India Truck & Bus Air Conditioner Market Research Report: Forecast (2024-2030)

India Truck & Bus Air Conditioner Market Report - By Vehicle Type (Bus, Truck), By Product Type (Roof Mounted Split AC, Back Wall AC), By Demand Type (OEM, Replacement), By Capacit...y (Up to 10 Kw, 10.1-25 Kw, 25.1-40 Kw, Above 40 Kw), and others Read more

- Automotive

- Jan 2024

- Pages 137

- Report Format: PDF, Excel, PPT

Market Definition

A bus and truck air conditioner is a specialized cooling system designed to regulate the temperature and humidity inside buses and trucks. It works by removing heat and moisture from the interior of the vehicle, ensuring a comfortable and controlled environment for passengers or drivers, especially during hot and humid conditions.

Market Insights & Analysis: India Truck & Bus Air Conditioner Market (2024-30):

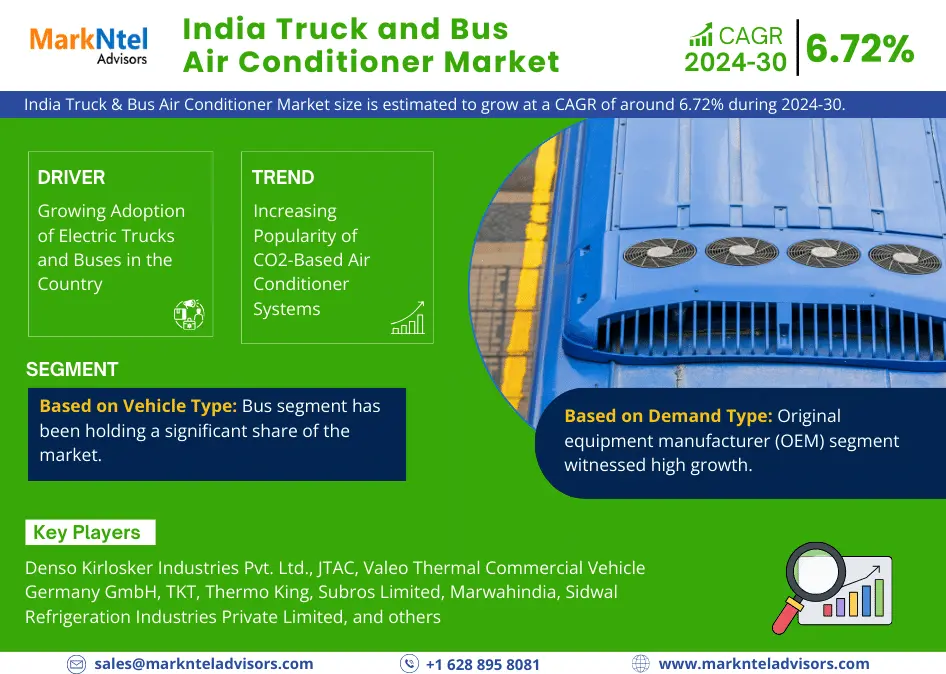

The India Truck & Bus Air Conditioner Market is estimated to grow at a CAGR of around 6.72% during the forecast period, i.e., 2024-30. The expansion of the market is propelled by the progressing development of road infrastructure, government regulations, an increasing count of private schools, etc. The rapid growth of road infrastructure, particularly state and national highways in the country, has been propelling the growth of the bus and truck industry in the country in recent years. Rapid national & state government initiatives and investments to boost the economic & industrial sectors, such as tourism, trade & commerce, etc., lead to the upward development of road infrastructure.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 6.72% |

| Region Covered | North, West, East, South |

| Key Companies Profiled | Denso Kirlosker Industries Pvt. Ltd., JTAC, Valeo Thermal Commercial Vehicle Germany GmbH, TKT, Thermo King, Subros Limited, Marwahindia, Sidwal Refrigeration Industries Private Limited, Songz, Ebespacher Gruppe GmbH & Co. KG, and others |

| Unit Denominations | USD Million/Billion |

According to the Ministry of Transport & Roadways, the total length of national highways has increased by around 47.85% from the period of 2014-2015 to 2022-2023. Consequently, this has led to the rapid adoption of buses & freight trucks in the country, due to extended routes and connectivity, increased trade and commerce, etc. This surge has increased the truck and bus air conditioner market size recently as operators seek comfort, a competitive edge, and climate control due to high temperatures.

Moreover, the private school sector in India has experienced significant growth in recent years due to the rising demand for quality education and improved infrastructure. According to the Global Education Monitoring Report 2022 by UNESCO, around 7 of 10 schools in India are private. As the population is booming in the country, the demand for quality education is further expected to grow in the coming years. Private schools are prioritizing the comfort and safety of students during transportation. Air-conditioned buses provide a more comfortable and controlled environment, especially in regions with extreme weather conditions. This would have a positive impact on market volume in the upcoming years.

