India Anime Market Research Report: Forecast (2024-2030)

India Anime Market Report - By Type (T.V., Movie, Video, Internet Distribution, Merchandising, Music, Pachinko, Live Entertainment), By Genre (Action & Adventure, Sci-Fi & Fantasy,... Romance & Drama, Sports, Others), By Age Group (Children, Teenagers, Young Adults), and Others Read more

- ICT & Electronics

- May 2024

- Pages 129

- Report Format: PDF, Excel, PPT

Market Definition

Anime refers to visual artwork that includes colorful characters and themes to present a story in the form of TV series, web series, or movies, among others. It involves animation work, which initially originated across Japan, and has become popular worldwide.

Market Insights & Analysis: India Anime Market (2024-30):

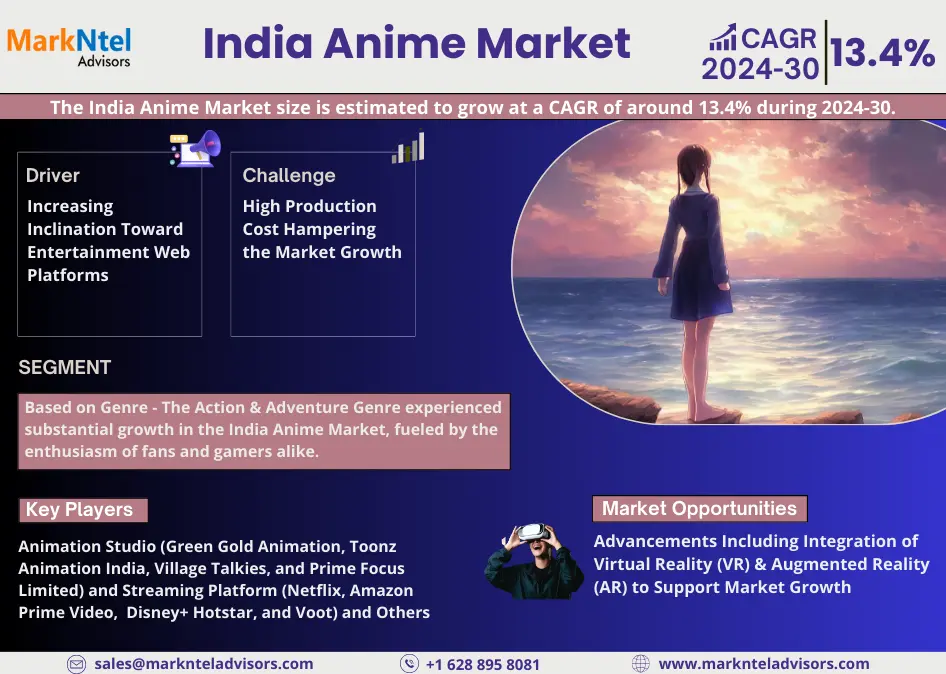

The India Anime Market size is estimated to grow at a CAGR of around 13.4% during the forecast period, i.e., 2024-30. Recently, hype in Japanese anime content has been witnessed across the landscape of India as many consumers, from children to young adults, like watching anime movies & series for entertainment. Internet-based distribution & gaming applications have also been contributing to the market expansion across the nation. Also, in recent years, online platforms in India have experienced a surge in memberships, resulting in increased time spent watching animated episodes and movies. Thus, this increased interest in watching movies and dramas online has further improved the demand for anime content.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 13.4% |

| Region Covered | North, South, East, West |

| Key Companies Profiled | Animation Studio (Green Gold Animation, Toonz Animation India, Village Talkies, Toei Animation, and Prime Focus Limited) and Streaming Platform (Netflix, Amazon Prime Video, Crunchyroll, Disney+ Hotstar, and Voot) |

| Unit Denominations | USD Million/Billion |

Additionally, the demand for anime games is rising due to immersive gaming experiences. Also, the market is expected to benefit from the broad distribution of anime content through various mediums, such as OTT platforms, comics, television, games, and social media. Furthermore, the anime market in India is characterized by innovation, with animation studios and streaming platforms constantly pushing creative boundaries. Moreover, advancements in technologies like AI, VR, AR, and IoT, along with rising disposable incomes, are expected to fuel market growth.

India Anime Market Driver:

Increasing Inclination Toward Entertainment Web Platforms – In recent years, consumers across India have been observed to be increasingly adopting online web platforms for entertainment purposes. With the presence of a wide range of content, including movies, web series, music, etc., which has been able to cater to diverse interests & preferences, the adoption of these platforms has increased. Hence, as online web platforms have been streaming a wide range of anime-based content, in different genres, their demand has also increased among consumers. In addition to this, the increasing internet penetration across the country has further supported the improved adoption of entertainment platforms like Amazon Prime, Netflix, etc., across the country. For instance:

- In 2023, according to the Internet & Mobile Association of India (IAMAI), the country has around 820 million active Internet users, and Internet penetration has increased by 8% in 2023, as compared to 2022.

Hence, the increasing internet penetration has enabled more people to access online content easily. Also, as these platforms allow consumers to access content anytime, anywhere, and on any device, their adoption has accelerated substantially among Indian consumers. Hence, with further amplification in the adoption of web streaming platforms, the demand for anime content would also escalate, as consumers prefer to watch different types & different genres of content.

India Anime Market Opportunity:

Advancements Including Integration of Virtual Reality (VR) & Augmented Reality (AR) to Support Market Growth – Several companies in India, which have been involved in the production of anime content are planning to integrate virtual & augmented reality into their workflows. This has been primarily influenced by the rising market trend of AR & VR technologies across the country. Consumers are increasingly inclined toward immersive experiences offered by AR & VR technologies in different sectors.

