Global Blended Cement Market Research Report: Forecast (2024-2030)

Blended Cement Market Report- By Material (Silica Fume, Fly Ash, Slag, Limestone), By Application (Residential, Non-Residential), By Region (North America, Europe, Asia-Pacific, So...uth America, Middle East & Africa) Read more

- Buildings, Construction, Metals & Mining

- May 2023

- Pages 175

- Report Format: PDF, Excel, PPT

Market Definition

Blended cement is sustainable cement prepared by substituting a part of the traditional Portland cement clinker with high-blending materials, such as silica fume, fly ash, slag, and limestone. These are used to enhance the properties of the blended cement.

Market Insights & Analysis: Global Blended Cement Market (2024-30)

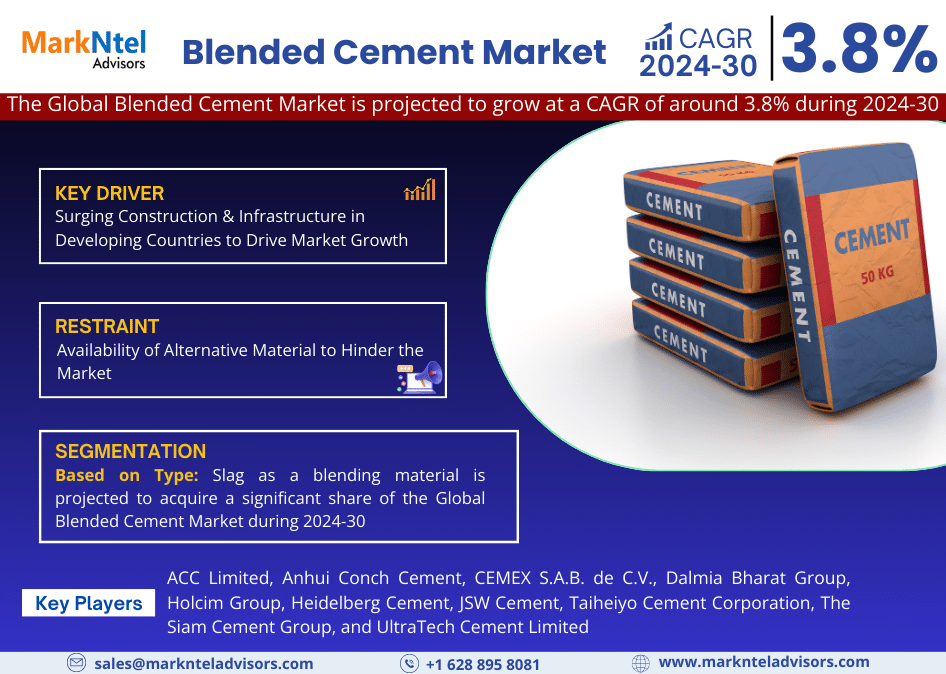

The Global Blended Cement Market is projected to grow at a CAGR of around 3.8% during the forecast period, i.e., 2024-30. Most of the market expansion is driven by rapid urbanization across different countries, numerous ongoing & upcoming building and construction projects associated with both residential & non-residential sectors, and massive investments in infrastructure developments related to roads, bridges, dams, public utility structures, airports, military facilities, power plants, etc.

Globally, India, Vietnam, Malaysia, Philippines, and Nigeria are emerging as highly lucrative areas for blended cement manufacturers owing to their booming construction industries with an exponentially increasing number of commercial & residential buildings. On the other front, the market growth is decent in the US, Poland, South Korea, and Turkey.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2023-2028) | 3.8% |

| Regions Covered | North America: The US, Canada, Mexico |

| South America: Brazil, Argentina | |

| Europe: The UK, Italy, Germany, France, and Others | |

| Middle East & Africa: Saudi Arabia, South Africa | |

| Asia-Pacific: China, India, Japan, South Korea, Others | |

| Key Companies Profiled |

ACC Limited, Anhui Conch Cement, CEMEX S.A.B. de C.V., Dalmia Bharat Group, Holcim Group, Heidelberg Cement, JSW Cement, Taiheiyo Cement Corporation, The Siam Cement Group, and UltraTech Cement Limited |

| Unit Denominations | USD Million/Billion |

With stringent government norms for various industries to eliminate or reduce the use of toxic materials in order to curb the alarming levels of carbon emissions, businesses have started adopting eco-friendly measures to contribute to a sustainable environment. Since cement is one of the most prominent building & construction materials, dramatically rising construction activities & infrastructural developments are augmenting the demand for blended cement, i.e., a cost-effective alternative to traditional Portland cement and can significantly reduce CO2 emissions.

Moreover, blended cement has become increasingly popular among both consumers & builders in recent years, which owes to its benefits, including limited to low permeability, superior resistance to chlorides/sulfates, excellent strength, and enhanced workability. Hence, these aspects project numerous opportunities for the Global Blended Cement Market to witness notable expansion in the coming years.

Global Blended Cement Market Driver:

Surging Construction & Infrastructure in Developing Countries to Drive Market Growth – The increasing population in countries such as India and China has led to a shortage of housing in major cities. This results in instigating the construction industry in these countries, driving the growth of the Global Blended Cement Market. Due to the properties of blended cement, such as durability, strength, and chemical resistance, the commercial sectors, residential & building blocks utilize blended cement. The worldwide population is anticipated to increase in the future with growing urbanization that triggers the demand for infrastructure support such as roads, dams, tunnels, highways, subways, and commercial infrastructure.