India Truck & Bus Air Conditioner Market Driver:

Growing Adoption of Electric Trucks and Buses in the Country – Rising demand for electric trucks and buses in India is driving the heightened requirement for truck and bus air conditioners. The government initiatives, carbon reduction goals, growing temperatures, and sustainability efforts by businesses resulted in a heightened demand for air-conditioned electric buses in the country. State governments such as Kerala, Karnataka, Tamil Nadu, Bengal, etc. are increasingly enhancing their public travel transport by heavily investing in sustainable & comfortable transportation.

For instance, in 2022, the West Bengal government awarded a contract to Tata Motors to manufacture around 1180 electric buses, which include 12-meter low-floor buses and 9-meter standard AC floor buses. Consequently, these types of government initiatives have accelerated the market in recent years.

Moreover, the rising growth of e-commerce and last-mile delivery services, especially in urban areas, is expected to increase the demand for electric trucks in the coming years. These vehicles are expected to be equipped with air conditioners to meet the evolving needs of logistics companies and contribute to sustainable urban transportation.

India Truck & Bus Air Conditioner Market Opportunity:

Government Stringent Mandate to Install Air-conditioned Systems to Offer New Opportunities – The government of India approved the draft notification that mandates the installation of air-conditioned systems in the cabins of trucks classified under categories N2 and N3. The decision aims to enhance road safety by providing comfortable working conditions for truck drivers, improving their efficiency, and addressing issues related to driver fatigue. In response to this, all trucks are to be equipped with air conditioners by 2025. This would result in retrofitting opportunities for truck manufacturers, as existing trucks are to be updated & modernized to comply with the new regulations. All these factors are expected to boost the market in the coming years.

India Truck & Bus Air Conditioner Market Challenge:

Low Adoption Rate in the SMEs – Due to growing inflation in the country, many small and medium enterprises (SMEs) prioritize affordability and operational efficiency in their transportation facilities over amenities like air conditioning. According to the World Bank, the inflation rate in India has increased to around 6.7% in 2022 from around 3.7% in 2019. Prioritizing affordability and efficiency allows them to allocate resources to areas that directly impact their core operations and growth.

Additionally, the infrastructure and road conditions in certain regions, such as low-tier cities, make it challenging to justify the added expense of air-conditioned buses & trucks. Thus, being inherently price-sensitive, SMEs could opt for non-air-conditioned vehicles to minimize initial costs and ongoing operational expenses. This could result in lower adoption rates of air-conditioned buses and trucks within this sector in the coming years.

India Truck & Bus Air Conditioner Market Trend:

Increasing Popularity of CO2-Based Air Conditioner Systems – The increasing introduction of CO2-based systems represents a noteworthy trend in the bus & truck air conditioner market. This is mainly driven by growing environmental concerns and consumer demand for energy-efficient transportation. For instance, in 2020, Valeo launched an all-electric, roof-mounted, zero-emission R744 (CO2) HVAC unit with a heat pump function, specifically designed for buses with alternative propulsion systems. CO2, or carbon dioxide-based ACs, are considered more environmentally friendly refrigerants compared to traditional options like hydrofluorocarbons (HFCs)-based ACs.

Additionally, efficiency is a critical factor in the automotive industry, particularly for vehicles where fuel efficiency is paramount. CO2-based systems offer improved energy efficiency, contributing to fuel savings and aligning with the industry's demand for eco-friendly and economical solutions, resulting in the increased adoption of C02 air conditioners in recent years.

Moreover, the Indian government approved ratifying the Kigali Amendment to the Montreal Protocol on phasing down climate-damaging refrigerant hydrofluorocarbons (HFCs). As a result, the government plans to phase down HFCs, used in air conditioners, refrigerators, and insulating foams, in four steps from 2028 onwards. This would result in the heightened adoption of lower global warming potential (GWP), like CO2 air conditioners, in buses and trucks in the forecast period.

India Truck & Bus Air Conditioner Market (2024-30): Segmentation Analysis

India Truck & Bus Air Conditioner Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. According to the analysis, the market has been further classified as:

Based on Vehicle Type:

- Bus

- Large Buses (10 Meter or Above)

- Medium Buses (7.1 Meter to 10 Meter)

- Small Buses (Below 7 Meter)

- Truck

- Heavy Duty Trucks (Above 7 Tones)

- Light & Medium Duty Trucks (Up to 7 Tones)

The bus segment has been holding a significant share of the market owing to the surge in outstation bus services and government initiatives. The rise of online booking platforms and apps like Zing Bus and Red Bus, alongside the increasing trends of migration and urbanization, has led to the growing adoption of outstation bus services in India in recent years. This increased adoption of outstation bus services has resulted in a demand for efficient, comfortable, and accessible transportation options. To meet this demand, operators are increasingly opting for air-conditioned buses, thereby fueling market growth.

