India Preclinical Research Market Report: Forecast (2025-2030)

India Preclinical Research Market Report - By Model Type (Patient-Derived Organoid (PDO) model, Patient-Derived Xenograft (PDX) model), By Service (Bioanalysis and DMPK studies, [I...n vitro ADME, In-vivo PK], Toxicology testing, [GLP, Non-GLP], Compound management, [Process R&D, Custom synthesis, Others], Chemistry, [Medicinal chemistry, Computation chemistry], Safety Pharmacology Others), By End User (Biopharmaceutical Companies, Government and academic institutes, Medical device companies, Others), and Others Read more

- Healthcare

- Nov 2024

- Pages 123

- Report Format: PDF, Excel, PPT

Market Definition

Preclinical research is the field that investigates a possible medication and tests it to find cures before the drug is used on humans. It entails experiments and other studies to determine the cause of illness by testing possible treatments on animals.

Market Insights & Analysis: India Preclinical Research Market (2025-2030):

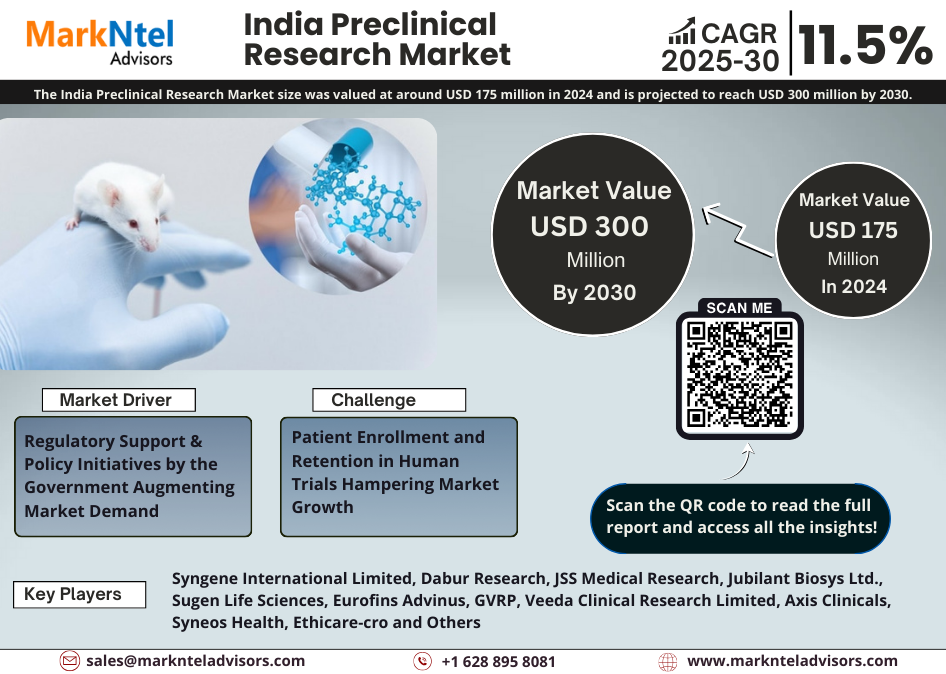

The India Preclinical Research Market size was valued at around USD 175 million in 2024 and is projected to reach USD 300 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 11.5% during the forecast period (2025-30). The market growth is ascribed to several factors including the sizeable patient base, rising demand for innovative drug development, encouraging government policies, low trial costs, and growing outsourcing trends of clinical trials in the R&D domain globally.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 175 Million |

