expansion of industrial gas manufacturing facilities in Saudi Arabia through various public and private partnerships are providing lucrative growth opportunities to this market. For instance, an industrial gas company called AHG Group in Saudi Arabia allocated about USD20 million to develop a new production facility in the Dammam region. Also, the SABIC company is investing hundreds of millions of dollars in the expansion of its air separation units in the Jubail and Yanbu regions to improve oxygen and nitrogen production.

Additionally, many projects in Saudi Arabia, under Vision 2030, include heavy investments, which are raising the demand for industrial gases in the country. For instance, the NEOM Green Hydrogen Project received about USD5 billion for the establishment of a green hydrogen plant with an annual production capacity of approximately 600 tons of green hydrogen per day, along with nitrogen and green ammonia gases. These kinds of projects are increasing the potential market growth.

Saudi Arabia Industrial Gases Market Challenge:

High Costs & Fragmented Supply Chain – The market is facing several challenges, including high capital investments and supply chain fragmentation. The setting up of industrial gas manufacturing facilities includes air separation units, advanced machinery, pipeline installation, tanks for storage, etc., which increases the overall investment to set up these facilities. Small facilities can range between USD50 million to USD200 million, whereas the large-scale manufacturing facilities can exceed USD500 million to USD15 billion. For instance, the mega complex called Jazan Industrial Gas Complex has invested about USD12 billion in supplying industrial gases. These high investments are putting a financial obstacle to small-scale and start-up companies from entering this market.

Additionally, the raw material price volatility and disruptions in the supply chains increase the transportation costs, which lead to delays in gas supply to various end-users, which are further restraining the market growth & expansion.

Saudi Arabia Industrial Gases Market Trend:

Integration of Smart Management Systems – The market landscape is changing due to the incorporation of smart technologies, such as AI, robotics, IoT, etc., in industrial machinery and devices, including the industrial gas manufacturing devices, under the Industry 4.0 mission of Saudi Arabia, which promotes the adoption of these technologies to improve the products and services in the country.

Several companies, such as Linde, SABIC, Air Products, Quadra, Jazan complex, etc., have actively started using this advanced machinery in their production units, which enables real-time monitoring of the gas leaks, requirements, and maintenance needs, and optimizes energy use. For instance, in 2023, the Air Products Quadra collaborated with the Bosco company to integrate real-time monitoring systems, such as Supervisory Control & Data Acquisition (SCADA) systems, in their facility for better control of production processes. These incorporations are actively transforming the market dynamics.

Saudi Arabia Industrial Gases Market (2025-30): Segmentation Analysis

The Saudi Arabia Industrial Gases Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Product Type:

- Oxygen

- Nitrogen

- Carbon Dioxide

- Hydrogen

- Argon

- Acetylene

- Helium

- Others

Out of these, nitrogen gas is leading the market, accounting for more than 30% market share. The dominance is due to the high demand for nitrogen gas in various industries, such as the petrochemical, electronics, healthcare, food & beverages, etc., because of its widespread applications. For instance, the rapidly rising food industry in the country is increasing the demand for nitrogen in modified atmosphere packaging (MAP) and for freezing food in liquid nitrogen.

Additionally, the well-established petrochemical industry in the country raised the demand for nitrogen to prevent explosions, corrosion, and blanketing storage tanks to increase quality production. Similarly, the growth of other industries is simultaneously raising the demand for nitrogen. Consequently, in Saudi Arabia, the industrial gas with the highest production capacity is nitrogen only. For instance, on average, the combined production capacity of nitrogen gas in Saudi Arabia is about 60,000 tons per day, which shows its high significance in the product segment of this market.

Based on End-User:

- Manufacturing

- Metallurgy & Glass

- Energy & Chemicals

- Healthcare

- Food & Beverages

- Electronics

- Others

Among these, the energy & chemicals hold the largest market share of about 28%. The dominance is due to the rapidly growing oil, gas, and petrochemical industries in the country, which largely depend on industrial gases, like hydrogen, nitrogen, oxygen, carbon dioxide, etc., for different industrial processes. For instance, the Jazan plant supplies approximately 20 million tons of oxygen per day and about 55,000 million tons of nitrogen daily to the Aramco refinery and IGCC facility.