In addition, recently the adoption of AR & VR has largely escalated in the entertainment segments, most specifically, in the gaming segment. Hence, as consumers are becoming aware of the benefits and world-class experience offered by AR & VR technologies, they are expected to actively adopt AR & VR in anime content in the upcoming years. Also, observing this incoming opportunity, several companies involved in anime content production are announcing their plans for the integration of AR/VR technology into their offerings. For instance:

- In 2023, Reliance Animation announced the integration of several technologies like AI & ML, virtual production, blockchain for content protection, VR & AR experiences, etc.

Hence, with this, the demand for anime content with AR/VR experience would escalate, which would drive the growth of the overall market in the coming years.

India Anime Market Challenge:

High Production Cost Hampering the Market Growth – The India Anime Market has been experiencing a significant challenge in its growth process, owing to the high production cost of the anime content. Anime production is a complex process, and every stage, from design to post-production requires substantial investment. In addition to the cost of script, production, direction, editing, etc., anime content also requires robust technologies for creation. The animators need to do extensive editing, along with which, content production requires sound effects & voiceovers as well. Hence, all of these steps add up to the overall production cost of anime content. Therefore, this increased production cost has led to the failure of many anime content to recoup this expense, and thus, has been negatively affecting the India Anime Industry growth.

India Anime Market (2024-30): Segmentation Analysis

The India Anime Market study by MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the country level. In accordance to the analysis, the market has been further classified as:

Based on Type:

- TV

- Movie

- Video

- Internet Distribution

- Merchandising

- Music

- Pachinko

- Live Entertainment

The Merchandising segment has been showcasing good growth in revenue generation, with a diverse range of products capturing the imagination of anime enthusiasts in India. Leveraging merchandising strategies & products has been serving as a potent tool for boosting overall revenue generation for organizations. This growth has been attributed to the control of licensing & merchandising rights, offering studios the chance to capitalize on additional revenue streams through product sales or the utilization of their intellectual properties & characters. From trendy t-shirts to quirky keychains & more, merchandise featuring beloved anime characters remains immensely popular, particularly among younger demographics in India. Additionally, collaborations between consumer product manufacturers and anime creators further amplify sales revenue, capitalizing on the widespread popularity of anime characters among viewers. For instance:

- In 2023, Celio India, the Indian arm of the French menswear brand, unveiled a line of clothing in partnership with the beloved anime series Naruto.

Hence, with increasing consumer’s inclination toward anime characters, the demand for merchandised products would increase, which would contribute to the segment’s growth in the coming years as well.

Based on Genre:

- Action & Adventure

- Sci-Fi & Fantasy

- Romance & Drama

- Sports

- Others

The Action & Adventure Genre experienced substantial growth in the India Anime Market, fueled by the enthusiasm of fans and gamers alike. With a surge in demand for adrenaline-pumping sequences and action-packed narratives among Indian consumers, anime studios have been answering with a plethora of action-centric content. The dominance of the action genre in the anime scene has been a testament to its universal appeal & enduring popularity. Further, the genre captivates both seasoned enthusiasts and newcomers. Thus, the widespread availability of anime titles on streaming platforms solidifies its position as one of the primary revenue contributors.

India Anime Market Recent Development:

- 2024: Green Gold Animation has launched a new anime show, i.e., "Mighty Bheem's Playtime," a spin-off series delving into our adventurous toddler's school experiences. Through its engaging narrative and endearing characters, "Mighty Bheem's Playtime" maintains its hold on young viewers on Netflix.

- 2023: Toei Animation announced its, plans to establish an office in India as part of its global expansion strategy, which would allow the company to manage its sales division locally.

Gain a Competitive Edge with Our India Anime Market Report

- India Anime Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- India Anime Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- India Anime Market Trends & Development

- India Anime Market Dynamics

- Drivers

- Challenges

- India Anime Market Regulations & Policies

- India Anime Market Hotspots & Opportunities

- India Anime Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- T.V. - Market Size & Forecast 2019-2030, USD Million

- Movie- Market Size & Forecast 2019-2030, USD Million

- Video- Market Size & Forecast 2019-2030, USD Million

- Internet Distribution- Market Size & Forecast 2019-2030, USD Million

- Merchandising- Market Size & Forecast 2019-2030, USD Million

- Music- Market Size & Forecast 2019-2030, USD Million

- Pachinko- Market Size & Forecast 2019-2030, USD Million

- Live Entertainment- Market Size & Forecast 2019-2030, USD Million

- By Genre

- Action & Adventure- Market Size & Forecast 2019-2030, USD Million

- Sci-Fi & Fantasy- Market Size & Forecast 2019-2030, USD Million

- Romance & Drama- Market Size & Forecast 2019-2030, USD Million

- Sports- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- By Age Group

- Children- Market Size & Forecast 2019-2030, USD Million

- Teenagers- Market Size & Forecast 2019-2030, USD Million

- Young Adults- Market Size & Forecast 2019-2030, USD Million

- By Region

- North

- South

- East

- West

- By Company

- Competition Characteristics

- Market Share by Revenue

- By Type

- Market Size & Analysis

- India Action & Adventure Anime Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Age Group- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Sci-Fi & Fantasy Anime Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Age Group- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Romance & Drama Anime Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Age Group- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Sports Anime Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2019-2030, USD Million

- By Age Group- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Anime Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Animation Studio

- Green Gold Animation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toonz Animation India

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Village Talkies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Toei Animation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Prime Focus Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Green Gold Animation

- Streaming Platform

- Netflix

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Amazon Prime Video

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Crunchyroll

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Disney+ Hotstar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Voot

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Netflix

- Animation Studio

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making