| Market Value By 2030 | USD 300 Million |

| CAGR (2025-30) | 11.5% |

| Leading Region | South region |

| Top Key Players | Syngene International Limited, Dabur Research, JSS Medical Research, Jubilant Biosys Ltd., Sugen Life Sciences, Eurofins Advinus, GVRP, Veeda Clinical Research Limited, Axis Clinicals, Syneos Health, Ethicare-cro, Liveon Biolabs Pvt. Ltd., IQVIA Inc., Bioneeds, TheraIndx Lifesciences Pvt. Ltd., Abiogenesis Clinpharm, Accutest Global, Asiatic Clinical Research, Bio Reliance Corporation, Cliniminds, Hi Tech Bio Laboratories, GVK Biosciences, and others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Moreover, due to the large number of patients suffering from autoimmune, immunology, cardiovascular, infectious, oncology, & respiratory diseases and central nervous system (CNS) disorders in India, the requirement for preclinical research and testing has grown drastically. Continuous preclinical research and trials are being conducted to develop drugs to cure millions of patients. For instance; In October 2023, NexCAR19 was approved by the Central Drugs Standard Control Organization (CDSCO) as India's first CAR-T cell therapy based on two small clinical trials that involved 64 people with advanced lymphoma or leukemia. Between 2023-24 more than 40 new drugs were approved by CDSCO for the cures of multiple diseases in India. Moreover, In March 2024, 229 new medical devices were approved after preclinical trials.

In India, phase two and phase three clinical trials, have grown from 15% to 18% just between the period 2017-23. Preclinical trials in India have become more accessible and accelerated due to the global increase in outsourcing trends in the R&D of preclinical trials. From 2012-22, approximately 49,269 clinical trials occurred in India and have been growing since then. Multinational pharmaceutical companies seeking to optimize their R&D expenditures, find India as a desirable option due to its affordable and high-quality preclinical research services as compared to other markets in the US and Europe. India also offers high-class research facilities and equipment with innovative research techniques available at low operational cost enhancing its competitiveness in the global market.

India Preclinical Research Market Driver:

Regulatory Support & Policy Initiatives by the Government Augmenting Market Demand – Due to the rise in diseases in India, there is a high expenditure on preclinical research and development of drugs. It is supported by various policies and government initiatives like the Make in India, Production-Linked Incentive (PLI) Scheme, Promotion of Medical Devices Parks Scheme, etc. PLI scheme provides incentives up to USD 456 million. It is to boost the domestic research, investments, and manufacturing of medical devices such as cancer care devices, radiology and imaging devices, anesthetics devices, implants, etc. This drives the market towards growth by bringing multiple global investments into the market. Also, the Central Drugs Standard Control Organization has implemented various measures like faster timelines for approval, and an online system for submission & monitoring, to streamline the process from preclinical to clinical phases. India is aligning its regulatory framework with international guidelines like Good Laboratory Practice & Good Clinical Practice which is important to ensure data credibility in preclinical research encouraging global acceptance and investment in the Indian market. For Instance;

- In 2022, India attracted 225 R&D projects valued up to USD 12.9 billion in capital expenditure.

Moreover, the budget allocations from the government help to strengthen the infrastructure required for preclinical research. As per the 2024 Union budget, the allocation of funds towards biotechnology R&D was around USD 130.37 million involving preclinical research and other processes. Furthermore, with collaborations with International Regulatory Bodies, India signed agreements with several countries allowing companies to facilitate mutual recognition of data and allowing Indian researched drugs to enter the global market. These agreements allow companies to justify the use of Indian facilities for preclinical trials ultimately driving the market towards exponential growth.

India Preclinical Research Market Opportunity:

Emergence of Targeted Therapies & Personalized Medicine – The emerging field of precision medicine and targeted therapies holds vast opportunities in the preclinical research market of India. Rapid growth can be seen in precession medicine specifically in oncology and immunology. It focuses on customized treatment based on the patient’s profile requiring intense preclinical research. Several international pharmaceutical companies like; Pfizer, Boehringer Ingelheim, AstraZeneca, and others are increasingly collaborating with Indian CROs for the preclinical stages, with a focus on target therapies, especially in oncology providing numerous opportunities for market growth.

In addition, the growing expertise of India in areas of molecular biology and genetic research can place India at the pinnacle of validation of biomarkers and identification of genetic targets that are crucial for precision medicine ultimately bringing more investments in the market.

