India Cement Market Research Report: Forecast (2025-2030)

India Cement Market Report - By Type, (Blended, [Portland Slag Cement (PSC), Portland Pozzolana Cement (PPC), Portland Composite Cement (PCC)], Ordinary Portland Cement (OPC), Othe...rs), By End Users, (Residential, Infrastructur, Commercial, Industrial), and Others Read more

- Buildings, Construction, Metals & Mining

- Nov 2024

- Pages 122

- Report Format: PDF, Excel, PPT

Market Definition

Cement is a material that is widely used for binding in construction activities, particularly in residential, infrastructure, commercial, and industrial development. Cement is a critical element that is responsible for holding the structure together.

Market Insights & Analysis: India Cement Market (2025-30):

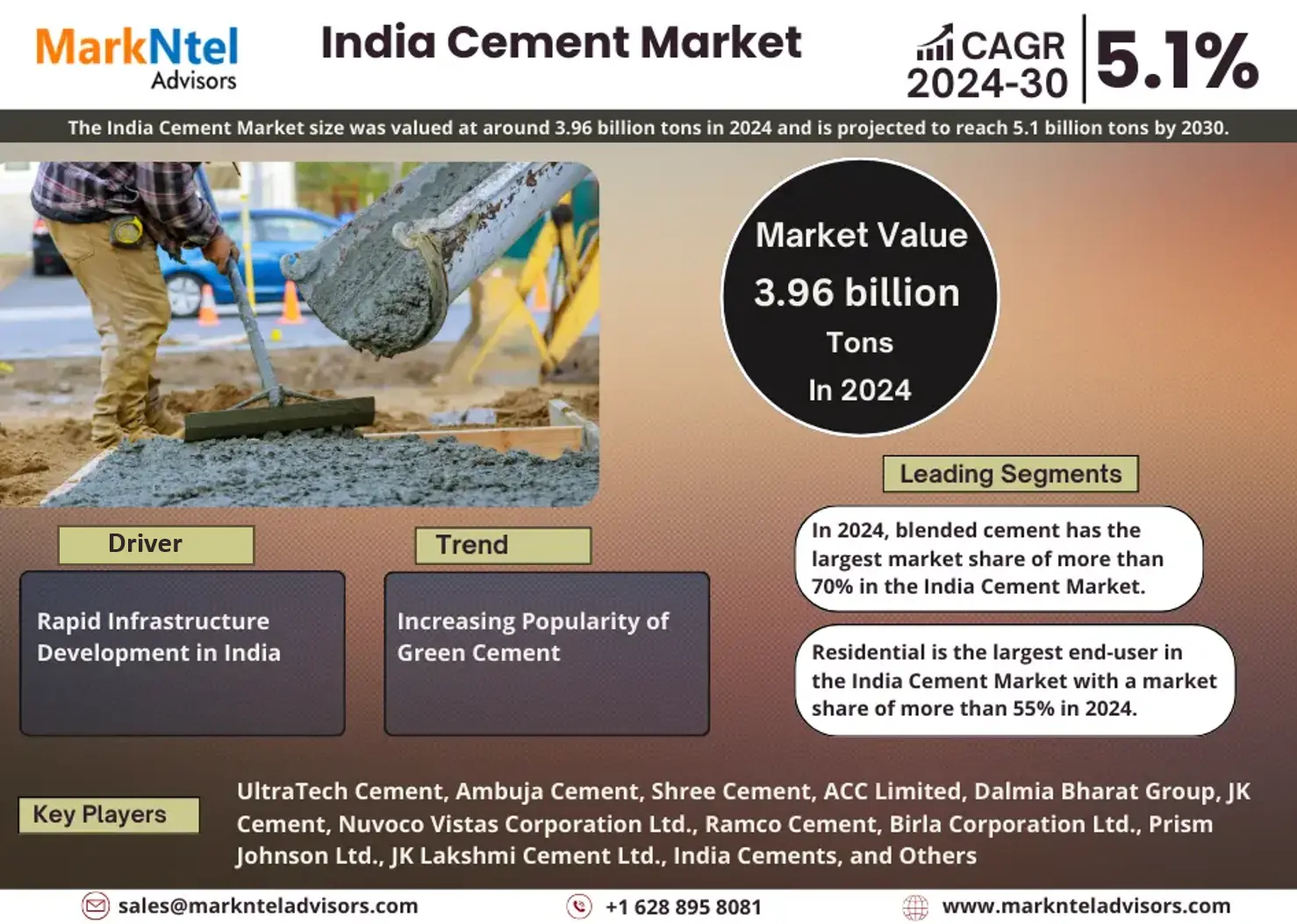

The India Cement Market size was valued at around 3.96 billion tons in 2024 and is projected to reach 5.1 billion tons by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.1% during the forecast period, i.e., 2025-30. This growth is attributed to the expansion in the cement’s end-user Industries in India including residential, Infrastructure, commercials, and industrial. In India, the cement industry had experienced a tailwind scenario with burgeoning demand for cement coming from the rapidly growing infrastructure in the country. India is witnessing an increase in fiscal spending on developing country’s infrastructure. Under this, there is a significant allocation of around USD29.7 billion for Indian railways. As per the railway ministry in 2024, India’s rail track is growing at 4km of rail track per day. This has led to the addition of 31,000 km of rail tracks in the last ten years of the country.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | 3.96 billion tons |

| Market Value By 2030 | 5.1 billion tons |

| CAGR (2025-30) | 5.1% |

| Leading Region | Southern region |

| Top Key Players | UltraTech Cement, Ambuja Cement, Shree Cement, ACC Limited, Dalmia Bharat Group, JK Cement, Nuvoco Vistas Corporation Ltd., Ramco Cement, Birla Corporation Ltd., Prism Johnson Ltd., JK Lakshmi Cement Ltd., India Cements, and Others |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

