Saudi Arabia Liquefied Natural Gas (LNG) Market Research Report: Forecast (2025-2030)

Saudi Arabia Liquefied Natural Gas (LNG) Market - By Deployment Type (LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping), By Infrastructure Type (Liquefaction Te...rminals, Regasification Terminals, Floating Storage and Regasification Units (FSRUs)), By End-User (Power Generation, Transportation (Marine, heavy-duty vehicles), Residential, Commercial, Industrial), and others Read more

- Energy

- Aug 2025

- Pages 130

- Report Format: PDF, Excel, PPT

Saudi Arabia Liquefied Natural Gas (LNG) Market

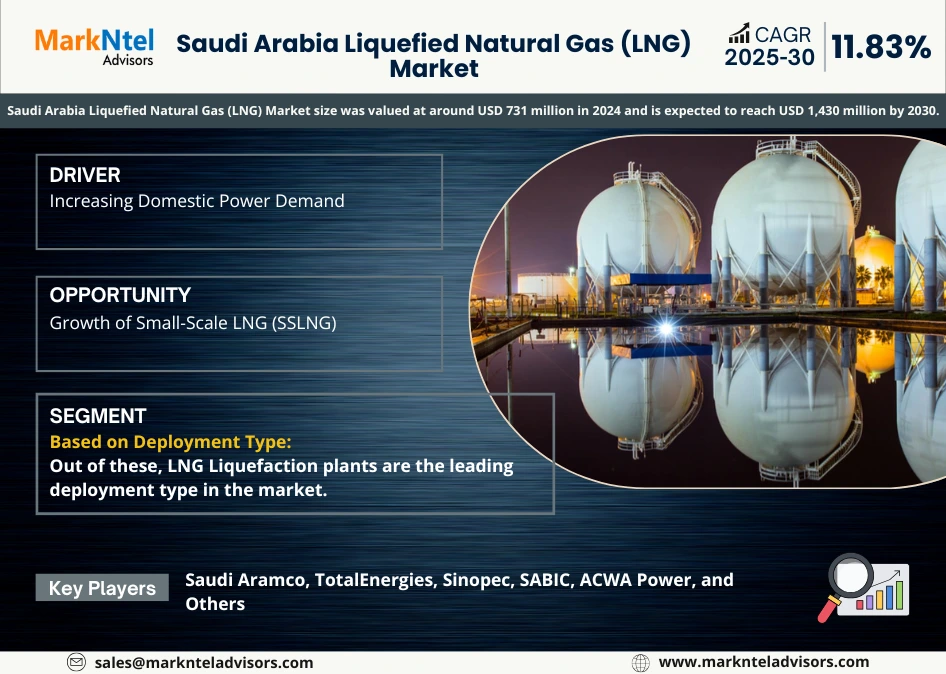

Projected 11.83% CAGR from 2025 to 2030

Study Period

2025-2030

Market Size (2024)

USD 731 Million

Market Size (2030)

USD 1.43 Billion

Base Year

2024

Projected CAGR

11.83%

Leading Segments

By Deployment Type: LNG Liquefaction plants

Market Insights & Analysis: Saudi Arabia Liquefied Natural Gas Market (2025-30):

The Saudi Arabia Liquefied Natural Gas (LNG) Market size was valued at around USD 731 million in 2024 and is expected to reach USD 1,430 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 11.83% during the forecast period, i.e., 2025-30. The market growth is driven by the country’s growing domestic population and expanding commercial, residential, and industrial sectors, where it has heavily relied on burning low-cost crude oil to meet the power demand. This is because it is technically challenging to extract natural gas in new, often costlier, non-associated and unconventional fields like Jafurah Basin, Karan, Wasit, etc., along with the rising costs from new suppliers. This has led to the country exploring LNG imports, which is a cost-effective way to reduce the oil burn, particularly during peak power demand, such as summers when there is high usage of cooling systems (like air conditioners). This peak demand is counter-seasonal to major global LNG importing regions and is creating attractive market pricing conditions for LNG suppliers, as it allows for more consistent, predictable, and year-round demand for their LNG assets.

Moreover, this practice comes at a high opportunity cost as crude oil can be freed up for export. For instance, studies indicate that importing LNG for power generation can be achieved at a discount to the opportunity cost of burning oil, which is estimated at around USD10-12/MMBtu equivalent. Additionally, the country’s Vision 2030 program aims to double the production of natural gas and expand its distribution network, which will help in meeting its environmental and air quality targets and will increase the market reception for companies offering cleaner LNG solutions.