Furthermore, the government initiative One Nation and One Permit would expect to boost the volume of this segment due to the easier and faster processing of permits for bus operators. Further, state governments such as Delhi, Karnataka, West Bengal, Uttar Pradesh, Tamil Nadu, etc. are increasingly taking steps to expand & replace their public transport buses in the upcoming years. Thus, these factors would positively accelerate the demand for air-conditioned buses in the coming years.

Based on Demand Type:

- OEM

- Replacement

During the historical period, the original equipment manufacturer (OEM) segment witnessed high growth due to the increased adoption of premium and high-end buses & trucks and the growth of the tourism industry. The country has witnessed an increase in the purchase of premium and high-end trucks in the past few years due to the boom in mining, road construction, and e-commerce. For instance, in 2021, Volvo commercial vehicles reported about a 25.8% jump in sales to 6,154 units in 2021 from around 4,892 units in 2020. This surge in sales has led to a growing demand for truck & bus air conditioners by original equipment manufacturers (OEMs) to outfit their premium commercial vehicles.

Furthermore, the growing tourism industry in India is estimated to foster demand for AC buses and luxury coaches. According to the Indian Tourism Statistics 2022 report, India received around 677.63 million domestic tourist visits in 2021. The percentage has increased by about 11.05% from around 610.22 in 2020. As tourism grows, tour operators and travel companies prefer fleets equipped with air conditioning to provide a superior travel experience to customers. Thus, the OEM segment is expected to hold its leading position in the forecast period as well.

India Truck and Bus Air Conditioner Industry Recent Development:

- In 2023, Valeo India has lined up an investment of USD 162 million in India over the next three to four years to accelerate its business in the country.

Gain a Competitive Edge with Our India Truck & Bus Air Conditioner Market Report

- India Truck & Bus Air Conditioner Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Truck & Bus Air Conditioner Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Truck & Bus Manufacturing Industry Outlook, 2023

- Current Scenario

- Production Vs Sales, By Vehicle Type

- By Internal Combustion Engine

- By Electric

- Government Initiatives for Future Industry Development

- India Truck & Bus Air Conditioner Market Trends & Developments

- India Truck & Bus Air Conditioner Market Dynamics

- Drivers

- Challenges

- India Truck & Bus Air Conditioner Market Hotspot & Opportunities

- India Truck & Bus Air Conditioner Market Regulations and Policy

- India State Governments Road Transport Service Expansion Plans

- India Truck & Bus Air Conditioner Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Vehicle Type

- Bus- Market Size & Forecast 2019-2030F, USD Million

- Large Buses (Above 10 Meter)

- Medium Buses (7.1 to 10 Meter)

- Small Buses (Below 7 Meter)

- Truck- Market Size & Forecast 2019-2030F, USD Million

- Heavy Duty Trucks (Above 7 Tons)

- Light & Medium Duty Trucks (Up to 7 Tons)

- Bus- Market Size & Forecast 2019-2030F, USD Million

- By Product Type

- Roof Mounted Split AC- Market Size & Forecast 2019-2030F, USD Million

- Back Wall AC- Market Size & Forecast 2019-2030F, USD Million

- By Demand Type:

- OEM- Market Size & Forecast 2019-2030F, USD Million

- Replacement- Market Size & Forecast 2019-2030F, USD Million

- By Capacity

- Up to 10 Kw - Market Size & Forecast 2019-2030F, USD Million

- 10.1-25 Kw- Market Size & Forecast 2019-2030F, USD Million

- 25.1-40 Kw- Market Size & Forecast 2019-2030F, USD Million

- Above 40 Kw- Market Size & Forecast 2019-2030F, USD Million

- By Region

- North

- West

- East

- South

- By Competition

- Competition Characteristics

- Revenue Shares & Analysis

- By Vehicle Type

- Market Size & Analysis

- India Bus Air Conditioner Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Product Type- Market Size & Forecast 2019-2030F, USD Million

- By Demand Type- Market Size & Forecast 2019-2030F, USD Million

- By Capacity- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- India Truck Air Conditioner Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Vehicle Type- Market Size & Forecast 2019-2030F, USD Million

- By Product Type- Market Size & Forecast 2019-2030F, USD Million

- By Demand Type- Market Size & Forecast 2019-2030F, USD Million

- By Capacity- Market Size & Forecast 2019-2030F, USD Million

- Market Size & Analysis

- India Truck & Bus Air Conditioner Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Denso Kirlosker Industries Pvt. Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JTAC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Valeo Thermal Commercial Vehicle Germany GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TKT

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thermo King

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Subros Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Marwahindia

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sidwal Refrigeration Industries Private Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Songz

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Eberspacher Gruppe GmbH & Co. KG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Denso Kirlosker Industries Pvt. Ltd

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making