Furthermore, the construction of a bullet train network between Gujarat and Mumbai of approximately 508 km will further add to the increasing infrastructure of India’s rail network. This expanding infrastructure development has resulted in the heightened demand for cement in the country. For example, it is estimated that the bullet train corridor between Gujarat and Mumbai which involves numerous tunnels and stations requires around 20,000 cubic meters of cement daily.

Apart from this, there is rapid growth in the residential sector and commercial sector of India. The government schemes like PM Awas Yojana for rural and Urban India are greatly boosting housing development in the country. The PM Awas Yojana for rural India has 34.9 million registered beneficiaries as of November 2024 with 26.6 million houses already being completed. For Urban India, the same scheme is being implemented with an investment of USD95.9 billion and has completed 8.7 million houses, out of 11.8 million sanctioned. The surge in the cement demand in the country is leading the industry to raise its installed capacity. These developments will boost the market growth over the foreseeable future.

India Cement Market Driver:

Rapid Infrastructure Development in India – By 2047, India wants to achieve an ambitious target of turning into a developed country and is transforming itself for it. This has resulted in increased government spending on the country's infrastructure to attain such a vast objective. In pursuit of this targeted investment of USD1.3 trillion between 2020 and 2025, India launched the "National Infrastructure Pipeline (NIP)" in 2020 based on the public-private partnership model. It has resulted in the wide-scale infrastructure development in the country with 1,967 projects still in the under-development stage in 2024. As per India Investment Grid (IIG), the launch of the Gatishakti master plan (NMP) by India in 2021 the Indian government has 15,928 projects with a total cost of USD 2.4 trillion in 2024. These projects primarily focus on enhancing and boosting the transportation and logistics capabilities of India by connecting various economic zones of the country.

As per Morgan Stanley, India’s infrastructure as a percentage of GDP stood at 5.3% in FY24 and will increase to 6.5% by FY29. This will result in the burgeoning growth in the cement consumption of India with the heightened infrastructure spending thereby boosting India’s Cement Industry over the foreseeable future.

India Cement Market Opportunity:

Expansion of Road Networks – In India, most of the transportation and logistical activities happen through roadways. The increasing spending on expanding the road networks of the country has resulted in massive consumption of cement in the country. Moreover, MoRTH has seen a rise of around 3% in its budget to USD32.3 billion in FY25. This highlights the strong expansionary outlook for the Indian road networks in the country. The Bharatmala project of the GoI which has completed 15,549 km of roads till FY24 is planning to complete the rest of 19,251 km of Bharatmala Phase-I by 2028. This will boost the demand for cement in India leading to market growth over the forecasted period.

India Cement Market Trend:

Increasing Popularity of Green Cement – The cement industry of India is rapidly trying to curb its CO2 emissions. The situation has led to cement companies in India reducing their clinker mix during cement production leading to the development of green cements. UltraTech Cement, the leading player stated that it has managed to bring down the clinker to 45% to produce composite cement. Furthermore, the Bureau of Indian Standards (BIS), in August 2023, released guidelines and specifications for the production of LC3 (Limestone Calcined Clay Cement). LC3 generates significantly less emissions relative to ordinary Portland cement by 40%. Moreover, it will also lead to up to 25% of cost reduction.

Additionally, one of the leading cement companies JK Lakshmi Cements has partnered with the Technology and Action for Rural Development (TARA) to decarbonize the cement production. Both organizations have signed long-term MoUs, leading to the development where LC3 is expected to be produced at the Jaykaypuram Plant of JK Lakshmi Cement. The unfolding of these situations highlights the increased efforts by the cement industry of India to decarbonize itself and adoption of environment-friendly products like green cement and LC3.

India Cement Market (2025-30): Segmentation Analysis

The India Cement Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2025–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Type:

- Blended Cement

- Ordinary Portland Cement

- Others

In 2024, blended cement has the largest market share of more than 70% in the India Cement Market. India’s cement industry voluntarily embarked on decreasing its carbon emissions by increasing the usage of blended-type cement. This has resulted in the adoption of the best cement blending practices from the USA and Europe by cement companies in India. The companies in India are actively replacing the clinker with other raw materials such as pozzolana, and granulated slag from blast furnaces.