Furthermore, Saudi Arabia is continuously developing its LNG capabilities, which can help in expanding its services to its neighboring countries, such as Bahrain and Jordan, which face gas shortages. This will broaden the market for LNG suppliers and infrastructure developers in the forecast period.

Saudi Arabia Liquefied Natural Gas Market Scope:

| Category | Segments |

|---|---|

| By Deployment Type | LNG Liquefaction Plants, LNG Regasification Facilities, LNG Shipping |

| By Infrastructure Type | Liquefaction Terminals, Regasification Terminals, Floating Storage and Regasification Units (FSRUs) |

| By End-User | Power Generation, Transportation (Marine, heavy-duty vehicles), Residential, Commercial, Industrial) |

Saudi Arabia Liquefied Natural Gas Market Driver:

Increasing Domestic Power Demand – The growth of this market is driven by the rising demand for power due to the country’s growing population, which has led to the expansion of its various sectors, such as residential, commercial, and industrial. Particularly, its expanding industrial sector, which is driven by the Vision 2030 program, the country heavily relies on energy-intensive systems, such as in water desalination plants, petrochemicals, mining, and manufacturing, along with the widespread air conditioning in its residential and commercial sectors during peak summers. This growth in power demand has also increased carbon emissions from these sectors, for which the country has made a significant push over the past decade.

Moreover, this transition is putting pressure on low-cost crude oil, which the country has freed up for exports and has made a push for a cleaner-burning fuel. For instance, by integrating LNG into its energy mix, either through imports or by increased domestic gas production, the country is striving to achieve a more sustainable balance. This is because LNG is a cleaner option as it gives off lower carbon dioxide emissions compared to crude oil and coal. For instance, studies have shown that LNG produces approximately 30% less carbon dioxide (CO2) than petroleum and 45% less than coal. All these factors are driving the market demand.

Saudi Arabia Liquefied Natural Gas Market Opportunity:

Growth of Small-Scale LNG (SSLNG) – The country is actively pushing towards achieving its sustainability goals, as exhibited by its Vision 2030 program. This is creating opportunities in the development of small-scale LNG (SSLNG), which can help in reducing air pollution and greenhouse gas (GHG) emissions from its transport and power sectors. This is because SSLNGs are less capital-intensive, have lower commercial and technical risks, and can be implemented quickly (within 18-24 months). This tangible and short-term delivery in the green energy project space can reduce the carbon footprint by displacing diesel in long-haul trucks and heavy crude oil in off-grid power plants. Additionally, this segment will also stimulate the local economy by increasing job opportunities for Saudi nationals in construction, fabrication, and distribution, creating a potential growth area for niche market players and technology providers in the forecast period.

Saudi Arabia Liquefied Natural Gas Market Challenge:

Historically Low Domestic Administered Natural Gas Prices – The government’s policy of maintaining historically low domestic natural gas prices is challenge for the market growth & expansion, as domestic gas is currently sold to utilities at USD1.25 per million British thermal units (MMBtu) while imported LNG is projected to cost at around USD10/MMBtu, creating a substantial price difference and making it economically unrealistic to import LNG for widespread domestic use. For instance, this is an ironic contrast to Saudi Aramco’s strategic plan to develop both import and export terminals for LNG in the country, going beyond the domestic price competitiveness.

Additionally, even though natural gas has the advantage of thermal efficiency over oil, the low prices have discouraged investments in more efficient natural gas plants. Increasing these prices is difficult because the power and petrochemical sectors rely on them for operating margins, and low prices are integral to the country's social welfare policy. This challenge hinders market growth by making a strong economic case for large-scale LNG imports difficult.

Saudi Arabia Liquefied Natural Gas Market Trend:

Growing Demand for LNG in Transportation – There is a growing demand for LNG in transportation as the country actively pushes towards its overarching sustainable goals, driven by the rising concern for climate change and diversification of its economy. This is driving the demand for LNG as a cleaner transportation fuel compared to oil and coal, which produce emissions like sulphur oxides and particulates. This demand is seeing growth in sectors such as trucking, marine, and rail. For instance, Jeddah Islamic Port received the LNG-powered MV BYD HEFEI motor vessel, which is a dual-fuel roll-on/roll-off carrier with a 7,000-unit capacity for vehicles and heavy equipment. This integration of LNG-powered vessels aligns with the National Transport & Logistics Strategy (NTLS) goals and the Saudi Green Initiative, ultimately driving revenue growth of the market players.