Moreover, the governments of many countries focus on infrastructure expansions to enhance their economic growth. These factors would aid in increasing construction activity, thus instigating the Blended Cement Market. Furthermore, the demand for blended cement is growing with boosting developments of constructions & infrastructures, and it is estimated that infrastructure & construction would increase in the estimated years.

Global Blended Cement Market Possible Restraint:

Availability of Alternative Material to Hinder the Market – The material, which provides almost the same properties as blended cement, is limiting the Blended Cement Market around the globe. The availability of alternative cementitious materials such as limestone, Portland cement, and other traditional cement & high price fluctuations would restrict the market growth in the estimated years.

Global Blended Cement Market (2024-30): Segmentation Analysis

The Blended Cement Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment & includes predictions for the period 2024–2030 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Type:

- Silica Fume

- Fly Ash

- Slag

- Limestone

Slag as a blending material is projected to acquire a significant share of the Global Blended Cement Market during 2024-30. The mounting demand for quality & eco-friendly materials, coupled with the shifting energy trends away from coal-fired plants, are leading to the rapidly diminishing availability of fly ash globally. Consequently, the demand for slag-based blends that exhibit superior durability, versatility, strength, and low heat of hydration is burgeoning worldwide.

Slag-based blended cement is ideal for sustainable infrastructure developments & facilitates exceptional housing facilities owing to its high compressive & flexural strength, better workability, superior finish, fewer cracking risks, and improved life. Due to its low heat of hydration, slag-blended cement is majorly used in mass construction because it is made up of non-metallic products that possess above 90% glass with silicates and alumino-silicates of lime.

Hence, as a result of the rapidly growing population & urbanization, various countries worldwide are witnessing numerous commercial & residential construction activities, which, in turn, are escalating the demand for slag blends and fueling the Blended Cement Market growth.

Based on Application:

- Residential

- Non-residential

The Residential application is projected to witness rapid growth & significantly boost the Blended Cement Market through 2028. It owes to a dramatic rise in residential building construction activities across Western & Eastern Europe, coupled with a robust rebound of the real estate sector in the developing countries of Central & South America, the Middle East & Africa, and Asia-Pacific, especially India & China, and Indonesia, wherein commercial construction & infrastructural developments are also on a continuous rise.

With ever-growing population rates and improving economic conditions in developing countries, massive investments are being directed toward the residential sector to facilitate housing facility developments. As a result, there's a rapidly growing demand for blended cement for the development of residential buildings owing to their brilliant quality & durability, i.e., stimulating the overall market expansion.

Global Blended Cement Market: Regional Projection

Geographically, the Blended Cement Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Asia-Pacific is the largest Blended Cement Market, with China, the world's largest cement producer, as the leading country in the regional market. This region includes developing countries, such as India, Indonesia, and Vietnam, which unveils a productive opportunity for the market. The growth of infrastructure & residential developments in China & India is estimated to boost the market globally. Furthermore, India is the second chief cement manufacturer in the world after China. It ascribes to the rising population & rapid urbanization, improving economy, and substantial investments by governments in smart city projects & other infrastructure developments, especially across India & China.

On the other hand, India is prominently backing the regional market growth, owing to its huge population, i.e., an enormous base for the exponential cement demand, and significant economic developments in recent years, which again cites an ever-increasing cement utilization in the country. Hence, these gains indicate the immense potential of the Asia-Pacific Blended Cement Market in the future years.

Global Blended Cement Market: Recent Developments

2023: ACC Limited launched a user-friendly and pre-blended concrete solution ‘Bagcrete’, which is a high-quality raw material of propositional blend.

Gain a Competitive Edge with Our Global Blended Cement Market Report

- Global Blended Cement Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Blended Cement Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Executive Summary

- Impact of Covid-19 on the Global Blended Cement Market

- Global Blended Cement Market Regulations & Policies

- Global Blended Cement Market Trends & Insights

- Global Blended Cement Market Dynamics

- Growth Drivers

- Challenges

- Global Blended Cement Patent Analysis, 2024

- Global Blended Cement Market Supply Chain Analysis, 2024

- Global Blended Cement Market Hotspot & Opportunities

- Global Blended Cement Market Outlook, 2019- 2030

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Material

- Silica Fume

- Fly Ash

- Slag

- Limestone

- By Application

- Residential

- Non-Residential

- By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

- By Company

- Competition Characteristics

- Revenue Shares

- By Material

- Market Size & Analysis

- North America Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- By Country

- The US

- Canada

- Mexico

- The US Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Canada Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- The Mexico Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Market Size & Analysis

- South America Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- By Country

- Brazil

- Argentina

- Brazil Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Argentina Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Europe Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- By Country

- The UK

- Italy

- Germany

- France

- Others

- The UK Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Italy Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Germany Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- France Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- By Country

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- Saudi Arabia Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- South Africa Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- By Country

- China

- Japan

- India

- South Korea

- Others

- China Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Japan Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- India Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- South Korea Blended Cement Market Outlook, 2019-2030

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Material

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Solutions Offered, Business Segments, Financials, Future Plans)

- ACC Limited

- Anhui Conch Cement

- CEMEX S.A.B. de C.V.

- Dalmia Bharat Group

- Holcim Group

- Heidelberg Cement

- JSW Cement

- Taiheiyo Cement Corporation

- The Siam Cement Group

- UltraTech Cement Limited

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making