Additionally, the country is actively increasing blue and green gases production through the government’s support, which is contributing to the dominance of energy & chemicals in the market. For instance, the NEOM Green Hydrogen Project has already been completed at over 60%. Similarly, the SABIC and Aramco exported over 24,000 tons of blue ammonia to South Korea and generated significant revenues. These factors show the leadership of energy & chemicals in the market.

Saudi Arabia Industrial Gases Industry Recent Development:

- 2024: Linde PLC partnered with Aramco and SLB to build one of the world’s biggest carbon capture and storage (CCS) hubs in Jubail, Saudi Arabia. The project will help reduce industrial carbon emissions by capturing up to 9 million tons of CO₂ every year. Phase 1 of the hub is expected to begin operations by the end of 2027.

- 2024: Air Products Qudra signed an agreement on July 16, 2024, to sell a 50% stake in its Jubail-based Blue Hydrogen Industrial Gases Company (BHIG) to Saudi Aramco. BHIG will produce low-carbon “blue hydrogen” using natural gas and carbon capture technology. As part of the deal, Aramco will have the option to receive hydrogen and nitrogen through pipelines, supporting cleaner energy goals in Saudi Arabia.

Gain a Competitive Edge with Our Saudi Arabia Industrial Gases Market Report

- Saudi Arabia Industrial Gases Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Industrial Gases Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Industrial Gases Market Policies, Regulations, and Product Standards

- Saudi Arabia Industrial Gases Market Supply Chain Analysis

- Saudi Arabia Industrial Gases Market Trends & Developments

- Saudi Arabia Industrial Gases Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Industrial Gases Market Hotspot & Opportunities

- Saudi Arabia Industrial Gases Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Volume (Million Tons)

- By Product Type

- Oxygen- Market Size & Forecast 2020-2030, USD Million

- Nitrogen- Market Size & Forecast 2020-2030, USD Million

- Carbon Dioxide- Market Size & Forecast 2020-2030, USD Million

- Hydrogen- Market Size & Forecast 2020-2030, USD Million

- Argon- Market Size & Forecast 2020-2030, USD Million

- Acetylene- Market Size & Forecast 2020-2030, USD Million

- Helium- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Distribution Channel

- Tonnage- Market Size & Forecast 2020-2030, USD Million

- Bulk & Cylinder- Market Size & Forecast 2020-2030, USD Million

- Packaged- Market Size & Forecast 2020-2030, USD Million

- On-Site Supply- Market Size & Forecast 2020-2030, USD Million

- By End-User

- Manufacturing- Market Size & Forecast 2020-2030, USD Million

- Metallurgy & Glass- Market Size & Forecast 2020-2030, USD Million

- Energy & Chemicals - Market Size & Forecast 2020-2030, USD Million

- Healthcare- Market Size & Forecast 2020-2030, USD Million

- Food & Beverages- Market Size & Forecast 2020-2030, USD Million

- Electronics- Market Size & Forecast 2020-2030, USD Million

- Others

- By Region

- North

- East

- South

- West

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type

- Market Size & Outlook

- Saudi Arabia Oxygen Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Nitrogen Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Carbon Dioxide Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Hydrogen Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Argon Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Acetylene Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Helium Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Distribution Channel - Market Size & Forecast 2020-2030, USD Million

- By End-User - Market Size & Forecast 2020-2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Industrial Gases Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Air Liquide Arabia / Air Liquide S.A.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Linde PLC / Linde Saudi Industrial Gas Company (SIGAS)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Air Products & Chemicals, Inc. / Air Products Qudra

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saudi Basic Industries Corporation (SABIC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Abdullah Hashim Industrial Gases & Equipment Co. Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aldakheel Industrial Gases Plant (DIGAS)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gulf Cryo Saudi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jubail Gas Plant Co. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ACWA Holding

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Taiyo Nippon Sanso Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Barrak Industrial Gases Factory

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arab Industrial Gases Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Air Liquide Arabia / Air Liquide S.A.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making