Saudi Arabia Liquefied Natural Gas Market (2025-30): Segmentation Analysis

The Saudi Arabia Liquefied Natural Gas Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Deployment Type:

- LNG Liquefaction Plants

- LNG Regasification Facilities

- LNG Shipping

Out of these, LNG Liquefaction plants are the leading deployment type in the market. The growth is due to the country’s increasing need to reduce the high opportunity cost of burning oil for power generation, which constitutes nearly half of its electricity fuel mix. Additionally, there is a rising demand for power generation, which is rapidly outpacing the domestic gas supply; therefore, the country is exploring LNG imports as they offer a flexible, immediate solution due to the slow and costly development of unconventional fields such as the Jafurah Basin. This is driving the demand for key players in the market for the development of LNG liquefaction plants in the country for efficient transportation and storage, for industrial clients who may be far away from these plants.

Based on End User:

- Power Generation

- Transportation (Marine, Heavy-duty vehicles)

- Residential

- Commercial

- Industrial

Among the above, the residential sector is the leading end user with a market share of about 47%. Its market lead is due to the exceptionally high power demand driven by the high air conditioning during peak summers. For instance, cooling alone accounts for about 70% of the power used in the residential sector. This increase in power demand is further driven by factors such as the growth of the country’s domestic population, rapid construction of residential buildings, and historically low electricity tariffs that have encouraged high consumption levels across the sector.

Moreover, these factors increase the need for burning large quantities of liquid fuels when natural gas is scarce. For instance, it was projected in a study that key players such as the Saudi Electricity Company (SEC) can expect peak load demands to double by 2030. This has driven the world’s largest oil company, Saudi Aramco, to explore LNG imports as a strategic and flexible solution to meet the seasonal demand of the country, thereby reducing the reliance on oil and contributing to the diversification of the national energy mix.

Saudi Arabia Liquefied Natural Gas Recent Development:

- 2025: Saudi Aramco is actively considering expanding its footprint in the global LNG market and wants to become a major international player beyond its focus on oil. Recently, it has increased its stake to 49% in MidOcean Energy, marking its first direct investment in international LNG assets.

- 2025: ACWA Power is a key partner in the NEOM Green Hydrogen Project, a major renewable‑powered hydrogen and ammonia plant set to begin operations by mid‑2026. The development of this hydrogen ecosystem relies heavily on natural gas and electrolytic infrastructure overlapping with future LNG value chains.

Gain a Competitive Edge with Our Saudi Arabia Liquefied Natural Gas Market Report

- Saudi Arabia Liquefied Natural Gas Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Liquefied Natural Gas Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Liquefied Natural Gas Market Policies, Regulations, and Product Standards

- Saudi Arabia Liquefied Natural Gas Market Supply Chain Analysis

- Saudi Arabia Liquefied Natural Gas Market Trends & Developments

- Saudi Arabia Liquefied Natural Gas Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Liquefied Natural Gas Market Hotspot & Opportunities

- Saudi Arabia Liquefied Natural Gas Market Outlook, 2025–2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Deployment Type

- LNG Liquefaction Plants – Market Size & Forecast 2020–2030, USD Million

- LNG Regasification Facilities – Market Size & Forecast 2020–2030, USD Million

- LNG Shipping – Market Size & Forecast 2020–2030, USD Million

- By Infrastructure Type

- Liquefaction Terminals – Market Size & Forecast 2020–2030, USD Million

- Regasification Terminals – Market Size & Forecast 2020–2030, USD Million

- Floating Storage and Regasification Units (FSRUs) – Market Size & Forecast 2020–2030, USD Million

- By End-User

- Power Generation – Market Size & Forecast 2020–2030, USD Million

- Transportation (Marine, heavy-duty vehicles) – Market Size & Forecast 2020–2030, USD Million

- Residential – Market Size & Forecast 2020–2030, USD Million

- Commercial – Market Size & Forecast 2020–2030, USD Million

- Industrial – Market Size & Forecast 2020–2030, USD Million

- By Region

- North

- East

- South

- West

- Central

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Deployment Type

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia LNG Liquefaction Plants Market Outlook, 2025-2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Infrastructure Type – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia LNG Regasification Facilities Market Outlook, 2025-2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Infrastructure Type – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia LNG Shipping Market Outlook, 2025-2030

- Market Size & Outlook

- By Revenues (USD Million)

- By Infrastructure Type – Market Size & Forecast 2020–2030, USD Million

- By End-User – Market Size & Forecast 2020–2030, USD Million

- By Revenues (USD Million)

- Market Size & Outlook

- Saudi Arabia Liquefied Natural Gas Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Saudi Aramco

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Total Energies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sinopec

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SABIC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ACWA Power

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Saudi Aramco

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making