Lowering the clinker usage with other alternatives will save energy as well as reduce the emissions of CO2. Such practices will also support the industry in achieving its CO2 emissions targets by 2050 of lowering by 45%. The increasing carbon awareness in India and the adoption of a sustainability approach by the cement manufacturers in India would result in the segment remaining a dominant category over the forecasted period.

Based on End Users:

- Residential

- Infrastructure

- Commercial

- Industrial

Residential is the largest end-user in the India Cement Market with a market share of more than 55% in 2024. This is primarily because housing in India is considered an important requirement for an individual, leading to healthy demand in the market throughout the year. This leads to major cement companies actively targeting this segment. This is seen in the rapidly growing bank credit outstanding in India towards the housing sector. As per the RBI’s data on the sectoral development of bank credit, the outstanding housing credit stood at around USD 323.7 billion in March 2024, which has risen from USD 205.2 billion in March 2022.

Furthermore, the Government of India (GoI)’s action to provide affordable housing has further boosted the market growth. Under the GoI scheme, PM Awas Yojana (Gramin), 25.5 million houses were constructed by the end of January 2024. The GoI of India has announced to construction of 20 million more houses under this scheme in the next five years which will further boost the cement market of India.

India Cement Market (2025-30): Regional Projections

Geographically, the India Cement Market expands across:

- North & Central

- South

- East

- West

The southern region of India includes states like Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, and Kerala, which hold the largest market share of about 27% in the India Cement Market. As per the Cement Manufacturers Association, the region had around 187.96 million tons of installed production capacity in FY23. This is primarily due to the market dynamics being more competitive with a large number of cement companies present in southern India in contrast to the other regions. For instance, as per ICRA in 2024, the top five cement manufacturing companies in the south possess around 47% market share of southern India’s capacity compared to the top five holding 83% of North India’s total capacity. Hence these large players in the South region present a huge opportunity for M&A in this region and market expansion.

India Cement Industry Recent Development:

- October 2024: Ambuja Cement acquired a 46.8% stake in Orient Cement Limited with an equity value of USD 963.5 million.

- July 2024: Ultratech Cement which holds around 22.7% equity in India Cement is looking to acquire 32.72% of additional equity in India Cements.

Gain a Competitive Edge with Our India Cement Market Report

- India Cement Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Cement Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Cement Market Supply Chain Analysis

- India Cement Market Import-Export Analysis

- India Cement Market Trends & Insights

- India Cement Market Dynamics

- Drivers

- Challenges

- India Cement Market Hotspot & Opportunities

- India Cement Market Policies, Regulations, Product Standards

- India Cement Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Million Tonnes)

- Market Share & Analysis

- By Type

- Blended

- Portland Slag Cement (PSC) - Market Size & Forecast 2020-2030F, Million Tonnes

- Portland Pozzolana Cement (PPC) - Market Size & Forecast 2020-2030F, Million Tonnes

- Portland Composite Cement (PCC) - Market Size & Forecast 2020-2030F, Million Tonnes

- Ordinary Portland Cement (OPC)- Market Size & Forecast 2020-2030F, Million Tonnes

- Others- Market Size & Forecast 2020-2030F, Million Tonnes

- Blended

- By End Users

- Residential - Market Size & Forecast 2020-2030F, Million Tonnes

- Infrastructure- Market Size & Forecast 2020-2030F, Million Tonnes

- Commercial - Market Size & Forecast 2020-2030F, Million Tonnes

- Industrial – Market Size & Forecast 2020-2030F, Million Tonnes

- By Region

- North & Central

- South

- East

- West

- By Competition

- Market Share of Top Companies

- Competition Characteristics

- By Type

- Market Size & Analysis

- North & Central India Cement Market Outlook, 2020-2030F

- Market Size & Analysis

- By Volume, Million Tonnes

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, Million Tonnes

- By End Users- Market Size & Forecast 2020-2030F, Million Tonnes

- By State

- Himachal Pradesh

- Punjab

- Haryana

- Uttarakhand

- Uttar Pradesh

- Madhya Pradesh

- Others

- Market Size & Analysis

- South India Cement Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues, Million Tonnes

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, Million Tonnes

- By End Users- Market Size & Forecast 2020-2030F, Million Tonnes

- By State

- Tamil Nadu

- Andhra Pradesh

- Karnataka

- Telangana

- Kerala

- Market Size & Analysis

- East India Cement Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues, Million Tonnes

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, Million Tonnes

- By End Users- Market Size & Forecast 2020-2030F, Million Tonnes

- By State

- Assam

- Meghalaya

- West Bengal

- Jharkhand

- Odisha

- Chhattisgarh

- Bihar

- Others

- Market Size & Analysis

- West India Cement Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues, Million Tonnes

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030F, Million Tonnes

- By End Users- Market Size & Forecast 2020-2030F, Million Tonnes

- By State

- Rajasthan

- Gujarat

- Maharashtra

- Market Size & Analysis

- India Cement Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- UltraTech Cement

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ambuja Cement

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Shree Cement

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ACC Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dalmia Bharat Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JK Cement

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nuvoco Vistas Corporation Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ramco Cement

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Birla Corporation Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Prism Johnson Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- JK Lakshmi Cement Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- India Cements

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- UltraTech Cement

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making