India Preclinical Research Market Challenge:

Patient Enrollment and Retention in Human Trials Hampering Market Growth – Patient enrollment and retention is one of the major challenges for India’s preclinical research market. Preclinical trials primarily involve animal testing but with New Drugs and Clinical Trial Rules (2023), the government aims to replace the use of animals in research, especially in drug testing. Due to a lack of awareness and engagement, the transition to early-phase human trials (Phase I) often faces hurdles in India. Approximately 30-40% of the Phase I trials run into enrollment delays in India impacting timelines and increasing costs. The main reasons for conservatism are myths surrounding clinical research in Indians, particularly regarding safety and ethical practices. Moreover, CROs are competing for a limited number of available test subjects in metro centers where most of the preclinical testing sites are found. This can restrain the market’s growth & expansion in the long run.

India Preclinical Research Market Trend:

Rising Technological Advancements – The adoption of cutting-edge technologies such as high-throughput screening (HTS), in silico modeling, and advanced imaging techniques are significantly enhancing the capabilities of pre clinical research in India. By boosting the speed and accuracy, these technologies streamline the drug discovery process to provide potential drugs for testing. Also, the integration of advanced technologies like AI, ML, and HTS into the drug discovery process is making the process of preclinical testing faster and much more accurate. With the use of AI, the leading Indian CROs like GVK BIO and Syngene International, are gaining greater efficiency by identifying potential drugs for testing in less time along with a 30-40% reduction in costs.

Moreover, companies like Jubilant Biosys, are venturing into 3D bioprinting and organ-on-a-chip technology to simulate better responses within human organs in preclinical trials. These technologies can improve drug candidate selection by 60% and save the cost of animal testing. These technological advancements provide higher precision on data, with quicker turnaround times further augmenting the size & volume of the industry.

India Preclinical Research Market (2025-2030): Segmentation Analysis

The India Preclinical Research Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

By Model Type

- Patient-Derived Organoid (PDO) Model

- Patient-Derived Xenograft (PDX) Model

Out of them, the Patient-Derived Organoid (PDO) Model leads the market with more than 50% of the market share. PDO models are becoming increasingly crucial in preclinical research as they provide a closer stimulation of human biology than animal models. This allows more accurate preclinical testing and helps in creating drugs for highly complex diseases like cancer. In India, they find their major application in personalized medicine as they work on patient-specific tissues for testing drug efficacy, ultimately helping in tailored healthcare. With multiple investments and the provision of resources in the Indian market by pharmaceutical and biotechnology companies in advanced preclinical models like PDOs, there is a high improvement in the predictability of drug outcomes and streamlined clinical trial processes. For Instance;

- In 2023, patented Akura 96 and 384 Spheroid Microplates were provided to Indian researchers under the distribution agreement between InSphero AG and Bionova Supplies.

By End User

- Biopharmaceutical companies

- Government and academic institutes

- Medical device companies

- Others

Out of them, biopharmaceutical companies lead the India Preclinical Research Market. It holds more than 40% of the market share. This is due to their high demand for rigorous safety, efficacy, and pharmacokinetic testing required for the development of new drugs. In India, they are rapidly investing in the expansion of pipelines to include biologics, biosimilars, gene therapies, and other novel therapeutics requiring preclinical services making them a major consumer for the Indian Pre clinical Research Industry. Both domestic and international biopharmaceutical companies outsource preclinical research to CROs like Syngene International and GVK Biosciences by taking advantage of the cost savings and India’s regulatory alignment with global standards. Through initiatives like Make in India and Pharma Vision 2020, the government helped increase local production and development capabilities to boost the biopharmaceutical sector.

India Preclinical Research Market (2025-30): Regional Projections

Geographically, the India Preclinical Research Market expands across:

- South

- North

- East

- West

Out of them, the South region dominates the India Preclinical Research Market. This region holds more than 35% of the market share. The existence of reputable biotech and pharmaceutical research & development centers in cities like Hyderabad, Bengaluru, and Chennai is propelling regional growth. Due to the presence of prominent companies like GVK Biosciences and Syngene International, the region has developed into a preclinical service hotspot. Also, the government support in the region towards the growth and development of biotech and pharma sectors has laid an impeccable foundation for research facilities to flourish.

India Preclinical Research Industry Recent Development:

- December 2023: Syngene International acquired a multi-modal biologics manufacturing facility from Stelis Biopharma Ltd. in Bangalore at a gross value of USD 6.17 billion, adding 20,000 liters of installed biologics drug substance manufacturing capacity for Syngene.

- September 2023: Syneos Health announced a strategic alliance with Oracle for using the Oracle Cerner Learning Health Network (LHN) and Oracle's study startup solutions to recruit patients and increase their diversity allowing Syneos to improve performance throughout the clinical lifecycle.

Gain a Competitive Edge with Our India Preclinical Research Market Report

- India Preclinical Research Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps business organizations to gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing business organizations to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Preclinical Research Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, business organizations can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Preclinical Research Market Trends & Deployments

- India Preclinical Research Market Dynamics

- Growth Drivers

- Challenges

- India Preclinical Research Market Opportunities & Hotspots

- India Preclinical Research Market Value Chain Analysis

- India Preclinical Research Market Regulations and Policy

- India Preclinical Research Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Model Type

- Patient-Derived Organoid (PDO) model- Market Size & Forecast 2020-2030, USD Million

- Patient-Derived Xenograft (PDX) model- Market Size & Forecast 2020-2030, USD Million

- By Service

- Bioanalysis and DMPK studies- Market Size & Forecast 2020-2030, USD Million

- In vitro ADME- Market Size & Forecast 2020-2030, USD Million

- In-vivo PK- Market Size & Forecast 2020-2030, USD Million

- Toxicology testing- Market Size & Forecast 2020-2030, USD Million

- GLP- Market Size & Forecast 2020-2030, USD Million

- Non-GLP- Market Size & Forecast 2020-2030, USD Million

- Compound management- Market Size & Forecast 2020-2030, USD Million

- Process R&D- Market Size & Forecast 2020-2030, USD Million

- Custom synthesis- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Chemistry- Market Size & Forecast 2020-2030, USD Million

- Medicinal chemistry- Market Size & Forecast 2020-2030, USD Million

- Computation chemistry- Market Size & Forecast 2020-2030, USD Million

- Safety Pharmacology-Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- Bioanalysis and DMPK studies- Market Size & Forecast 2020-2030, USD Million

- By End User

- Biopharmaceutical Companies- Market Size & Forecast 2020-2030, USD Million

- Government and academic institutes- Market Size & Forecast 2020-2030, USD Million

- Medical device companies- Market Size & Forecast 2020-2030, USD Million

- Others- Market Size & Forecast 2020-2030, USD Million

- By Region

- North

- East

- West

- South

- By Company

- Competition Characteristics

- Market Share and Analysis

- By Model Type

- Market Size & Analysis

- North India Preclinical Research Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Model Type- Market Size & Forecast 2020-2030, USD Million

- By Service-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- South India Preclinical Research Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Model Type- Market Size & Forecast 2020-2030, USD Million

- By Service-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- West India Preclinical Research Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Model Type- Market Size & Forecast 2020-2030, USD Million

- By Service-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- East India Preclinical Research Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Model Type- Market Size & Forecast 2020-2030, USD Million

- By Service-Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- India Preclinical Research Market Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Syngene International Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Dabur Research

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- JSS Medical Research

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Jubilant Biosys Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Sugen Life Sciences

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Eurofins Advinus

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- GVRP

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Veeda Clinical Research Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Axis Clinicals

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Syneos Health

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Ethicare-cro

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Liveon Biolabs Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- IQVIA Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Bioneeds

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- TheraIndx Lifesciences Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Abiogenesis Clinpharm

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Accutest Global

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Asiatic Clinical Research

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Bio Reliance Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Cliniminds

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Hi Tech Bio Laboratories

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- GVK Biosciences

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Deployments

- Financial Details

- Others

- Others

- Syngene International Limited

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making